Best Apps For Saving Money And Budgeting

I’m glad to help you get started with creating content on “best apps for saving money and budgeting”. Here is a brief overview of how you can structure your content and some sample text to guide you in your writing process.

Read More : How To Balance Fun Spending Without Guilt

Article: Best Apps for Saving Money and Budgeting

Introduction

In today’s fast-paced world, managing finances can seem like an uphill battle, especially when unexpected expenses crop up at every turn. Maybe you’re juggling student loans, eager to save for that dream vacation, or attempting to master the art of adulting by planning your retirement. Whatever your financial goals, utilizing the best apps for saving money and budgeting can transform your approach to money management. With the click of a button, these apps offer intuitive tools and analytics that transform complex financial data into straightforward insights. Gone are the days of tedious spreadsheets and manual calculations. Now, with just a few taps on your smartphone, you can effortlessly track spending, set savings goals, and ensure you’re on the right path to financial wellness. Not convinced yet? Imagine sipping your favorite beverage while an app does the number-crunching for you, tracking subscriptions you forgot existed, or even investing pocket change into a diversified portfolio. Intrigued? Let’s dive deeper into how these digital wizards are making a significant impact.

Explore Popular Money-Saving Apps

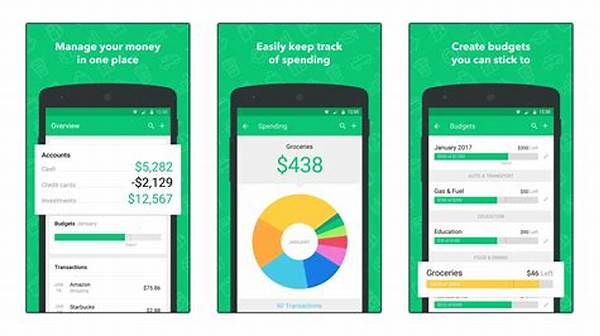

When it comes to the best apps for saving money and budgeting, the marketplace is brimming with choices. From apps like Mint, which acts as your all-in-one financial planner, to YNAB (You Need a Budget), which offers personalized tracking and goal setting, there’s something for everyone. These apps provide flexible options designed to accommodate different financial habits, from envelope budgeting systems to automated savings tools.

Key Benefits and Features

Why settle for less when you can use the best apps for saving money and budgeting? These apps not only help you save money but also educate you about financial health. With user-friendly interfaces, they deliver features such as customizable budgets, spending alerts, and in-depth spending reports. You’ll gain clarity over your finances and uncover trends you may never have realized existed before.

Take the Leap: Start Budgeting Today!

If you’ve been contemplating taking control of your finances, there’s no better time than now. The best apps for saving money and budgeting won’t just streamline your financial tracking; they’ll make budgeting a breeze and perhaps even a bit of fun. Dive into app stores, read reviews, and choose an app that suits your lifestyle. Remember, the journey to financial freedom is a marathon, not a sprint, and these apps are excellent companions along the way.

H2: How to Choose the Best Money-Saving App for You

As the digital marketplace swells with financial apps, selecting the best one can be overwhelming. Consider your personal financial goals—is it saving, tracking, or investing? Different apps offer varied features, so evaluating them based on your needs can help clarify your choice.

—

Structure for a Detailed Article

Introduction

Managing personal finances in today’s digital age no longer means sorting endless paper bills and receipts. With the rise of technology, individuals and families can better manage their money using the best apps for saving money and budgeting. These apps provide a consolidated view of financial health, making it easier for everyone to understand where their money is going and how best to save or spend.

The Role of Technology in Financial Wellness

The rapid advancement in technology has opened new avenues for personal finance management. What used to require meticulous manual entries in ledger books can now be completed efficiently using a smartphone. This shift has eased the process, making it accessible to people from all walks of life.

H2: Key Features of Top Budgeting Apps

Whether it’s automation, spending alerts, or saving goals, the best apps for saving money and budgeting focus on ease of use while providing powerful tools. These apps often include secure data encryption, financial forecasts, and personalized budgeting plans. By offering customizable templates and real-time data tracking, users have more control over their finances than ever before.

Advantages Over Traditional Methods

Traditional budgeting methods often lack real-time tracking and predictive analysis that digital apps offer. The immediacy of updates and the availability of historical data in apps provide invaluable insight into financial trends and opportunities for savings that were often missed before the digital age.

H3: Real User Experiences

Hearing firsthand from those who’ve already taken the leap into the digital budgeting world can be incredibly persuasive. Stories abound of users who felt transformed overnight, realizing savings goals they once thought impossible.

Conclusion

As financial challenges continue to evolve, embracing technology can be a major step forward. By selecting the best apps for saving money and budgeting, one stands a better chance of achieving financial stability and success.

—

Bullet Points for Best Apps for Saving Money and Budgeting

H2: Top Benefits of Money-Saving Apps

Descriptive Content

Budgeting apps have revolutionized the way individuals manage their finances, offering something for everyone, from beginners to financial gurus. The beauty of these apps lies in their capacity to handle both micro and macro financial details meticulously. Users swiftly transition from the old-world hassles of budgeting to a seamlessly integrated financial experience that fits into their pockets. These tools are not just about tracking; they bring an element of fun and engagement to the budgeting process. With game-like features, social sharing options, and the satisfaction of hitting personal financial milestones, users find a greater sense of accomplishment. Meanwhile, the flexibility of these applications makes for an indispensable tool in today’s dynamic financial landscape — bringing transparency, efficiency, and a new level of financial interaction.

—

Expanding Perspectives on Money-Saving Apps

Introduction

Amid the myriad of financial stresses, there’s a light at the end of the tunnel thanks to technology. Enter the world of the best apps for saving money and budgeting—a realm where your smartphone transitions from a social gadget to your financial guardian.

H2: The Journey Begins

Adopting a budgeting app is akin to embarking on a journey towards financial enlightenment. These tools invite users to navigate financial landscapes with agility and confidence, banishing uncertainties tied to money management.

H3: Unpacking the Benefits

Users experience a transformation in the way they interact with money as apps provide continual guidance and support. You are no longer alone in your financial odyssey, but accompanied by cutting-edge algorithms designed for optimal financial performance.

Delight in Discovery

The thrill of uncovering new savings potential and smarter spending habits empowers users. As financial habits improve, other life goals come into sharper focus, providing users with a template for achieving broader life aspirations.

Testimonials from the Tech Savvy

Real-life user stories underscore the effectiveness of embracing digital tools. From freelancers to families, everyone benefits from the integration of these apps into everyday life.

Conclusion

In a confusing and often overwhelming financial world, the best apps for saving money and budgeting offer more than just numbers—they offer a way forward, toward personal financial freedom and peace of mind.