The Psychology Of Saving Money Explained

- The Psychology of Saving Money Explained

- Unveiling Mental Barriers

- Redefining Financial Success

- Discussion on the Psychology of Saving Money Explained

- Psychological Triggers – An H2 Insight

- The Role of Emotions in Savings – An H3 Examination

- Goals for the Psychology of Saving Money Explained

- A Deep Dive into Savings Strategies

- Approaching Saving with a Fresh Perspective

- Tips to Enhance Your Savings Game

- The Intricacies of Financial Discipline

The Psychology of Saving Money Explained

Saving money might seem straightforward—put a portion of your income away for future use. Easy, right? Yet, for many, this seemingly simple task is laden with emotional complexity and psychological barriers. Understanding the psychology of saving money can be like unlocking a treasure chest of financial well-being and security. It goes beyond numbers and budgets—it’s about motivations, fears, and the stories we tell ourselves about money. Our relationship with money is deeply personal and often tied to our identity and upbringing. Whether you identify as a spender or a saver, these labels are usually ingrained from past experiences, societal cues, and even parental advice. So, how do we navigate these waters and develop a healthier financial mindset?

Read More : Tips For Budgeting And Saving

In the world of finance, numbers are often seen as black and white, but the emotions tied to them are most definitely not. Each financial decision we make is a reflection of our psychological quirks and cognitive biases. For instance, many of us fall victim to short-term desires, making it challenging to prioritize long-term savings goals. This is where understanding the psychology of saving money explained can provide us with the insight needed to bridge the gap between wanting to save and actually doing it. The art of saving is about rewiring our brain patterns to appreciate the gratification found not in immediate spending but in future security.

Saving money has less to do with arithmetic and more with behavioral change. Behavioral economics shows us that knowing the importance of saving is not enough. What truly matters is creating an environment that encourages saving, one that rewards small victories and builds new habits. It’s about changing our narrative from a mindset of deprivation to one of empowerment. Financial literacy plays a pivotal role in this journey. When you are informed about “the psychology of saving money explained,” you are armed with tools to create meaningful changes in spending habits and saving behavior.

Unveiling Mental Barriers

Many of us find ourselves inching closer to the payday, waiting desperately to indulge in newfound salary luxuries, only to repeat the cycle the following month. Why is it that despite good intentions, saving feels like a chore? The psychology of saving money explained unveils a pattern: Cognitive dissonance. This mental dance occurs when individuals struggle between their financial aspirations and their current spending behaviors. Our brains are wired to favor immediate satisfaction, leaving our future selves to deal with the consequences. This part of psychology highlights the need to embrace mindful spending and saving practices.

Redefining Financial Success

Financial success is not solely reflected by your bank balance but by the peace of mind you acquire with financial stability. Through understanding the psychology of saving money, individuals can craft personalized strategies that resonate with their unique needs and lifestyles. It’s about setting realistic goals, celebrating small wins, and making incremental changes that lead to significant improvements. It’s not just a practical action but an emotional journey toward achieving freedom from financial stress.

—

Discussion on the Psychology of Saving Money Explained

The topic of saving money may often appear mundane, but the psychology behind it is fascinating, nuanced, and ripe for discussion. Understanding the psychological factors that impact our saving behaviors can offer profound insights into financial planning. One might assume that saving money solely depends on financial literacy or income level. However, the complex interplay of emotions, perceptions, and habits paints a more accurate picture. For instance, studies reveal that early financial education in childhood influences adult saving behaviors significantly. In essence, the psychology of saving money explained involves unraveling deep-rooted beliefs and reshaping them.

Psychological Triggers – An H2 Insight

A key to understanding saving psychology is identifying psychological triggers that push us either towards or away from saving. Triggers such as fear of scarcity, inheritance practices, and societal expectations greatly influence saving habits. This explains why some people instinctively lean towards saving for emergencies, while others view money as a means for instant gratification. The psychology of saving money explained also sheds light on how individual experiences contribute to unique financial behaviors, proving that one-size-fits-all financial advice often falls flat.

The Role of Emotions in Savings – An H3 Examination

Emotional intelligence plays a hefty role in managing finances. True, rational decisions should ideally guide money management, but emotions often take the lead. People tend to make financial decisions based on moods – spending when happy to reward themselves, or when sad as a form of emotional compensation. The psychology of saving money explained helps dissect these habits, paving the way for more informed choices. Being aware of emotional triggers helps construct resilient saving strategies that can mitigate impulsive financial decisions, aiding in effective long-term wealth accumulation.

Moreover, volatile economic climates add layers of fear and confusion, disrupting usual saving patterns. A global pandemic, for example, has sparked an increased awareness of the need to secure financial futures, as seen through the substantial jump in savings rates in households worldwide. It’s clear that while informed decisions start with rational thinking, emotional awareness is crucial in maintaining consistent saving habits. A nuanced understanding of these psychological aspects fosters better financial health and well-being.

Goals for the Psychology of Saving Money Explained

The psychology of saving money explained is a multifaceted concept intertwining emotions, history, and behaviors, essential for cultivating financial literacy and independence. By delving deep into personal finances, the insights garnered help tailor specific strategies conducive to healthy saving habits.

A Deep Dive into Savings Strategies

Savings strategies go beyond the monthly deduction from paychecks; they embody a lifestyle change. Acknowledging the psychology of saving money explained provides a foundation to assess one’s own financial narrative. Who knew that saving could be both science and art? The journey starts with understanding behavioral economics, which highlights why knowledge isn’t sufficient to change financial behaviors. It rests on the ability to align emotional incentives with saving goals.

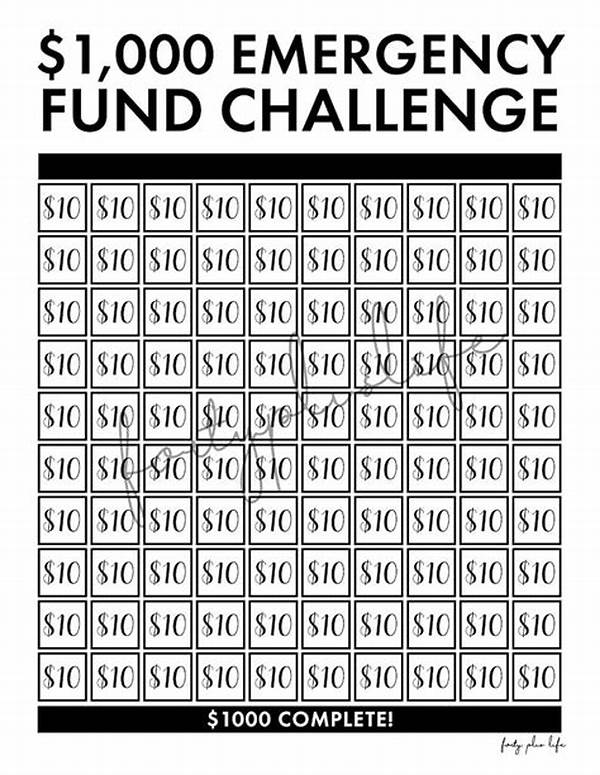

Contemporary research showcases innovative techniques like gamified saving apps that inject enjoyment into financial discipline. These platforms use progress tracking, rewards, and user-engagement boosting savings success. Moreover, the dynamics introduced by peer support systems encourage cooperative saving efforts, pooling resources for higher interest rates or communal benefits.

Approaching Saving with a Fresh Perspective

Crafting a fresh narrative around money allows individuals to redefine their relationship with it. Forging financial success involves introspective work to let go of outdated beliefs and embrace structured, flexible saving plans. Involving the community, joining financial awareness groups, or leveraging social media for accountability helps maintain motivation. The psychology of saving money explained acts as a guiding light, enabling individuals to navigate their unique financial journeys with renewed vigor. As we embark on this expedition of financial enlightenment, it’s crucial to remember that saving is not just about accumulating wealth—it’s about creating a life free from financial anxiety and enriched with security and peace of mind.

—

Tips to Enhance Your Savings Game

For many, saving can be a daunting task filled with sacrifices, but with the right approach, it becomes a rewarding experience. Embracing the psychology of saving money explained leverages both cognitive and emotional aspects, ensuring a comprehensive approach to achieving financial stability and peace of mind.

The Intricacies of Financial Discipline

Financial discipline ties deeply into the psychological framework, setting the stage for a sound financial future. By leveraging insights into one’s behavior and developing a robust savings strategy, financial independence becomes attainable.

An effective financial plan stems from recognizing and harnessing individual strengths and weaknesses. Those who adopt this mindset are better positioned to handle life’s financial curves. Tools like budgeting apps or online courses layer knowledge with practical application, proving useful in perpetuating financial discipline. The exploration into the psychology of saving money explained offers essential insights beneficial to individuals serious about their economic prosperity.