Best Budgeting And Saving App

- Choosing the Perfect Budgeting App for Your Needs

- Why Investing in a Budgeting App is Worthwhile

- Detailed Analysis on Budgeting Apps’ Efficiency

- Streamlining Financial Goals with Apps

- Exploring User Testimonials

- Examples of Best Budgeting and Saving Apps

- Structural Benefits of Choosing the Right App

- Essential Features of Top Tier Apps

In the whirlwind of our daily lives, managing personal finances can seem like an uphill battle. The rise of the digital era has transformed nearly every facet of our lives, including how we organize and handle our financial matters. Once an arduous process of balancing checkbooks and manually tracking expenses, budgeting has now become more efficient and accessible through the magic of financial apps. These tools are more than just electronic ledgers; they are personal financial advisors in your pocket. So, when we talk about the “best budgeting and saving app,” we are not merely discussing convenience, but a comprehensive solution that fosters financial literacy and empowerment.

Read More : Ditch The Debt: This Unlikely Appliance Hack Slashes Your Monthly Electricity Bill By 20%!

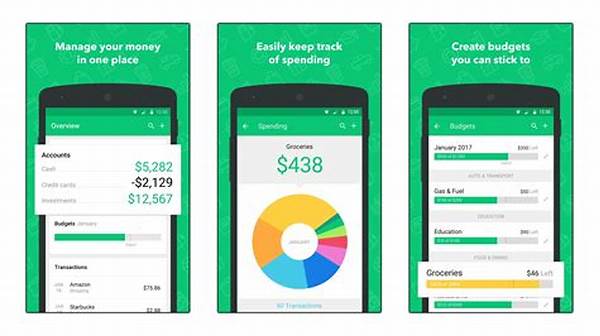

Today’s financial landscape is more complex than ever. With myriad spending avenues — from credit cards to online shopping platforms — keeping track of your expenses can feel like juggling flaming torches. Add to that the ambitious savings goals we set, whether for a dream vacation or a secure retirement, and it’s clear why the demand for budgeting apps has surged. These apps don’t just help track every penny, they offer insights into spending habits, provide reminders for bill payments, and suggest savings strategies tailored to individual financial situations. The best budgeting and saving app will do all this while offering a user-friendly interface that makes managing money as seamless as scrolling through social media.

The evolution from cumbersome spreadsheets to sophisticated apps is a step forward, driven by technology and consumer needs. The digital age demands dynamic solutions — an app that not only keeps up with the user’s lifestyle but anticipates their financial needs. Whether you’re a tech-savvy millennial, a busy parent, or a retiree looking to stretch your pension, there’s a budgeting app geared towards making your financial life easier. This is where the competitive edge of the best budgeting and saving app becomes apparent; it’s tailored, interactive, and empowering. Yet, amidst the sea of available applications, finding the perfect fit can be akin to finding a needle in a haystack.

Choosing the Perfect Budgeting App for Your Needs

When searching for the best budgeting and saving app, consider what features align with your financial goals. Are you looking for something that automates your savings or perhaps an app that offers investment advice? Personalization is key. Apps that adapt to the user’s lifestyle and financial habits can turn budgeting from a chore into a useful daily practice.

Why Investing in a Budgeting App is Worthwhile

In today’s fast-paced world, having a trusted financial companion in the form of a budgeting app is like having a financial coach at your fingertips. These apps not only bring clarity and organization to your financial life but also lead to informed decision-making. In this era, where financial security is paramount, investing time in selecting the best budgeting and saving app is an investment in peace of mind and a prosperous future.

—

Detailed Analysis on Budgeting Apps’ Efficiency

The functionality and effectiveness of budgeting apps have piqued the interest of financial analysts and everyday users alike. It’s no longer just about tracking expenses but engaging in detailed analysis of how these expenses align with personal financial goals. The best budgeting and saving app excels not just in categorization but in providing meaningful insights that can transform how users interact with their finances.

With a powerful app, users can dive deep into understanding their spending patterns, analyze where most of their money is going, and establish a realistic budget that reflects their lifestyle. These insights aren’t mere data; they are the stepping stones to financial freedom. Furthermore, many apps offer educational tools that enhance the user’s financial literacy, turning everyday spenders into savvy financial experts.

Streamlining Financial Goals with Apps

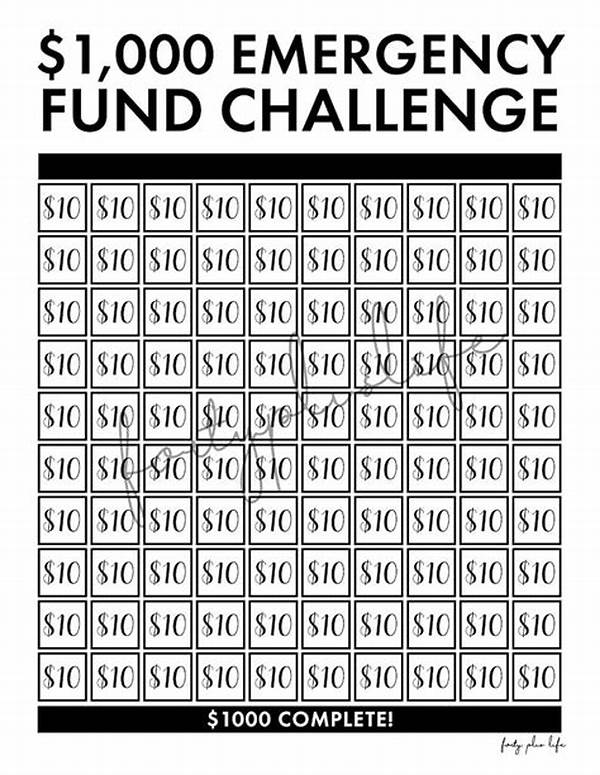

By setting up specific financial targets within the app, users can track their progress over time, receive alerts when they’re overspending, and celebrate milestones as they reach their savings goals. This motivational aspect plays a crucial role in maintaining discipline and commitment to personal financial objectives. The gamification of budgeting transforms the often tedious task of managing money into an engaging challenge, nudging users towards better financial health.

Exploring User Testimonials

User reviews and testimonials play an invaluable role in understanding the real-world effectiveness of these apps. A quick glance at community forums, app stores, or social media will reveal stories from users who’ve turned their financial lives around by harnessing the power of the best budgeting and saving app. These stories not only build credibility but inspire potential users to take that first step towards financial freedom.

Examples of Best Budgeting and Saving Apps

Structural Benefits of Choosing the Right App

Choosing the best budgeting and saving app is akin to finding the right partner for your financial journey. These apps provide the structure that many find difficult to achieve on their own. At their core, they simplify complex financial operations into digestible daily habits, setting users on a disciplined path towards financial achievement.

A carefully curated budgeting app becomes like a GPS for your money, guiding every financial decision with precision and foresight. Not only does it help users maintain oversight on their expenses, but it also offers peace of mind knowing that all financial matters are organized, accessible, and secure. In essence, it’s about transforming financial chaos into clarity and cultivating a disciplined approach to personal finance.

Essential Features of Top Tier Apps

By leveraging the best budgeting and saving app, you set yourself up for sustainable financial success. Whether you’re starting fresh or refining your current financial strategy, the right app can be the game-changer you need.

Combining rigorous functionality with ease of use, the best budgeting and saving app becomes an indispensable tool for anyone looking to enhance their financial health and literacy. These apps serve not just as financial trackers but as builders of wealth and stability.