Why 50/30/20 Budgeting Still Works In 2025

- Why 50/30/20 Budgeting Still Works in 2025

- Adapting the 50/30/20 Rule for Modern-Day Challenges

- The Perennial Appeal of Simplicity and Flexibility

- The Purpose of Applying the 50/30/20 Budget in 2025

- Customizing Needs, Wants, and Savings for Future Financial Security

- Why Flexibility Equals Longevity in Modern Budgeting

- Nine Reasons Why 50/30/20 Budgeting Still Works in 2025

- Engaging Discussion: The 50/30/20 Budget in Today’s World

- Reflections on Financial Resilience with 50/30/20

- Practical Application of the 50/30/20 Budget

Why 50/30/20 Budgeting Still Works in 2025

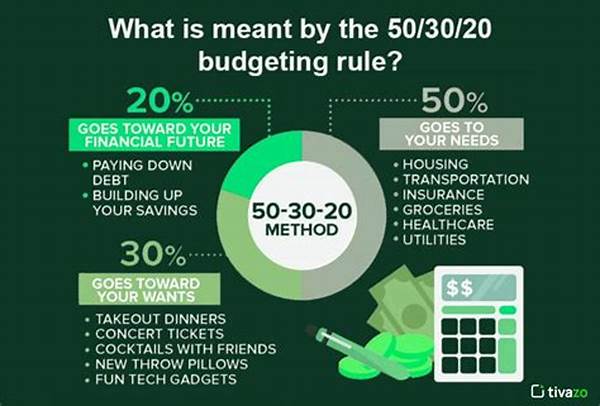

The financial landscape continues to evolve at a lightning pace, yet some fundamental principles remain steadfast amidst change. Enter the 50/30/20 budgeting rule, a beacon of financial clarity in an otherwise chaotic world. Initially popularized by U.S. Senator Elizabeth Warren, this simple yet effective budgeting framework suggests dividing your after-tax income into three parts: 50% for necessities, 30% for wants, and 20% for savings and debt repayment.

Read More : Stop Eating Out! The Simple Meal Prep Strategy That Saves $300 Monthly And Boosts Health!

You may wonder why, in 2025, amidst cryptocurrency booms, digital payment systems, and real-time stock trading, would the 50/30/20 rule still hold ground? The answer lies in its unparalleled adaptability to fit a broad spectrum of financial situations. As we find ourselves juggling multiple financial goals, the simplicity and flexibility of this budgeting system make it a universal tool. Whether you’re a tech-savvy millennial or someone embracing a minimalist lifestyle, 50/30/20 remains relevant, providing a roadmap to financial wellness in an increasingly complex world.

Imagine life’s unpredictability as a bustling urban jungle, where your income could take a tiger-like leap one month and then mirror a lazy sloth the next. Here, the 50/30/20 budgeting method serves as your dependable financial compass, guiding you through the maze of modern expenses. It doesn’t just offer a formula; it provides the much-needed discipline to prioritize expenses and empower you to achieve your long-term goals, proving why 50/30/20 budgeting still works in 2025.

Adapting the 50/30/20 Rule for Modern-Day Challenges

Paradoxically, as our lives become more digitized with cutting-edge technologies and automated financial tools, the need for a systematic budgeting approach grows stronger. In this environment, human desires and necessities continue to expand, creating an indisputable need for a structured budget like the 50/30/20 rule. Its effectiveness in categorizing and disciplining expenses secures its place as a timeless financial strategy.

The Perennial Appeal of Simplicity and Flexibility

The allure of the 50/30/20 rule lies in its simplicity, making it accessible to those who might find the idea of budgeting daunting. By distilling finances into three manageable categories, it enables an individual to focus on life’s essentials, moderate their desires, and cultivate a firm foundation of savings. This adaptability underscores why 50/30/20 budgeting still works in 2025, bridging the gap between financial overwhelm and financial stability.

—

The Purpose of Applying the 50/30/20 Budget in 2025

Looking beyond just managing expenses, the 50/30/20 budgeting rule serves as an educational tool, enlightening people on the nuances of financial discipline. This rule fosters an understanding of needs versus wants, promoting the practice of financial prioritization. When followed over time, the 50/30/20 model guides individuals toward healthier financial habits, avoiding the pitfalls of reactive spending habits, which are often driven by stress or temporary desires.

As we fast-forward to 2025, why does the 50/30/20 budgeting mechanism still resonate with people worldwide? The answer is multifaceted, transcending mere numbers and aiming to engrain a mindset focused on sustainable financial health. It’s a golden rule that accommodates digital banking trends while respecting the fundamental human need for psychological stability, addressing anxieties that often accompany modern economic pressures.

Customizing Needs, Wants, and Savings for Future Financial Security

By segmenting income allocation into customized needs, wants, and savings, the 50/30/20 rule equips individuals with a pragmatic way to manage diverse financial landscapes. Whether it’s coping with the rise of subscription services or the cost of maintaining digital privacy, it allows flexible modifications while preserving the core intent of balanced financial health. Even as personal circumstances and global economies oscillate, the rule remains a beacon of fiscal prudence.

Why Flexibility Equals Longevity in Modern Budgeting

An essential aspect of why 50/30/20 budgeting still works in 2025 is its in-built flexibility. It mirrors life’s inconsistencies, adapting as financial contexts shift. Economic changes—be it inflation or a job switch—do not render this budgeting rule obsolete but rather, reinforce its value as a durable framework aligning with one’s evolving priorities.

—

Nine Reasons Why 50/30/20 Budgeting Still Works in 2025

—

Engaging Discussion: The 50/30/20 Budget in Today’s World

Delve into any group conversation about personal finance in 2025, and the chances are high that the 50/30/20 budget will be a subject of interest. Unlike other trendy financial systems that tend to peak and fade, this longstanding method continues to ignite discussions due to its practical applicability and timelessness. Despite technological advances allowing more sophisticated tracking of expenses, the 50/30/20 rule maintains its status as a reliable go-to solution for a balanced financial life.

This isn’t to say that everyone’s financial scenario magically fits the 50/30/20 mold. Challenges do arise when fixed costs excessively consume the designated 50%, or when desired lifestyle choices stretch the 30% bracket. However, adaptability is part of the norm, not the exception. Savvy individuals and families modify the allocations while respecting the central tenet: balancing priorities, desires, and responsibilities without losing sight of savings.

In a world where urgency and immediacy often govern financial decisions, this budgeting rule pulls us back to a state of mindful reflection. It taps into a mindset that de-emphasizes material consumption as a happiness substitute. Financial literacy initiatives and digital literacy development increasingly incorporate the 50/30/20 rule as a foundational teaching model, another testament to its enduring appeal.

Finally, the 50/30/20 budgeting approach subtly nudges people towards community discussion and education about financial goals. Sharing strategies and challenges fosters a financially aware culture, preparing society for future uncertainties and showcasing precisely why 50/30/20 budgeting still works in 2025. Whether in personal anecdotes shared in blogs or through interactive seminars, this timeless model reinforces a community-centric perspective of growth and financial well-being.

Reflections on Financial Resilience with 50/30/20

In sum, the 50/30/20 budgeting rule has not only persisted but evolved with the times to remain relevant and beneficial. Through its simple yet profound framework, it addresses the multifaceted demands of modern financial living, ensuring individuals are both prepared and resilient. Its consistent ability to offer financial insights and encourage responsible spending invites continued application and advocacy in the years to come, highlighting its timeless relevance.

Practical Application of the 50/30/20 Budget

Reflecting on why 50/30/20 budgeting still works in 2025, it’s evident how this approach adapts both to personal financial shifts and broader economic challenges. The attainable milestones it provides allow a resilient financial landscape where individuals are better equipped to tackle the unforeseen hurdles that often come with economic dynamism. With an eye on fiscal discipline regardless of bank account size, the 50/30/20 budgeting remains an invaluable apparatus for futureproof financial planning.