Tips For Budgeting And Saving Money

In today’s fast-paced world, managing finances efficiently is not just a necessity but a life skill. It’s as important as knowing how to cook or drive. After all, money may not buy happiness, but having control over your finances undoubtedly brings peace of mind. Imagine a life where you’re not constantly worried about an unexpected bill or the next paycheck. Instead, envision financial stability—where you can confidently say yes to adventures or retirement plans without a second thought. Intriguing, right?

Read More : How To Build A Savings Buffer In 3 Easy Steps

Grasping the art of budgeting and saving is akin to mastering a dance. It requires practice, patience, and the ability to adapt. The essence lies in balancing today’s demands while planning for future aspirations. Many of us find ourselves tangled in the modern-day conundrum of spending more than saving. It’s not just about stashing cash for a rainy day; it’s about creating a roadmap that allows for both enjoying life and saving for those important goals. How do you strike this balance without feeling deprived? That’s where our tips for budgeting and saving money come into play.

Whether you’re just beginning your financial journey or looking for advanced hacks to amp up your savings game, it’s all about informed strategies combined with motivation. By leveraging our tips for budgeting and saving money, you can transform your financial narrative. You’re not in the race alone; millions seek the same clarity, and successful ones have stories worth emulating. Grab a cup of coffee, or maybe a comforting tea, and dive into a wealth of wisdom that’s entertaining, enlightening, and truly empowering.

Drawing from diverse techniques, ranging from conventional wisdom to modern strategies, we’re ready to unravel the mysteries of financial stability. Prepare for a journey that blends humor with insights, practicality with fun. You’re not just saving money; you’re crafting a life story with foresight and delight. Buckle up as we delve into the vibrant world of financial freedom today.

Budgeting Basics: The Foundation of Financial Success

Let’s start by demystifying the budgeting basics. Budgeting is not about restricting your expenses to the extent that life loses its charm. It’s about making sure every dollar has a purpose, whether it’s saved, spent, or invested. You might have heard financial gurus propound the 50/30/20 rule—50% for needs, 30% for wants, and 20% toward savings. This rule serves as an excellent starting point, especially if budgeting seems daunting.

Meanwhile, tools and apps are available to automate and track your expenses effortlessly. Budgeting software can analyze your spending patterns and provide insights to adjust your habits effectively. Trustworthy apps like YNAB (You Need a Budget) and Mint offer features that turn budgeting into a rewarding endeavor.

The art here is turning a perceived chore into a game. Challenge yourself to spend less on certain categories each month and celebrate the milestones when you achieve your financial goals. Set regular financial reviews—weekly or monthly—to reflect on your progress. If you have a partner, embark on this quest together as it strengthens both your relationship and your financial future. The experience is both an adventure and a learning curve, filled with moments of triumph and re-evaluation.

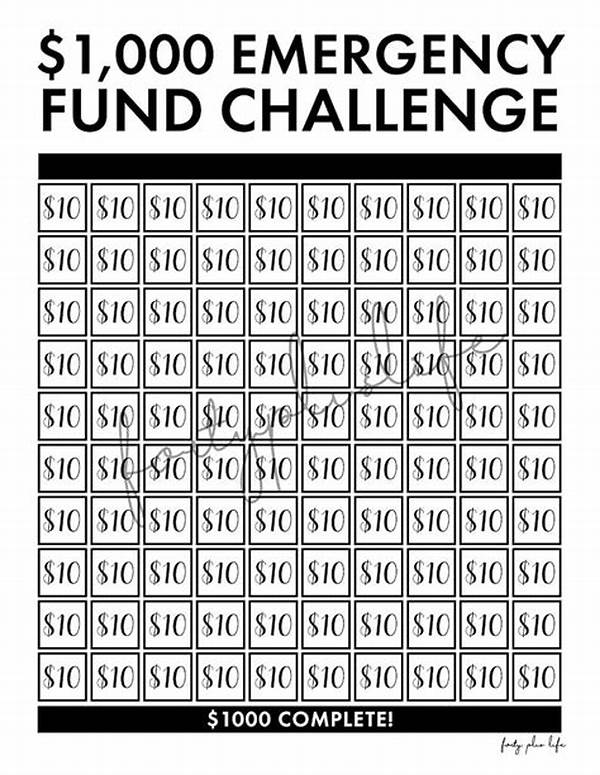

Finally, as a bonus tip: never underestimate the power of an emergency fund. It’s your safety net in times of unpredictable financial strain. Target at least three to six months’ worth of living expenses in an easily accessible account as a starting point. It’s not just about saving—it’s about providing peace of mind and transforming financial anxieties into manageable tasks.

—

The Psychological Shift: Changing Your Money Mindset

Often, the biggest hurdle in achieving financial success is not a lack of resources but mindset barriers. Shift from viewing budgeting as a restrictive task to seeing it as a tool for freedom. Embrace the philosophy that every penny counts, not in a stingy way, but in a mindful way.

Initially, break any shackles of guilt and shame associated with past financial mistakes. It’s crucial to forgive yourself, learn, and move forward. Turn those bruises into badges of wisdom and resilience. Transforming your financial mindset requires persistent effort and reflection. Recognize that money is a means to an end, a tool to create the life you envision rather than an end goal in itself.

Consider the incorporation of visualization exercises, akin to athletes envisioning their success before a competition. Visualize your financial goals and the lifestyle you wish to maintain. Picture it vividly and often—it keeps you motivated and focused, aiding in the persistence needed for long-term success.

Another key aspect of changing your mindset involves engaging with positive financial influences. Join communities, whether online or locally, that focus on financial growth and support. They offer shared experiences, accountability, and encouragement, enriching your journey to financial freedom.

By committing to a psychological transformation, you enhance the efficacy of any practical budgeting techniques you employ. It’s about changing the lens through which you view money to morph hardship into opportunity and routine financial management into a strategic play.

Smart Saving Strategies: It’s More Than Just Cutting Costs

Diversifying Your Savings Approach

One critical aspect of effective financial management is incorporating a diversified savings strategy. It’s not merely about slashing expenses or cutting the proverbial financial fat. Instead, explore avenues that increase opportunities for saving without compromising your lifestyle.

Consider the classic “pay yourself first” strategy—transfer a fixed percentage of your income into savings as soon as you receive your paycheck. This ensures you’re prioritizing your future before accommodating current expenses. Furthermore, create multiple savings accounts earmarked for specific goals: an emergency fund, travel, retirement, or that hobby you’ve always wanted to explore. This separation not only structures your savings plan but provides clear visual motivation.

Investing in Your Future

Investing is a powerful ally in the journey of financial wellness. It’s where your money starts working for you, potentially growing faster than traditional savings methods. Dive into the world of stock markets, real estate, or mutual funds. The key, however, is education and research—never venture blind into any investment arena. Books, courses, webinars, and financial advisors exist to guide newcomers through the sometimes intimidating landscape of investing.

Remember, the magic of compound interest is your friend. The earlier and more consistently you invest, the more you gain over the years. Even small, regular investments can lead to substantial growth over time. Align your investments with your risk tolerance and financial goals. The right mix will furnish a robust financial future.

Conclusion: Tips for Budgeting and Saving Money

In conclusion, mastering the tips for budgeting and saving money is akin to acquiring a superpower that equips you to handle life’s unpredictable storms. These tips enable a balanced approach that marries today’s necessities with tomorrow’s dreams, reducing stress and promoting a sense of freedom. By incorporating strategic budgeting tactics, psychological mindset shifts, and diversified saving strategies, you turn a daunting task into a rewarding journey. Now, with enthusiasm and dedication, craft your financial story, ensuring it ends with the satisfaction of a life well lived.

Practical Financial Management Hacks

Feel free to delve deeper into these aspects to enrich your financial literacy further and actively implement these tips for budgeting and saving money. Let’s journey towards financial empowerment together!