Why Millennials Are Choosing Cash Stuffing In 2025

Why Millennials Are Choosing Cash Stuffing in 2025

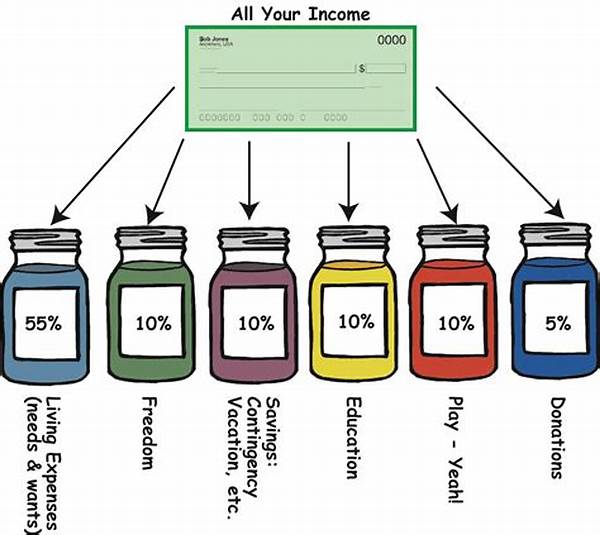

In an age dominated by digital transactions and cryptocurrencies, one might assume the practice of using cash would be practically extinct by 2025. However, the trend known as “cash stuffing” has been charming its way into the millennial demographic, proving that sometimes, what’s old is indeed new again. Cash stuffing is the retro way of budgeting that involves physically placing cash into envelopes earmarked for different spending categories. It’s tangible, it’s visual, and most importantly, it’s forcing many to reconsider their financial habits.

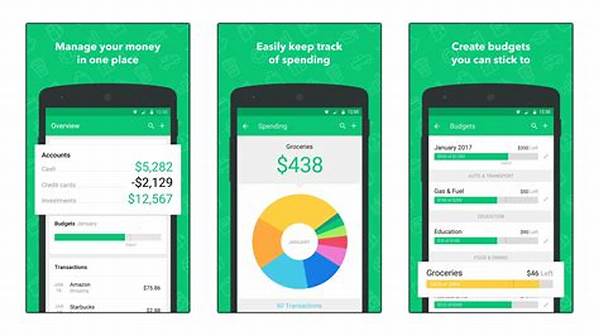

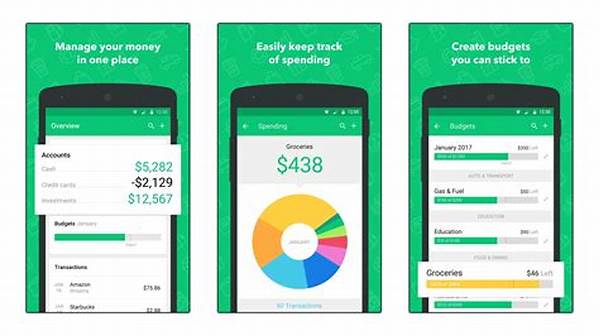

Read More : The Best Envelope Budgeting Apps Reviewed

Millennials are no strangers to financial turbulence. Having come of age in the aftermath of the 2008 financial crisis, and later navigating the economic upheaval brought on by the global pandemic, this cohort is more financially astute and cautious than their predecessors. The evolution of cash stuffing from a simple budgeting technique into a broader financial trend says a lot about contemporary consumer behavior. Why are millennials choosing this method in 2025? For one, it provides an unmatched level of transparency and control. It’s like having a financial diet plan, where every dollar is micromanaged, thus helping avoid those sneaky overdraft fees or the overspending traps that digital banking can sometimes sneak on unwary consumers.

Adding a sprinkle of humor, it might remind some millennials of Monopoly money, but let’s face it, there’s a serious undertone to this seemingly playful act. Unlike digital transactions that can be somewhat invisible and abstract, cash stuffing offers a tangible relationship with money, calling forth a psychological anchor that many find soothing in an era of digital overload. Essentially, it’s a millennial pushback against the overwhelming digital wave, and in some sense, a rebel yell against modern banking and transaction methods. Plus, who can resist the simple joy of coloring and labeling those folders?

The Benefits of Cash Stuffing

The question on everyone’s lips might be why millennials are choosing cash stuffing in 2025, and the reasons are as multifaceted as they are intriguing.

Older generations might recall their own struggles with cash budgeting and wonder what’s so appealing about these archaic methods for millennials. Focused on security and freedom, many millennials view cash stuffing in 2025 as an innovative way to regain control over personal finances. Amidst the modern-day sea of credit card debts and complex loan systems, some find that returning to basics is the most effective approach. Many report that handling cash directly reduces impulsive spending — it’s a lot harder to part with a crisp $20 bill than a few clicks for an electronic transaction. Users express feeling empowered and enjoy the sense of achievement in seeing real money lining their envelopes.

—

Detailed Description

Cash stuffing has found itself in the spotlight of 2025’s financial revolution, capturing the imagination and wallets of millennials with its quirky blend of simplicity and effectiveness. This tactile budgeting system once reserved for a bygone era is now a symbol of financial freedom and control for a generation that embraces both nostalgia and innovation.

In an extensive survey conducted by a popular financial blog in 2025, results showed that nearly 40% of millennials had ditched their digital-only budgeting methods for cash stuffing to some degree. The survey revealed startling insights: the tactile experience and psychological associations with spending actual cash led to more mindful spending practices. Millennials are finding that physically allocating cash for different categories helps with the discipline they felt was missing from purely digital methods.

Why Millennials Love Cash Stuffing

Perhaps one of the most compelling reasons why millennials are choosing cash stuffing in 2025 is the return to a sense of materiality in finance. This desire isn’t just a rejection of the overwhelming digital banking and transaction systems but also a yearning for authenticity and transparency. With cash, what you see is what you get, and there is no hiding behind complex algorithms or unrecognizable deductions—the cash is right there in front of you.

Add to that the communal and often social aspect of cash stuffing in 2025, where budgeting doesn’t have to be done in isolation. Social media is abuzz with millennials sharing their cash-stuffing tips, envelope designs, and personal stories. This interaction is reminiscent of the way cooking has become a shared online experience, turning a solitary task into a collective celebration. Cash stuffing communities online have transformed this budgeting technique into a vibrant subculture, complete with its own aesthetics and languages, further driving its popularity.

Simplicity Meets Strategy

To skeptics who might argue that stuffing a bunch of envelopes is too simplistic, the response would be simple costs savings. Putting cash aside means you spend only what you physically allocate. The intuitive and strategic nature of this method attracts millennials who are eager for straightforward solutions amidst financial systems that seem purposely opaque. As they work through their cash stuffing journey, millennials gain a deeper, more personal understanding of their spending habits, leading them to make more informed financial decisions that align with their personal values and life goals.

H2: How Cash Stuffing Is Evolving in the Millennial Era

With engaging narratives and strategic simplicity, cash stuffing is taking the millennial world by storm. It’s just another example of how today’s youth are adapting old systems to fit modern challenges. Cash stuffing encourages fiscal responsibility, promotes community, and perhaps most importantly, it puts financial power literally back into the hands of millennials. Therefore, the question of why millennials are choosing cash stuffing in 2025 can be answered by understanding the richness and control that accompanies this age-old budgeting craft, wrapped in a contemporary twist.

—

Key Points

Cash Stuffing in the Digital Age

Cash stuffing seems ironic in a digital world, but this nostalgic method resonates with millennials. The tangibility and direct control over finances that cash stuffing offers contrasts starkly with intangible digital transactions. This old-school budgeting method presents a fresh, empowering perspective to financial management, encouraging more conscious spending habits. For millennials, cash stuffing isn’t just budgeting—it’s a cultural statement and a financial strategy, a reaction to the complexities of today’s financial systems. By adopting this method, millennials are crafting a financial narrative that connects their love for vintage simplicity with modern needs for control and clarity, answering the call of why millennials are choosing cash stuffing in 2025.