Help With Budgeting And Saving

Help with Budgeting and Saving

Read More : Smart Budgeting Tips For Renters In Big Cities

In today’s fast-paced world, mastering the art of budgeting and saving is not just a trend; it’s a necessity. The overwhelming burden of financial stress is something many of us are familiar with, be it students grappling with tuition fees or professionals juggling bills and loans. Statistics reveal that a significant percentage of individuals face monthly struggles when it comes to financial management. Critical as it is, budgeting isn’t as daunting as it may seem. Instead, it is a practical tool that helps streamline your expenses, manage debts, and secure your future. What if there was a method—simple and effective—that could help with budgeting and saving, providing you more control and freedom when it comes to your finances?

Imagine this: you’re at a cafe with a friend, and the bill arrives. You’ve planned your expenses so meticulously that you feel comfortable treating your friend, without a second thought about breaking the bank. Or consider the scenario where an unexpected car repair doesn’t send your monthly budget into a tailspin because you’ve already allocated funds for emergencies. These scenarios aren’t daydreams; they can be a reality with the proper budgeting techniques. Through this article, we are diving deep into the world of budgeting to offer you help with budgeting and saving in a way that’s not only informative but transformative.

Budgeting is like planting seeds for future financial security. It encourages disciplined spending and fosters the habit of saving. As we navigate through this process, we’ll equip you with strategies that can seamlessly fit into your lifestyle. Whether you’re someone who’s never tracked expenses before or a seasoned pro looking to refine your techniques, this article promises to deliver value. With relatable anecdotes and actionable tips, our goal is to shift your perspective, proving that budgeting is less about restriction and more about empowerment.

Our story begins in a small town where Maria, a young professional, finds herself buried under a heap of student loans. With dreams as vast as the Montana sky, Maria’s current reality is a stark contrast. She needed a lifeline, a way to handle her finances without sacrificing her dreams. That’s when she stumbled upon a life-changing method that offered help with budgeting and saving. Armed with this newfound knowledge, Maria was not only able to repay her loans but also afford a trip to her dream destination. Her journey isn’t unique; it’s one many can embark upon with the right tools and attitude.

Mastering the Basics of Budgeting

Understanding what budgeting truly entails is the first step toward financial freedom. At its core, budgeting involves planning and projecting where your money will go based on your income and expenses. This might sound a bit dry, yet when executed properly, it injects both a fun challenge into your everyday routine and unparalleled peace of mind. Whether you’re someone who shops till they drop or a sucker for saving, knowing what budgeting can achieve is crucial for sustainable wealth management.

Your budget starts with an acknowledgment of your income. This is where accuracy and honesty are key. It’s easy to overlook small side gigs or sporadic cash flows, but these can form an essential part of your income stream, providing a cushion for those lean months. Knowing your precise income guides the proportion of your monthly budget to allocate to savings, entertainment, necessities, and emergency funds.

Now, let’s talk about expenses. You’ve probably heard of the term “spending leak”—it’s the small, often unnoticed expenditures, like that daily latte or sporadic purchases that add up. These can obliterate your budget if ignored. The act of auditing your spending habits can be an exhilarating discovery process. By identifying and controlling these discrepancies, you’ll create more room for meaningful investments and savings.

Remember, a budget is not a rigid mold but a flexible tool. Life is unpredictable, and your budget should reflect that. Maybe that means increasing your food expenses when you host a holiday dinner or adjusting savings after receiving a yearly bonus. The idea is to adjust, prioritize, and align your spending with your evolving life goals. Above all, it’s about devising a system to help with budgeting and saving that suits your personal rhythm.

Finding Creative Ways to Save

Saving money doesn’t have to feel like a punishment or deprival. It can be an engaging, rewarding experience. Take the case of Jordan, a single parent who turned saving from a dreaded chore into an enjoyable game. By implementing help with budgeting and saving strategies, Jordan transformed a mundane task into an exciting journey of resourcefulness, involving the whole family in goals and dreams.

One of the simplest and entertaining methods involves setting specific savings goals and timelines. Picture saving up for a relaxing vacation—by selling unused items or switching brands for necessities—and witnessing that dream materialize by simply redirecting a few dollars every week. Suddenly, budgeting becomes synonymous with nurturing hope and excitement.

Aside from setting goals, modern technology offers myriad ways to streamline the saving process. Numerous apps provide innovative solutions for saving money, whether it’s through automated rounding-up programs or finding discounts that you would’ve otherwise overlooked. A small investment of time in understanding these apps can provide huge payoffs when it comes to filling your piggy bank effortlessly.

Finally, the aspect of shared experiences plays an enormous role. Jordan implemented a “no-spend” challenge calendar with their kids, marking days when the family wouldn’t spend at all. Not only did this approach save them money, but it also enriched family bonds and encouraged creativity. Adopting similar strategies can transform your budgeting task into a group effort, creating engagement and fostering financial wisdom in those around you.

Engaging Financial Planners and Tools

In seeking help with budgeting and saving, one cannot overlook the power of expert advice and digital tools. Leveraging specialized knowledge can fast-track your financial success. Consider Mary and Joel, a couple dreaming of buying their first home. They adopted a mix of personal financial advice from a certified planner and online tools tailored for millennial spenders.

Financial planners provide an unbiased view of your financial situation, detached from the emotional impulses that often cloud self-assessments. They can recommend investment paths, tax savings, and retirement planning that align with your lifestyle choices. With customized plans and strategic insights, professionals offer services that simplify daunting financial goals into attainable milestones.

Let’s not forget the powerful utility of budgeting software and mobile applications. Applications like Mint or You Need A Budget (YNAB) allow users to seamlessly track expenses, receive alerts, optimize subscriptions, and even automate savings. Imagine having a virtual financial assistant available 24/7, ensuring your budget remains pristine and your savings grow.

This interaction between personalized advice and tech support creates a robust system for anyone aiming to refine their financial strategies. By honing in on both, Mary and Joel accelerated their journey toward homeownership, transforming a distant dream into an achievable reality. With such resources readily available, your aspiration for a secure financial future becomes less of a fantasy and more of a clearly mapped-out journey.

The Importance of Continuous Learning and Adaptation

The financial landscape is ever-evolving, requiring consistent updates and adaptability in our strategies. In the same way that societal norms change, influenced by technology, economy, or cultural shifts, so too must our approach to managing money. Lifelong learning forms the backbone of effective financial management because it cultivates the flexibility to integrate new practices whenever necessary.

Take Alisha, a digital nomad who thrives on her adaptability. Tracking global economic trends, she shifted her investment strategy to include cryptocurrencies and international stocks, thus maximizing her financial stability across markets. Alisha’s story reaffirms the value of staying informed and agile in financial endeavors.

Knowledge can be sought from numerous sources: credible blogs, financial publications, webinars, or even podcasts from industry leaders who share invaluable insights. Just 30 minutes dedicated weekly to financial education can expand your knowledge horizon tremendously.

Moreover, developing a circle of financially savvy peers is priceless. Engaging with a community focused on budgeting and saving introduces you to diverse perspectives and innovative methods. You collectively mold these ideas into a cohesive strategy that evolves with every conversation or challenge.

As you embrace lifelong learning and adaptability, remember that financial wisdom is cumulative. Each lesson, whether drawn from success or failure, contributes to better decisions and increased security. Your quest for help with budgeting and saving transforms into a lifelong adventure—a series of possibilities waiting to be unlocked and conquered.

Five Examples of Help with Budgeting and Saving

Description: Empowering Your Financial Journey with Budgeting and Saving

Empowering your financial journey begins with understanding the importance of budgeting and saving. These two cornerstones create the foundation for a life without the constant stress of financial instability. When adopted effectively, budgeting is not about imposing severe restrictions; it’s a liberating practice that allows you to align your spending with your life goals.

Consider the simple act of tracking daily expenses. It may initially seem tedious, but over time, it uncovers patterns that can be fine-tuned to improve financial health. Similarly, employing an envelope system might appear old-school, yet the physical limitation of cash envelopes forces mindful spending.

Moreover, the automated savings plans can offer a valuable lifeline for those who find it challenging to save intentionally. Without even thinking about it, the set-and-forget method bolsters your savings account over time. Community initiatives such as forums and workshops empower you with diverse insights, strategies, and encouragement from fellow learners and experts alike.

While our modern digital landscape offers advanced solutions, never underestimate traditional strategies that have withstood the test of time. It all boils down to identifying what works for you, experimenting, and gradually building a flexible framework that feels empowering rather than restrictive. By embracing these seemingly small practices, comprehensive help with budgeting and saving becomes a reality. These endeavors collectively foster financial security, peace of mind, and, ultimately, the freedom to pursue your heart’s desires without compromise.

Help with Budgeting and Saving: Strategies for Success

The quest to achieve financial stability is both an exciting adventure and a challenging task. Having a roadmap to navigate these waters can make all the difference. Developing practical strategies provides a solid foundation from which you can gradually build a comprehensive financial plan tailored to your unique needs and ambitions.

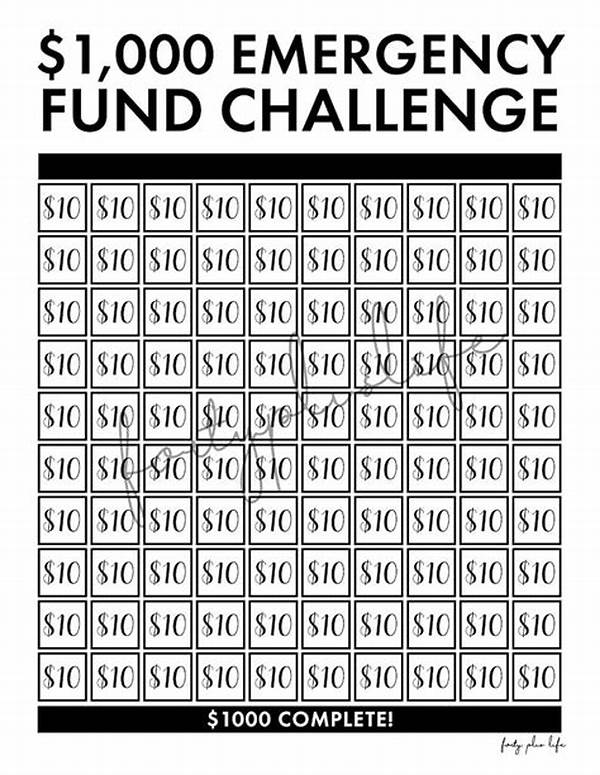

One of the most crucial steps in developing effective budgeting strategies is setting realistic goals. Whether planning for short-term adventures or long-term dreams, your budget should be designed to accommodate various life stages and changes. This includes building an emergency fund, vital for financial security against unexpected events like job loss or expensive repairs.

Incorporating a regular review process further strengthens planning. Reviewing your budget every few months enables adaptation to changing circumstances and opportunities for increased savings. Regular assessments highlight unnecessary expenditures and free up resources for aligning better with your evolving financial aspirations.

Another key strategy comes from actively engaging with learning initiatives. Dive into workshops, webinars, or online courses specifically aimed at enhancing your financial literacy. Even gaining one new insight has the potential to significantly impact your budgeting practices positively.

Lastly, don’t underestimate the role of mental fortitude in monetary pursuits. Maintaining a growth mindset, where challenges are viewed as opportunities for improvement, helps you overcome frustrations and retain focus on your ultimate goals. Remember that progress isn’t always linear, and being equipped with a resilient, optimistic outlook sustains your drive for success.

With practical strategies as your guide, you realize that help with budgeting and saving is not merely about following generic blueprints; it encompasses personal growth, adaptation, and continuous learning to manifest your dreams into tangible reality.

Ten Quick Tips for Help with Budgeting and Saving

The Art of Budgeting: Mastering Financial Freedom

The art of budgeting lies in understanding its transformational potential it holds. At the heart, efficient budgeting isn’t a barrier to enjoying life but a gateway to freedom; it lends clarity to priorities and balances present desires with future aspirations. Recognizing this vital perspective shift, one finds empowerment instead of constraint.

Approaching budgeting requires the attitude of a sculptor chiseling imperfections to bring forth a masterpiece. By extracting clutter from financial habits through meticulous planning, control is regained. While it may seem challenging initially, taking proactive steps to allocate, save, and invest rewards with stability and resilience over time.

Moreover, the journey into financial literacy should celebrate individuality. Given the diversity of income sources, lifestyles, and visions, personal finance transcends one-size-fits-all solutions. As unique life stories unfold, tailoring strategies to fit specific narratives creates authentic and lasting success in the practice of budgeting.

It’s essential also to embrace fluctuations and adapt to emerging financial contexts. Both successes and challenges serve as rich learning grounds nurturing one’s knowledge, creativity, and perspectives. The key resides within approachability, grounding efforts in practicality, and using resources wisely.

Ultimately, advancing along the path of budgeting opens exciting avenues where a life unshackled by debt and overspending materializes into an environment conducive to pursuing dreams fruitfully. Begin today—equip yourself with the tools and mindset necessary for help with budgeting and saving, and embark on your journey toward improved financial stewardship and empowerment.