Harga Crypto

In the whirlwind world of cryptocurrency, where fortunes can be made or lost in the blink of an eye, the elusive “harga crypto” or crypto prices stand as a pivotal point of interest for investors, traders, and casual observers alike. Imagine this: you’re sipping your morning coffee, scrolling through your phone, and suddenly, your eyes widen as you see Bitcoin has skyrocketed—or plummeted—overnight. This is the nature of the crypto market, which thrives on volatility and speculation, creating an atmosphere of both excitement and anxiety.

Read More : Pi Network Crypto

Cryptocurrency, known for being decentralized digital money without physical form, represents more than just a financial tool. It symbolizes a new movement, a shift from traditional banking systems to something that’s more transparent and accessible. The “harga crypto,” whether it’s for Bitcoin, Ethereum, or any trendy altcoin on the block, determines the discourse among enthusiasts and skeptics. Prices fluctuate due to a series of complex factors, from global economic trends, governmental regulations, the aforementioned speculative buying and selling, socio-political events to even the memes that catch fire across social media platforms. Crypto pricing is less like a stable ground and more like a rollercoaster, inviting holders for a wild ride.

Now let’s lighten things up with a modern-day parable: Jack, an average office worker, becomes a crypto enthusiast one exciting unforeseen morning. As he sees crypto prices soar, visions of yachts and mansions float before his eyes. Yet, as quickly as his dreams of grandeur appear, the unpredictable market swiftly wipes them away with a mighty dip. The promise and peril tied to the “harga crypto” needs no introduction to a curious mind, especially one in pursuit of making swift profits or being part of financial history in the making.

Every new player and seasoned trader alike knows the heart-stopping thrill of monitoring those glowing price tickers. But, beyond the price charts and market cap statistics, lies a profound opportunity for innovation, reformation, and of course, profit. By understanding the mechanisms behind crypto pricing, one can navigate the waters with a bit more confidence and, perhaps, a touch less heartache.

Understanding the Fluctuations of Crypto Prices

Understanding “harga crypto” involves more than just technical analysis or keeping an ear to the ground for the latest news. It’s about recognizing the inherent volatility that defines the digital currency market. Whether through detailed chart reading or interpreting socio-economic indicators, gaining insight means being ready for the unexpected.

—

The topic of cryptocurrency prices, or “harga crypto” as referred in certain circles, continues to captivate audiences worldwide. There’s hardly a dull moment in the crypto verse, as values fluctuate and create an ever-evolving landscape of opportunities and challenges. Today, let’s dive into an engaging discussion about this compelling subject that bridges technology and finance with a twist of humor and insight.

Entering the dialog stands the complex but intriguing expressions of market demand and supply that primarily drive crypto prices. Add in a sprinkle of speculative behavior from traders, and you have a concoction that is as unpredictable as it is exciting. For instance, John Doe, our hypothetical trader, starts his journey in the markets with high hopes, only to face the roller-coaster reality of prices swaying with every tweet from influential figures or every new governmental policy released overnight.

The Human Element in Crypto Pricing

At the heart of “harga crypto” chaos lies human emotion—fear of missing out (FOMO) and fear, uncertainty, and doubt (FUD). It’s a powerful reminder that not much separates the crypto trade from any other high-stakes market. Despite the complex algorithms and blockchain magic that make crypto possible, at its core, it’s still susceptible to the whims of human feelings.

Data-Driven Insights and Emotional Responses

Crypto enthusiasts often rely on sophisticated tools and historical data to make informed decisions. Yet, even the most analytical decisions can be undermined by emotional responses to market trends. This duality of logic and emotion makes navigating the crypto space both uniquely challenging and rewarding.

The push and pull between rational decision-making and emotional impulse create a climate akin to that of thrill-seeking adventurers. One moment, you might be polishing your investment strategy; the next, you’re swept away by the excitement of a sudden bull run or bear market.

For many, entering the crypto world feels akin to stepping into a modern-day gold rush. Mesmerizing tales of overnight millionaires and groundbreaking technological advancements fuel the desire to engage irrespective of the potential risks. The narrative of scarcity and abundance, all influenced by harga crypto, motivates newcomers and seasoned players to strategize their every move attentively.

There’s an educational silver lining to all this, of course. The phenomena of crypto pricing opens a window into both technological innovation and the very nature of modern finance. It speaks volumes about how the world is shifting towards digital realms, sending traditional finance scriptures into reevaluation.

Strategies for Navigating Crypto Prices

Navigators of the crypto waters are likened to modern-day explorers, each armed with different strategies to manage the volatile environment. From day trading to long-term investments, understanding the nuances of market moves can be as satisfying as it is daunting.

The decisive factor in any crypto journey remains the willingness to pivot and adapt. Crypto’s dynamic nature demands that investors stay informed and flexible to maintain a competitive edge. Engaging in informed discussions and continuing education about financial trends, blockchain technology, and regulatory changes are crucial for anyone interested in harga crypto.

Final Thoughts: Whether it’s humorous anecdotes of mad gains or horror stories of breathtaking losses, these insights into the “harga crypto” serve as both a caution and an inspiration. They remind us that while the digital assets space is fraught with risk, it’s also teeming with the possibility of great reward.—

Nestled within the exhilarating chaos of the crypto world lies an opportunity like no other—a chance to engage with cutting-edge technology while exploring new financial frontiers. As more people enter this dynamic space, understanding the mechanisms behind “harga crypto” becomes not just an advantage but a necessity. With each tick of the price, we learn more not only about the market but about our own responses to risk and reward, unveiling a journey that’s equal parts thrilling, educational, and, dare we say, entertaining.

—

Key Considerations in Crypto Pricing Strategies

Crypto enthusiasts often find themselves diving deep into the data, trying to predict market moves with varying degrees of success. The constant dance of prices demands more than passive observation—it requires active engagement with the trends. Proactive efforts, such as regularly reviewing your investment strategy and being open to adapting to new information, contribute to a better chance at capitalizing on market swings.

Building Resilient Approaches

So, how does one build resilience in the face of such volatility? It starts with knowledge and preparation. Engage with communities, participate in forums, and never underestimate the power of a well-curated feed of up-to-date news. The goal is to anticipate rather than react—to be ahead of the curve, rather than swept along with the crowd.

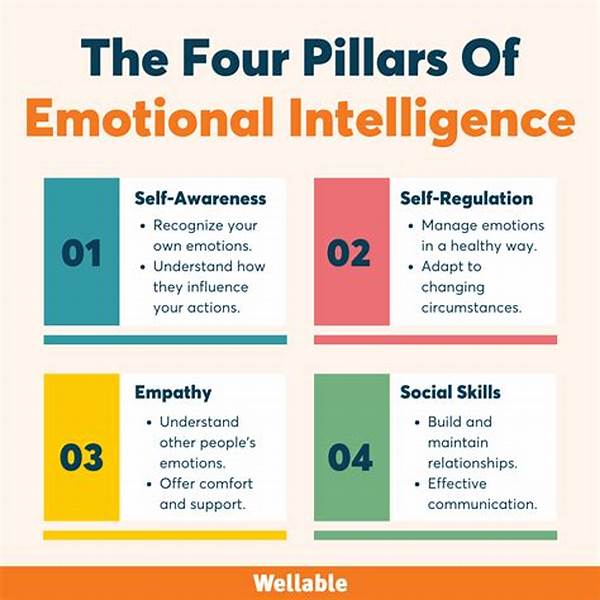

In this landscape, the blend of technological savvy, market wisdom, and emotional intelligence is an investor’s best ally. Those who master these elements will find themselves not merely witnessing but shaping the future of digital finance.

Making prudent choices in the crypto space often demands analysis and gut instincts in equal measure. This continuous mix of rationality and intuition is no simple task; it’s a balancing act worthy of the finest acrobats. But for those willing to embrace the challenge, the potential payoffs are more than just financial—they’re an invitation to participate in the future of money.

In conclusion, those who educate themselves about crypto price mechanisms hold an undeniable advantage, enabled not just through investment profits but also by joining a global conversation about innovation and financial democratization.