Zero-based Budgeting Explained For Beginners

- The Marvels of Zero-Based Budgeting

- Change Management in Zero-Based Budgeting

- Aligning Strategic Goals with Financial Plans

- Structuring Zero-Based Budgeting for Beginners

- Adapting Zero-Based Budgeting in Organizations

- Descriptive Illustration of Zero-Based Budgeting Benefits

- Detailed Breakdown of Zero-Based Budgeting

In an ever-evolving financial landscape, where maintaining control over expenditures is at the forefront of successful business strategies, zero-based budgeting emerges as a compelling approach. If you’ve been searching for a method to revolutionize how you plan and execute your budget, this might just be your eureka moment. Imagine a clean slate, an opportunity to rewrite the script of your fiscal future each time you sit down to allocate resources. This is the heart of zero-based budgeting explained for beginners—a strategy that challenges the conventional and embraces the innovative.

Read More : Best App For Budgeting And Saving

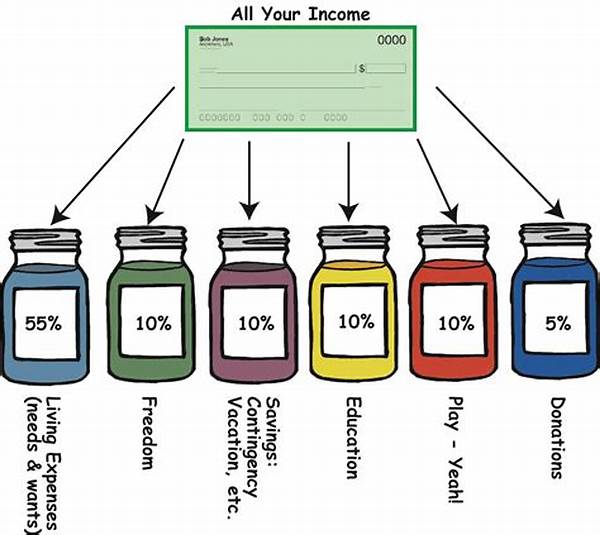

Zero-based budgeting (ZBB) is rooted in simplicity but unfolds into a complex dance of numbers and strategy. Unlike traditional budgeting, which often begins with the previous year’s figures, ZBB demands that every expense must be justified from scratch for every new period. This method pushes organizations to scrutinize every cost, fostering an environment where efficiency reigns supreme. The unique selling point of ZBB is its potential to redirect resources toward high-impact activities, thus increasing value.

Imagine your budget as a blank canvas, where each brushstroke is a deliberate choice. Whether you’re a seasoned executive or a fresh entrepreneur, understanding zero-based budgeting explained for beginners can unlock this palette of possibilities. The beauty of ZBB is that it forces prioritization—only the most essential and effective processes are funded, paving the way for strategic growth initiatives.

ZBB isn’t just a budgeting method; it’s a mindset shift. It offers a lens through which to view your financial operations, compelling you to focus not merely on cost-cutting but on value creation. The journey to mastering zero-based budgeting explained for beginners starts now. Are you ready to transform your budgeting strategy and amplify the potential of your financial decisions? Dive in, explore, and embrace the revolution that is ZBB.

The Marvels of Zero-Based Budgeting

Zero-based budgeting explained for beginners carries with it a promise of transformation and efficiency. Yet, to truly harness its power, one must navigate its intricacies. This budgeting strategy, renowned for its rigorous approach, forces decision-makers to prioritize spending based on necessity and efficiency. It’s like assembling a puzzle with carefully chosen pieces, ensuring each one contributes to the complete picture of financial health.

This method is particularly appealing to businesses that must adapt quickly to changing market conditions. By resetting the budget to zero each cycle, organizations embrace flexibility alongside accountability. Moreover, as each expenditure category is analyzed for its effectiveness, zero-based budgeting fosters a culture of innovation. Businesses that have transitioned to ZBB often report not only cost savings but also enhanced strategic focus on growth areas.

—

Understanding the nuances of zero-based budgeting explained for beginners requires more than a cursory glance; it involves diving into its practical implications. One might wonder why more organizations aren’t jumping on this bandwagon if it’s as beneficial as it seems. The answer lies in implementation challenges and organizational inertia. The initial shift to ZBB can be daunting, as it demands a cultural change and more resources in the planning phase. However, the rewards of streamlined processes and enhanced resource allocation often outweigh these challenges.

Change Management in Zero-Based Budgeting

Implementing zero-based budgeting explained for beginners comes with its share of resistance. Employees accustomed to traditional budgeting methods may view ZBB as just another management fad. Convincing them otherwise requires a well-crafted change management strategy. A significant part of this involves training employees and showcasing the success stories of other organizations that have thrived post-transition.

Overcoming Resistance to Change

To ensure a smooth transition, companies must initiate an open dialogue about the benefits of zero-based budgeting. Management should address concerns regarding job security and the perceived additional workload. It’s essential to paint a picture not just of cost savings but of opportunities for professional growth, as employees can play a more active role in shaping their department’s financial strategies.

Once the psychological barriers to change are overcome, the technical aspects of zero-based budgeting explained for beginners become the focus. Training sessions and workshops can gradually ease employees into this new paradigm. By doing so, companies not only improve their financial health but also cultivate a culture of continuous improvement and agility.

Aligning Strategic Goals with Financial Plans

The shift to zero-based budgeting necessitates aligning strategic goals with financial plans. For beginners, this might seem like deciphering an ancient script, yet it is far from insurmountable. By framing each budget item as a contributor to larger organizational goals, ZBB brings clarity to how resources are distributed and utilized.

A well-implemented ZBB strategy enhances internal communication as each department outlines its justification for funding. This cross-departmental dialogue ensures that everyone is on the same page and working towards common objectives. It fosters a collaborative atmosphere where innovation can thrive, given that resources are allocated to initiatives with the highest potential for impact.

—

To help set the stage for your zero-based budgeting journey, consider the following actions:

Structuring Zero-Based Budgeting for Beginners

Implementing zero-based budgeting explained for beginners isn’t a one-size-fits-all solution—it requires a tailored approach depending on the organization’s size and complexity. An organization’s success with ZBB begins with robust planning, clear communication, and a commitment to ongoing assessment.

Initially, organizations should reassess their budgeting processes, setting up a dedicated ZBB project team to oversee the transition. This team should include individuals from key departments to ensure diverse insights and perspectives. The next step is to define a clear roadmap, outlining timelines, objectives, and responsibilities. Here, the emphasis should be on collaboration, with regular meetings to address challenges and share insights.

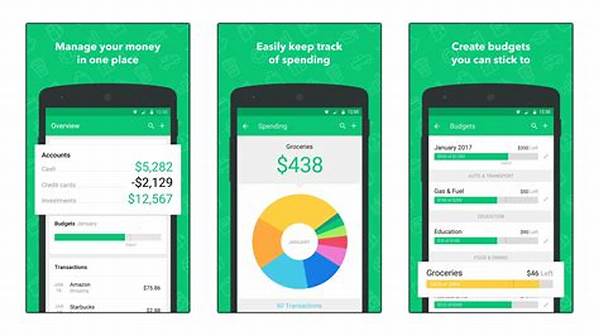

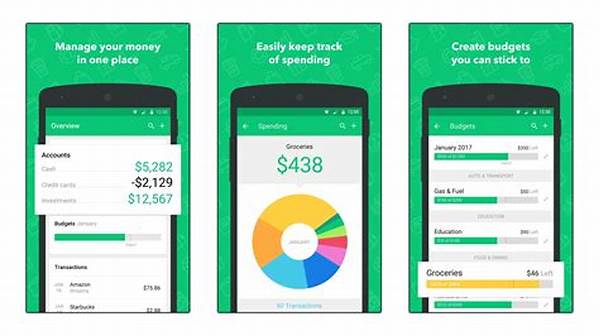

Furthermore, leveraging technology can play a crucial role in the effectiveness of zero-based budgeting explained for beginners. Budgeting software and analytics tools offer powerful features to ease the ZBB process, transforming what could be an overwhelming task into a manageable one. By embracing technology, organizations can keep track of their budgets more efficiently, ensuring that resources are allocated for maximum impact.

Adapting Zero-Based Budgeting in Organizations

As organizations adapt to zero-based budgeting explained for beginners, they should focus on continuous improvement and the strategic alignment of their budgeting practices. This implies a culture shift from mere cost-cutting to strategic spending, ensuring that funds are allocated to those areas that promise the highest returns.

To foster this environment, leadership must emphasize the narrative of opportunity over change. Management should encourage experimentation, where departments can present innovative ideas and receive funding based on the value they add to the organization. This encourages employees to think critically about their budgetary decisions, fostering a culture of accountability and creativity.

By aligning their strategic vision with financial reality, organizations can embrace zero-based budgeting as a cornerstone of their financial strategy. The journey may be challenging, but the rewards—enhanced focus, strategic clarity, and improved financial health—make it a pursuit worth undertaking.

—

To visualize the concept of zero-based budgeting explained for beginners, consider the following scenarios:

Descriptive Illustration of Zero-Based Budgeting Benefits

In a world teeming with businesses vying for space and visibility, adopting zero-based budgeting explained for beginners can set you apart. Imagine a tech startup bursting with potential yet hamstrung by limited initial funds. By adopting ZBB, they identify unnecessary expenditures and redirect funds towards research and product development, placing themselves firmly on the path to innovation and growth.

In the non-profit sector, where every dollar counts, ZBB acts as a beacon of hope. Organizations can methodically assess every expenditure, channeling funds towards programs with the highest potential for impact. This disciplined approach not only boosts morale but also fosters trust among donors, who see their contributions being utilized effectively.

Healthcare organisations, known for their complex budgeting needs, can also significantly benefit from zero-based budgeting. By optimizing resources through ZBB, hospitals can cut down on excessive administrative costs. The funds saved can be redirected towards improving patient care services, leading to better health outcomes and increased patient satisfaction.

Ultimately, the concept of zero-based budgeting explained for beginners is not just a budgeting reform but a strategic overhaul. In education, universities can assess various departments and determine which areas are yielding the highest academic success. By aligning expenditures with institutional goals, they can invest more in research, innovation, and student experience.

In the retail world, companies often find themselves weighed down by legacy costs tied to maintaining physical stores. By using ZBB, retailers can critically assess and reduce these costs, shifting resources towards improving their digital presence and delivering a seamless omnichannel customer experience.

Detailed Breakdown of Zero-Based Budgeting

Perfecting a zero-based budget involves the art of negotiation and the science of data analytics. For those new to this, visualize yourself at the starting line of a race. You know the finish line, but the path is new each time. This demands agility and a keen sense of direction, both of which ZBB provides in abundance.

Implementing zero-based budgeting explained for beginners begins with data. The process requires gathering historical data, market trends, and strategic goals—all before starting any financial allocation. It’s like setting out ingredients before cooking, ensuring each component is critical to the meal’s success.

Stakeholder engagement becomes a crucial part of the process. Each department head needs to articulate their mission, highlight achievements, and justify future financing needs. In short, they become advocates for their domains, developing resilience and an eye for value-enhancing opportunities. Imagine a melting pot of ideas being discussed, evaluated, and acted upon—this is the essence of ZBB.

Ultimately, while the path to mastering zero-based budgeting might be fraught with initial challenges, the end result is strategic alignment. Organizations not only gain financial clarity but encourage employees to be strategic thinkers, aligning their daily operations with long-term goals. Indeed, zero-based budgeting explained for beginners is not merely a financial tool—it’s a strategic catalyst reshaping the future of financial planning.