The Simple Math: How To Calculate The Real Interest Rate On Your Credit Card Purchases!

The Simple Math: How to Calculate the Real Interest Rate on Your Credit Card Purchases!

Read More : Crypto Wallet

In this fast-paced world where credit cards have become an integral part of our financial lives, understanding the real interest rate on your purchases can be elusive. Whether you’re charging dinner, a new gadget, or perhaps even a spontaneous vacation, knowing how much these charges actually cost you over time is crucial. So, how do you unravel the mystery of credit card interest rates and calculate what you’re truly paying? Welcome to the world of “The Simple Math: How to Calculate the Real Interest Rate on Your Credit Card Purchases!”

Let’s kick things off with a scenario. Meet Jim. Jim loves his credit card perks, from reward points to cashback. But for some reason, his credit card bills always feel heavier than expected. He wonders, “Am I paying more than I think?” That’s where the real interest rate comes into play, and that’s what we’re simplifying today. This isn’t one of those intimidating financial lessons; instead, think of it as decoding the magic behind the numbers.

Imagine your credit card company as a quirky magician with a twist, hiding the true cost of credit under layers of ‘Annual Percentage Rate’ (APR), compounding factors, and other fees. But fear not! With our reliable calculation method, we’ll unmask these tricks. Truly, the simple math: how to calculate the real interest rate on your credit card purchases! is just within your reach!

Unveiling the Secrets: How to Decode Credit Card Interest

To put it into perspective, understanding your real interest rates involves considering your card’s APR, the balance that carries over each month, and how often interest is compounded. Begin by noting the APR – this can typically be found on your statement or your credit card provider’s website. This is the first hint in your magic act of financial transparency.

Next, factor in how often your credit card compiles interest (daily, monthly, etc.). This impacts how quickly your credit card debt can grow if not paid strategically. For example, if compounded daily, interest can quickly accumulate if the total balance isn’t cleared at the end of the month. So, alongside our hero Jim, imagine managing your card wisely, and minimizing interest charges becomes less of a mystery and more of a winning strategy.

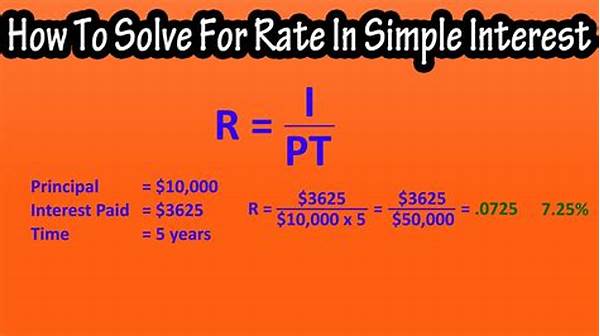

Now, let’s add the intrigue: divide the APR by 365 (days) if compounded daily to get the daily rate, then multiply by the average daily balance in your billing cycle. Adjust as necessary if it’s compounded monthly. By conducting this fairly simple calculation, you can unveil the actual cost of credit you’re shouldering, empowering you to plan better and smarter card use. There you have the simple math: how to calculate the real interest rate on your credit card purchases!

Understanding Your Real Interest Rate: Benefits Beyond the Numbers

Grasping the true interest rate gives you leverage over your financial decision-making. It’s not just about paying less. It’s about having a strategic edge, freeing up funds for savings, investments, or even further valuable purchases — and all that without falling into the credit trap. Jim soon realized this shift after applying our simple math technique. He noticed extra savings accumulating in his account, resulting in less stress and more prospects.

Have you ever imagined vacations without the post-travel money blues? Or treated yourself guilt-free, thanks to clever financial management? Jim achieved all this by recognizing the importance of understanding real interest rates, enabling him to sidestep financial confusion effectively. By turning this knowledge into everyday practice, his financial health began a positive transformation.

Strategic Tips for Credit Card Users

1. Consistently pay your full balance by the due date to avoid interest.

2. Be wary of introductory rates and when they expire.

3. Use credit card rewards strategically for maximum benefit.

4. Track expenses and set alerts to manage spending.

5. Consider switching to a card with a lower interest rate if needed.

6. Stay informed on your card’s terms and conditions for potential changes.

7. Take advantage of balance transfer offers if beneficial.

8. Create a budget that allows for emergency savings.

9. Review your statement regularly for unauthorized charges.

Understanding credit card interest through “The Simple Math: How to Calculate the Real Interest Rate on Your Credit Card Purchases!” can feel empowering, leaving less room for uncertainty in your financial journey. Embrace this newfound clarity, navigate wisely, and you’ll soon encounter the rewarding benefits that come from informed credit card usage!