App For Budgeting And Saving

In a world where financial stability can seem like a mission impossible, the longing for a reliable method to manage one’s budget and nurture a sustainable saving habit is more relevant than ever. The journey often begins with the question: how can one effectively manage their finances without feeling overwhelmed? Enter the app for budgeting and saving—a digital tool designed to take the guesswork out of fiscal responsibility. Imagine a scenario where, instead of dreading the arrival of financial statements, you eagerly anticipate monitoring your smoothly managed expenses and growing savings. No longer is budgeting synonymous with deprivation; it’s about empowerment and understanding where every penny is going.

Read More : Budgeting/saving

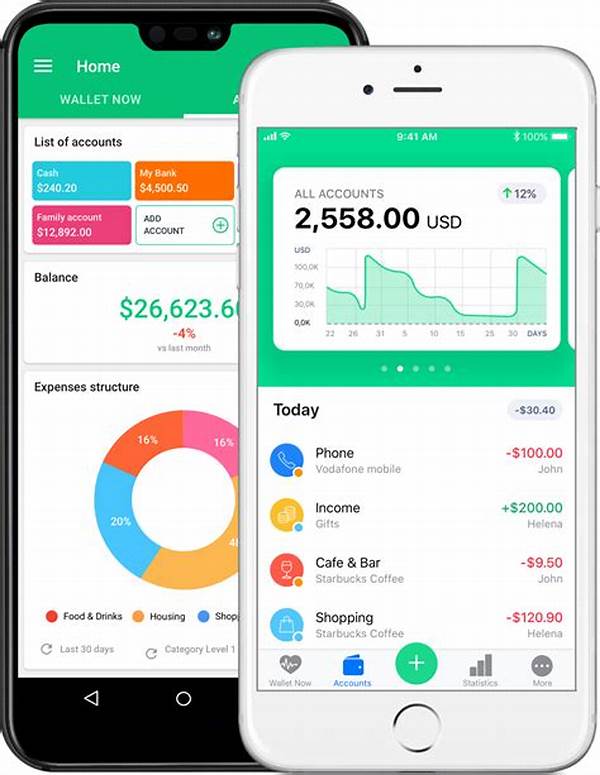

The digital era has granted us this superpower: the capability to oversee our finances from the palm of our hand. These apps promise not just simplicity but also security, ensuring your financial information remains as guarded as Fort Knox. They cater to both the savvy saver and the financial novice, transforming complex financial concepts into simple, actionable tasks. Through a series of alerts, visuals, and step-by-step structures, a great app for budgeting and saving can turn a once intimidating task into a daily habit that feels second nature.

These apps provide a versatile range of features—from tracking your daily expenses to setting ambitious savings goals and sticking to them. They often include interactive charts and analytical breakdowns that help discern spending patterns and pinpoint areas for improvement. But it’s not just about numbers. These insights can evoke an emotional response, motivating users to become better stewards of their own financial destiny. As you become closer to achieving your financial goals, each milestone celebrated serves as a positive reinforcement, making the act of budgeting and saving deeply satisfying.

The beauty of an app for budgeting and saving lies in its adaptability to your lifestyle. Whether you are traveling the world or simply trying to cut back on your morning coffee spend, these apps allow you to adjust and adapt constantly. Each update not only reflects your current financial standings but serves as a roadmap guiding you toward financial wellness. In an ever-changing world, the ability to have real-time insights into your financial health is not just a luxury; it’s a necessity.

Why You Need an App for Budgeting and Saving

Research shows an overwhelming percentage of people are interested in learning how to better manage their money. Despite this, many are unsure where to start. That’s where an app for budgeting and saving comes in, offering not just a starting point but a continuous journey toward financial literacy. These apps prove that by investing a few moments each day, users can develop a keener understanding of their financial habits. Ultimately, they promote a more stable, confident approach to money management.

Budgeting—perhaps not the most glamorous or exhilarating topic, yet undeniably one of the most important ones. As humorists might joke, it’s the art of figuring out where your money went, instead of wondering where it all went. But in all seriousness, the app for budgeting and saving can transform this often mundane task into something almost enjoyable, like a puzzle waiting to be solved. You’re in the driver’s seat, with a dashboard of financial insights that light the way to better financial health.

Transforming Budgeting Into a Journey

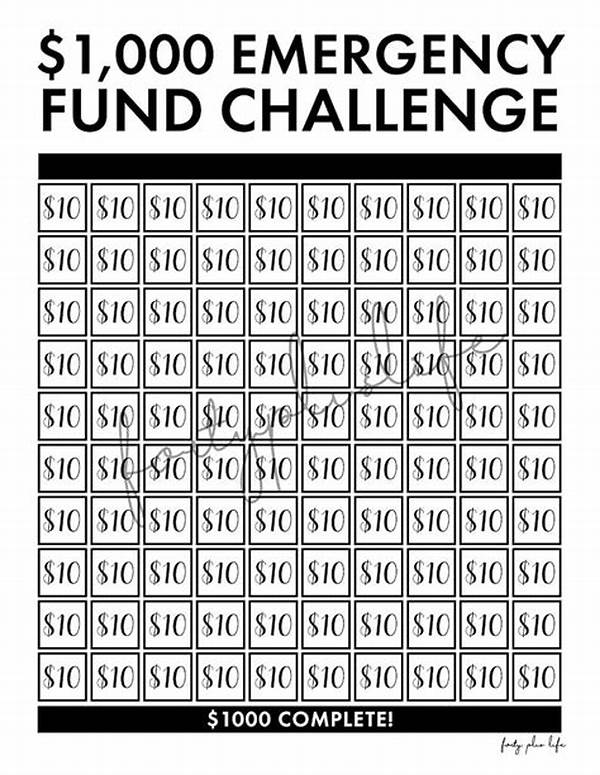

For many, the fear of budgeting stems from the notion that it equates to making sacrifices or experiencing scarcity. Yet, the advent of digital financial tools has shifted this narrative. With an app for budgeting and saving, it becomes a journey of self-discovery. The app doesn’t just tell you to spend less; it shows you how every dollar you save can get you closer to owning a dream home, traveling the world, or living debt-free. Imagine, with each passing day, seeing your hard-earned money working a little harder for you.

The Apps Making Waves

What makes a standout app for budgeting and saving isn’t just its functionality but how it resonates with its users. Some apps stand out for their user-friendly interfaces, while others capture users’ hearts with their advanced analytics. Interviews with everyday app users reveal a common appreciation for any tool that not only streamlines finances but does so in a way that’s relatable and easy to integrate into one’s life. A well-designed app becomes a personal finance confidante, guiding users through the peaks and troughs of financial management with both practicality and empathy.

Tailored guidance, real-time updates, and the ability to personalize features are among many factors fueling the increasing popularity of such apps. Ultimately, the narrative these tools craft is one of empowerment, urging users to embrace autonomy in managing their own financial futures.

Exploring The Benefits of App for Budgeting and Saving

With the ever-growing digital landscape, a multitude of apps have sprouted, each promising to be the ultimate app for budgeting and saving. These applications aren’t just digital spreadsheets; they’re comprehensive life tools—part personal finance advisor, part motivator. They do much more than categorizing expenses and setting alerts; they provide meaningful insights and forecast trends, allowing users to anticipate not just the next billing cycle but their financial future.

But why does personalization in budgeting applications matter so much? Just as no two financial journeys are the same, no two budgeting strategies should be either. Apps that allow for customization let users experiment and find what works best for them, transforming once-frustrating bill days into opportunities for improvement and personal growth.

The beauty of any effective app for budgeting and saving lies not just in its ability to manage money but in creating a seamless user experience that incorporates humor, storytelling, and practical advice. An educational platform disguised as an app? Absolutely. It’s finance reimagined for the modern world, offering powerful storytelling behind numbers and opportunities.

Encouraging User Engagement and Financial Wellness

Recent studies have shown that users who regularly engage with their budgeting apps report two significant outcomes: decreased financial anxiety and increased savings. Building a commitment to regular interaction with one’s own finance becomes second nature. Each user’s story is unique, with testimonials reflecting how these apps have propelled them towards unparalleled financial independence. From saving for future dreams to minimizing debts, the lessons learned are countless.

Financial management doesn’t have to be cumbersome, nor the conversation around it dull. It can—and should—be as engaging and personalized as the lives of those who use them. So, whether you’re a financial novice or an experienced saver, finding the right app for budgeting and saving might just be the best investment you can make.

Examples of Popular Apps for Budgeting and Saving

Venturing into the world of financial planning might seem daunting. The good news? It’s genuinely a field of exploration rather than a constraint-filled territory. Apps these days elevate the entire experience, creating a narrative where every financial decision is linked to a greater purpose. Mere budgeting transitions into strategic personal financial planning.

Understanding the nuances between various apps helps narrow down the choice, but more importantly, it ensures a better fit between user expectations and app functionality. Each storytelling journey within an app for budgeting and saving is unique, combining intuitive design and useful features to elevate user satisfaction and results.

Financial savvy doesn’t happen overnight. Growing it is akin to developing any other skill. Using an app coupled with patience and curiosity guarantees smoother sailing in the otherwise stormy seas of personal finance. So gear up—an exciting financial journey awaits!

In conclusion, mastering personal finance these days is akin to brushing up on a new form of art—it’s colorful, filled with possibilities, and incredibly rewarding. Every individual’s journey is different, and its outcome depends largely on how well-equipped they are at handling the challenges along the way. Embrace the digital tools at your disposal, find the best app for budgeting and saving that suits you, and embark on a remarkable journey towards financial wellness and security.