Cara Kerja Crypto

In an age where digital transactions are rapidly becoming the norm, the concept of cryptocurrency has emerged not only as a tech trend but as a revolutionary financial asset. But what exactly is ‘crypto,’ and how does it function in the labyrinthine world of finance? To put it simply, cryptocurrency is a form of digital or virtual currency that utilizes cryptography for security. This makes it incredibly difficult to counterfeit. A defining feature of cryptocurrencies is that they are generally not issued by any central authority, rendering them theoretically immune to government interference or manipulation. Bitcoin, created in 2009, was the first decentralized cryptocurrency, and since then, numerous other cryptocurrencies have sprung up, each with its own unique characteristics and potential use-cases.

Read More : Apa Itu Crypto

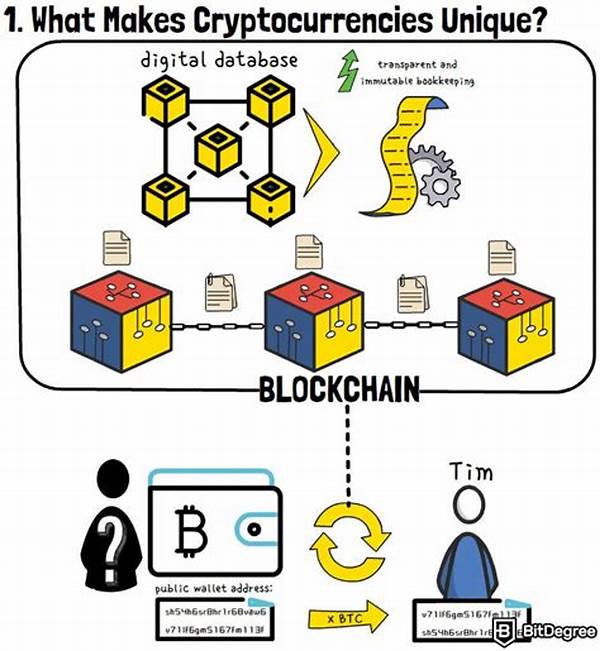

In the buzz surrounding cryptocurrencies, understanding the mechanics of how they work is crucial. Cryptocurrency runs on blockchain technology, a type of distributed ledger technology (DLT) that assures the integrity of transactional history. Each block in the blockchain contains a set of transactions, and once a block is completed, it’s added to the chain in a linear, chronological order. This distributed network of computers, referred to as nodes, cashes in with algorithms to verify and secure transactions, ensuring the system’s decentralization and security. At its core, the technology promises transparency, minimal transaction costs, full user autonomy, and a peer-to-peer (P2P) network. A truly transformative financial tool awaits those who strive to understand and harness its potential.

The Fundamentals of Blockchain

Blockchain is the backbone of cryptocurrency, providing an unalterable record of transactions that assures trust in this digital asset’s legitimacy. Unlike traditional banking ledgers, a blockchain ledger is shared across all nodes of the network, preventing cybersecurity attacks, data breaches, and misuse. The data is secured using cryptographic methods, giving crypto its name. This ensures that even though anyone can see the details of transactions, they remain anonymous and secure.

Bitcoin’s initial flaw, double-spending, is solved by using centralized intermediaries in traditional systems. However, cryptocurrency employs distinct techniques to guarantee no duplication in digital currency. Cryptographic problems, solved via Proof-of-Work or Proof-of-Stake methods, demand significant computational energy, confirming the legitimacy of each transaction and adding new blocks to the chain. Miners—a catchy term for the nodes that solve these problems—are then rewarded with newly created cryptocurrency tokens.

As we venture further into the land of digital currency, the exhilarating field of cryptocurrency trading calls out to everyone seeking financial growth. The global adoption of crypto will create exciting investment opportunities, spawning a new financial narrative—one that offers you a chance to be part of financial history.

Understanding Cryptography in Crypto

Cryptography enables the secure creation of digital signatures, passwordless authentication, and secure sharing of data between multiple parties. Essentially, it uses mathematical principles to encrypt and decrypt information. In the crypto sphere, asymmetric cryptography serves as the security backbone for transactions, ensuring that only true ownership allows asset transactions.

The cryptographic keys consist of a pair of systems, one public (known to everyone) and one private (known only to the owner). When a transaction is initiated, it is broadcasted to the network, and the money is moved from the sender’s cryptocurrency wallet to the receiver’s wallet. This method confirms that the transfer is issued from an authentic source.

When you dive deep into understanding how crypto works, it becomes clear that it’s not merely a digital form of cash. Crypto involves intricate mechanisms of decentralization, tokenization, and smart contracts that have the potential to redefine everything from payment processing to supply chain management. The combination of these elements could impact the financial system’s core itself, introducing new operational environments that traditional financial institutions might need time to adapt to. The manual for mastering cryptocurrency lies in grasping these core principles, juxtaposed against our existing financial systems.

With each tick of time, cryptoscreens showcase the latest breakthrough experiments in this domain. For someone who thrives on adrenaline and innovation, the world of cryptocurrency doesn’t just present an opportunity for financial maneuvering; it offers insights into a future that is inconceivably dynamic and invitingly exciting. The ultimate promise of a better financial journey unravels with each blockchain adventure.

—

In a world still trying to grasp the intricacies of digital finance, the “Crypto Revolution” is an inevitable giant that can’t be ignored. Its operations are not just about traditional currency replacement; it’s a sophisticated dance of computer science, cryptography, and economic strategy. This is an attempt to decode and explore how cryptocurrencies work in modular necessities and immense potential.

Cryptocurrencies matter because they offer an intriguing alternative to traditional fiat currencies and banking systems. Unlike conventional currency, backed by physical commodities like gold or by a government, cryptocurrency operates on technology and trust. At the heart of this lies the blockchain—a publicly-accessible, immutable set of records designed to withstand the sands of time.

The Tech Backbone: Blockchain

At its most basic level, a blockchain is a ledger distributed across a network of numerous computers, each called a node. These nodes work collaboratively to validate and record transactions, effectively making a decentralized record of events. The ledger is secured by cryptography, effectively preventing unauthorized accesses, guaranteeing that once a piece of data is registered, it remains unchanged forever.

Smart contracts are a compelling aspect of blockchain technology, self-executing contracts with the terms of the agreement directly written into code. These programs automatically execute actions, bring accountability, and remove intermediaries, reducing costs while increasing transactional transparency.

Mining and Verification: The Engine Room

Cryptocurrency operates efficiently thanks to an optimal mix of mining and verification. Miners—technologically adept individuals—perform complex computations to add new transactions to the blockchain. The verification concept called Proof-of-Work involves solving cryptographic puzzles to control the creation of new blocks on the blockchain, making the ecosystem challenging to infiltrate.

The incentive for miners lies in the reward system. Each time they solve these puzzles and declare a block to be valid, they are rewarded with cryptocurrency tokens—hence sustaining and encouraging the network. The result is a self-sustaining, self-renewing infrastructure that provides enhanced user participation and economic engagement.

Navigating the Complexity of Cryptocurrency

Understanding how crypto works is not just a matter of technical comprehension, but also about grasping an ideology rapidly reshaping the economy. Cryptocurrency establishes a system that is visibly autonomous, creating significant ripples in both macro and microeconomic spheres. As we witness a seismic transition in financial dealings, learning about these processes is critical for envisaging an informed future.

For any proactive investor, examining these systems is a matter of pragmatic necessity. As adoption rates skyrocket, this isn’t just about riding a financial wave; it’s about jumping on the crest of an evolving, fluid economic paradigm.

Grasping how cryptocurrency operates is the first step to understand its rapid growth and adoption. With thousands of cryptocurrencies circulating today, sophisticated investment strategies pivot around understanding the technology. Engagement with digital assets like Bitcoin, Ethereum, and Litecoin leads the charge for a revolutionary future. The blueprint for financial inclusion isn’t on paper anymore; it’s in nodes, wallets, and miners—creating an indelible line in the sands of modern finance.

Goals for Understanding How Crypto Works:

—

The world of cryptocurrency can often feel like a wild, uncharted frontier. Navigating it requires a vigilant eye on market trends and in-depth knowledge of the foundations—one of which is thoroughly understanding how crypto works. As enthusiasts and professionals alike stand at the cusp of a financial revolution, this understanding is not just valuable; it is essential. Decentralized ledgers, cryptographic protections, and unique rewards systems craft an evolving landscape that could redefine currency and transactions for a century to come.