Expert Warning: The #1 Time Of Month When People Overspend (and How To Stop It)!

H1: Expert Warning: The #1 Time of Month When People Overspend (and How to Stop It)!

Read More : Ditch The Struggle: Why Letting Go Of The Keeping Up With The Joneses Mentality Guarantees Peace!

Every month, there’s a moment when your wallet feels significantly lighter, and your bank account seems emptier than it should be. Ever wonder why? Financial experts have been scratching their heads too, and what they’ve found is shocking yet enlightening. There’s indeed a specific time of the month that makes even the most prudent spenders go off-balance. Imagine being equipped with knowledge that allows you to dodge these financial pitfalls? Here we present to you an exclusive insight into understanding the expert warning: the #1 time of month when people overspend (and how to stop it)! Get ready, because this could save you a fortune every year.

Understanding when and why this overspending occurs is crucial. Typically, the overspending frenzy kicks in right after payday. It’s the time when you feel the richest. According to statistical reports, nearly 70% of monthly income is spent within the first week after payday. The money is burning a hole in people’s pockets and retailers use this psychological phenomenon to their advantage through marketing campaigns and sales. The remainder of the month is often spent piecing together the shattered remains of a budget, sipping instant noodles.

The trick is not about stashing money under your mattress but recognizing the cues that lead to indiscriminate spending. We’ll dive deep into some surprising strategies that experts suggest which will revolutionize your financial habits. Ready to transform the way you handle money, avoid the common traps, and resist temptation like a champ? Let’s uncover the secrets in this reading journey!

H2: Practical Tips to Resist Overspending

You might be wondering; “how do I outsmart myself and avoid this overspending trap?” Well, good news! The road to more disciplined spending is not as rocky as you may think. Here are some tried and true tips.

—Understanding the Phenomenon: The Dangers of Post-Payday Spending

The excitement of seeing a fresh, fuller bank account balance can make the most disciplined among us vulnerable. Why does overspending immediately after payday happen? The reason is simple; it’s a psychological reaction. The joy of financial replenishment diminishes our self-regulation, leading to irrational purchasing decisions. This is where expert warning: the #1 time of month when people overspend (and how to stop it)! plays a crucial role in helping understand this behavior and stave off the need to splurge.

According to a survey conducted among thousands of shoppers, approximately 75% confessed to making impulsive buys after payday. These are not necessarily big-ticket items, but the small, cumulative purchases that quietly drain your funds. From ordering extraneous coffee when you have a coffee machine at home to splurging on unnecessary online deals, these repetitive actions lead to diminished fiscal health. To counter this, financial experts suggest developing a robust spending plan.

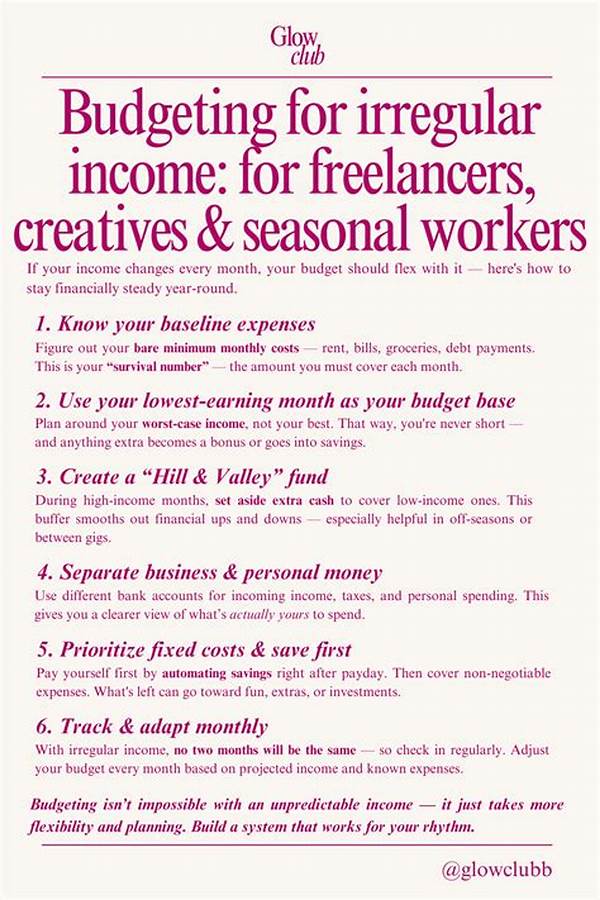

When you know the why of your spending habits, the how of improvement becomes less daunting. It starts with budgeting. Creating a budget enforces a framework within which you must operate. Implement the 50/30/20 rule, a favorite among financial planners: 50% on needs, 30% on wants, and 20% on savings. With a concrete plan, you’ll have a blueprint to avoid overspending traps.

H2: Transforming Your Financial Habits

Temptation is everywhere, yet learning from testimonials of those who have succeeded can inspire transformational habits. Consider Andrew, a self-proclaimed shopaholic who turned his finances around. For Andrew, awareness became power when he learned about the expert warning: the #1 time of month when people overspend (and how to stop it)!

Andrew started by listing his average monthly expenses. He realized his weakness laid in impulsive clothing purchases. To counteract this, he introduced a 72-hour rule: no unplanned purchases without giving himself a 72-hour waiting period. This minimized impulsive buys by 80% in the first month, saving him over $300! For Andrew, investing time in self-reflection and understanding helped him break free from the cycle of paycheck to paycheck life.

The secret sauce isn’t just knowing these methods, it’s applying them with conviction. Educate yourself about your financial behaviors, set achievable goals, and keep track of progress. You’ll find yourself not just spending less, but spending better.

H3: Psychological Triggers and Emotional Spending

In many cases, spending is linked to emotional triggers. Whether it’s retail therapy after a stressful day or treating oneself as a reward, emotional spending is a common trap. This is where the expert warning: the #1 time of month when people overspend (and how to stop it)! comes in handy. Understanding your emotional triggers can empower you to recognize and avoid these pitfalls. Journals, mindfulness meditation, or talking to a friend are simple yet powerful tools to navigate emotional spending environments.

—Topics Related to “Expert Warning: The #1 Time of Month When People Overspend (and How to Stop It)!”

—Exploring Strategies to Curb Spending Habits

The lure of a great sale or the rush of buying something new can make resisting overspending difficult. However, understanding the triggers behind these behaviors and implementing strategic measures can successfully curb the habit. Here’s a quick guide on how you can structure your monthly finances to ensure those hard-earned dollars are put to the best use.

Firstly, recognize the problem. Accept that a significant spike in spending occurs post-payday. This temporary financial high causes an illusion of wealth, driving unnecessary expenditures. Awareness is the first step toward change. Armed with the expert warning: the #1 time of month when people overspend (and how to stop it)!, you can plan better.

Introduce structure into your finances, like a zero-based budgeting system. Assign every dollar a job before the month starts. This approach eliminates the surplus cash that usually leads to spur-of-the-moment decisions. By meticulously planning out each expenditure, you find that savings come naturally, and financial stress diminishes.

Next, it’s critical to separate needs from wants. Regular review of expenses helps identify spending patterns and evaluates what can be cut down. Engage in a ‘pause and reflect’ practice before making any purchase. By cultivating patience as a discipline, you gradually build resistance against the urgency to buy.

Lastly, consider incentives to save. Whether it’s seeing the numbers grow in a savings account or rewarding oneself with a non-financial treat, creating a positive association with saving can stimulate better fiscal responsibility.

H2: Emotional Spending Triggers and How to Overcome Them

Overspending is often linked to emotional needs, making it harder to navigate. When feelings of inadequacy, boredom, or stress hit, spending becomes a comfort tool. Recognizing these emotional triggers is pivotal in formulating a robust defense against overspending. With simple measures and self-awareness, the detrimental cycle can be broken, allowing for better financial health.

H3: Expert Techniques for Financial Discipline

To develop financial discipline that withstands the test of time, consider these expert techniques. By setting clear, tangible financial goals, automating savings, and continually educating oneself about money management, one can reverse the overspending trend. Emphasize accountability by setting regular financial check-ins and celebrate small wins to maintain motivation and ensure lasting change.

—H2: Illustrations Related to “Expert Warning: The #1 Time of Month When People Overspend (and How to Stop It)!”

Overspending often comes wrapped in layers of emotional and psychological triggers. It may start on a light note, like buying a small indulgence, but it can swiftly grow into a concerning habit without realizing, which leads to the expert warning: the #1 time of month when people overspend (and how to stop it)! Through stories and illustrations within this article, hopefully, you’ve gained some insight into how to navigate your financial journey wisely.

Recognizing overspending as a habitual error is pivotal. To exercise discipline, track expenses, and build better money habits that fortify against future pitfalls is the key takeaway. By understanding triggers, employing smarter technologies, and by practicing patience, you’ll find yourself making gradual yet impactful changes in how you manage money each month.

With perspective, discipline, and a touch of humor, you can shake off the shackles of paycheck-to-paycheck living. Consider this journey a step towards a financially liberated future, ready to tackle any spending temptation that comes your way with confidence and knowledge.

—Short Article: The Eternal Struggle of Overspending Post-Payday

The excitement of payday is often short-lived, not because of what it brings, but rather what it enables us to let go of — our money. Nearly everyone encounters this phenomenon: the post-payday spending spree, which has become a cultural norm more than a mere occurrence. But did you know this is backed by psychology and marketing intertwined intricately with our spending behaviors?

The thrill of a hefty bank balance feels empowering, leading to a false sense of security with our funds. Herein lies the challenge: cracking this financial enigma is no longer just a goal, it’s a necessity. Introducing the expert warning: the #1 time of month when people overspend (and how to stop it)! It’s about hacking the brain’s impulse control to stabilize finances and ensure a long-lasting peak of financial joy.

H2: Budgeting: The Saving Grace

Financial experts suggest creating budgets as a life-saving tool, likening it to a financial map in a world rigged with financial traps. By dividing income into neat clusters for necessities, savings, and luxury, one creates a hassle-free financial experience. It’s not just about what one earns, but how effectively they utilize and prioritize.

H3: The Emotional Side of Spending

As humans, emotions drive many of our choices, and spending is no exception. Substituting a stressful day with a new purchase may seem comforting but can result in unnecessary financial burdens. Identifying emotional triggers and developing healthier coping mechanisms is crucial in mastering spending habits.

The solution lies not only within knowledge but in consistent application. Streamline budgets, acknowledge emotional triggers, and harness the power of digital tools to reinforce financial management. March forth with determination to conquer the overspending habits, knowing every mindful choice is a victory for your pocket and peace of mind.