How To Build A Savings Buffer In 3 Easy Steps

In today’s fast-paced world, financial stability can sometimes seem more like a myth than a reality. But what if I told you there’s a tried and true method that can help you achieve it? That’s right, we’re talking about creating a savings buffer—a financial safety net that can cushion you against life’s unexpected expenses. Imagine this: No more panic attacks when your car breaks down, no more sleepless nights worrying about an unexpected medical bill. How does that sound? Pretty amazing, right? Well, you’re in the right place because we’re going to walk you through how to build a savings buffer in 3 easy steps. But wait, do not expect mundane, parental advice here; instead, think of this as your exclusive backstage pass to a less stressful life, mixed with a dash of humor.

Read More : Why Millennials Are Choosing Cash Stuffing In 2025

To kick things off, the first step in creating your savings buffer might surprise you: track your spending. Consider this your treasure map, leading you to hidden fortunes buried in your day-to-day expenditures. While it may not seem groundbreaking, it helps you identify where your money disappears each month. And trust me, it’s pretty effective. It’s like finding out your magician friend’s secret trick—everything suddenly makes sense. Once you’re in the know, it’s easier to divert those funds to your savings. The second step is to set a clear savings target. In this stage, think of yourself as the CEO of Your Life Inc. Make it formal, make it tangible, and most importantly, make it happen. What goal can you set today that would have your future self writing you thank-you letters? Setting a realistic savings target gives you direction and makes the journey to financial stability far less daunting. Lastly, put your savings on autopilot. If you’re anything like me, the words “set it and forget it” might resonate deeply within your lazy-bean soul. Automating your savings is like having a personal financial assistant—you can just relax and sip your coffee while your savings grow.

Saving doesn’t have to be a bumpy ride through the land of financial jargon and guilt trips. It’s more of a choose-your-own-adventure with a rewarding ending. So why not start today? Don’t just dodge financial stress—embrace a future that puts you in control.

Automate to Accumulate: The Secret to Effortless Saving

Sometimes, the hardest part of saving is actually remembering to do it. Imagine if you could lock in those savings without lifting a finger—welcome to the joy of automation!

—

In the quest for financial independence, knowing how to build a savings buffer in 3 easy steps can be invaluable. It’s like obtaining a master key to the vault of financial peace. As we delve into this guide, remember that each step can transform your finances from a turbulent sea into a calm, predictable lake. Now, sit back, relax, and prepare to become the hero of your financial story.

Understanding how to build a savings buffer in 3 easy steps begins with awareness. Awareness of where your money comes from and, more importantly, where it goes. It requires putting on your detective hat and monitoring every dollar that slips through your fingers. This method is not about making you feel guilty for buying that extra coffee but about shedding light on patterns that may be financially leaking you dry. Consider this first step as a fact-finding mission. You might even find it entertaining—like a treasure hunt you embark on with each month’s bank statement as your map.

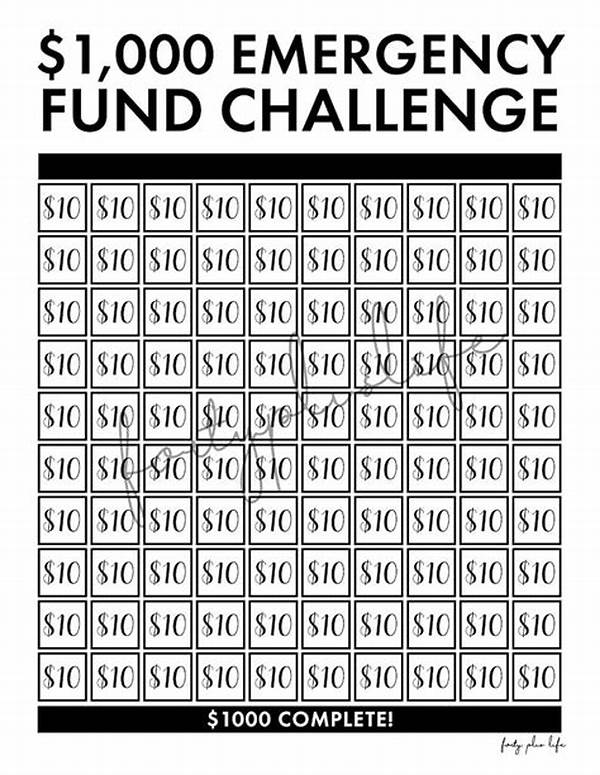

Next, let’s address the elephant in the room, or rather, the tiny mousehole that your savings seem to vanish into. Setting clear, achievable goals will shift your savings from being an intangible concept to a concrete reality. Think of this step as laying the foundation of your financial fortress. A sturdy savings target acts as your moat, keeping stressors at bay while fortifying your resources. It’s crucial to keep your goals realistic; otherwise, you’ll feel more like you’re preparing for an epic battle rather than a smooth financial journey.

Third, we explore the ease of automating your savings. By now, you’re practically a wizard in financial spell-casting, and automation is your most powerful charm. It’s the “set it and forget it” solution that aligns the universe in your favor. It’s your autopilot on a turbulent financial flight—ready to take over should you falter. Automation is not just a convenience; it’s an unbreakable commitment to your future financial self.

Setting Realistic Financial Goals

Taking the time to set realistic financial goals makes the journey to saving effectively much less intimidating. When you picture what you’re working toward with a definitive plan, instead of being filled with anxiety, you’ll feel a surge of invincibility.

Creating an Actionable Savings Plan

An actionable savings plan is like having a GPS for your financial journey. Combine the magic of automation with the discipline of goal-setting, and you’re well on your way to creating an unshakeable savings buffer.

Now, let’s dive deeper into each of the steps:

—

Summaries: How to Build a Savings Buffer in 3 Easy Steps

—

Purposefully Building a Savings Buffer

Embarking on any endeavor without a defined purpose can feel like sailing without a compass. When it comes to building a financial buffer, the reasons could be numerous—securing peace of mind, preparing for the future, or simply having the freedom to have an impromptu adventure without breaking the bank. The beauty of knowing how to build a savings buffer in 3 easy steps lies in its clarity and simplicity.

The primary objective of creating a savings buffer is often to diminish financial stress. Knowing there’s a safety net ready to catch life’s unexpected curveballs brings comfort that is both rational and emotional. However, this process isn’t just a basic financial strategy—it becomes a lifestyle choice that subtly shifts how you manage money daily, leaving stress behind like a forgotten relic.

But the journey doesn’t stop there. A savings buffer is much more than just a static amount sitting idly in a savings account. It’s a tool of empowerment, giving you the liberty to make choices that were merely dreams before. This isn’t just about money; it’s about freedom—freedom to switch careers, pursue higher education, start a business, or travel the world.

By setting goals and automating your savings, you’re effectively crafting a future that’s resilient against financial strain. What initially starts as a quest for financial stability soon becomes the backbone of a lifestyle where opportunities are yours for the taking. The narrative of how to build a savings buffer in 3 easy steps isn’t just about financial prudence—it’s a story of unlocking potential, a compelling tale of financial liberation.

Navigating Challenges in Building a Savings Buffer

Challenges will arise in any significant financial endeavor, yet they are not insurmountable. By knowing the common pitfalls, you become adept at avoiding them, turning obstacles into stepping stones.

Strategies for Maintaining Motivation

Sustaining motivation is transformative. With the right mind-set and continuous enthusiasm, your financial goals evolve from distant aspirations to lived realities.