Saving Money Budgeting

In today’s fast-paced world, managing finances can often feel like trying to juggle flaming torches while riding a unicycle. The importance of having a clear plan for saving money and budgeting cannot be overstated. However, creating such a plan often becomes overwhelming. Many individuals get distracted by sparkling offers, and impulse purchases, only to find themselves bewildered at the end of the month, wondering where all their money went. So, how can one make saving money budgeting both practical and effective? The answer lies not only in clear strategies but also in a mindset shift.

Read More : Budgeting Challenges That Actually Build Wealth

By implementing a smart saving money budgeting strategy, individuals are not only securing their present needs but also preparing for future aspirations and potential emergencies. Imagine you are driving on a long road trip. Saving money budgeting acts as your roadmap, fuel gauge, and service station stops combined, ensuring that you reach your destination without any hitches. Where does this drive lead to? It leads to financial security, freedom, and opportunities knocking at your door.

While we dive deeper into the world of saving money budgeting, let’s add a twist: thinking of this discipline not as a restrictive measure, but rather as an empowering tool. What if saving was fun? And budgeting was a game with rewards? Think of budgeting as setting life goals, where each saved penny is a step closer to winning the grand prize – your financial dream. This shift in perspective transforms mundane financial chores into exciting challenges with visible milestones and achievements.

Engaging the Art of Saving Money Budgeting

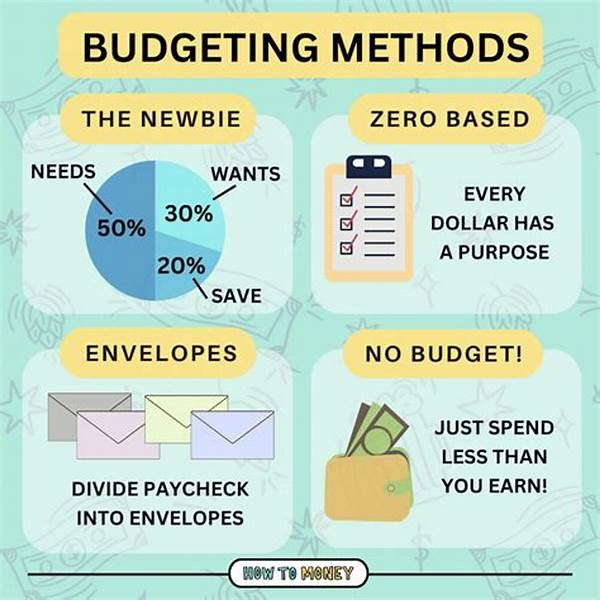

Utilizing a saving money budgeting strategy involves categorizing expenses into needs, wants, and savings. It’s essential to strike a balance among these categories to maintain a healthy financial lifestyle. By allocating a fixed percentage of your income to each category, you create a balanced financial plan. Consider following the 50/30/20 rule: 50% for needs, 30% for wants, and 20% for savings. This approach is both simplistic and effective, providing a structured pathway to saving money.

Saving money budgeting becomes even more engaging with the involvement of technological tools. Various apps offer features that not only track spending but also offer insights and recommendations tailored to your financial behavior. These digital companions transform saving money budgeting from a task into an interactive experience.

Finally, consider involving others in your journey toward financial stability. Join communities or social media groups focusing on financial wellness and saving tips. Sharing experiences and exchanging knowledge can not only motivate you but also introduce methods and ideas you hadn’t thought of before. Remember, saving money budgeting is not a solo adventure – it is an opportunity to connect, learn, and grow together.

—

Whether you consider yourself financially savvy or a complete novice, having a structured approach in saving money budgeting is crucial. This structure provides a strong base on which you can build a successful financial future.

Identifying Financial Goals

Setting clear financial goals provides direction. Are you saving for a vacation, a new car, or perhaps retirement? Defining these goals allows you to tailor your saving money budgeting strategy accordingly. Interview successful savers and you’ll find that a majority have one common strategy: well-defined objectives.

Steps to Create a Budget

Creating a budget may seem daunting, but breaking it down into manageable steps simplifies the process. Start by tracking all your income and expenditures for a month. Use this data to categorize and allocate funds accordingly. Saving money budgeting starts with awareness; once you understand the flow of your money, you can mold it effectively.

Remember to review your budget regularly. Life circumstances change, and so should your budget.Allow flexibility for unexpected expenses while remaining dedicated to your overarching goals. Maintain a dynamic budget where you’re not overly strict yet remain disciplined.

—Additional Topics Related to Saving Money Budgeting

- Understanding the 50/30/20 Rule

- Digital Tools for Budget Management

- Psychological Insights on Spending Behavior

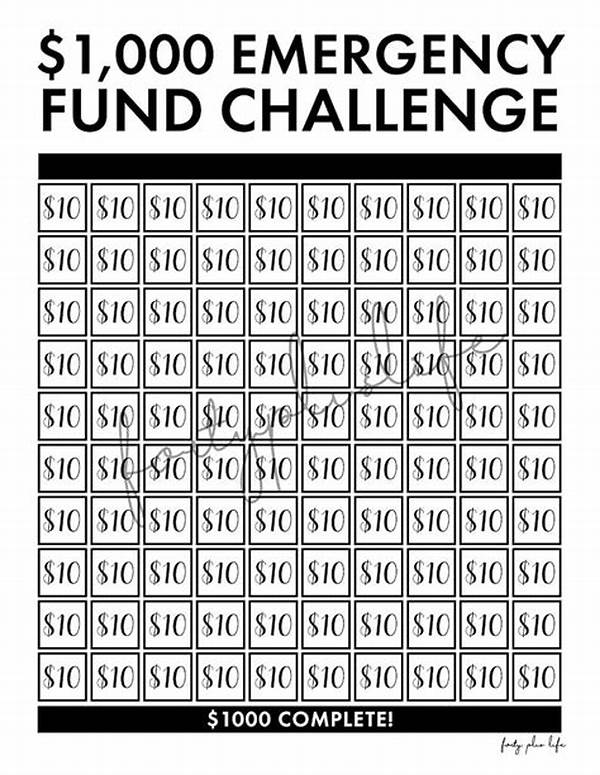

- Emergency Fund Essentials

- Long-Term vs. Short-Term Financial Planning

- Impact of Lifestyle Changes on Budgeting

—

The Purpose of Saving Money Budgeting

The primary purpose of saving money budgeting revolves around achieving financial freedom and security. By adopting a methodical approach, individuals can experience a significant reduction in financial stress, better prepare for unforeseen emergencies, and steadily achieve long-term aspirations.

While it may initially seem restrictive, saving money budgeting empowers you to allocate resources effectively, enabling life experiences and financial achievements previously thought unattainable. Visualize it as setting boundaries that guide rather than constrain; a map to navigate through complex financial seas.

Ultimately, saving money budgeting is about making informed decisions that align with personal values and life goals. Whether it’s purchasing a home, funding education, or simply enjoying a comfortable retirement, a properly managed budget acts as a catalyst, propelling you towards these milestones.

—

Unveiling the Secrets of Successful Budgeting

Learning from those who’ve mastered saving money budgeting can offer invaluable insights. Successful savers, much like skilled artisans, refine their technique over time. They palatably blend discipline with occasional indulgence, ensuring they remain motivated and focused.

Habits That Transform Your Savings

Successful budgeting is less about restricting expenses and more about cultivating effective spending habits. Understanding your financial strengths and weaknesses allows you to make rational adjustments. For example, employing features like automatic transfers to savings accounts can ensure consistent contribution.

Moreover, integrating humor into your journey creates a lighter atmosphere. Indulge in witty financial blogs or podcasts that blend entertainment with education; making saving money budgeting a part of lifestyle rather than a chore transforms the mundane into moments of growth.

Ultimately, dissecting complex budgeting into digestible steps – like setting achievable short-term goals – ensures consistency. Celebrate small victories along the way; after all, each step contributes to the larger financial masterpiece you’re creating.

In conclusion, saving money budgeting is an art – a dynamic process that demands adaptation, commitment, and creativity. By embracing this approach, you’re not merely budgeting; you’re shaping your financial narrative with intent and purpose.