Saving Jars Budgeting

H1: Saving Jars Budgeting – Your Path to Financial Freedom

Read More : Jangan Lewatkan Kesempatan Peluang Investasi IKN 2026! Yuk Gabung Sekarang!

In today’s world, saving money can often feel like a daunting task filled with sacrifices and number-crunching nights. But what if saving could be fun, simple, and even rewarding? Welcome to the world of saving jars budgeting—a unique, tangible method of managing your finances. Imagine having all your financial goals segmented into little pots of motivation that not only guide your spending habits but also bring you joy as you visually witness your savings grow. This method harks back to the classic piggy bank idea but revamped to fit the nuanced demands of modern life. By adopting the saving jars budgeting strategy, individuals can break the traditional walls of complex budgeting, making saving money an enjoyable endeavor. Say goodbye to spreadsheets and hello to colorful jars that reflect your financial priorities, from an emergency fund to that dreamy vacation plan.

Narrated through countless testimonies, saving jars budgeting transforms tedious budgeting processes into a storytelling saga where each jar represents a chapter of your financial journey. Whether you’re saving up for a swanky new gadget, an anniversary trip to Paris, or simply a rainy-day fund, this budgeting method excels in maintaining your focus and motivation. The emotional connection to physically seeing your savings increase within each jar can be far more impactful than digital figures. Furthermore, it’s a perfect blend of rationality and creativity—a budgeting strategy that respects arithmetic rules while allowing your imagination to flourish.

This financial technique has been the silent magician behind many success stories where individuals regained control of their finances and achieved their dreams. It’s simple yet highly effective—aligning perfectly with both rational and emotional spectrums, making it an ideal method for those who find traditional budgeting too rigid. Moreover, the exclusivity of tailoring your jars according to personal preferences adds a dash of fun and excitement, drawing more people toward this rewarding financial journey.

H2: Why Saving Jars Budgeting?

Having explored the fundamental concept of saving jars budgeting, let’s delve deeper into why it’s capturing so many hearts. The great strength lies in its simplicity and the visual satisfaction it provides. As you fill the jars, not only do you feel the growing weight of each jar, symbolizing your achievements, but the positive reinforcement also makes you less likely to dip into your savings unnecessarily. According to numerous studies and financial analyses, methods that provide visual reinforcement significantly increase savings discipline and, consequently, success rates.

Moreover, the personalization factor cannot be overstated. Your jars can vividly represent personal aspirations, not dry numerals on a screen. Imagine having a jar labeled “Tahiti Getaway” gradually filling up, serving as a constant, tangible reminder of your tropical dream. This aspect creates both a personal account and a verifiable pledge to yourself, translating dreams into achievable goals. Saving jars budgeting molds the often tedious and dull process of saving into an exercise of creativity.

—

Description with Related Umbrella Headings

Financial wisdom tells us that saving is key to economic stability and prosperity. However, the journey to building a savings empire can sometimes be laden with monotonous ordeals and uninspiring figures. Enter saving jars budgeting; a strategy that’s revolutionizing how individuals approach their savings by interspersing a dose of fun and engagement into a quintessentially serious endeavor.

Saving jars budgeting encourages individuals to personalize their budget plan through jar allocation. This doesn’t only add a layer of enjoyment but also facilitates a consistent attachment to personal goals. The strategy’s ability to morph classic saving intentions into vibrant goals makes it stand out in the personal finance sphere. According to research, individuals who utilize more interactive saving strategies often report higher satisfaction and success in meeting financial objectives.

H2: How Does Saving Jars Budgeting Work?

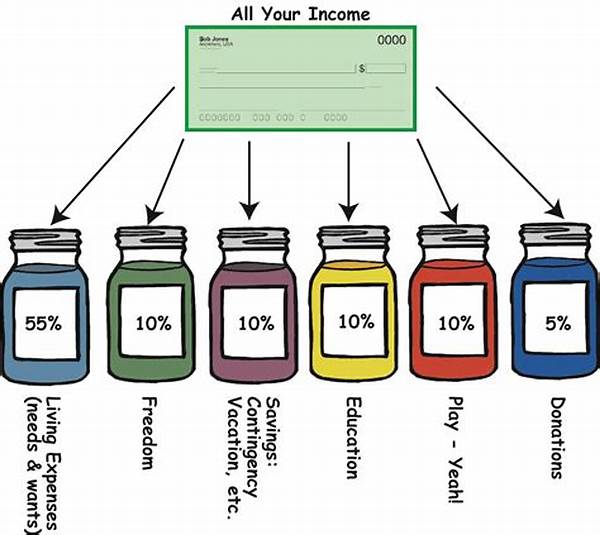

Saving jars budgeting is more than just allocating money into pots; it’s an intuitive approach to making your financial goals more tangible. One might start with fundamental categories such as ‘Needs,’ ‘Wants,’ ‘Emergencies,’ and ‘Dreams.’ By allocating your income into these jars, you effectively gain control over your finances, avoiding overspending and impulse purchases. It’s a simple yet profound way of retraining spending habits.

H3: Transforming Financial Habits with Saving Jars Budgeting

This approach trains individuals to prioritize their spending, tailoring their financial habits according to what’s essential towards achieving both short and long-term goals. It motivates discipline as the visual growth in each jar is both a reminder of prudence and a promoter of perseverance. This concept makes financial management a more approachable and less intimidating exercise for people from all walks of life, enhancing both financial literacy and smart saving habits.

As the narrative of testimonials and successes unfolds, it’s clear that the benefits of saving jars budgeting extend beyond immediate financial gratification. It fosters a culture of financial prudence and responsibility that outlasts the jars themselves, engraining valuable financial knowledge. The widespread positive narratives around this strategy add credibility and appeal.

Seeing your savings visually accumulate acts as a powerful motivator. No numbers on a paper or screen to contend with—just the growing weight and fullness of your jars, driving you forward. Additionally, in our fast-paced digital world, the tactile nature of handling your savings introduces mindfulness to your economic wellbeing, something often missing in traditional digital budgeting.

Overall, saving jars budgeting is not just a strategy; it’s a movement towards a positive, visually engaging paradigm of personal finance. By looking at your finances in this manner, you ensure your financial health stays balanced, enjoyable, and strong. Whether you’re budgeting for growth, security, or luxury, the engaging process of saving jars budgeting offers you both the flash and the funds.

—

Summarized Points about Saving Jars Budgeting

—

The saving jars budgeting method is an invigorating twist on traditional budgeting strategies, managing to balance whimsy with wisdom. Through strategic jar divisions, individuals forge stronger relationships with their financial targets. Saving jars budgeting doesn’t just prioritize monetary growth, but also emphasizes personal development in financial management.

The principle that compels the effectiveness of saving jars budgeting lies in its blend of the physical and psychological. Visual prompts often evoke stronger emotional responses than digital formats. These jars foster a sense of achievement and provide an irreplaceable tactile interaction with personal ambitions.

In essence, saving jars budgeting equips users with not just financial growth, but a transformed perspective on money management. From enforcing frugality to inspiring aspirations, this innovative approach leads the charge in career financial wellness. Through jar allocations that capture diverse financial dreams, saving jars budgeting steadily injects personality into practical savings. This strategy continues to evolve, resonate, and redefine how financial goals are dreamed and achieved.

H2: Conclusion and Invitation to Join the Saving Jars Movement

Consider saving jars budgeting as more than a mere money-saving technique—it’s about carving out your financial storyline, a story where you are the author of your monetary destiny. The benefits you reap from the jars extend into tales of conscious spending, dedicated saving, and ultimately, fulfilled aspirations. Join the parade of successful savers who have welcomed this rewarding budgeting lifestyle and begin your journey toward financial freedom today.

—

Saving Jars Budgeting: Quick Descriptions

The increasing popularity of saving jars budgeting redefines financial management by introducing an emotionally gratifying, highly efficient budgeting option. Stakeholders from diverse financial landscapes attest to its effectiveness and positive impact, promoting simplicity and engagement in money handling. Start transforming your financial landscape with saving jars budgeting today, infusing every savings goal with intention and clarity.