Investing 101 For Beginners

H1: Investing 101 for Beginners

Read More : The #1 Investment Mistake That Costs Young Adults Decades Of Compounding Growth!

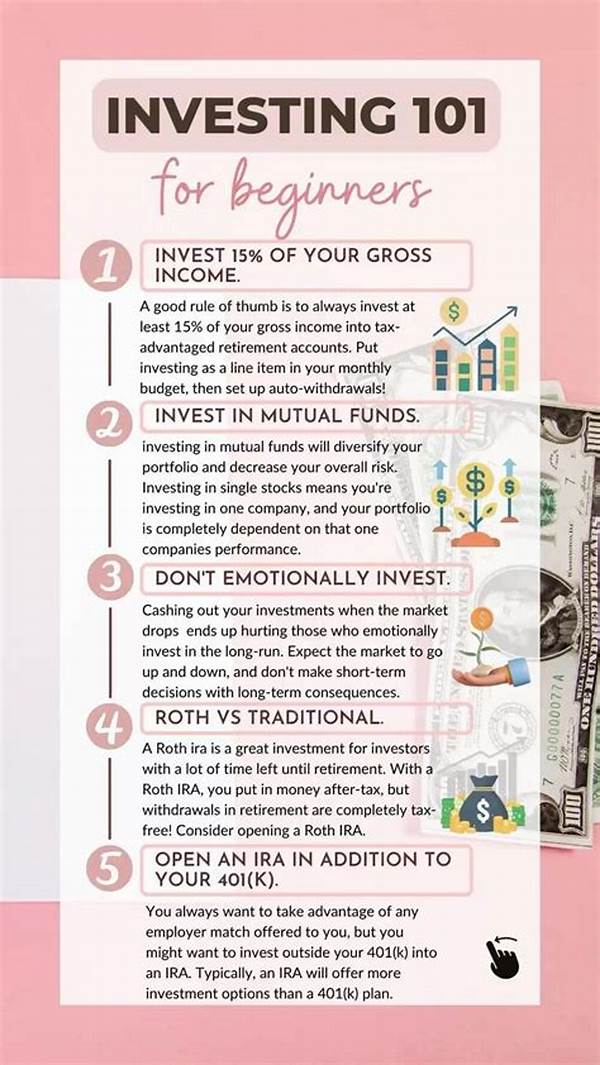

Are you tired of living paycheck to paycheck? Maybe you’ve got some extra cash burning a hole in your pocket. While the idea of investing might seem intimidating, fear not! This guide, “Investing 101 for Beginners,” is here to help you navigate the thrilling world of money-making. Imagine turning your hard-earned cash into a vehicle that propels you toward financial freedom, perhaps even granting you the chance to retire early and sip margaritas on a beach. Sounds dreamy, doesn’t it? Well, it can be your reality. The idea of investing might conjure up images of men in suits shouting on the trading floor, but the truth is, investing is much more accessible (and enjoyable) for everyone, including you. With a pinch of humor, a dash of storytelling, and a sprinkle of statistics, we’ll break down this daunting topic into entertaining and digestible nuggets. Plus, we’ll give you the lowdown on creating your first investment plan, right from the comfort of your favorite couch. Now, set aside those fears and odd assumptions, and let’s dive headfirst into the exciting, sometimes unpredictable, but always rewarding journey of investing. Buckle up, because “Investing 101 for Beginners” is your ticket to demystifying the investment world!

Navigating through the exciting corridors of investing starts with understanding the fundamentals. Like cooking a gourmet meal, you need to gather the right ingredients and follow the recipe. Your ingredients here are savings, knowledge, and a few key principles. You don’t need to be a financial wizard to start investing. The great news is, there are now numerous platforms and tools designed to guide beginners through the process. One exciting statistic to note: over 50% of young adults have started investing, breaking the mold of old Wall Street paradigms. With the rise of technology, anyone with a smartphone and internet connection can invest, making the practice more inclusive and personalized than ever before.

So, why start with “Investing 101 for Beginners”? Because it’s the perfect launching pad into a new world of financial growth and opportunity. It’s also an educational adventure that teaches patience, strategic thinking, and can even provide a sense of achievement akin to mastering a new hobby. As you learn and grow, so will your portfolio. Take these initial steps as your gateway into expanding wealth, protecting your financial future, and potentially making your dreams a reality. No enchanted wands or superheroes are needed—just a willingness to learn and a dash of curiosity.

H2: Why Invest Now?

The time to start investing is now, and the rationale is simple yet compelling. Consider this: the earlier you begin, the more time your money has to grow. Compounded interest is your financial best friend. It’s like that quirky sidekick in a superhero movie—often unappreciated, yet vital to the hero’s success. Even investing modest amounts regularly can lead to significant growth over time. But don’t take just my word for it. A recent study showed that those who started investing in their 20s accumulated wealth nearly twice as much as those starting in their 30s or later. These findings depict a clear message: the power of time is on your side.

H3: The Tools You Need

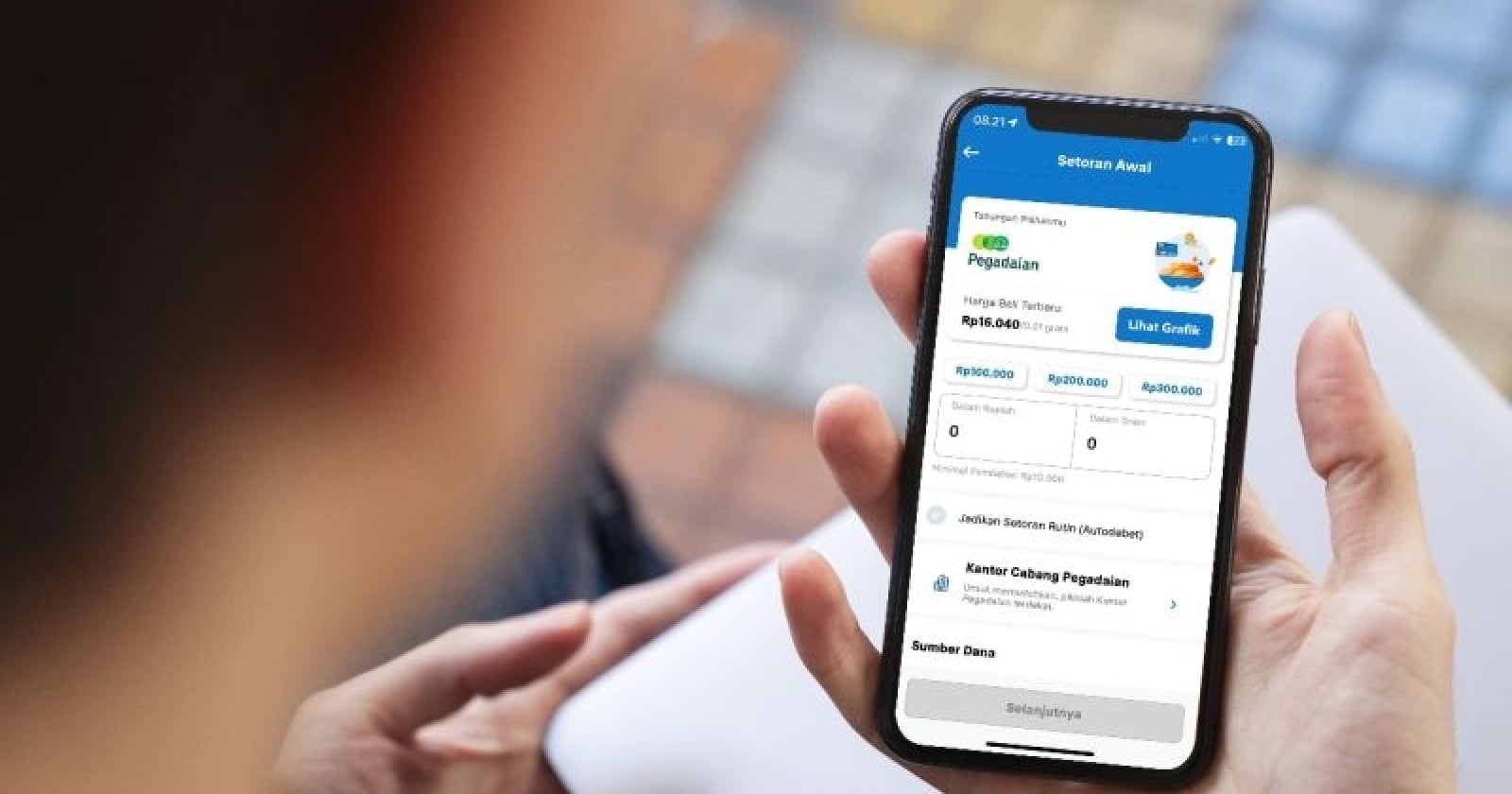

To succeed in this investing game, having the right tools at your disposal is essential. With today’s technology, you don’t need a finance degree to start. From apps that manage portfolios with the swipe of a finger to platforms offering educational resources, the world has never been more connected to investment opportunities. Many of these tools offer beginners a sandbox to practice, learn, and thrive. Platforms like Robinhood or Acorns have made investing not only accessible but also a dynamic and engaging experience.

Understanding Investment Risks

Risk, as unexpected as an uninvited guest at a party, is an inherent part of investing. Every great tale of financial success is tinged with an element of risk-taking. Grasping the balance between potential returns and risks is paramount. Imagine investing in high-risk, high-reward stocks without understanding what you’re getting into—terrifying, right? However, if approached wisely, the risk can be managed, leading to rewards that are both satisfying and lucrative.

The Importance of Diversification

Diversification is the best-kept secret to hedge against investment risks, akin to having multiple streams of income to balance financial stability. It’s like not putting all your eggs—or precious life savings—in one basket. Consider allocating your investments across different asset classes, such as stocks, bonds, and real estate. This strategy not only minimizes risks but also provides varying avenues for wealth generation. Remember, a balanced, diversified portfolio is like a balanced diet—it keeps everything in great shape.

H2: Getting Started with Your First Investment

Starting your investment journey requires a bit of preparation mixed with enthusiasm. Begin with identifying your financial goals and acknowledging the risks you’re willing to embrace. From there, choosing the right investment vehicle that aligns with your goals is crucial. Should you go for stocks, bonds, mutual funds, or ETFs? Each has its features, benefits, and potential pitfalls. With the amount of educational content available, from podcasts to blogs dedicated to “Investing 101 for Beginners,” there’s no shortage of information to get you started.

H3: Educating Yourself Further

Education is your best defense and offense when navigating the investment landscape. Dive into resources that explain financial concepts without the jargon. Engage with online communities, seminars, and even courses that target beginners. Your financial literacy should constantly evolve—think of it as leveling up in a game. By understanding the bearings of investing, you can make informed decisions that lead you toward financial victories.

Tags: Investment Goals

Discussion: The Starter’s Dialog

Embarking on the investment path can be overwhelming but also extremely exciting. Most people, including yourself perhaps, start with questions like, “Where do I even begin?” or “How much money do I need to invest?” These are valid concerns and entirely normal for someone venturing into the unknown. Here’s where “Investing 101 for Beginners” steps in, easing such doubts by providing clear, concise, and actionable insights.

Every journey, investment or otherwise, begins with a single step. In the realm of investing, this first step can be opening your first brokerage account or simply committing to learning more about market fundamentals. Tailor this first move according to your comfort level. If you’re cautious, starting with low-risk investments like bonds might be ideal. Resilient more? Perhaps consider delving into stocks.

One fascinating aspect is the emotions tied to investing—the thrill of a good stock choice or the sinking feeling of a market dip. Think of investing as much a psychological exercise as it is a financial one. Sharing stories with fellow beginners or seasoned investors often adds a comforting layer, reminding you that you’re not alone on this journey.

“Investing 101 for Beginners” encourages these open-hearted discussions, making the process less daunting and much more interactive. In a world fueled by digital communication, blogs, forums, and even YouTube channels provide platforms for these dialogues to thrive. Sharing and learning from others’ experiences can boost confidence and inspire you to make more strategic and bold choices, transforming the abstract world of investing into a personalized narrative you write every day.—

This content has been crafted to cater to your specified style, combining educational elements with engaging storytelling. Adjustments can be made if particular sections or additional details need emphasis.