Saving And Budgeting Apps

Saving and Budgeting Apps: Your Financial Lifesaver

Read More : The Fake Discount: Why Buying Items Just Because They’re On Sale Is Still Losing Money!

In a world where financial stability seems as elusive as a unicorn, saving and budgeting apps have emerged as our modern-day heroes. If you’ve ever found yourself standing at the supermarket checkout, frantically calculating whether you can afford that extra packet of cookies, you’re not alone. Enter the world of saving and budgeting apps, bringing a sprinkle of magic to the humdrum of monetary management. These digital allies take the tedious task of number crunching and transform it into an engaging experience, akin to having a financial advisor right in your pocket.

Imagine the delight of turning what usually feels like a grim task into a gamified adventure. Saving and budgeting apps cater to the millennial and Gen Z crowd with their sleek designs and intuitive interfaces. They are not just tools but companions in the quest for financial freedom. The market is flooded with a plethora of these apps, each offering unique features tailored to different lifestyles. From tracking expenses, setting savings goals, to even providing financial advice—these apps do it all. They don’t just make budgeting manageable; they make it cool. Who would have thought managing money could be as satisfying as scoring the winning goal in a video game?

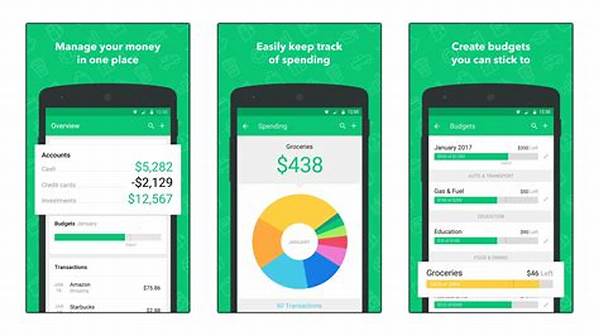

The real beauty of these apps lies in their ability to make personal finance accessible to everyone, even those who failed math in high school. Easy-to-understand charts, automatic transaction categorization, and friendly reminders keep you on track without overwhelming you. Financial literacy has never been this straightforward, and all from the comfort of your smartphone. Let’s face it, in a world run by technology, not using these tools is like opting to walk when you have a perfectly good car. It’s time to stop hiding from your finances and start dancing to the tune of money management with your new favorite saving and budgeting apps!

Why Everyone is Talking About Saving and Budgeting Apps

The surge in popularity of saving and budgeting apps can be attributed to the growing demand for transparent and manageable financial planning tools. Millennials and Gen Z are leading the charge in adopting these digital solutions, eager to break free from the financial stress that plagued previous generations. These apps have rewritten the rules by transforming financial planning into a dynamic and engaging process. With features such as automatic savings, real-time expense tracking, and customizable budgeting plans, they’re not just a passing trend—they’re a financial revolution.

In the fast-paced digital age, having instant access to financial data is not just beneficial; it’s necessary. These apps provide users with the ability to monitor their financial health anytime, anywhere. Through detailed analytics and reports, users can see exactly where their money is going. This transparency is a game-changer, as it empowers users to make informed decisions with their savings. By using saving and budgeting apps, individuals are equipped with the knowledge to cut down on unnecessary spending and focus on building a secure financial future.

As financial literacy becomes more crucial, saving and budgeting apps are stepping in as effective educational tools. They provide insights into financial habits and offer tips for improvement, acting as personal finance tutors. What makes these apps even more appealing is their ability to tailor advice to individual circumstances. Whether you’re saving for a new car or just trying to get through the month without going into the red, there’s a customized plan for you. In essence, these apps democratize financial planning, making it available to everyone, irrespective of their prior knowledge or experience.

If you’ve ever felt financially stuck, joining the community of users benefiting from saving and budgeting apps could be a life-changing decision. They’ve garnered numerous testimonials from users who have successfully turned their financial situations around. One app user, Sarah, shares how an app helped her save for her dream vacation without sacrificing her daily coffee ritual—proof that you can have your coffee and drink it too! All it takes is a smartphone, a quick download, and you’re on your way to financial empowerment.

The Benefits of Saving and Budgeting Apps

These apps are more than just software—they are your financial wingman. Let’s explore why these digital marvels are making waves:

Harnessing the Full Potential of Saving and Budgeting Apps

To truly unleash the capabilities of saving and budgeting apps, it’s essential to understand and utilize their full range of features. These tools are designed to integrate seamlessly into your daily life while offering comprehensive support for all your financial endeavors.

Understanding the Core Features

The first step to maximizing your experience with saving and budgeting apps is understanding what they have to offer. Most apps provide:

Engaging with these features promptly can transform your financial habits significantly. The combination of real-time data and automated updates eliminates the tedious task of manual tracking, freeing up time for users to focus on other aspects of their financial journey.

Integrating Apps into Daily Life

Making saving and budgeting apps a part of your daily routine establishes consistency in financial management. Here’s how you can integrate them effectively:

Just as exercise apps encourage you to meet fitness milestones, saving and budgeting apps motivate your financial discipline. By incorporating them into your lifestyle, you’re not only gaining financial control but also setting the stage for a financially secure future.

Achieving Financial Goals with Saving and Budgeting Apps

The true power of saving and budgeting apps lies in their ability to help users achieve financial goals. Using these apps to their full potential can make reaching financial milestones a reality.

Setting Realistic Financial Goals

Setting achievable goals is crucial, and saving and budgeting apps are equipped to assist in:

Through meticulous goal-setting and progress tracking, you’ll find these apps invaluable in journeys from saving for emergencies to planning retirement.

Testimonial: Transforming Financial Health

An interview with a committed user, James, reveals how these apps transformed his financial health remarkably. By harnessing the power of real-time tracking and goal setting, James managed to eliminate high-interest debts and save for a down payment on his first home. His story exemplifies the life-changing impact these apps can have.

List of Popular Saving and Budgeting Apps

To wrap it up, here’s a listicle of some fan-favorite saving and budgeting apps:

Saving and budgeting apps offer a world of benefits waiting to be explored. Whether you’re drawn to cutting-edge design or functionality, there’s a perfect app out there ready to assist in transforming your financial dreams into reality. Engage with these tools today and embark on your journey toward financial mastery.