Budgeting And Saving Sim Answers

H1: Budgeting and Saving Sim Answers

In today’s fast-paced world, financial security is more crucial than ever. Gone are the days when saving a few dollars under the mattress was enough to guarantee a stable future. Enter the world of budgeting and saving sim answers—a realm where virtual reality meets financial literacy, offering not only a glimpse into wise financial decisions but also practical, actionable strategies to enhance your financial health. Imagine navigating your finances as if you were playing an intricate and rewarding game, discovering strategies that work, identifying pitfalls, and ultimately achieving your financial goals, all through the lens of virtual simulations. The innovative approach of budgeting and saving sim answers changes the way we perceive financial education, making it not only informative but also interactive and engaging.

Read More : Budgeting Mistakes You Must Avoid In 2025

This personalized financial adventure empowers you by placing you in various realistic scenarios, each designed to challenge your understanding and application of financial knowledge. Think of it as a playground for your financial decisions—here, you can afford to make mistakes, learn from them, and gain valuable insights without any of the real-world consequences. The magic of budgeting and saving sim answers lies in its ability to transform complex financial concepts into simple, digestible, and enjoyable experiences. Providing an invaluable toolkit for navigating life’s financial challenges, it is a must-explore for anyone eager to master the art of financial stewardship.

The game-like simulation is not only fun but also deeply educational, offering a safe space to hone your budgeting skills. By engaging with the dynamic scenarios in budgeting and saving sim answers, you will become adept at managing expenses, recognizing investment opportunities, and building a robust savings plan. Whether you’re a newcomer to the world of finance or a seasoned expert, the lessons embedded within these simulations are universally beneficial. By the end of your journey, you’ll find yourself armed with the confidence and knowledge to make informed financial decisions, ultimately leading you towards a future of financial independence and success.

Understanding Budgeting and Saving Sim Answers

To embark on this financial odyssey, it’s essential to understand the core concepts behind budgeting and saving sim answers. This isn’t merely a software tool; it’s a comprehensive educational experience designed to reshape your relationship with money. Each simulation is meticulously crafted, almost as if your financial seminar has been intertwined with an epic, engaging narrative. The true brilliance lies in its unique ability to appeal to a broad audience, rendering financial literacy both accessible and enjoyable. The engaging experience is not only practical but also rooted in research-backed financial strategies.

—

H2: The Art of Mastering Budgeting and Saving Sim Answers

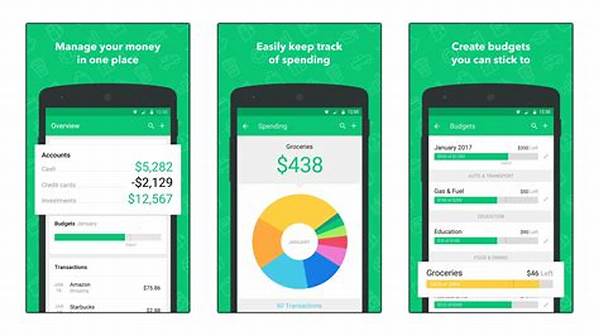

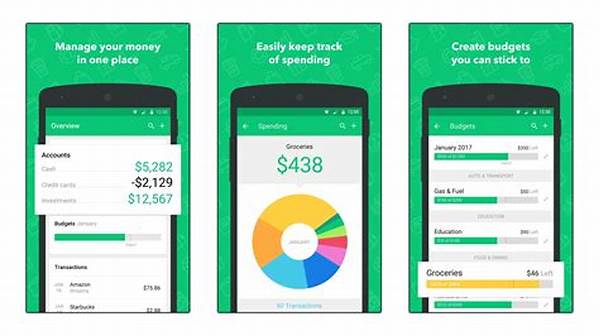

Delving deeper into the world of budgeting and saving sim answers requires an understanding of practical application. Picture this: a recent study found that individuals using financial simulations are significantly more aware of their spending habits and save approximately 20% more than those who do not use such tools. The compelling statistics from such research further underscore the utility of these simulations. By providing you with a virtual financial advisor, these simulations help you make judicious financial decisions over time.

By interpreting and learning from the scenarios presented, you’ll become proficient in managing your finances both in the game and in reality. From setting realistic budgets to creating robust emergency funds, budgeting and saving sim answers will guide you towards achieving financial stability. These simulations offer an invaluable lesson in saving, budgeting, and investing, all while strengthening your decision-making skills and enhancing your overall financial literacy.

H3: Embracing the Future of Financial Literacy

Navigating through budgeting and saving sim answers means embracing the future of financial literacy. One of its most appealing aspects is its capacity to make financial education readily available to everyone, irrespective of age or background. As technology continues to advance, this gamified approach will undoubtedly play a pivotal role in how future generations learn about personal finance. As more people access these simulations, the collective financial literacy will improve, leading to more informed financial decisions and, ultimately, a more financially secure society.

The rise of budgeting and saving sim answers marks a transformative shift in financial education. By turning the often daunting realm of finance into an engaging, interactive game, these simulations have revolutionized how we approach learning about money. So, whether you’re looking to refine your budgeting skills, improve your savings strategy, or simply want an entertaining way to boost your financial IQ, budgeting and saving sim answers offers a pathway toward a more prosperous future.

—

Examples of Budgeting and Saving Sim Answers

H2: Creative Examples of Budgeting and Saving Sim Answers

Embarking on an adventure with budgeting and saving sim answers is not just about financial stability; it’s about gaining confidence and expertise that’s as real as it gets. By blurring the lines between education and entertainment, these simulations ensure that financial literacy is accessible and enjoyable. The stories and lessons you learn here carry forward into real-world scenarios, where informed decisions pave the way for a financially secure future. Whether you’re playing on your own or integrating these simulations into educational curriculums, the power of budgeting and saving sim answers captivates and educates, setting a benchmark in personal finance education. The success stories from those who’ve embraced this tool stand testament to the transformative impact it can have on one’s financial journey.