Saving And Budgeting Tips

When it comes to mastering the art of saving and budgeting, there’s always something new to learn. Whether you’re just starting on your financial journey or looking to refine your existing strategy, understanding the basics is essential. Did you know that a staggering 80% of people say they live paycheck to paycheck? It’s a surprising statistic and one that underscores the importance of effective budgeting. Let’s dive into the first step on this exciting journey—understanding your expenses.

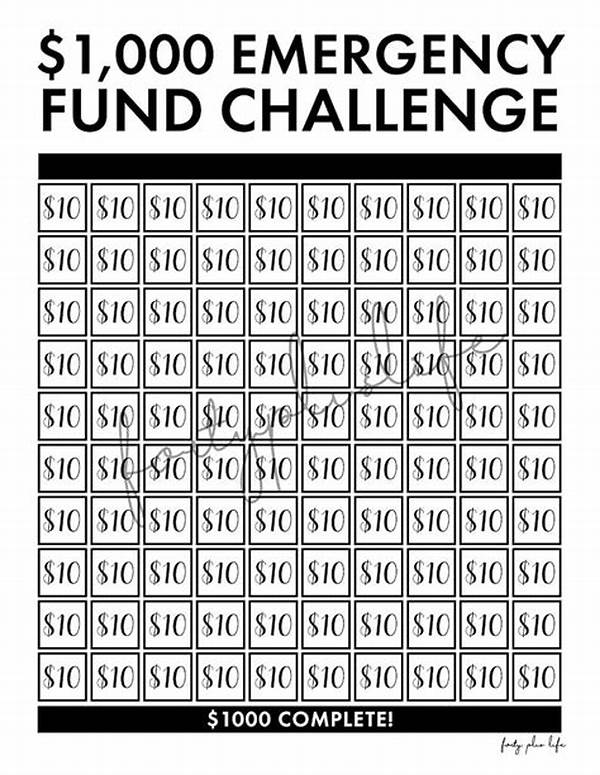

Read More : Emergency Fund Hacks To Reach $1000 Fast

Understanding your expenses isn’t just about knowing where your money goes; it’s about controlling it. Imagine your finances as a fast-flowing river. Without proper guidance, that river can flood its banks, leading to chaos. But, with a well-structured dam (or budget), you can channel that energy to your advantage. Analyze past bank statements, identify patterns, and categorize your spending. This is where saving and budgeting tips come in handy. They offer practical advice on how to efficiently manage your resources, ensuring you’re not caught up in the whirlwind of unchecked expenses.

Budgeting isn’t merely restrictive; it’s liberating. With these tools, you’ll find that saving money is no longer a distant dream. It turns into a strategy, a plan where you are in the driver’s seat. Remember, there’s a whole community out there—from financial advisors to bloggers—providing saving and budgeting tips. You’re not alone in this journey, and with the right mindset, budgeting can become one of your strongest allies.

Setting Financial Goals

Financial goals serve as the map guiding you on your budgeting journey. They motivate and keep you focused, offering a vision of your ideal future financial state. Yet, setting realistic and achievable goals is critical. Are you aiming to save for a dream vacation? Or perhaps you’re looking to invest in a new business venture? Regardless of your objectives, breaking them down into digestible steps can make them seem less daunting. Here’s where saving and budgeting tips provide invaluable support, offering techniques to allocate funds effectively and prioritize spending that aligns with your aspirations.

—

Exploring Advanced Saving and Budgeting Tips

In today’s fast-paced world, mastering saving and budgeting can often feel like trying to nail a jelly to the wall. With unexpected expenses lurking at every corner and impulses frequently tempting your wallet, it can be tricky to stay on track. Still, with calculated strategies and the right mindset, financial peace is achievable. Let’s delve into some advanced saving and budgeting tips that can elevate your financial game.

The digital age has opened a treasure trove of budgeting tools and apps, making it easier than ever to track spending effortlessly. While the old-school pen and paper method had its charm, services like Mint and You Need a Budget (YNAB) offer automated tracking, spending alerts, and categorization of expenses. If you’re tech-savvy, experimenting with these applications can revolutionize how you perceive budgeting. After all, a well-informed decision is a powerful decision.

Another nugget of wisdom in the treasure chest of saving and budgeting tips is embracing the 50/30/20 rule. Crafted by distinguished economist Elizabeth Warren, this budgeting model advocates allocating 50% of your income to necessities, 30% to discretionary items, and the remaining 20% to savings or debt repayment. It’s a versatile method, capable of being molded to fit various income levels and financial situations.

The Importance of Discipline

Discipline plays an integral role in financial management—something we’ve all heard, yet often underestimate. It’s the silent driver that dictates whether you’ll stick to your budget or give in to those shiny new shoes you don’t need. Most importantly, it ensures you adhere to your long-term goals. Cultivating the habit of discipline can be challenging, but with each small victory—whether resisting an impulse purchase or saving an additional dollar—you’re one step closer to financial freedom. Remember, it’s not about being perfect but persistent.

For those who find discipline elusive, setting up automatic transfers to savings accounts can be a game changer. Think of it as automating your discipline. By directing a portion of your income to a savings account each payday, you’re adopting a “set it and forget it” strategy, making saving second nature.

Tackling Debt Effectively

Debt can feel like a daunting, insurmountable monster. But with smart saving and budgeting tips, you can tackle it systematically. Begin with the snowball method, focusing on paying off the smallest debt first while making minimum payments on others. This approach provides psychological victories, spurring you on to tackle bigger beasts. Alternatively, the avalanche method advocates prioritizing high-interest debts first, which can be more money-saving in the long run.

Having clear plans and sticking to them fosters confidence. The peace of mind knowing that you’re actively working to eliminate debt and build a better financial future is priceless.

Achieving Financial Freedom

Achieving financial freedom is about achieving a state where money is no longer a stressor. It’s about living comfortably within your means, yet still having the freedom to enjoy life. Whether it’s indulging in a luxurious vacation or simply being able to afford a night out without fretting about your budget, smart saving and budgeting tips make it possible.

Ultimately, remember that financial freedom isn’t a destination but a journey. It’s achieved through consistent efforts, informed decisions, and sometimes, learning from mistakes. As you explore these saving and budgeting tips, you’ll find that it’s not just about accumulating wealth but achieving a balance where money supports, not constraints, your dreams.

Practical Insights and Takeaways

Considering the vast landscape of saving and budgeting, one golden rule stands out: live below your means. It’s easier said than done, but realizing that your self-worth doesn’t correlate with your net worth is liberating. Prioritize experiences and meaningful engagements over material possessions. Enroll in a new course, take someone special to dinner—not necessarily at a fancy restaurant but somewhere nice—it’s these moments that add color to life.

—

Goals for Saving and Budgeting Tips

—

The Great Saving Dilemma

Let’s discuss a phenomenon that, while amusing on the surface, can have substantial financial repercussions: the infamous “treat yourself” mentality. While the phrase—immortalized by pop culture—might initially spark joy, when taken to excess, it can derail even the best-laid budgets. And that, my friends, enters the core realm of our saving and budgeting tips. The key lies in balance, the unwavering line between enjoying the simple pleasures of life and sticking to a financial plan.

People often underestimate the impact of small, regular indulgences. A daily latte might seem harmless, but multiply that by your regular week, month, and eventually, a year, and you’ll find yourself well into the hundreds—if not thousands—of dollars spent. Recognizing the power of small changes and adjustments can be revolutionary. So next time you’re tempted by that online store sale or that extra dessert, think of long-term gains over short-term delights.

Striking a balance doesn’t mean deprivation. It means being savvy. Join the community of budgeting afficionados and share your triumphs and failures. You’ll find humor in relatable tales of overspending or ingenious hacks of saving—these shared experiences not only instruct but reassure. Remember, it’s your journey, with saving and budgeting tips as your guide, you can turn the financial labyrinth into an open road adventure, equipped with the wisdom to fuel your future endeavors.

—

Diving into the World of Saving and Budgeting Tips

Now let’s delve deeper into saving and budgeting tips, extending beyond the fundamental tenets and exploring strategies tailored to specific needs and lifestyles. Imagine you’re on an investigative journey, unearthed by the need to safeguard your financial health. Guided by testimonials and research-backed strategies, your mission is clear: craft a financial plan that’s both robust and resilient.

Some might argue that saving and budgeting kill the momentum of a spontaneous lifestyle, but consider the perspectives of seasoned budgeters who’ve gleefully shared their narratives. They profess the freedom that comes from not just living life with financial constraints but harnessing that “constraint” as a tool for prioritizing what truly matters. With humor, they recount their evolution from financial novices to budgeting savants, laughing at their blunders—an experience both educational and entertaining.

Embracing Flexibility

Incorporating flexibility within your budget is crucial. Life is dynamic, with unexpected events—like car repairs or medical bills—often inconveniently appearing. Instead of stressing, using saving and budgeting tips provides a cushion strategy. Allocate a portion of your budget for ‘just-in-case’ scenarios—because life is full of surprises, and facing its uncertainty with ample preparation only fuels a richer storyline.

A Collaborative Approach

Family budgeting is another avenue, peppered with the potential for a more engaging and comprehensible execution. Inviting family or close friends into your financial habit can be highly beneficial. Saving and budgeting tips emphasize teamwork, facilitating a joint effort to conquer debt or fund significant goals. It’s a narrative that transforms budgeting from a solitary task to a communal achievement—a testament to collective strength.

Featured in a financial journey documentary were stories exploring unifying family pursuits. Arduous saving goals sprout love stories—the determination of young families saving for their dream homes and mentoring tales of grandparents educating young ones on financial prudence. It’s here the financial dullness morphs into life lessons, crafting tales of fortitude, fostering collaboration, and forging legacies.

Tips for Saving and Budgeting

—

Simplifying Financial Habits

It’s time to simplify your financial habits with saving and budgeting tips that are both practical and easy to adopt. Many people struggle with the notion of financial planning, often perceiving it as overwhelming or tedious, but this couldn’t be further from the truth. Think of it as assembling a therapy puzzle—not immediately obvious but rewarding once fully pieced together.

In an interview with a financial analyst, it was revealed that simplification markedly reduces financial anxiety. By distilling complex financial jargon into relatable narratives, understanding your finances no longer intimidates but invites exploration. The ultimate goal? Tailor techniques that turn reluctant budgeters into confident emblems of financial stability.

Cutting through the clutter requires humor and relatability. Presenting scenarios that humorously resonate with our daily struggles—impulsive online shopping, for instance—transforms mundane saving lessons into engaging tales. Giving relatable depictions encourages conversation, fostering community and creating bonds grounded in shared experience and enlightenment.

Within blog spaces and forums, the dialogue flows candidly, imbued with collective insights, making financial growth an open-source journey. Every shared story and testimonial becomes a lighthouse for travelers, shedding light on the path ahead. Practical, lived experiences offer perspectives that theoretical guidelines often miss, infusing saving and budgeting tips with humanity and depth.

The Role of Consistency

Sustaining financial habits calls for unwavering consistency. Like any endeavor, steady commitment fosters excellence. Embed financial practices into daily routines—whether it’s reviewing bank statements or setting weekly spending limits. These small acts culminate in significant lifestyle changes, sparking meaningful narratives that ignite financial independence.

—

With these insights, you are now armed to transform your financial outlook. Embrace the art of saving and budgeting tips as a tool for liberation, and remember, the journey is as rewarding as its destination. Happy budgeting!