Best Apps For Budgeting And Saving

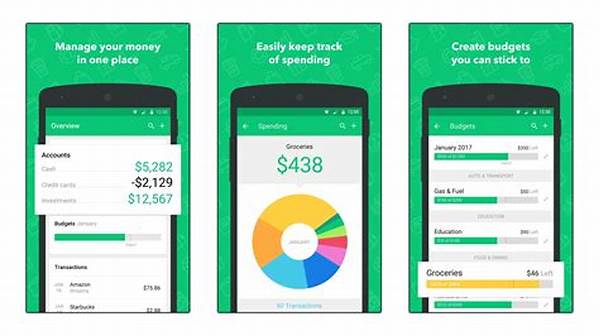

In today’s fast-paced world, managing finances can feel like juggling flaming swords while riding a unicycle. It’s no wonder that many people are turning to technology to help keep their financial ducks in a row. Whether you’re saving for that dream vacation, a new car, or planning for the future, the best apps for budgeting and saving are here to save the day. No need to sift through mountains of receipts or lose sleep over an unbalanced checkbook. These apps do the heavy lifting for you, keeping your wallet healthier and your stress levels lower. Through intuitive interfaces and intelligent algorithms, they offer not just a way to track spending, but also insightful analytics to help you maximize your savings. These apps understand that everyone’s financial situation is unique, offering customizable features that tailor the experience to meet individual needs.

Read More : Budgeting/saving

Now, how did we get here, you ask? Let’s dive into the fascinating world where Silicon Valley meets personal finance. A plethora of research by financial experts and tech wizards has culminated in a digital solution that simplifies saving money, and who doesn’t love simplicity, right? In an exclusive interview, an industry innovator hilariously confessed that forgetting his wallet at a coffee shop ignited his journey into crafting one of these lifesaver apps. Talk about turning caffeine-fueled embarrassment into entrepreneurial gold!

These apps aren’t just about cold, hard numbers; they bring a human touch with personalized advice that feels like your financially savvy best friend whispering into your ear. You’ll find tips and tricks within the app, making it as engaging as scrolling through your social media feed, but with the added perk of potentially fluffing up that savings account. This blend of creativity, technology, and analytics is what sets the best apps for budgeting and saving apart as indispensable tools in personal finance.

How to Choose the Right Budgeting App

Selecting the best apps for budgeting and saving involves a little bit of soul-searching combined with some good ol’ fashioned comparison shopping. The financial landscape can often feel like a tangled web, but rest assured, there’s an app designed just for you. Let’s start with usability—a financial app should not require a PhD in economics to operate. Evaluate the user interface: is it intuitive? Does it make you want to engage with it regularly? A good app will make managing your money entertaining rather than chore-like.

Security can’t be understated, either. Look for apps that offer encryption and two-factor authentication to keep your financial data safe. We all had that one embarrassing typo in a text—imagine that but with your bank balance. Thankfully, these apps are programmed to make sure there are no numerical slip-ups, so you won’t mistakenly put yourself in the red while being captivated by colors and icons.

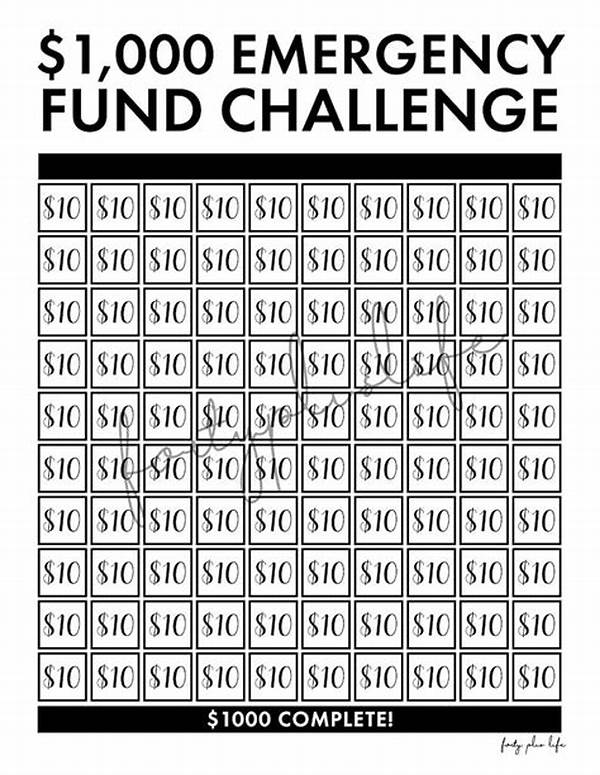

Beyond mechanics, the features are the secret sauce that makes these apps stand out. Whether it’s AI-driven spending reports, manual input options, or direct integration with your bank accounts, these tools are designed to empower users to take control of their finances. Some apps even offer rewards programs for successfully meeting your savings goals, gamifying the process to add a layer of motivation.

Top Features of the Best Apps for Budgeting and Saving

The best apps for budgeting and saving serve as a full suite of tools with features that go beyond basic tracking. These include:

1. Easy integration with bank and credit accounts.

2. Real-time spending alerts and notifications.

3. Comprehensive analytics and customizable reporting.

4. Goal-setting capabilities with progress tracking.

5. Multi-platform accessibility, making financial management seamless across devices.

6. Encrypted security features to keep your data private.

7. User-friendly interfaces that enhance interaction.

8. Personalized tips based on spending habits.

9. Community forums for advice and support.

In this age of technology, it’s about more than just keeping track of expenses—it’s about keeping track of your life goals, one digital transaction at a time. With the best apps for budgeting and saving, a financially bright future is just a download away!

How Budgeting Apps Enhance Financial Literacy

Imagine a world where you’re not just saving money, but also gaining financial wisdom. With the best apps for budgeting and saving, you’re doing just that. These apps go beyond basic penny-pinching tactics by offering a wealth of knowledge that guides users in making informed decisions. Financial literacy is a powerful tool—it’s the difference between being trapped in a cycle of debt and stepping confidently toward wealth accumulation.

In interviews with financial educators, a recurring theme is how these apps empower users to understand their spending patterns. Through interactive charts and graphs, users can visualize their expenses, making abstract numbers more tangible and comprehensible. This visual storytelling not only enhances understanding but also promotes behavioral change. As users interact with the app, lessons in budgeting naturally unfold, akin to receiving personal finance classes on your smartphone.

But financial literacy doesn’t stop at understanding—it’s about application. These apps provide real-time feedback on budgeting habits, allowing users to adjust their strategies promptly. It’s like having a financial advisor in your pocket, ready to offer advice whenever you need it. The best apps for budgeting and saving celebrate every financial victory, no matter how small, reinforcing positive behaviors and fostering a sense of financial competence.

Best Apps for Families and Couples

Budgeting isn’t just a solo endeavor. Families and couples can greatly benefit from financial apps that cater to group spending. “Money talks” are often the most daunting discussions in relationships, yet they’re essential. With the best apps for budgeting and saving, these discussions become less awkward and more productive. These apps allow shared access and visibility, offering transparency and fostering trust in financial dealings.

Imagine both partners receiving notifications for expenditures! Not only does this promote accountability, but it also sparks conversations about goals and future plans. Whether saving for a family vacation or planning for a major purchase, these apps serve as mediators that align everyone’s financial aspirations. With synchronized budgeting, financial success as a family or couple becomes a clearer, more attainable goal.

How Budgeting Apps Foster Financial Discipline

Discipline is the unsung hero of successful budgeting—fortunately, these apps are masters at promoting it. By setting spending limits and sending timely alerts, the best apps for budgeting and saving keep users accountable. The apps don’t just tell you when you’ve overspent; they provide insights into how to curb such behavior moving forward. This proactive approach encourages users to adhere to their budgeting goals, ultimately fostering a disciplined financial lifestyle.

Each app excels at balancing rigidity with flexibility—like a seasoned yoga instructor who knows precisely when to challenge the body or help it rest. Through personalized goals and adaptable plans, users are encouraged to maintain discipline while accommodating life’s unpredictability. With their help, financial discipline doesn’t feel like a straitjacket but rather a supportive guide.

Thus, whether you’re a serial spender or a penny-wise planner, mobile budgeting apps offer the tools necessary to take control of your financial destiny. So why wait? Turn your phone into your financial ally today with the best apps for budgeting and saving.