Daily Habits That Save You Hundreds Per Month

- Daily Habits That Save You Hundreds Per Month

- Mindful Spending and Budgeting

- The Hidden Gems of Financial Literacy

- The Path to Financial Freedom

- Discussion: The Secret Sauce of Financial Mastery

- Bridging the Gap with Financial Tools

- Small Investments, Large Returns

- Five Key Details to Start Saving

- Comprehensive Review: Sustainable Habits for Financial Growth

- Mapping Out a Financially Savvy Lifestyle

Daily Habits That Save You Hundreds Per Month

In a world where every penny counts, discovering daily habits that save you hundreds per month can bring a significant change to your financial life. Imagine the peace of mind and extra comfort you could experience if only you knew the secrets to cutting down those unnecessary expenses. Whether it’s that irresistible morning latte or the enticing deal on new shoes, small expenses can add up quickly, straining your budget more than you might realize. However, don’t worry! With a little bit of discipline and awareness, you can effectively manage your expenses without feeling deprived.

Read More : Emergency Fund Hacks To Reach $1000 Fast

Every single day presents an opportunity to make smarter financial decisions. What’s more, adopting these daily habits doesn’t require a drastic lifestyle change; rather, it’s about being more mindful and making subtle adjustments to your everyday routine. Think of it as a journey to financial freedom—each little change brings you closer to securing a more prosperous future. This article will explore simple yet effective daily habits that will not only safeguard your wallet but will also empower you to gain control over your finances in a way you’ve never imagined. Welcome to a lifestyle that pays off, literally!

By the end of this article, you will be armed with practical tips and insights that pave the way for a more financially secure life. So, let’s dig in and discover the daily habits that save you hundreds per month, leading to a more enriched and empowered day-to-day existence.

Simple Changes, Big Savings

Let’s start with the basics. One of the most effective daily habits that save you hundreds per month is meal prepping. By planning your meals weekly and cooking at home, you can significantly reduce the amount spent on dining out. Besides, home-cooked meals are often healthier, contributing to better well-being—a double win for your health and your wallet! Try setting aside a couple of hours over the weekend to prepare meals, so you’ll always have something delicious and ready waiting for you at home.

Next up, the underrated habit of making a shopping list can be a game-changer. How many times have you found yourself wandering the aisles, picking up items you don’t really need? Shopping with a list not only ensures you buy what’s necessary, but it also helps avoid impulsive purchases that can quickly add up. Additionally, sticking to generic or store brands instead of name brands without compromising on quality can contribute to substantial savings over time.

Finally, analyze your subscriptions. Let’s face it, in the age of online streaming and monthly memberships, it’s incredibly easy to lose track of how many services you’re subscribed to. Take some time to review your subscriptions and evaluate whether you truly need each one. Cancel those that no longer serve a purpose. It might surprise you how much these sneaky recurring expenses eat into your budget.

—

Mindful Spending and Budgeting

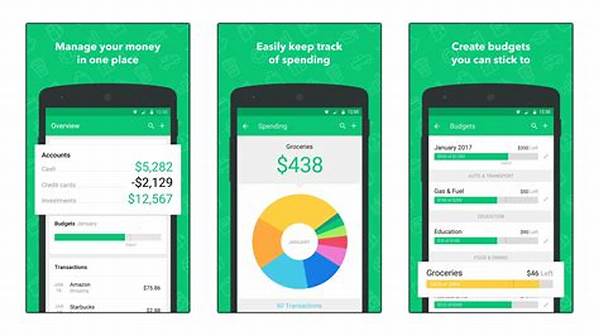

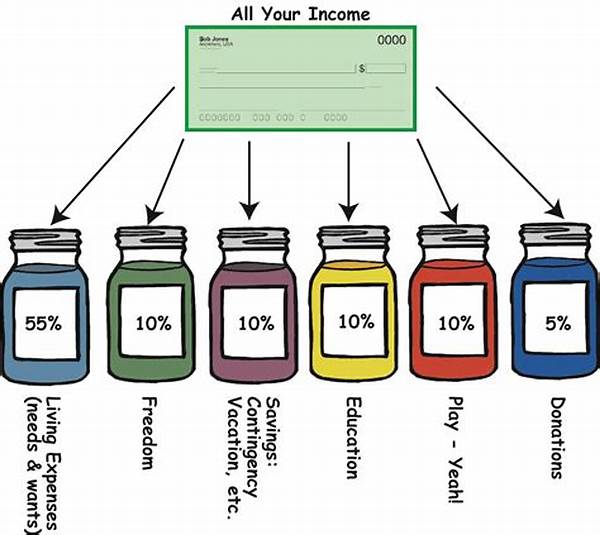

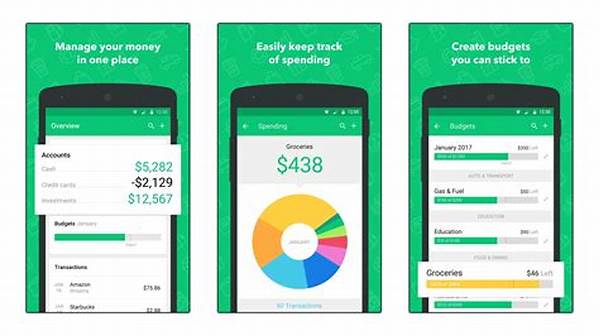

When talking about daily habits that save you hundreds per month, practicing mindful spending tops the list. Oftentimes, individuals fail to realize the impact of unconscious spending. By being more present and aware during your spending endeavors, you curate your expenses far more thoughtfully. Implementing a budget may sound like a no-brainer, but sticking to one can be trickier than it seems. Discipline is key, and with budgeting apps at your fingertips, tracking spending has never been more accessible and, dare we say—fun?

The Power of DIY

Do-it-yourself strategies are all the rage and for good reason. Whether it’s brewing your coffee, fixing minor home repairs, or crafting personal gifts, DIY options allow you to save significantly while adding a unique personal touch. The satisfaction from creating or fixing something on your own can lead to a delightful sense of accomplishment. Plus, it draws out creativity that might have been lying dormant!

On your journey to financial savvy, look for workshops or online tutorials that can help you hone your DIY skills. It’s a fantastic way to learn, grow, and most importantly, save money. Not to mention, you could find a new hobby you genuinely love.

—

The Hidden Gems of Financial Literacy

Education is undeniably influential when adopting daily habits that save you hundreds per month. Boosting financial literacy improves spending knowledge, which can translate to savvy financial habits. Maybe you’ve heard of compound interest, but have you invested time in understanding its power? Perhaps you’ve considered investing, yet you feel slightly intimidated. Through books, courses, or financial blogs, there’s an abundance of resources readily available to enhance your financial acumen.

Learning from experts and those who share relatable stories helps break down complex concepts into digestible insights, making the journey less daunting and more interactive. For instance, stumbling upon testimonials from individuals who have shifted their spending habits can inspire similar transformations in your life.

As you delve deeper into the world of financial literacy, have patience and stay open-minded to change, because forming new habits takes time. Daily habits that save you hundreds per month are within your grasp, waiting to lead you towards a fulfilling, financially secure future.

—

The Path to Financial Freedom

Daily habits that save you hundreds per month don’t just benefit your bank account. They also foster a mindset of deliberate, intentional choices in other areas of life. As these habits gradually become second nature, you’ll find yourself more empowered to tackle various financial goals, whether it’s retirement savings, paying off debt, or even planning that dream vacation.

Remember, consistency is crucial, and every small step counts. Tracking progress not only makes the journey gratifying but also provides motivation to continue evolving these habits over time. Celebrate the milestones you achieve along the way—it’s an ongoing process with lifelong rewards.

By introspecting and adjusting your daily routines, you’ll cultivate a sustainable lifestyle that prioritizes what truly matters. Share your experiences with others, even inspiring your friends and family to embark on their paths to financial empowerment. Together, we can foster a community that thrives on mindfulness, happiness, and security.

Embrace a New Financial Perspective

Even in today’s fast-paced world, these daily habits can align perfectly with your lifestyle, saving you money without cutting corners on quality. By embracing these tips, you’re not merely adopting a temporary solution; you’re incorporating lasting changes that redefine your relationship with money. Soon, you’ll come to realize how liberating it feels when financial stability isn’t a distant dream but an achievable reality.

Take ownership of your financial journey today. Challenge yourself to implement these practical, cost-saving habits, and witness the transformation unfold. After all, who wouldn’t want to feel the thrill of those hundreds piling up every month—ready to be spent on things that truly matter to you?

—

Discussion: The Secret Sauce of Financial Mastery

While everyone dreams of a stress-free financial life, not everyone knows the secrets behind achieving it. Daily habits that save you hundreds per month can be your secret sauce. Imagine how liberating it feels to have a couple of extra bills in your pocket. Isn’t it worth exploring the potential of these habits more deeply?

Let me share an example of Emily, a young professional who felt her paycheck disappeared the moment it arrived. That all changed when she discovered the magic of budgeting and meal prepping—simple yet impactful habits that saved Emily hundreds each month. By redistributing her saved expenses into a travel fund, she managed to visit her dream destinations. Emily’s story isn’t unique; it’s a narrative waiting to be embraced by many.

Understanding the Impact of Frugality

Frugality isn’t just a lifestyle; it’s an art that requires finesse and precision. Those who master this art notice how beautifully it transforms their financial landscape. By identifying what truly adds value to daily life, wasteful expenditures can be minimized significantly. Adopting the habit of mindful spending encourages wiser financial decisions and enables individuals to focus on priorities, be it retirement plans, emergency funds, or memorable experiences.

Leveraging Technology for Smart Choices

In today’s fast-paced digital era, leveraging technology has never been more vital. Mobile apps designed for budgeting, expense tracking, or even helping you find the best deals, are integral in aiding habit-forming processes. Embracing these tools can further magnify the impact of daily habits that save you hundreds per month and streamline financial management like never before. Harnessing the power of technology, individuals can maintain structured spending minus the chaos, fostering clearer financial paths.

Access to a wealth of information and actionable insights empowers individuals to make intelligent, cost-effective decisions. Exploring these resources enhances both confidence and competence in everyday financial management.

—

Bridging the Gap with Financial Tools

A common misconception about saving money is the perceived necessity to sacrifice pleasure or enjoyment. This fallacy couldn’t be further from the truth if approached with creativity and open-mindedness. Daily habits that save you hundreds per month are simply about minimizing waste and maximizing efficiency.

The implementation of budgeting tools, from digital spreadsheets to user-friendly apps, provides clarity on spending patterns. It allows for transparent insight into areas requiring restraint or optimization. These tools not only facilitate savings goals but also create a realistic blueprint for future aspirations.

Finance specialists swear by the basic practice of tracking every dollar that leaves the wallet. Matthew, a financial advisor, recounts countless client relations where simple tracking turned their financial dilemmas into promising progress. Such testimonies highlight the efficacy and ease of adopting disciplined financial habits within everyday budgeting.

—

Small Investments, Large Returns

It’s often said that change starts from within, and this holds true when observing daily habits. Avoiding the urge to make grandiose adjustments all at once prevents potential burnout. Breaking down goals into manageable, achievable tasks ensures steady progress, continuously fostered by motivation and small victories.

Daily habits that save you hundreds per month rely on compiling minor shifts into significant leaps. Transitioning from impulse buying to deliberate purchases redefines the consumer experience. Over time, individuals foster a profound appreciation for what truly enriches their lives, trimming excesses that might otherwise ensue.

Most importantly, embracing these habits instills a sense of discipline, fostering a perennial understanding of resource value. Developing consistent and responsible spending habits naturally aligns with personal, familial, or broader monetary objectives, enabling a life of abundance, simplicity, and satisfaction.

Simplifying Lifestyle for Maximum Effect

The world often portrays simplicity as synonymous with sacrifice; in reality, it equates to unburdened living. Redirecting focus towards experiences and connections rather than material possessions deepens life’s fulfillment. Ultimately, saving money becomes more than just a tangible outcome—it’s a testament to mental prosperity and emotional well-being too.

Daily habits that save you hundreds per month reveal an irreplaceable lesson: authenticity in simplicity propels us towards purposeful living. Refining our relationship with money by nurturing conscious choices enhances both individual and collective experiences. Let’s rise to this challenge, fostering an empowered financial future.

—

Five Key Details to Start Saving

The Art of Consistent Savings

Developing consistent saving is a journey that requires both momentum and commitment. As we delve into daily habits that save you hundreds per month, it’s crucial to remain patient and perseverant. Habits like preparing meals at home instead of dining out and developing a weekly shopping list can reap significant savings over time. Although seemingly small-scale, these financial practices accumulate effectively, easing economic strain and promoting accessible wealth-building opportunities.

Budgeting, particularly through personalized apps, aligns expenses with needs, preventing erratic financial disruption. Breaking it down into digestible segments makes the process considerably less intimidating. Trust the gradual transformation as previously unnecessary subscriptions are reassessed, recovering otherwise lost capital. More than a restraint, this habit serves as one crucial aspect of nurturing responsible financial literacy.

As tangible benefits manifest, recognize the intrinsic value of persistence and diligence. A backdrop of recurring small successes fosters long-term motivation, redefining our collective comprehension of money management into an enlightened dialogue. A dynamic relationship with financial resources emerges, rendering everyday habits naturally aligned with value-added living.

Keeping Commitment Alive

Consistency becomes your ally, helping maintain proactive approaches towards achieving desired outcomes. Aiding this commitment is openness to innovation and creative adaptability within finance, celebrating deviations from predictability. Prioritize financial health through intelligent consideration of savings strategies, appreciating present visibility alongside future prosperity.

Embark on an exploration of possibilities interwoven with lasting satisfaction, continually integrating cost-effective practices into everyday scenarios. As financial landscapes evolve, embrace the fluidity of change, preserving valuable lessons along with invaluable experiential gems. Equipping oneself with sustainable economic perspectives creates unparalleled foundations for enduring fulfillment and lasting enjoyment throughout life’s journey.

—

Comprehensive Review: Sustainable Habits for Financial Growth

Navigating personal finance can often feel like walking a tightrope. One misstep, and you’re tumbling into a whirlwind of expenses. Yet, finding balance is simpler than it sounds, and it begins with adopting daily habits that save you hundreds per month. It’s fascinating how minor adjustments induce significant savings, sculpting the canvas of your financial landscape with strokes of discipline and awareness.

To illustrate, imagine James, a college student with a modest part-time job. Balancing tuition fees, monthly bills, and leisure activities was exhausting. Grasping the efficacy of budgeting, James started allocating funds with precision. He minimized unnecessary costs through meal preparations and optimized public transport over costly rideshares. These daily habits saved James hundreds each month, revealing avenues he never considered possible.

Tools for Building Financial Resilience

Practical tools exist to simplify financial decisions, arming individuals with unwavering confidence. As with James, keeping track of every expense empowers us to harness purchasing power constructively. It’s akin to strengthening muscles—discipline rooted deeply in the realm of mindful spending.

Moreover, technology offers a toolkit of effortless features to complement financial resilience. Weekly expenditure breakdown graphs, advanced alerts that flag overspending patterns, or simply music playlists when contemplating financial choices, engage users in the holistic budgeting narrative. Each tool, unique yet universal, complements responsible decision-making, crafting a trajectory laced with promising outcomes.

Embracing a Vision Beyond Today’s Expenses

Understanding that minor present sacrifices afford vast future opportunities embodies the ethos of daily habits that save you hundreds per month. Foregoing a fleeting luxury enables the realization of expansive aspirations down the line. Whether it’s securing educational advancements, taking picturesque vacations, or enjoying leisurely retirement years, the cumulative effect of routine habits unveils limitless adventures.

By embedding a frugal yet fulfilling mindset, navigating life’s ebbs and flows thrives on clarity and grace. Financial strategizing transforms into an ongoing dialogue, respected and articulated by experiences shared with trusted individuals. Together, each discussion enriches comprehension, contributing form and substance to ambitions yet unexplored.

—

Mapping Out a Financially Savvy Lifestyle

Committing to financial discipline integrates seamlessly into swollen schedules populated with professional and personal activities. Employing daily habits that save you hundreds per month evolves financial literacy into intuitive practices flourishing within unpredictable environments. Every dollar counts, ensuring calculated risks return with compounded rewards.

Minimalism, naturally bridging economic boundaries, helms efforts to save extravagantly, redirecting value towards deeper significance. Submission to quality rather than excessive quantity defines purchase selections, and satisfaction engenders contentment instead of consumption. Anchored by conscious choice, every mindful effort pays off exponentially both materially and aesthetically.

Financial improvement manifests numerously, encompassing emotional endurance, habitual awareness, and genuine appreciation for gratefulness. By continuously refining decisions, naturally aligned financial wellness propels individuals forward harmoniously, prudently securing fulfilling lifetimes anchored with purpose and security.

Conclusion: Cultivating Your Financial Garden

Planting seeds of intentionality enhances financial growth, nurturing opportunities that blossom through wise and sustainable intentions. Reflecting on daily habits that save you hundreds per month activates potential for harvesting financial rewards, enriching existences defined by choice, freedom, and exuberance. Envision life bonded with self-guided success, and trust it to flourish beyond imagination.