How To Budget For A Vacation Without Debt

How to Budget for a Vacation Without Debt

Planning a vacation is a thrilling experience, embodying the promise of relaxation, adventure, and memory-making. Yet, the question looms: how can you enjoy this escape without coming home to a mountain of debt? Most people equate vacations with a hefty price tag, assuming that an excursion away from the daily grind means dipping into savings or, worse, maxing out credit cards. What if I told you there’s a way to indulge your wanderlust without financial worries? Welcome to our comprehensive guide on how to budget for a vacation without debt.

Read More : How To Budget Using Ai Money Apps

The feeling of sinking into your airplane seat or pulling up to a dreamy destination shouldn’t be marred by anxiety over the ensuing bills. Today, we’re diving into the art of budgeting for a vacation — a masterpiece that’s as much about the journey as it is the destination. Picture this: a vacation where you return home with no regrets, no surprise charges, and certainly no debt. This vision isn’t a fantasy; it’s achievable with deliberate planning and clever financial tactics.

Imagine yourself marveling at the Eiffel Tower, sipping coffee in a quaint Italian café, or lounging on a pristine beach in the Maldives. What makes these scenarios even sweeter? Knowing your travel funding is secure, affordable, and entirely debt-free. Our story unfolds with insight into strategic savings, savvy planning, and tapping into deals and discounts that keep your pocketbook happy.

Planning with foresight not only shields your finances but enhances the vacation experience. Knowing that expenses are covered lends peace that allows you to soak up every moment, from sunrise meditations to sunset strolls. So, how does one embark on this rewarding journey? Let’s explore effective steps and ideas that underscore the ethos of a debt-free vacation.

The Journey to a Debt-Free Vacation

Creating a budget for your vacation should start with a clear understanding of costs. You need to account for transportation, accommodation, meals, activities, and a little extra for unexpected expenses. Once the numbers are on paper, you can begin your quest to find deals. Research speaks volumes here: flexible travel dates and booking in advance often score the best rates. Additionally, leveraging travel rewards points or frequent flyer miles can translate into significant savings.

Engaging Discussions on Vacation Budgeting

Let’s dive deeper into the subjects revolving around how to budget for a vacation without debt. There’s more to explore: from real-life experiences to actionable advice, the conversation is as dynamic as the trips you dream of taking.

Challenges and Rewards

Understanding the hurdles of sticking to a travel budget is crucial. Sometimes, temptations arise — an unplanned excursion or an exquisite meal. The secret isn’t necessarily saying “no” to these experiences, but finding smart ways to accommodate them. Having a flexible budget that allows for some indulgence without detriment to other plans can make all the difference.

Budgeting doesn’t end with planning; it follows you through your trip. Keeping an eye on daily expenditures ensures that the enjoyment today doesn’t become tomorrow’s stressor. However, mastering this means you’ll reap the emotional and imaginable freedom upon returning home with financial confidence intact.

The Emotional Aspect of Financially Sound Travel

Travel is much more than logistics; it’s about fulfilling personal dreams and desires. The emotional satisfaction of a wisely-budgeted vacation is immense; it reflects self-control and intelligent decision-making. By setting up financial parameters, you empower not only your travels but your experiences as well.

Tips for Savvy Vacation Budgeting

How to Budget for a Vacation Without Debt

Now that we’ve explored various facets of vacation budgeting, let’s discuss how to put these tips into practice effectively.

Holidays are meant for relaxation, exploration, and rejuvenation — not financial headaches. By understanding the tools and methods available to fund your trip logically and safely, you’ll reclaim what so many desire: a stress-free getaway.

Eight Tips for a Debt-Free Getaway

Here are eight crucial tips to ensure your dream vacation doesn’t turn into a debt-riddled nightmare:

1. Create a Realistic Budget

2. Leverage Discounts and Rewards

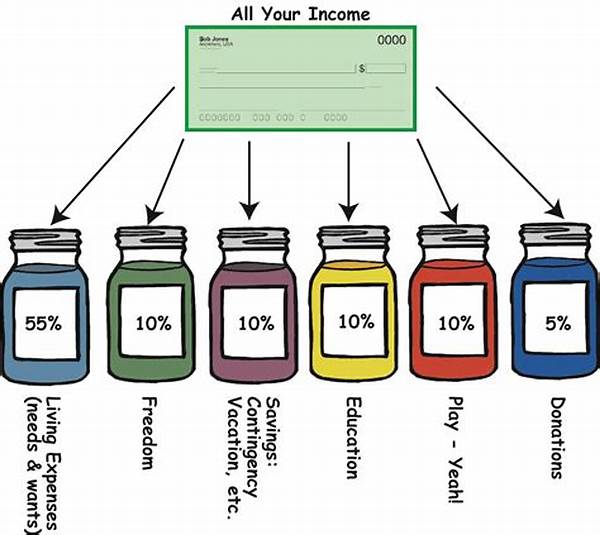

3. Set Up a Travel Fund

4. Plan in Advance

5. Opt for Alternative Accommodations

6. Pack Smart and Light

7. Embrace Prepaid Currency Cards

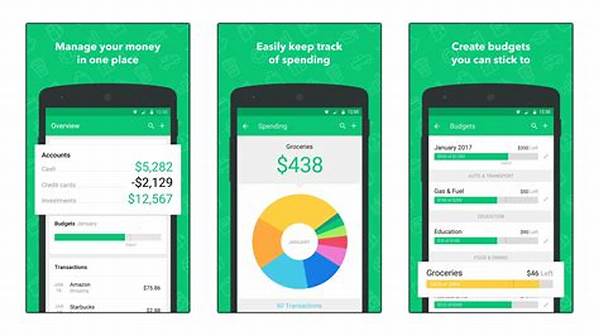

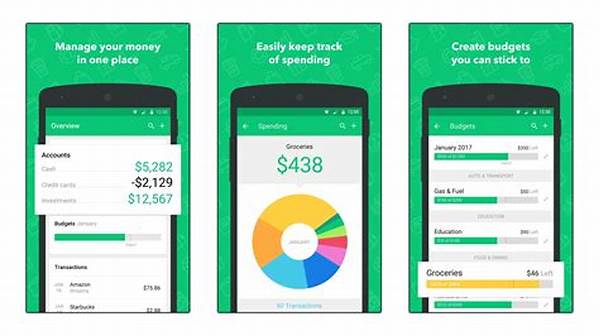

8. Monitor Daily Spending

In embracing these strategies, the power of understanding how to budget for a vacation without debt becomes evident, unlocking more travel freedom and opportunities for unforgettable journeys.

A Thorough Examination of Vacation Budgeting

The blend of emotional appeal and practicality in travel budgeting cannot be overstated. As more people seek authentic experiences without the burden of debt, knowledge and preparation become essential allies.

Preparing for Financial Independence in Travel

Financial independence in travel involves exciting planning and stringent discipline. It’s the balance between dreaming and doing, setting ambitious travel goals but grounding them in financial reality. The genuine joy arises when you realize dreams realizable without future financial burden, propelled by preparation and savvy spending.

The quest for how to budget for a vacation without debt represents more than a lesson in thrift; it’s a transformative approach empowering globetrotters to maximize enjoyment without minimizing economic security.

This comprehensive guide and accompanying discussions underscore the achievable reality of fiscally responsible travel. Through informed strategies, insightful tips, and practical challenges, one can unlock the gate to endless possibilities provided by debt-free exploration.