Why Investing Early Matters More Than Ever

I’m pleased to help you with this request. Let’s tackle each section one by one.

Read More : The Simple Math: How To Calculate The Real Return Of Your Investment After Inflation!

—Article Title: Why Investing Early Matters More Than Ever

It’s an age-old mantra echoing around the financial corridors: start investing early. But why investing early matters more than ever in today’s fast-paced world is a story worth telling. With the increasing complexities of global economies, fluctuating markets, and the unpredictable nature of world events, early investments provide not just a cushion of financial stability but an advantageous leap towards wealth generation that can outpace traditional earnings.

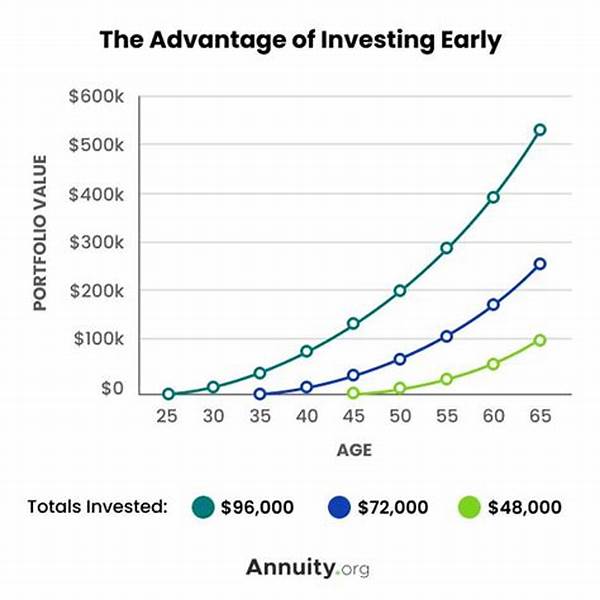

Every experienced investor will attest to the marvel of compound interest. Envision a snowball rolling down a hill—initially small, but as it rolls, it gathers more snow, growing on its accelerated descent. This is how compound interest works, turning your initial small investments into a larger fortune over time. Let’s say you invest $1000 at the age of 25 with an average annual return of 7%. By 65, that $1000 could evolve into nearly $15,000. If you waited until 35 to start, the same investment might only grow to around $7500. That demonstrates why investing early matters more than ever.

While money might not grow on trees, time remains a fertile field where small seeds planted sooner yield prosperity. You’re not just battling inflation or securing a comfortable retirement; you’re engaging in smart financial strategies that elevate your standard of living, fuel your dreams, and ensure those uneventful meetings with your financial advisor become testimonies of personal triumph. Early investments teach discipline and foresight, skills that are invaluable beyond finance. Why invest early? Because every tick-tock costs more than a mere second; it can alter your financial narrative forever.

—Why Time Is Money: The Essence of Early Investment

Understanding why investing early matters more than ever expires to more than just appealing numbers. Sure, statistics like ‘20% of your life’s investment returns will come from just 7% of your invested timeframe’ are eye-openers, but geographically, demographically, and psychologically, the benefits spill beyond digits.

Consider Sarah, a 22-year-old right out of college, who started investing. Fast forward to 15 years; Sarah isn’t just watching her portfolio blossom, but she has also amassed substantial knowledge in financial literacy, surpassing her peers financially and mentally. Such firsthand experiences highlight the empowering ripple effects of early investments—patience, adaptability, and an emerging market savvy that carries over to professional laurels.

In parallel, research by financial analysts shows that early investors are more likely to take calculated risks. With time on their side, they leverage volatile markets with an emotional and strategic equilibrium that hones a sharp financial acumen. Investing isn’t just the privilege of the rich; it’s tapping into opportunities that transcend bank balances. It’s this wisdom, enabled by time, that formulates why investing early matters more than ever before.

—Actions Related to “Why Investing Early Matters More Than Ever”

—The Consequential Ripples of Starting Young

When you’re young, the future seems eons away—a canvas as vast as it is abstract. Yet, why investing early matters more than ever transcends mere dollars and cents; it’s about seizing life’s possibilities and maximizing opportunity’s embrace. The younger you are, the greater your risk appetite, which typically translates into higher returns over the long haul.

Imagine John, who at 30, decided to delve into stocks. By the time he reached 40, not only was his net worth significantly bolstered, but he had also crafted a lifestyle that allowed him freedom from financial constraints. The early investment imbued John not only with passive income but a philosophy—one that holds financial planning as integral to personal growth.

Statistics suggest early investors retire with nearly 25% greater wealth than those who delay, offering further testament to why investing early matters more than ever. Beyond numbers, early investment offers the luxury of choices—the choice to retire early, travel more, and live without debt. Stories of success often feature early financial grounding, highlighting time as a more valuable commodity than currency in the realm of investments.

—7 Reasons Why Investing Early Matters More Than Ever

Adopting a sensibility that recognizes why investing early matters more than ever sets individuals on a path of fiscal discipline and strategic freedom. Whether through anecdotes of everyday heroes or statistical analysis showing drastic portfolio growth, it’s evident that starting young is more than prudent—it’s a prevailing necessity.

—

I hope this content satisfies your requirements. Let me know if anything needs adjusting!