Ditching The High-fee Advisor: How Robo-advisors Provide Superior, Low-cost Guidance!

Article: Ditching the High-Fee Advisor: How Robo-Advisors Provide Superior, Low-Cost Guidance!

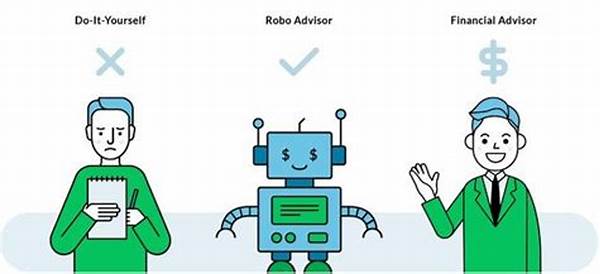

In the world of investment, striking a balance between risk and reward is crucial, but doing so alongside exorbitant advisory fees can be a daunting task for many. Chances are, if you’re reading this, you’ve experienced that gut-wrenching moment when the fees listed on your advisory services dwarf the actual returns you were expecting. There’s a pervasive myth in financial management that bigger fees equate to better service. But is that really the case? Enter the age of robo-advisors, which are here to demystify investment and usher in a new era of low-cost, efficient, and effective financial guidance. Let’s uncover just how ditching the high-fee advisor: how robo-advisors provide superior, low-cost guidance!

Read More : Why Financial Advisors Recommend Etfs

Primarily targeting millennials and younger investors, robo-advisors emerged in the post-2008 financial crisis landscape with the promise of streamlined, algorithm-driven investment portfolios. Imagine a world where your financial advisor is a sophisticated algorithm capable of analyzing market trends without taking a coffee break! With compelling stats showing robo-advisors managing billions in assets and charging fees as low as 0.25% compared to traditional advisors’ typical 1-2%, it’s no wonder they’re capturing market attention.

These digital platforms offer a simple, intuitive approach to investing, leveraging state-of-the-art technology to manage and diversify portfolios with cost-efficiency and precision unattainable by humans laden with office overheads and, let’s face it, occasional bad days. A testament to their prowess, a 2022 study found that portfolios managed by robo-advisors outperformed many traditional portfolios managed by human advisors. By adopting this groundbreaking technology, investors worldwide are finally waving goodbye to high fees and embracing a smarter, more efficient way to build financial wealth.

But beyond the cost benefits, robo-advisors provide another subtle, yet substantial advantage: emotional objectivity. Humans are, by nature, emotional beings often predisposed to making irrational investment decisions in the heat of the moment. Robo-advisors, however, are immune to such pitfalls. They make data-driven decisions, maintaining a steady hand through market volatility, ensuring your investment strategy remains on track towards your financial goals. The emotional turmoil of watching stock markets fluctuate diminishes when you know your investments are algorithmically secured.

Why Robo-Advisors Are a Game-Changer

The rise of robo-advisors represents more than just a technological advancement; it signals a fundamental shift in how we approach financial management. These systems democratize investment, providing access and opportunities once reserved for those with significant resources. As you contemplate ditching the high-fee advisor: how robo-advisors provide superior, low-cost guidance!, it’s time to embrace the digital future of investment and ensure your financial journey is anchored in technology that saves you money and enriches your experience.

—

Structured Insight into Robo-Advisors

Understanding the Landscape

Financial management is a challenging endeavor, prompting many to rely on advisors who often charge a hefty percentage of their returns. The traditional system, characterized by nuanced advisement for any investment decision, is witnessing a digital revolution. Enter the robo-advisor: a blend of algorithmic efficiency and investment strategy perfection, touted for providing high-quality service at a fraction of the cost. Let’s delve into the ins and outs of ditching the high-fee advisor: how robo-advisors provide superior, low-cost guidance!

Algorithmic Efficacy

Robo-advisors are software-driven platforms that utilize advanced algorithms to manage portfolios. Unlike human advisors who might be distracted by personal biases or external factors, robo-advisors strictly follow pre-programmed investment principles aimed at achieving optimal returns. This objective investing approach has proven effective for users seeking strategic growth without the personal touch.

Accessibility and Inclusivity

In an era where investment access was once a gated luxury for the financially prominent, robo-advisors stand as bastions of inclusivity and democratization. Suited for a tech-savvy generation, these platforms allow entry-level investors and seasoned market players alike to partake in professional-grade investment opportunities without breaking the bank.

Breaking Down Cost Barriers

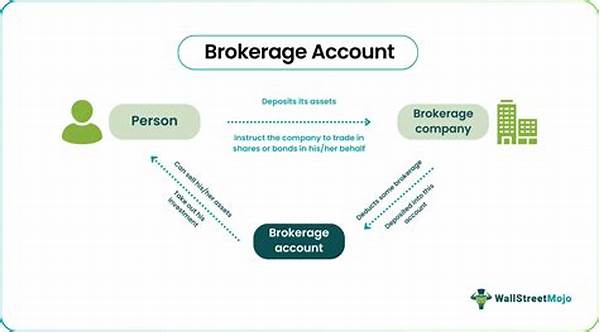

One of the most significant attractions of robo-advisors is their cost structure. By eliminating high commissions and service fees typically associated with traditional advisors, these digital platforms allow more of your earnings to be reinvested, compounding your returns.

The Emotional Edge

Intriguingly, robo-advisors bring an impartial edge that humans simply cannot. Eliminating emotional decisions from the investment equation, they ensure consistent, rational strategies are in place. Similar to having a calm pilot in a turbulent sky, you can rest assured that your investments are being handled with laser-sharp focus.

The Future Outlook

As financial technology continues its explosive growth trajectory, the question is not if, but when more investors will shift towards digital platforms. The early adopters are already witnessing first-hand how ditching the high-fee advisor: how robo-advisors provide superior, low-cost guidance! enables smarter wealth building for the modern age.

—

Real-World Examples

Examples of Effectiveness

Embracing the New Wave

Ditching the high-fee advisor: how robo-advisors provide superior, low-cost guidance! is not merely a trend but a fundamental change in financial strategies. Robo-advisors empower investors by providing efficient, effective, and affordable access to market-driven investments. They break down the prohibitive costs associated with traditional financial advisors, making professional-level investing available to everyone. By automating the investment process, robo-advisors ensure that every dollar is working smarter and harder for you, proving that technology and finance are indeed a match made in heaven for the modern investor. With robo-advisors at the helm, financial freedom is no longer a distant dream but an achievable reality.

—

Robo-Advisors: The Modern Investor’s Ally

Tech-Driven Financial Solutions

The future of financial advising lies at the intersection of cutting-edge technology and age-old investment principles. Robo-advisors embody this union, transforming conventional investing through innovative tools that lower costs and improve outcomes. With personalized algorithms crafting intricate investment plans, clients experience previously unimaginable precision, efficiency, and reliability.

Furthermore, these platforms thrive on efficiency. They allow automatic rebalancing of portfolios, accessing vast arrays of ETF and index funds with ease. For the investor seeking both growth and stability, robo-advisors ensure comprehensive solutions that adapt to evolving financial goals and market changes. Switching from traditional methods to digital platforms is not just a cost-saving decision; it is a step towards a smarter, more informed way of managing assets. Embrace ditching the high-fee advisor: how robo-advisors provide superior, low-cost guidance! Embark on your digital investment journey today, and experience the modern age where your financial future is an algorithmic masterpiece.

—