How To Avoid Lifestyle Creep And Save More

How to Avoid Lifestyle Creep and Save More

In the heart of contemporary living, where every scroll and swipe is a potential sales pitch, lies an understated yet pervasive challenge—lifestyle creep. This sneaky phenomenon occurs when increased income results in proportional rises in spending, ultimately leading to a negligible change in savings. Imagine your salary expanding like a balloon, and as it grows, so does your propensity to spend on fancier dinners, luxurious gadgets, and exotic vacations. The thrill of a stylized life is exhilarating; however, it can also steer you away from your long-term financial goals. Welcome to the gripping saga of battling lifestyle creep and finding a more fulfilling path to financial freedom.

Read More : Smart Grocery Shopping Tips That Beat Inflation

If lifestyle creep were a character in life’s drama, it would be that stealthy villain whose antics you don’t realize until it has already struck. Often, the tale begins innocuously—with a celebratory purchase upon securing a raise, justified by the hard work it took to get there. But gradually, this indulgence can become a relentless companion. Consciousness of lifestyle creep won’t only safeguard your bank balance but will also ensure that your newfound earnings translate into sustainable prosperity.

Two decades ago, my good friend, Mark, ascended quickly in his career. As his paychecks grew, so did his expenditures. Fancy cars and deluxe apartments became norms, yet his savings could barely catch their breath. It wasn’t until a casual dinner conversation that the glaring reality struck him—he was a classic victim of lifestyle creep. Inspired to turn tables, Mark adopted strategies to conquer this silent underminer and instead redirected his efforts to how to avoid lifestyle creep and save more. Today, he shares his stories as a passionate advocate for financial literacy and a believer in intentional spending.

Practical Tips to Combat Lifestyle Creep

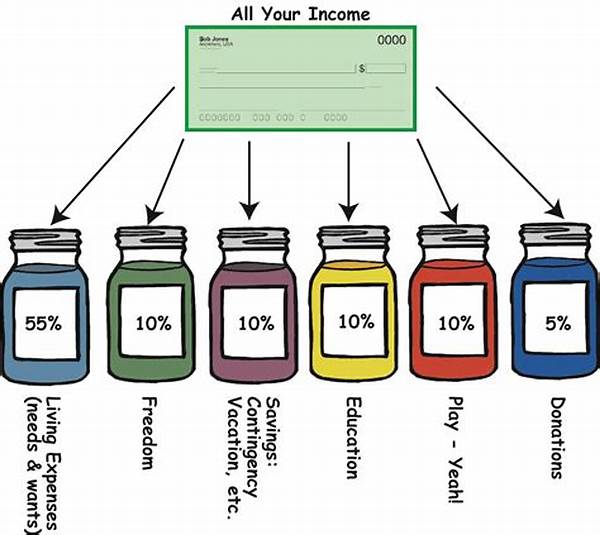

When aiming to combat lifestyle creep, the key is mindfulness coupled with practical actions. Start by setting clear financial goals and differentiating between needs and wants. Savings should be treated like a recurrent “bill” that is non-negotiable every month. By prioritizing contributions to savings and investment accounts, you lay a foundation solid enough to withstand the gusty winds of impulse purchases.

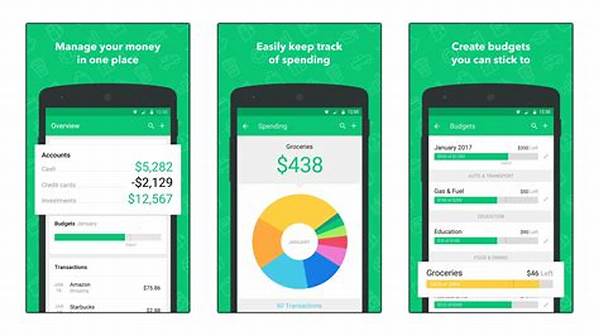

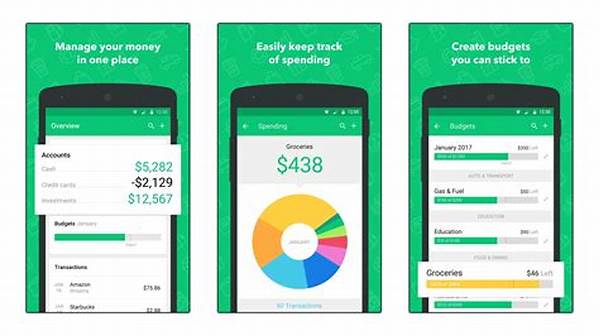

Furthermore, regular financial check-ins are crucial. Proactively review your budget and adjust as necessary to reflect changes in income or lifestyle preferences. Engaging with financial apps and trackers can illuminate spending habits and highlight areas for improvement. As a piece of humorously sagacious advice: think of your budget as your warden. It doesn’t confine you but liberates your future self from financial worries. In essence, mastering how to avoid lifestyle creep and save more is all about crafting a balance between enjoying today and investing in tomorrow.

Strategies to Build Wealth Wisely

The pathway to avoiding lifestyle creep and saving more isn’t complete without strategies aimed at genuine wealth accumulation. Engage in thoughtful investment planning. Whether it’s stocks, real estate, or 401(k)s, diversifying your portfolio is key. Financial literacy is the superpower that turns your earnings into tangible wealth. Personal growth through books, webinars, and courses on financial management can propel you farther than you’d imagine.

Building a lifestyle that suits your new financial status yet ensures that it’s sustainable requires discipline and a farsighted approach. Encourage conversations around wealth-building with friends and family to not only learn but also share insights. Encourage celebrations for meeting savings goals rather than just snapping up every shiny new acquisition.

Setting Goals to Avoid Lifestyle Creep

Building Healthy Financial Habits

Developing habits that bolster your financial health is a key aspect of sidestepping lifestyle creep. It’s akin to training for a marathon—consistent, intentional steps lead to formidable milestones. Adopting a frugal approach does not mean a bare-bones existence; instead, it translates to conscious spending choices. Those little pockets of money saved from not indulging in daily espressos can fund that dream trip or secure your future endeavors.

Begin this transformation by questioning each purchase: does it get you closer to or further from your desired financial state? The decisions made today pave the way for tomorrow’s freedom. Finally, remember that the pursuit of how to avoid lifestyle creep and save more is as much about mental fortitude as it is financial savvy. Celebrate minor victories, reflect on setbacks, and always keep the grand vision in sight.

In conclusion, how to avoid lifestyle creep and save more is not only a guiding mantra but also a commitment to a fulfilling, financially secure future. Embrace the narrative of smart spending, intentional saving, and enthusiastic investment. You, too, can write a success story like Mark’s and inspire others to embark on this enlightening journey.