Investing For Beginners

Investing for Beginners

Starting your journey in the world of investing can feel like diving into the deep end of a pool. With a myriad of terms, strategies, and platforms to navigate, it’s easy for beginners to feel overwhelmed. However, understanding the basics and what to expect can demystify the process and lay a solid foundation for future financial success. In this article, “investing for beginners,” we’ll explore what makes this domain intriguing and accessible, even for those without prior experience.

Read More : The Market Crash Nightmare: 4 Simple Steps To Recession-proof Your Investment Portfolio!

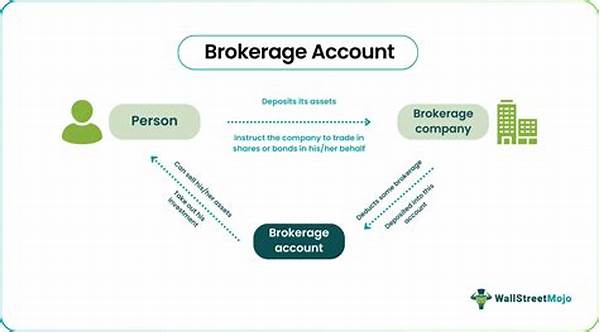

Imagine you’re at a bustling market, and everyone around you is making trades. This market is the stock market, a place where buying and selling stocks happens at lightning speed. For beginners, the first step is to understand the language of investing. Terms like stocks, bonds, mutual funds, and ETFs may seem like jargon, but they’re merely different ways to grow your wealth.

The story of successful investors often starts small. Think of Warren Buffett, who began his investment journey by purchasing a few shares with his savings. The key to his success lay in patience, discipline, and a commitment to understanding the businesses he invested in. As a beginner, you can draw inspiration from such stories and recognize that every expert was once a novice.

Now, why should you, an investing beginner, dive into this world? Besides the potential for financial growth, investing teaches valuable lessons in patience, risk management, and strategic planning. It’s not just about buying low and selling high; it’s about making informed decisions that align with your financial goals and understanding market trends.

Investing for beginners isn’t just about the choice of investments; it’s also about setting realistic expectations. While some investments may yield high returns, others might offer steady, modest growth. The challenge is to balance your risk tolerance with your desired outcomes. One way to simplify the process is to leverage the power of technology and investing platforms that offer guided paths for beginners.

Building a Foundation in Investing for Beginners

As you embark on this financial adventure, it’s crucial to equip yourself with knowledge and resources. Here are a few steps to help you get started:

By embracing these steps, beginners can start their investment journey on stable ground, building the knowledge and confidence needed to make informed decisions.

—

Description Section for Investing for Beginners

Navigating the intricate waters of investing can be a daunting task, especially for novices. Yet, the promise of financial independence propels many to explore the domain of “investing for beginners.” Here lies the opportunity to transform mere curiosity into a rewarding financial expedition. Let’s dive deeper into this journey, providing you with the tools and insights to make sound investment choices that align with your aspirations.

Imagine walking into a vast library filled with books on investment strategies, stock market histories, and economic theories. For beginners, this wealth of knowledge can feel overwhelming. However, by approaching it with curiosity and a thirst for understanding, you can uncover the mysteries of the financial world. Start with the basics—understand what investing is and why it’s a pivotal component of financial growth.

Why Investing Matters

For many investing beginners, the idea of growing wealth doesn’t just mean padding the bank account; it means achieving freedom. It’s about designing a future where financial strain is minimized, and dreams become attainable. It’s about nurturing little acorns today that might grow into mighty oaks tomorrow. Investing wisely today can lead to a more secure and prosperous future.

Venturing into investments offers opportunities but also demands an understanding of risk management. Just like a chess player plots several moves ahead, investing requires strategic planning. Consider your financial goals and risk tolerance; these are your compass in the investing journey. As you delve into stocks, bonds, and other investment vehicles, remember that diversification is your safety net.

Steps to Successful Investing

Encapsulating the essence of investing for beginners is to balance optimism with caution. Every step forward is a learning experience, and every investment decision, a chance to grow not just wealth but wisdom too. As you embark on this exciting path, keep in mind that investing isn’t just about financial gain; it’s about building a future where possibilities abound.