Best Apps For Budgeting And Saving Money

Best Apps for Budgeting and Saving Money

Read More : App For Budgeting And Saving

In today’s fast-paced digital world, managing finances efficiently seems like a monstrous task for many. With so many temptations floating around and the cost of living continuously rising, budget control can feel like trying to tame a wild bull. However, embraced by the charm of technology, a slew of apps awaits to rescue us from the financial chaos. Imagine best apps for budgeting and saving money as your ultimate financial companions, designed meticulously to keep your wallet from looking like an abandoned graveyard. With unique features and tailored advice, these apps have become a go-to choice. They empower people to not only save effectively but also to gain a firm grip over their expenditures.

Picture yourself as a financial wizard. Each time you tap into these apps, it’s like flipping pages of a magical spellbook. Sounds like a fantasy? Well, these apps turn that fantasy into reality! From setting budgets, tracking expenses, to receiving alerts when you’re about to go overboard—it’s like having a personal financial advisor by your side. You might argue that keeping a budget is old news, but what if these apps didn’t just help you stick to your goals, but motivated you to create new ones? It’s not about being frugal to the extreme, but about gaining insights that help you prioritize and enhance spending quality.

Let’s dive into the narrative of Anne, a university student who once drowned in overdraft fees. Struggling with finances was part of her daily folklore. Enter “App XYZ,” one of the best apps for budgeting and saving money. A skeptical Anne signed up and after a few weeks of dedicated use, she transformed her financial mishaps into harmony. Celebrating pizza nights with her mates while saving effectively for her dream trek was something she never imagined. Her friends began to notice her adeptness in managing money, and soon, Anne became the unofficial ‘Savings Guru’ of her social circle!

Now, I bet you are pumped and ready to jump into action. But with hundreds of apps on the market, how do you choose? Keep those financial frowns at bay because we’ve curated an insightful top picks’ list cleared for takeoff. We’re talking about real game-changers here! The trick is to analyze the features and opt for best apps for budgeting and saving money that mold to your specific needs. Whether it’s creating monthly saving challenges or automatically analyzing spending habits to provide tailored feedback, the future of financial sovereignty lies in your hands.

Why Choose the Best Apps for Budgeting and Saving Money

Now that we have piqued your interest, it’s time to delve into the profound reasons why these apps make wise investments. These tools don’t just account for your everyday pennies, but also streamline financial management in ways we had only dreamt of before. Imagine an app that not only holds your money accountable but also gives you a roadmap to financial freedom.

By offering you insightful data, these best apps for budgeting and saving money help you uncover trends in your spending habits, no matter how mundane. Whether it’s the unnoticed culinary splurges or those little snack stopovers, these apps give you the power to plan ahead and cut unnecessary expenses with humor and grace. The best part? You don’t need to be a financial expert. These apps are user-friendly, making them accessible to everyone from tech-savvy youth to busy parents or retired folk fishing for ways to save.

Structural Insight into Budgeting Apps

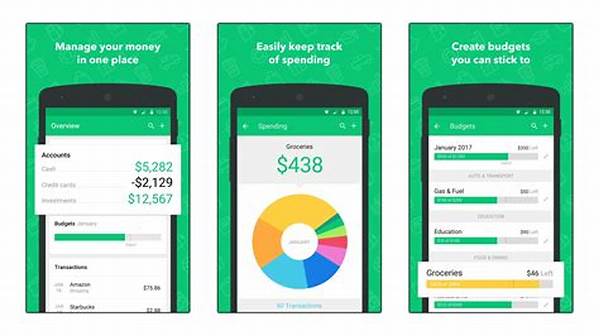

Let’s delve deeper into how best apps for budgeting and saving money help in achieving financial steadiness. First off, these applications thrive on the principle of transparency, offering users a clear snapshot of their financial health. By pulling data from multiple sources such as bank accounts, credit cards, and other monetary outlets, these apps provide a centralized view of your finances, making it incredibly easier to track every dollar.

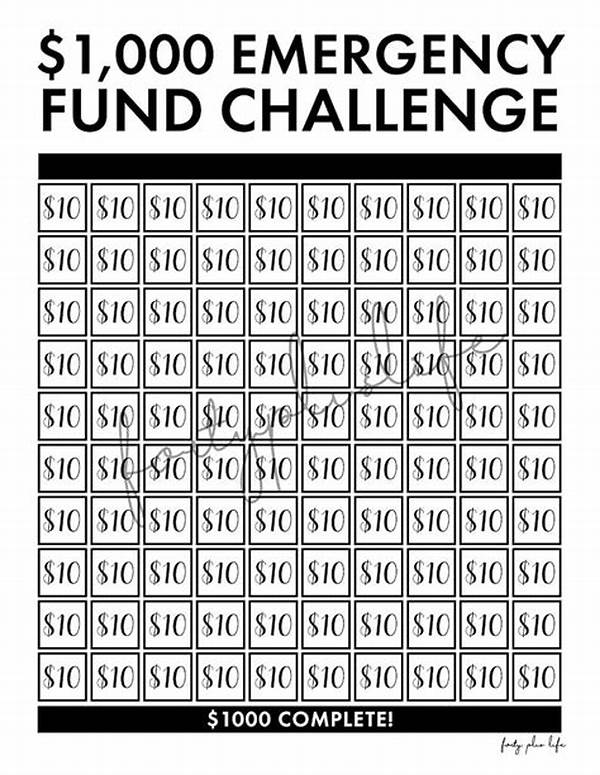

In essence, diversifying options, when it comes to budgeting and saving, is part of their primary allure. Users can set personalized goals, be it saving for an overseas vacation, a new gadget, or establishing an emergency fund. The compelling ‘push notification’ feature acts as your subliminal mentor, making sure you don’t forget to contribute to your allocated funds. The apps aim to eliminate the stigma of stinginess often associated with saving.

Understanding that nobody wants to continue living paycheck to paycheck, financial experts involved in app development consistently analyze market trends and consumer behavior through comprehensive research and analysis. Such statistics are used to build efficient algorithms embedded within these apps to positively influence spending and saving habits. Besides, integrating intelligent reporting systems offers a detailed breakdown of patterns that might have gone unnoticed before.

Fascinatingly, the narrative twist offered by these apps is how they add a fun element to what might seem like a dreary task. Gamification, loyalty rewards, or even the occasional financial meme shared within the app community, bring laughter and joy to users, wrapping serious matters in whimsical transparency. Essentially, it’s more than just saving money; it’s about experiencing money management as an adventurous journey.

Moreover, best apps for budgeting and saving money often include forums or community spaces where users can exchange success stories and challenges. It fosters an inclusive environment, creating a shared experience where one can learn from another’s triumphs or failures. These platforms prompt discussions that enhance knowledge, all the while nurturing emotional support among its network of users.

Harnessing Advanced Features

Utilizing advanced features within these budget-centric apps can be literal game-changers. Insights derived from tools that track spending categories are indispensable for meticulous budget planners. Beyond smart algorithms, personalized alerts help users stick to their commitments, optimizing savings potential. Imagine AI-driven engines that predict potential overspending based on past behaviors and set proactive alerts to curb tendencies—these offerings stand out as unique selling points.

The Impact of Best Apps for Budgeting

Exploring the impact of best apps for budgeting and saving money, we witness a transformation that extends beyond individual benefits—it elevates collective financial literacy. Financial interviews and testimonials underscore the life-altering effects brought by consistent app use. Families experience relief from financial strain, individuals regain control over impulsive buys, and communities celebrate improved economic awareness—it’s a ripple of progressive change televised by lived experiences.

Actions for Maximizing App Benefits

To truly harness the power carried within best apps for budgeting and saving money, here are eight practical actions:

Goal Setting with Budgeting Apps

Laced with the bells and whistles of the best apps for budgeting and saving money, goal setting becomes an enticingly adventurous escapade. Unlike generic endeavours, proper app-guided goal setting guarantees systematically orchestrated optimism towards achieving financial independence. In an era where unpredictability looms around, having eclectic troves empowers individuals to face financial decisions with both reason and passion.

Predicated on foundational research, app developers exhibit prowess in embedding goal-setting features tailored for diverse demographics. Be it within urban landscapes or suburban environments; diverse economic contexts warrant tailored features that address specific financial nuances. This dynamic adaptability exemplifies an app’s prowess in meeting burgeoning financial desires, instilling numeracy efficacy for diverse users.

By fostering not just accountability but transformative habitual changes toward money handling, these apps morph saving endeavors from mundane regimens into vibrant standardized experiences. This effectively reshuffles perceived financial burdens into tangible achievements. Picture being a master of financial finesse. It invigorates understanding, paving the path towards unprecedented growth and the cultivation of intuitive financial intuition.

Exploration of Best Apps for Financial Growth

Regardless of how well-versed one might be with finances, a helping digital hand that guides, advises, and encourages diverse saving techniques surely pays dividends. Investigating the broader impact, these applications embody a multiverse where the numerical sphere converges with transformative learning experiences, magnifying personal benefits tenfold.

For instance, real-time data analytics integrated within these apps carry substantial weight, forecasting potential financial boons while outlining areas for caution. As clients entrust these platforms with delicate financial details, heightened security protocols assure unmatched privacy, transforming potential misgivings into staunch trust. In this narrative unfolding, another subplot emerges—strategic foresight.

Dynamic Overview of Budget Tools

Role-playing as effective daily budget mentors, these dynamic tools usher in streamlined management—keeping you in the loop about fiscal dynamics. Whether streamlined tax assessments, expenditure categorization, or weekly spending audits, users appreciate their diligence. With a modicum of user training and consistent feature exploration, these budget travelers can and will optimize personal dynamics en route to financial euphoria.

Their multitudinal feat cannot be understated. Unquestionably, the conquest of financial dominion augments an untapped prominence in illustrating modern-day fiscal literacy. Through investigative research and direct consumer feedback, developers embrace adaptability blended with seamless integration to uphold revolutionary standards.

In a nutshell, these apps progressively awaken innovative financial methodologies, repainting economies through tailored investments meant to build inclusive, vibrant financial foundations. These aren’t merely apps—they’re digital armaments, protecting and nurturing your assets’ lifespan within the fiscal continuum.

Quick Insights into Best Budget Apps

Engaging with Apps for Financial Consistency

Being drawn into the world of budgeting apps isn’t just about financial restructuring—it’s an adventure layered with exploration, discovery, and education of a higher quality. Equipped with tabulated expenditure plans and calculated trajectories, users find themselves orchestrating endeavors previously deemed impossible. Ultimately this instills intuitiveness in money matters, transforming monetary constraints into adventurous ankhs leading to liberation.

Navigating through diverse app dynamics continues to elevate users’ understanding of leveraging advanced technological paradigms for effective fiscal engagement. With future wasn’t prospects hinging on digital literacy, this fusion of entertainment and learning emerges as the quintessence of modern-day financial interoperability. Future implications point towards an enriched fiscal future, plumbed with insights grounded in experience and knowledge.

By proliferating these instrumental applications, invoking tradition alongside tireless innovation, a new-age budgeting saga unfolds—crafted for adaptation by discerning users across the economic tapestry. A mutual voyage enveloped within experiential enrichment signifies the paradigmatic heart of an evolving fiscal cosmos. In digital symphony orchestrated by these impactful tools, users boast the best apps for budgeting and saving money embossed with confidence and guarantee.