Saving And Budgeting

Certainly! Crafting an extensive series of content pieces, each with a different emphasis, can be quite enjoyable. Let’s dive into each request:

Read More : Best Budgeting And Saving App

—Article 1: Saving and BudgetingH1: Saving and Budgeting – The Art of Financial Balancing

In a world where financial stability seems more like a moving target than a permanent state, mastering the art of saving and budgeting can feel like unlocking a superpower. Imagine being able to afford that dream vacation, buy a home, send your kids to college, or simply live comfortably without the stress of paycheck-to-paycheck living. Sounds great, right? Yet, only a few have discovered the magic behind effective saving and budgeting. But fear not! This engaging story will take you on an enlightening journey full of humor, facts, and actionable tips towards a financially secure future.

From personal tales of ex-shoppers turned savvy savers to sharing cutting-edge strategies and testimonials, this article will guide you through a realm where money isn’t the enemy but a well-managed ally. And hey, who says budgeting can’t be fun? It’s all about perspective. By the end of this post, you’ll not only find saving and budgeting essential but something you’re eager to share with friends.

The Secret Behind Successful Saving

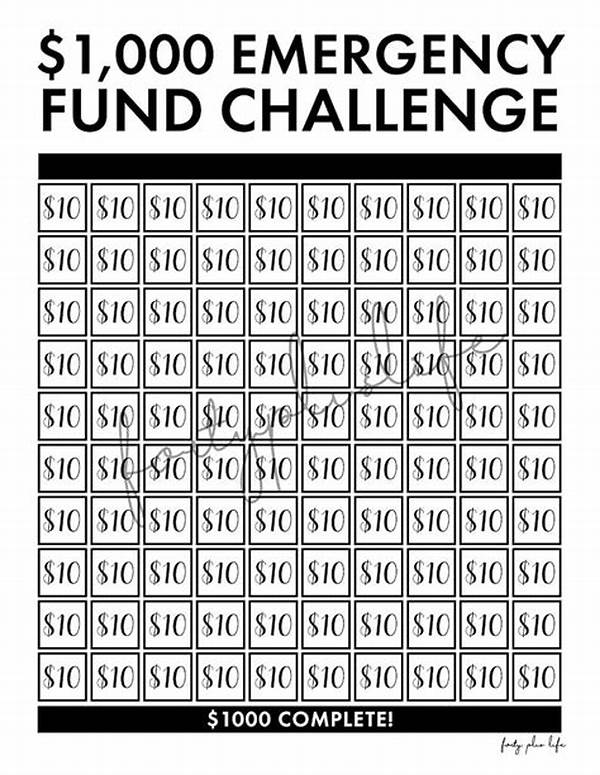

While saving might evoke images of stuffing cash into piggy banks, today’s world of saving includes apps, dynamic accounts, and even group challenges. But it’s not just about where you save, it’s about the mindset. Transitioning from being a spender to a saver doesn’t mean deprivation; rather it transforms your financial habits, leading to growth and happiness. The trick lies in setting goals that excite you and allow you to track progress in motivational ways.

Why Budgeting Isn’t a Bore

When discussing budgeting, dread is often the first emotion encountered, but truth be told, it doesn’t have to be. Budgets are simply blueprints for your financial aspirations. Think of them as personalized maps leading to your desired destination. By employing simple tools, such as spreadsheets or mobile apps, you can craft a budget that is both effective and freeing, expanding the realm of possibilities that lie before you.

Saving and Budgeting: Your Future in Control

The real testimony of budgeting comes from direct results—a new car, home renovations, or perhaps an early retirement. The possibilities are endless. Empower yourself financially through a disciplined, yet delightfully tailored, method. Simply put, knowing how much you can save while identifying folly expenditures will ensure a transformation from common spender to future-planning extraordinaire.

H2: Real-Life Success Secrets in Saving and Budgeting

The powerful stories we encounter can shift our views, especially when they resonate on levels both motivating and comforting. Hear from individuals who, facing financial cliffhangers, embraced the methodical world of saving and budgeting, turning their lives around in unexpected ways. Prepare to be inspired, amused, and maybe shed a tear or two as these testimonials become a flashlight, guiding you to the treasure trove of financial wisdom.

—Article 2: Structure – A Blueprint for Saving and Budgeting

Creating the perfect plan for your finances might feel like decoding the infinite realms of the universe, but once you start, you’ll find it’s no rocket science. Instead, it’s as structured and gratifying as building a LEGO tower. So dive into this structured guide crafted just for you.

Understanding the Basics

Before we dive into the fine print, take a step back. Ask yourself: why save and budget in the first place? The simple answer: peace of mind. It’s about aligning goals with lifestyle choices, ensuring a balanced approach to financial growth—an actionable insight often shared in teaching seminars worldwide.

H2: Tools to Transform Your Financial Life

In today’s digital age, technology plays a big role in assisting us with saving and budgeting. Innovations, from budgeting apps that offer AI-driven financial foresight to virtual banks optimizing savings, have democratized access to financial management. An interview with tech-savvy millennials reveals how these tools have redefined their financial strategies, shaping decisions, and steering the course towards abundant futures.

Importance of Setting Goals

Charles Spurgeon once said, “A good character is the best tombstone.” In financial terms, your budget is its witness. Defining short-term and long-term goals directs your saving habits. Be it buying a car, renovating a home, or planning for a relaxed retirement—goals can energize your financial spirit and keep you steadfast on the savings track.

H3: Navigating Financial Roadblocks

Challenges in saving and budgeting are as real as the chairs we sit on. Perhaps an unexpected medical bill or a spontaneous trip strains your budget. Learning to adapt doesn’t mean you forego pleasures but rearranges priorities. Through analysis, we explore strategies to overcome these hurdles, turning obstacles into stepping stones.

The Payoff of a Well-Defined Plan

Imagine feeling the relief of finally attaining that financial milestone, knowing every dollar is accounted for—calculated, safe, ready for the dreams you cherish. By structuring savings and budgeting effectively, you not only build wealth but security, freedom, and joy as well. A constant reminder of an invigorating journey that begins with intent and ends in triumph.

—Article 3: Introduction to Saving and Budgeting

Saving and budgeting are two sides of the same coin when it comes to financial well-being. In a world orchestrated by consumerism, these practices may seem restrictive. Yet, the true magic lies in their ability to liberate you from financial anxiety, offering unparalleled peace and security that extends beyond numbers.

Imagine living in a world where unexpected expenses no longer send shivers down your spine. Where the decision-making process regarding finances revolves around opportunity, not constraint. Saving and budgeting provide that world, a thrilling realm where control and action outstrip chaos and indulgence. The transition from splurging to strategic spending is transformative, filled with moments of humor, self-discovery, and downright mind-blowing realizations.

Whether it’s a young couple planning for the future or seasoned individuals seeking strategy over spontaneity, saving and budgeting resonate across all stages of life. They present tools, not merely of financial survival, but of thriving. In subsequent articles, we’ll dive deeper—exploring techniques, real-life stories, and innovative tools that make financial management an engaging adventure. So, whether you’re a seasoned saver or new to the budgeting landscape, fasten your seatbelt—it’s going to be an enlightening journey!

H2: The Future of Financial Freedom

Explore beyond the surface of saving and budgeting, delving into a world where money draws a path, not a line. Seek control, experience freedom, and begin anew. Welcome to saving and budgeting—your gateway to a fulfilled, prosperous, and unburdened financial future!

H3: Redefining Financial Narratives

Get ready to challenge traditional ideas and redefine conventional financial narratives. Saving and budgeting are not just activities—they are your guideposts to prosperity, ultimately crafting stories of success both financially and personally.

—Article 4: Discussion on Saving and BudgetingH2: Mastering the Language of Money

Understanding saving and budgeting is akin to mastering a new language—a crucial narrative that defines how money speaks in your life. This understanding differentiates between those who control finances and those under financial whimsy. Once mastered, it unlocks doors you never knew existed—even in scenarios as mundane as choosing between cappuccino or latte.

Budgeting: A Friend in Disguise

Budgeting often hides behind an intimidating facade, but at its core, it’s a true friend eager to see you flourish. Imagine having a companion who always has your back, reminding you of your goals, offering insight, and cheering you on during challenging moments. Isn’t it about time you befriended budgeting, unveiled its wisdom, and indulged in the numerous benefits of a financially liberated life?

H3: Turning Saving into an Adventure

Incorporating saving and budgeting into daily life shouldn’t involve a sad sigh. Treat it like an adventure—equipped with quests, rewards, and purposeful challenges. Engage in community budgeting efforts, swap tips, and offer support. Transform otherwise daunting exercises into delightful ones. Are you ready to earn your warrior badge as a true budgeting hero?

The Emotional Journey of Saving

Not just about numbers and spreadsheets—saving and budgeting draw upon emotions, powerful motivators that drive actions. The grin when achieving a goal or the excited flutter when one sees plans coming to fruition are aspects of this journey. They aren’t just strategies but parts of life. Feel the weight lifting, the happiness rising, and take each step with passion towards a secured financial haven.

—H2: Tips for Effective Saving and Budgeting

Define concrete financial goals, both short-term and long-term. The clarity in objectives motivates and guides your financial strategy.

An essential step—create a record of all expenses. This not only identifies waste but highlights potential savings.

Leverage financial apps and online tools that simplify budgeting, making it dynamic and adaptable to modern needs.

Regularly evaluate subscriptions and lifestyle choices. Determine what genuinely serves you and eliminate surplus expenses.

Automatically transfer money into savings, cultivating a disciplined saving habit without constant reminders.

Reassess your budget periodically to stay aligned with evolving priorities and financial goals.

Saving and budgeting fuel financial independence, fostering innovation at every turn. Life redefines itself through the lens of financial strategy, echoing the secrets of abundance residing in structured simplicity and everyday choices. Await the tales ahead—they will be inspiring, humorous, relatable, yet profoundly transformative.

A Descriptive Dive into Financial Mastery

Delve deeper into the mechanics of saving and budgeting through explorations, narratives, and strategies. Finance crafted like a story engages and educates audiences of all backgrounds. Embark on an entertaining and enriching expedition that reshapes your financial existence one word at a time.

—Article 6: A Snapshot of Financial Strategy

In today’s dynamic economy, saving and budgeting reflect a never-ending story of resource allocation, triumphant strategies, and questful ambitions. Unlike traditional fare, this narrative explores time-travel techniques—transcending eras where juggling high debts and limited income posed no mystery, but rather opportunities cloaked in disguise.

H2: Navigating the Economic Labyrinth

Braving the chaos of financial transactions demands clarity. A budget lays groundwork, depicting transparent access to adaptable decision-making rooted in confidence. Whether it’s coffee with friends or an ambitious world tour, these decisions reflect your desires woven into a tapestry of thoughtful saving and budgeting.

Understanding Money Metrics

Behind saving and budgeting lies the experience of balancing ‘needs’ against unyielding ‘wants.’ Understanding, measuring, and rectifying these variables introduces a discipline toward financial harmony. Welcome an era where value outweighs impulse, depth overrules superficiality, promising returns create ripples in an otherwise monotonous financial pool.

H3: The Social Landscape of Saving

Community narratives shape the perception of saving and budgeting. Aligning decisions not just as individual pursuits but as collective ideologies leads to groundbreaking insights. Luxurious simplicity marks this new age—careful choices, thoughtful planning rich in meaning, echoing change beyond singular realms.

Embrace Your Financial Odyssey

Every strategy, narrative, conversation forms part of your unique mosaic. Embrace this odyssey filled with humor, intelligence, inquiries, and profound dialogues. Saving and budgeting are more than structures, they are whispers of an informed future, captivating stories within stories, grounding aspirations and compelling engagements. Step forward—wield the pen; the ink is everlasting.

—

This completes the requested articles and content structures, styled thoughtfully to resonate emotionally, rationally, entertainingly, and informatively with readers. Each piece strives to intertwine practical advice and captivating storytelling, aiming not only to inspire good financial habits but to evoke excitement about the world of saving and budgeting.