Budgeting And Saving Apps

Budgeting and Saving Apps

Read More : Why Automatic Savings Tools Work Best

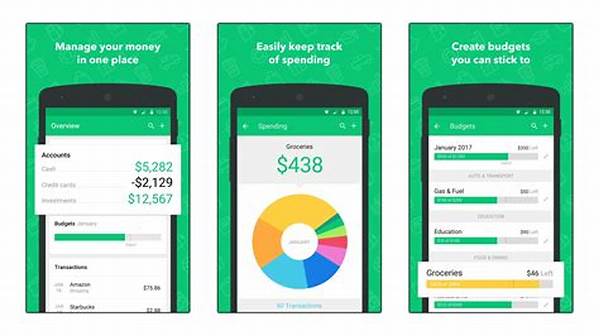

In today’s fast-paced world, managing finances efficiently has become a necessity. With the advent of technology, budgeting and saving apps have emerged as game-changers for individuals looking to keep their finances in check. These digital tools not only provide insights into spending habits but also offer a platform to set financial goals, track expenses, and save for the future. Whether you are a college student trying to save money or a working adult planning for retirement, budgeting and saving apps have something valuable for everyone. Imagine having all your financial data at your fingertips, seamlessly organized in a user-friendly interface. You no longer have to guess where your money went at the end of the month. Instead, you can unlock financial freedom and take charge of your economic well-being.

Have you ever wondered why you can’t seem to save despite having a steady income? The answer might lie in unmonitored expenses and a lack of financial planning. This is where budgeting and saving apps step in, offering an array of features designed to streamline your financial management. They categorize your expenses, alert you when you are close to overspending, and even automate saving for you. Thanks to cutting-edge technology, managing your finances has never been easier or more efficient.

Moreover, these applications come with tailored solutions, ensuring users get a personalized experience. For instance, some apps specialize in simplifying tax deductions for freelancers or business-related expenses for entrepreneurs. They can also integrate with your bank accounts, providing real-time updates and enhanced security features. On top of all that, these apps turn what once seemed like dull financial chores into engaging activities through gamification and motivational challenges, ensuring you stay committed to your financial aspirations.

How Budgeting and Saving Apps Change Financial Dynamics

Budgeting and saving apps are no longer a luxury—they are a necessity for anyone aiming to gain better control of their financial life. They not only simplify finance management but also introduce an aspect of fun and engagement through interactive dashboards and goal-setting challenges. By providing a snapshot of your financial habits, these apps serve as educational tools, highlighting areas where you can improve and manage resources better. They act as a personal financial advisor, available to you 24/7, ensuring that financial discipline is just a click away.

—Description of Budgeting and Saving Apps

Budgeting and saving apps have revolutionized how individuals manage their finances. In a world where every penny counts, these apps provide a practical solution for maintaining financial health. They not only facilitate the monitoring of expenditures but also promote saving behaviors. The psychological impact of seeing your savings grow gives users a sense of accomplishment and motivates them to continue with their financial strategy, leading to more informed financial decisions.

The Features That Make Them Essential

One of the primary features that make budgeting and saving apps indispensable is their ability to synchronize with bank accounts and credit cards, offering real-time data analysis. Instant notifications about unusual transactions or high expenses can help users avoid overspending and potential bank charges. Aside from tracking expenses, these apps also offer budget creation and financial goal-setting features, turning them into powerful planning tools rather than just tracking utilities.

Impact on Financial Behavior

Budgeting and saving apps have a significant impact on consumer financial behavior. People who utilize these apps report increased savings and reduced instances of debt. By making financial data readily accessible, these apps encourage users to adopt better spending habits. The convenience of mobile access ensures that these tools fit seamlessly into any lifestyle, proving that financial management doesn’t have to be complicated or time-consuming.

A recent study indicates that users of budgeting and saving apps save up to 25% more money compared to those who don’t use them. This statistic alone should prompt anyone to consider integrating such an app into their daily routine. It’s like having a pocket-sized financial assistant that provides guidance and support to help users meet their financial goals.

The various insights provided regarding spending categories can also help in lifestyle adjustments. For instance, if monthly reports reveal overspending on dining out, users might be encouraged to cook at home more, leading to healthier eating habits and financial savings. It’s a win-win situation that enhances both fiscal and personal well-being.

To conclude, budgeting and saving apps stand out not just as a technological advance but as pivotal tools that bridge the gap between consumers and financial literacy. They empower individuals to take charge of their economic future with confidence. No longer are these apps optional extras; they are indispensable components of a robust financial strategy.

—Details About Budgeting and Saving Apps

Simplifying Your Financial Life

Navigating the world of finance might seem daunting at first, but budgeting and saving apps simplify the process. They bring a structure to chaos, dividing your expenses into clear categories, which helps you understand your habits better. With just a few clicks, you get an accurate overview of your financial health, helping you make informed decisions about your spending patterns and savings needs.

Set a savings target, and your app becomes your cheerleader, sending gentle reminders and congratulating you when you reach milestones. It’s not just about hard numbers; it’s about redefining your relationship with money, transforming anxiety into assurance. Taking control of your finances is empowering, and with these apps, you are creating a path to financial independence.

Most users find comfort in knowing that there is a tool aiding them in their fiscal journey. The blend of technology and financial management not only makes monetary tasks less tedious but also enhances the ability to stay committed to financial goals. It’s one less thing to worry about, allowing you more time to focus on things you love.

In an era where convenience is key, budgeting and saving apps provide just that. Automating your financial tasks not only saves time but also reduces the mental load of remembering due dates and bills. They’ve brought about a revolution in personal finance by making budgeting and saving a tangible and achievable task for everyone.

—Enabling Better Financial Choices with Budgeting and Saving Apps

More than ever, budgeting and saving apps are at the forefront of the personal finance revolution. These powerful tools allow you to take charge of your financial journey, eliminating the guesswork and anxiety that often accompanies fiscal planning. They are designed not just for tracking but also for educating, building a foundation of financial literacy that can lead to a more secure and stable future.

Customization is another standout feature of budgeting and saving apps. These applications are intelligently designed to conform to individual preferences, ensuring the advice and insights you gain are relevant to your unique financial circumstances. Whether you’re saving for a new car, a dream vacation, or a downpayment on a house, these apps provide a tailored approach to help you meet your financial objectives efficiently.

Budgeting Apps: A Modern Solution

One of the key advantages of budgeting and saving apps is their ability to integrate seamlessly with existing technology. They connect effortlessly with your bank accounts, offering real-time updates and insights. This convenience means you can keep a constant eye on your finances without the hassle of manual tracking. It’s like having a financial advisor in your pocket, always ready to offer guidance and support when you need it most.

Transformative Savings Habits

Budgeting and saving apps don’t just help you spend wisely; they actively influence your savings habits. By displaying clear indicators of your savings progress and offering tangible rewards for reaching milestones, these apps help turn saving money into a fulfilling activity rather than a daunting task. Research has shown that these visual goals and progress markers can significantly impact the likelihood of meeting financial objectives, as people respond well to seeing their successes visually.

Let’s face it, the traditional ways of saving money can be mundane. But with the gamification aspect many of these apps provide, you find yourself engaging more with your savings plan. It’s like leveling up in a game, but in real life—who knew personal finance could be so rewarding and fun at the same time?

The reliability and ease of use make budgeting and saving apps a must-have in this digital era. They offer a fresh perspective on personal finance management, allowing users to approach their financial planning with newfound excitement and determination. So why wait? Dive into the world of budgeting and saving apps and take a proactive step towards financial wellness today.