Bubble Crypto

In recent years, the term “bubble crypto” has become increasingly popular, frequently appearing in financial news and discussions among investors. Cryptocurrency, a digital or virtual form of currency that uses cryptography for security, has captured the imagination and wallets of people across the globe. Bitcoin, Ethereum, and numerous altcoins have seen unprecedented growth and adoption, leading many to wonder if this phenomenon is a sustainable financial revolution or merely a speculative bubble waiting to burst. The allure of getting rich quickly, coupled with the decentralized nature of cryptocurrencies, has drawn in millions. However, with every bull run, skeptics raise concerns about the potential for a bubble burst that could leave late investors in significant financial trouble. Whether you view cryptocurrencies as the future of finance or a precarious gamble, it’s crucial to approach this fascinating market with both curiosity and caution.

Read More : Why Diversification Is Key In Crypto Portfolios

From young, tech-savvy enthusiasts to seasoned Wall Street veterans, the world of crypto offers a unique intersection of technology and finance that is hard to ignore. The underlying blockchain technology promises to revolutionize industries, while the digital currencies themselves challenge the very notion of centralized banking systems. Despite the enthusiasm, the bubble crypto scenario poses serious questions about valuation and market maturity. Are we witnessing the dawn of a new monetary era, or is this just an overblown market trend that will leave many in disillusionment? Understanding the dynamics of this market is essential for any potential investor or tech aficionado.

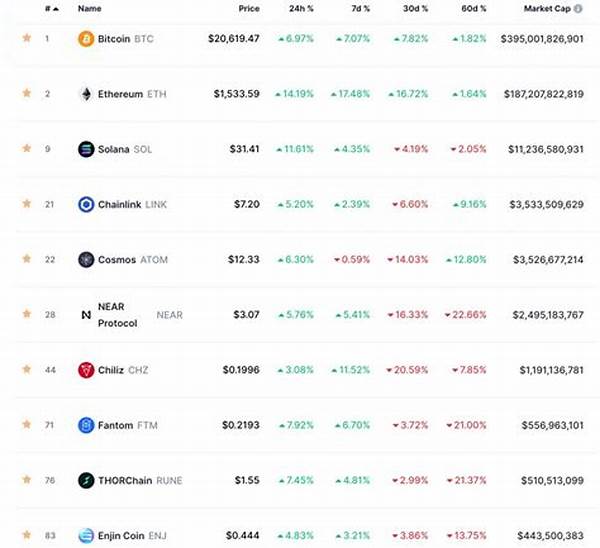

Navigating the crypto market can be like deciphering an enigmatic code. Every rise and fall in crypto prices adds fuel to the debate. Supporters cite technological potential, privacy benefits, and the democratization of wealth, while critics caution against market manipulation, regulatory crackdowns, and the infamous bubble crypto phenomenon. The market’s volatility can be both a blessing and a curse, providing incredible opportunities for profits while also posing severe risks. As the world continues to watch bitcoin surges and sudden crashes, the story of cryptocurrencies is both exhilarating and nerve-wracking. Yet, understanding the market, remaining informed, and approaching investments with a grounded strategy can help you make sense of this unpredictable and ever-evolving space.

The Future of Crypto Markets

The crypto landscape, though still in its infancy, continues to mature as both individuals and institutions explore this new frontier. With potential regulatory frameworks on the horizon, more stable investment avenues may become available. The bubble crypto narrative may play out differently in the future as markets stabilize, blockchain technology advances, and digital currencies become a normalized component of global financial systems.

—

Navigating the Bubble: The Current Crypto Conversation

The term “bubble crypto” is not just a catchy headline—it’s a critical concept that encapsulates the inherent risks and explosive growth of the cryptocurrency market. Over the past decade, cryptocurrencies have shown both volatile price swings and innovative breakthroughs, sparking a conversation about their future. The market’s unpredictability, combined with the rapid dissemination of blockchain technology, ensures that crypto-related discussions remain crucial in both financial and technological spheres.

Diving deeper, the discussion around bubble crypto isn’t purely speculative; it involves looking at tangible indicators and past performance. Historically, markets that exhibit rapid price increases followed by equally steep declines often face the “bubble” label. That’s precisely what’s been observed in several crypto cycles, with prices soaring due to speculative buying and plummeting when fears of overvaluation become mainstream. High-profile cases, such as Bitcoin reaching unprecedented highs and then tumbling, serve as vivid reminders of the volatility inherent in these digital assets.

Riding the Crypto Wave: Opportunities and Perils

The ride of cryptocurrencies has been akin to a rollercoaster, with euphoric highs and despairing lows. While the potential for high returns is undeniably attractive, it’s critical to acknowledge the risks. Many investors have entered the market driven by ‘FOMO’—the fear of missing out—only to endure the harsh realities of a bubble crypto scenario when the market corrects itself. However, amidst this volatile backdrop, lucrative opportunities do exist for those who are well-informed and ready to manage their risks wisely.

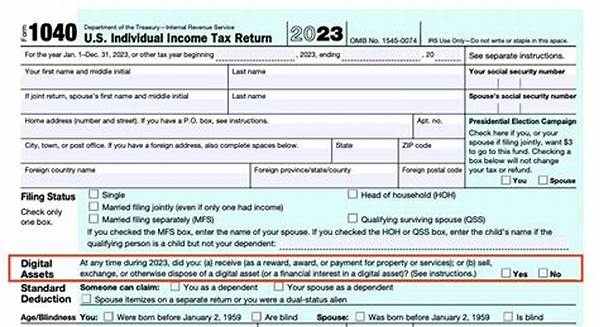

In a world where digital assets can surge or crash with a single tweet or regulatory announcement, understanding the market’s psychological intricacies becomes imperative. Investors engaging in the crypto space must equip themselves with robust knowledge, stay updated on market trends, and maintain a diversified portfolio. Tools that offer real-time analytics and market sentiment tracking can significantly aid in making informed investment decisions and mitigating the supercharged risks associated with potential market bubbles.

Lessons from Past Market Bubbles

The story of financial bubbles is as old as markets themselves. The tales of Tulip Mania or the Dot-Com bubble provide invaluable lessons for modern-day crypto investors. Recognizing patterns, understanding market psychology, and implementing sound investment principles can offer a defense against the inevitable market corrections. The lesson here is not to shy away from innovation but to embrace it with the wisdom of past experiences. The key lies in discernment—separating hype from genuine opportunity and recognizing when a trend becomes unsustainable.

The bubble crypto discourse presents a fascinating subject of study and vigilance. It’s a world where innovation meets speculation, and fortunes are won and lost, sometimes overnight. Whether you’re an investor or an observer, understanding the nuances of this dynamic landscape can prepare you for what lies ahead in the financial universe of cryptocurrencies.

Top 8 Topics Related to Bubble Crypto

The Evolving Story of Crypto Markets

The narrative surrounding cryptocurrencies has been a captivating saga of innovation, disruption, and speculation. From Bitcoin’s mysterious inception by an anonymous creator to its evolution as a household name, the story unfolds with the drama worthy of a blockbuster. Whether seen through the eyes of a financial analyst or a technological enthusiast, the crypto tale is layered with intrigue. However, this saga is far from over. The prospect of a bubble crypto event, while alarming to some, adds an element of suspense that keeps audiences engaged and markets vigilant.

Cryptocurrency, in its essence, offers the promise of a revolutionized financial system liberated from the constraints of central banks and traditional financial institutions. Yet, the inherent uncertainties surrounding the sector contribute to a broader conversation about the potential and risks of speculative markets. Each twist in this ongoing narrative challenges investors and policy-makers alike to rethink strategies, question preconceived notions, and brace for future developments. The blend of technological advancement and financial speculation makes the crypto story one of the most riveting to watch unfold in today’s rapidly changing economic landscape.

Bubble Crypto: Perceptions and Realities

In analyzing the bubble crypto, one must consider both the subjective emotions it stirs and the objective data it presents. This balance between perception and reality defines its impact on investors and markets. Where one sees extravagance and unsustainable growth, another sees a chance for pioneering change. The gap between these perspectives forms the crux of the crypto debate, demanding a comprehensive analysis to navigate what could potentially be either the breakthrough of the century or an impending financial catastrophe.

While mainstream media often highlights price volatility and bubble possibilities, the true innovation behind blockchain technology and its applications has much to offer. Beyond the financial market, blockchain’s potential to reshape everything from supply chains to healthcare systems cannot be understated. Yet, the line between speculative investment and genuine breakthroughs remains thin, and crossing it requires careful consideration and strategic insight. Hence, understanding the bubble crypto phenomenon involves not only examining market patterns but also exploring the structural shifts it may herald for future economies.