How To Save For A Car Without Going Broke

How to Save for a Car Without Going Broke

Read More : Budgeting Saving Money

Buying a car is a dream for many, a symbol of freedom and independence. Yet, the journey to car ownership can sometimes feel like navigating through a maze of financial challenges. Fear not, because we’re about to unravel the mystery of how to save for a car without going broke. Imagine cruising down your favorite road, windows down, music playing, and knowing you achieved your goal without financially crashing. This article will not only captivate your interest but also provide you with a roadmap to make that dream car a reality without sacrificing your financial well-being.

The desire to own a car is universal, fueled by the allure of convenience and the romance of road trips. But if you’re worried about draining your bank account, you’re not alone. Too often, dreams of car ownership are derailed by inadequate planning. With the right strategy, you can not only afford the car but also save money in the process.

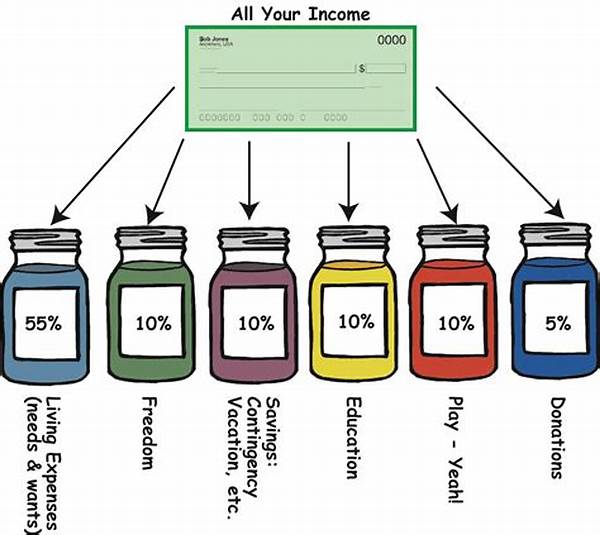

It’s all about setting clear goals, creating a budget that respects your lifestyle, and finding ways to cut costs without slashing the fun out of life. Whether it’s setting up a dedicated savings plan or cutting out those daily lattes, there are creative solutions waiting to be discovered on your path to financial health and car ownership glory.

Creative Tips to Save for Your Dream Car

Once you’ve set your sights on that car, the only thing left is to figure out a clever yet practical plan. By incorporating these techniques, you will soon find yourself closer to your goal: setting realistic savings goals, automating your savings, taking on a side hustle, and cutting back on unnecessary expenses. If you’re committed, the road to buying a car won’t be a rough ride.

—

Exploring the Art of Saving

The financial journey of how to save for a car without going broke begins with the art of self-control and discipline. Most of us face the juggling act of day-to-day expenses while planning for future investments. Saving for a car requires you to set thoughtful priorities while enjoying the journey. Trust the numbers and start by analyzing your income against your outgoings. There’s a good chance you’ve underestimated your potential savings.

Finding Financial Balance

A crucial element is finding the balance between living your life and saving towards your dream. Explore your financial habits and identify small changes that can make a big difference. Brewing your own coffee or swapping big nights out for cozy nights in can add up. Remember, every penny counts when you’re on this road, and these changes don’t necessarily mean you’re sacrificing your lifestyle.

Automating Your Savings

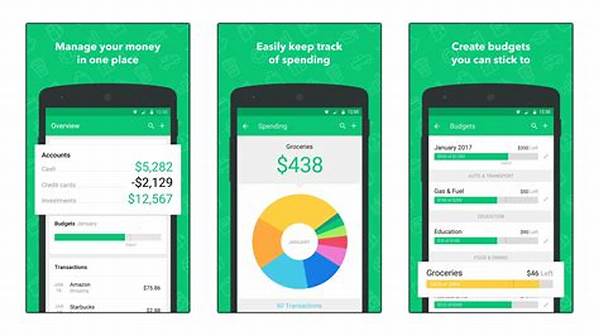

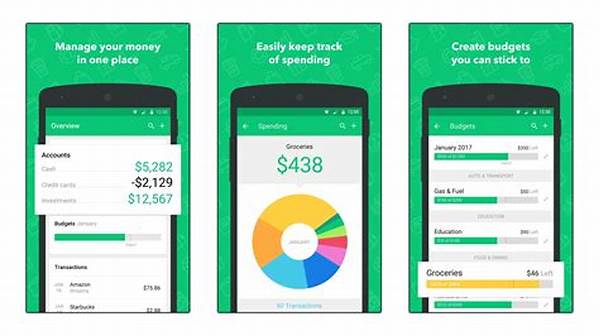

Automating savings is another efficient way to stash away cash without feeling the squeeze. Set up automatic transfers to a dedicated savings account as soon as your paycheck hits. You’ll be surprised how quickly your savings grow without you having to think about it. It’s a set-and-forget strategy that is effective and stress-free.

By following these strategies and diving into the detailed guides of how to save for a car without going broke, you’ll be parking your dream car in your driveway before you know it.

—

Topics Related to Car Savings

The adventure of how to save for a car without going broke is one filled with clever strategies, focused effort, and exciting possibilities. To begin this journey, envision your future, assess your current resources, and craft a plan that balances your aspirations with your realities.

With a solid plan and determination, the journey to car ownership is not only attainable but also enjoyable. Dive into resources, seek advice, and tune into your financial intuition. Your car-owning future awaits, and the path to get there is ready for you to take the wheel.