Best App For Budgeting And Saving

Best App for Budgeting and Saving

In today’s fast-paced world, managing finances effectively has become more crucial than ever. Whether you’re a thrifty spender or someone who tends to splurge on the latest gadgets, having a robust financial plan is key to achieving financial stability. Enter the realm of budgeting and saving apps—technological marvels designed to help you keep track of your spending, save for future goals, and achieve peace of mind. Let’s delve into why finding the best app for budgeting and saving might just be your ticket to financial freedom.

Read More : Budgeting And Saving Tips

Imagine this: you’re sipping your morning coffee, scrolling through social media, and a pop-up notification reminds you of your current spending trends and how much closer you are to that dream vacation. That’s the beauty of using budgeting apps! Not only do they make money management a breeze, but they also add a gamified experience to saving money—encouraging you to save more with little rewards and insights. The cherry on top? They provide personalized financial advice tailored to your spending habits, all at the touch of a button.

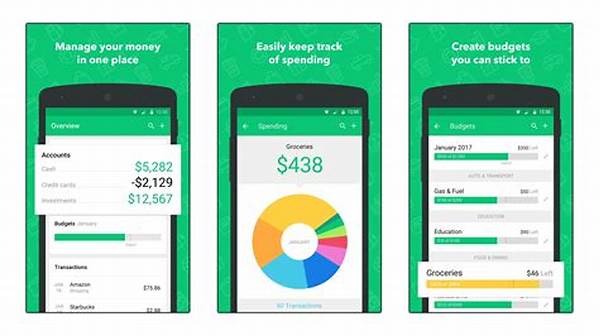

However, with the plethora of apps available, finding the best app for budgeting and saving might feel like searching for a needle in a haystack. Some apps offer intuitive pie charts, while others are more straightforward with robust data analysis capabilities. It doesn’t just end at aesthetics; security is paramount, especially when dealing with personal financial information. The best app for budgeting and saving would ideally encrypt your data, ensuring your financial secrets remain undisclosed.

While apps like YNAB (You Need A Budget) and Mint have set benchmarks in this domain, new players are constantly emerging, offering unique features that cater to diverse financial habits. Remember, while the best app for budgeting and saving should align with your specific needs, it should also be engaging and easy to navigate, making budgeting less of a daunting task and more of an everyday habit.

Choosing the Right App for Your Financial Goals

Finding the perfect budgeting app isn’t just about trendy features; it’s about meeting your personal financial goals effectively. Each app comes with its own set of strengths—some excel in expense tracking, while others provide exemplary saving tips tailored to your lifestyle. Whether you aim to get out of debt, save for a significant purchase, or simply gain better control over your spending, selecting an app that aligns with these objectives can make all the difference.

—

Discussion: The Hunt for the Best App for Budgeting and Saving

Navigating the financial landscape can be challenging without the right tools. In this modern age, budgeting apps serve as the compass guiding us towards economic sanity in an otherwise chaotic monetary world. But how do you sieve through the myriad of options to pinpoint the absolute best app for budgeting and saving? The secret lies in understanding your financial habits and aligning them with app features that cater uniquely to those needs.

Understanding User Needs

The first step towards identifying the best app for budgeting and saving revolves around comprehending what users truly value in budgeting software. For some, the ability to visually track expenses at a glance is a game-changer; for others, it could be the detailed analytics or the convenience of automatic expense categorization. Essentially, understanding that user needs are varied and multifaceted is crucial. This has pushed developers to create more personalized experiences within their apps.

Evaluation Through Personal Stories

Take Jessica, for instance, who struggled with overspending. By using a budgeting app, she could instantly see where her money went and feel more in control. Such testimonials highlight the power of specific app features and their impact on everyday users. These stories not only provide insights into the effectiveness of the apps but also evoke a sense of trust and relatability among potential users. Hence, selecting an app that resonates with personal financial stories can be pivotal.

With trust and personal efficiency at the core, the best app for budgeting and saving seamlessly integrates into everyday life without overwhelming the user. It suggests practical ways to cut unnecessary expenses and encourages sticking to a budget without compromising on essentials. This harmonious balance ensures that users experience budgeting as a helpful guide rather than an overbearing dictator.

The Role of Design and Interface

An app’s design and interface play a crucial role in user engagement and satisfaction. Sleek designs with intuitive interfaces are often topmost on the list for many users. A cumbersome, cluttered interface might deter even the most financially disciplined individuals from using an app. Therefore, the best app for budgeting and saving should boast a user-friendly design that makes financial management less of a chore and more of an engaging activity.

Ultimately, choosing the best app boils down to individual preferences intertwined with practical features that resonate with one’s financial objectives. By examining personal spending habits, reading real-user testimonials, and focusing on simple yet effective app designs, finding the right tool can transform and greatly simplify one’s financial journey.

—

Exploring Options: Developing the Right Tool for Budgeting

In a world that’s increasingly leaning on digital solutions for everyday tasks, creating an efficient budgeting app requires more than just coding skills. It demands a deep understanding of user needs, market trends, and the financial hurdles faced by different demographics. This section breaks down the necessary steps and considerations in crafting that ultimate financial assistant.

Research and Development

1. Market Analysis: Identify existing market players and analyze their strengths and weaknesses.

2. User Feedback: Collect comprehensive feedback from diverse user groups to cater to varied financial habits.

3. Technological Expertise: Use the latest technology for secure, swift, and user-friendly apps.

4. Partnerships and Integrations: Collaborate with financial institutions for seamless data integration.

Key Features of the Best Apps for Budgeting and Saving

Before diving into coding, it’s vital to outline the features that will set your app apart from the competition. A focus on ease of use, data security, and tailored advice can create an app that not only meets but exceeds user expectations. Remember, the objective is to blend functionality with an engaging user experience, ensuring the app not only serves as a budgeting tool but also a trusted financial advisor.