Budgeting Mistakes You Must Avoid In 2025

As 2025 approaches, many are looking to tighten their financial belts and optimize their budgets. It’s a time of new beginnings, reflection, and for some, financial resolutions. However, before plunging headfirst into an ambitious financial plan, it’s essential to recognize the budgeting mistakes you must avoid in 2025. This article aims to enlighten you with a touch of humor, insight, and a dash of practicality, steering you clear from financial pitfalls that might derail your 2025 plans.

Read More : Best Apps For Budgeting And Saving

The art of budgeting isn’t just about numbers; it’s a vision, sometimes an ambitious one. Imagine going on a road trip without knowing your destination. That’s what happens when you set a budget without clearly defining your financial goals. Many start with fervor and enthusiasm, jotting down expenses, savings, and wishful purchases, but without a purpose or a defined destination, your budget could become just another forgotten spreadsheet. Remember, a budget is not a punishment but a plan set to help you achieve financial freedom.

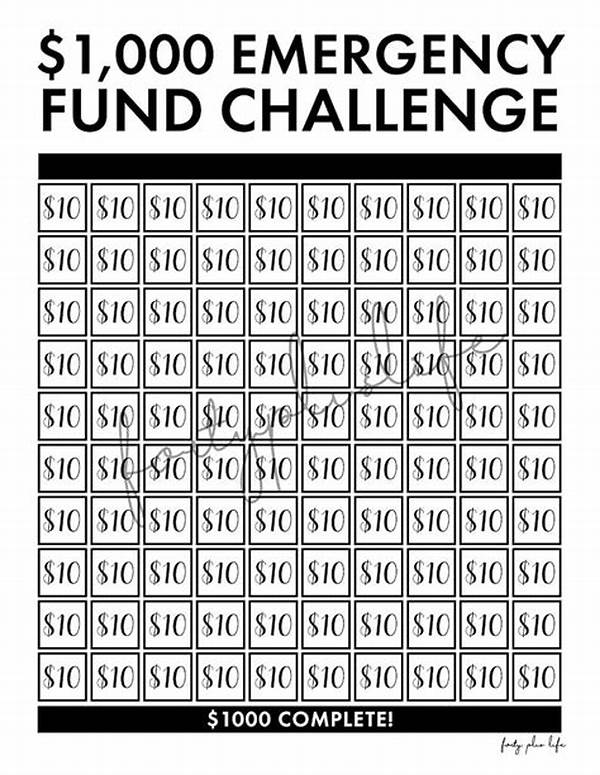

Now you’d think having an extraordinary financial mind ensures no blunders, right? Not quite. Many savvy individuals have stumbled upon common budgeting blunders, turning what should be a vibrant financial canvas into a chaotic palette. From neglecting emergency funds to overestimating income, these mistakes can cost you peace of mind and financial security. The trick is not just knowing the theory, but understanding and implementing the strategy to steer clear from these budgeting mistakes you must avoid in 2025.

Then comes the interesting part – setting your priorities straight. Is it that luxurious vacation or paying off more of your debt? Balancing wants and needs can sometimes feel like having that angel and devil on your shoulders. With social media constantly showcasing extravagant lifestyles, one might feel pressured to keep up. The solution? Design a budget that reflects your values and circumstances, ensuring you don’t let societal pressures redefine your financial priorities.

So, what’s the call to action? Spend some time analyzing your current budgeting framework. Take a humorous approach – imagine what your budget would say if it could talk. “Why are you ignoring that subscription you don’t use?” or “You’re eating out three times a week? Wow!” Digest, reflect, and adjust while keeping your eyes on the financial horizon. Remember, with a precise map (budget), you’ll safely navigate through 2025 without veering off course.

Common Pitfalls in 2025 Budgeting

Overlooking the Basics

Moving into 2025, let’s dive deeper into the budgeting mistakes you must avoid in 2025. Our conversation with financial experts has revealed that despite technological advancements, many fundamental errors persist. Ignoring the basics like keeping track of daily expenses can dismantle even the most robust financial plan. It’s not about penny-pinching but recognizing every penny matters and counts toward your larger goals.

Failing to revise your budget regularly remains a top offender. In conversation with finance aficionados, the mantra remains – update, update, and update! The economic landscape changes, and so should your budget. It’s akin to shopping for winter wear during a summer sale; the timing and context matter.

Misjudging Investment Opportunities

Another crucial error is the allure of “get-rich-quick” schemes. With the rise of cryptocurrency and digital investments, many find themselves entangled in investments they barely understand. Do the research, lean on expert advice, and avoid winging it based on hearsay. This prudent approach is crucial in sidestepping significant financial pitfalls.

Creativity in budgeting can open doors to opportunities, allowing for adjustments rather than rigid constraints. In 2025, flexibility remains key. Having interviewed numerous financial planners, their advice remains consistent – tailor your budget to accommodate life’s unpredictabilities without derailing your long-term objectives.

—

Five Objectives for 2025 Financial Success

With 2025 looming large on the horizon, the need to solidify a realistic and effective financial plan has never been clearer. The importance of recognizing and avoiding common budgeting mistakes you must avoid in 2025 can’t be overemphasized. These objectives serve as guiding posts in ensuring your financial journey is not only secure but rewarding.

Navigating Financial Decisions in 2025

Budgeting may not always feel glamorous, but it certainly holds the key to financial success and peace of mind. Weaving humor, storytelling, and relatable experiences into your financial narrative not only makes the process less daunting but also exceptionally rewarding. Now is the time to introspect, adapt, and design a financial blueprint that aligns with your life’s aspirations and 2025 goals.

—

Imagining a Fault-Free 2025 Financial Journey

Learn from Mistakes, Embrace Success

Sculpting a fault-free financial journey in 2025 begins with learning from past mistakes and embracing success. Avoiding budgeting mistakes you must avoid in 2025 becomes achievable when you remain vigilant, adaptable, and proactive in your financial endeavors. Be it engaging with financial communities, seeking expert consultations, or leveraging technology, all avenues lead to enlightenment and empowerment.

The journey demands resilience – a journey where humor, persistence, and wisdom coexist, leading to financial abundance and security. Embrace growth, cherish financial insights, and incentivize yourself with financial milestones. Sensibly sidestepping potential hurdles could indeed ensure 2025 becomes your hallmark year of financial success.