Crypto

Crypto

Read More : Exchange Crypto

Cryptocurrency, often referred to simply as “crypto,” has been one of the most transformative financial technologies of the 21st century, offering a new paradigm of decentralized finance. Unlike traditional currencies issued by governments, cryptocurrencies are digital and decentralized, relying on blockchain technology to ensure security and transparency. This technology enables the creation, transfer, and verification of digital currencies, fundamentally changing the way people perceive money, investment, and the global economy. Once considered a niche interest, crypto has evolved into a global phenomenon, captivating individuals of all backgrounds and prompting businesses and governments to adapt to an ever-changing financial landscape.

There is a tantalizing allure to crypto, driven by stories of immense wealth accrued overnight and the potential for new financial freedoms. However, what makes crypto truly fascinating is more than just its profit potential. It’s the promise of a fairer financial system, where peer-to-peer transactions diminish the need for intermediaries and empower individuals. Cryptocurrency offers unique advantages, such as lower transaction fees, increased privacy, and financial inclusion, especially in regions with limited access to traditional banking services. These benefits have spurred a growing interest and adoption across the globe.

Yet, the world of crypto is not without its challenges. Its volatile nature, regulatory ambiguities, and potential for misuse highlight the complexities of this digital frontier. As the realm of crypto continues to expand, it demands vigilance, understanding, and innovation from its participants. For investors, enthusiasts, and skeptics alike, the key is to stay informed and adaptable in this dynamic environment.

The Future of Crypto: Opportunities and Challenges

As we look to the future, crypto holds immense potential to revolutionize industries beyond finance. From supply chain management to voting systems, blockchain technology—crypto’s backbone—offers novel solutions to age-old problems. However, as with any pioneering technology, balancing innovation with regulation is crucial to ensuring crypto’s sustainability and mainstream adoption.

—An Introduction to Crypto

In the ever-evolving digital landscape, the term “crypto” has emerged as both a buzzword and a beacon of technological innovation. Originating from the Greek word “kruptós,” meaning hidden or secret, crypto now denotes a world of digital currencies that promises privacy, security, and autonomy from traditional financial systems. With the advent of Bitcoin in 2009, the first decentralized cryptocurrency, a new era of financial technology was born, sparking a tech revolution.

The primary allure of crypto lies in its decentralized nature. Unlike traditional currencies governed by central banks, cryptocurrencies rely on complex algorithms and consensus mechanisms rather than a centralized authority. This decentralized architecture confers several benefits: security from tampering, protection from inflationary policies, and empowerment of individuals in managing their own wealth. Crypto truly turns the established norms of finance on their heads.

Simultaneously, the rise of crypto has unveiled both opportunities and challenges. As more companies and individuals embrace digital currencies, the demand for expertise in this field has surged. Despite its alluring promise, the volatility and complexity inherent in crypto pose significant risks, often deterring conservative investors. However, enthusiasts argue that with great risk comes great reward, making crypto an enticing venture for the innovative and the daring.

Crypto in Daily Life

What’s more, the impact of crypto extends far beyond the confines of financial markets. Cryptocurrencies are increasingly infiltrating everyday transactions, allowing people to buy everything from a cup of coffee to real estate using digital assets. Companies that acknowledge and adapt to this shift in consumer preference stand to gain a competitive edge. Yet, the road to widespread adoption is paved with hurdles, including regulatory challenges and technological barriers.

Despite these obstacles, the momentum behind crypto continues to grow. As governments and policymakers navigate the implications of digital currencies, the dialogue around regulation is gaining traction. Effective governance will be key in unlocking the full potential of crypto while ensuring that vulnerabilities such as fraud and digital theft are addressed. A balanced approach to regulation could pave the way for crypto to become an integral part of the global economic fabric.

Understanding Crypto: A Fresh Perspective

The dialogue on crypto is evolving, driven by breakthroughs in technology and changing societal attitudes toward finance. Beyond speculative trading, crypto is increasingly being recognized for its potential to drive positive change in communities worldwide. By providing access to financial services to those unbanked, promoting transparency, and powering innovation through blockchain, crypto is reshaping how we perceive and interact with value.

—10 Topics Related to Crypto

The Dynamic Nature of Crypto

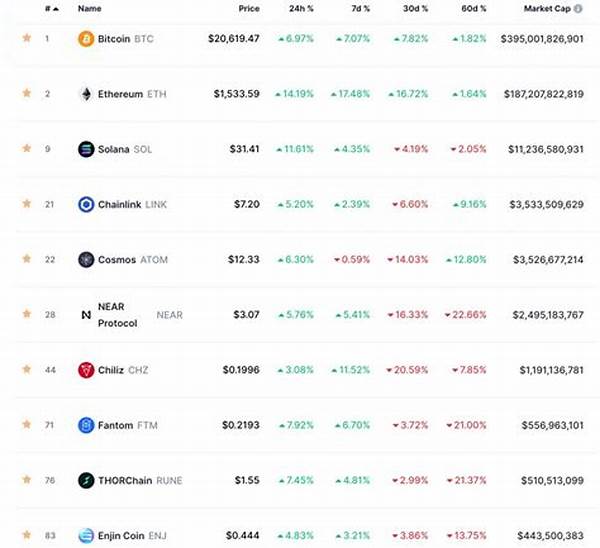

Cryptocurrencies represent a dynamic and revolutionary realm in the financial world. With each passing year, the crypto space evolves, introducing innovative financial models, unique digital assets, and groundbreaking blockchain applications. This rapid evolution propels crypto from the sidelines of the financial mainstream into the foreground, challenging existing conventions and compelling stakeholders to reassess traditional financial paradigms.

The enthusiasm surrounding crypto is palpable, engendering a sense of urgency in investors eager to tap into new opportunities before the masses. Beyond mere speculation, enthusiasts cite the transformative potential of blockchain to drive democratization, transparency, and efficiency throughout the economy. Enthusiasts and skeptics alike navigate a tangled web of technological jargon, volatile value fluctuations, and evolving regulations in pursuit of wealth and innovation.

Amidst the fervor lies a stark reality: the volatility and risk inherent in crypto investing can lead to significant financial swings. Yet, the promise of high returns entices many to delve into this world, driven by the belief that the future of finance is, indeed, decentralized. Embracing this technology requires diligent research, risk assessment, and a dynamic mindset willing to accept both the highs and the lows of the crypto rollercoaster.

Decentralized Finance: The New Frontier

As the conventional banking system encounters increasing scrutiny, decentralized finance, or DeFi, emerges as a beacon of alternative solutions, reshaping the financial landscape through smart contracts and decentralized applications. Embracing the decentralized ethos of crypto, DeFi platforms offer financial services such as lending, borrowing, and trading without intermediaries, democratizing access and reshaping the future of finance.

—Understanding the Implications of Crypto

Cryptocurrencies are more than just digital alternatives to cash—they represent a whole new financial ecosystem that challenges conventional notions of money, banking, and economic sovereignty. With cryptocurrencies, individuals can conduct peer-to-peer transactions locally and globally, ensuring seamless and instantaneous cross-border transfers without third-party interventions. This innovation alters the dynamics of international trade, remittances, and even charitable donations.

The widespread adoption of crypto is gaining traction as more institutions recognize its potential to streamline operations, cut costs, and offer customers enhanced privacy. Leading companies embrace crypto payments, furthering legitimacy and providing a model for other businesses. Yet, despite these advancements, the volatility of crypto values remains a significant concern for would-be adopters. Fluctuating valuations can impact profitability, requiring businesses to devise strategic approaches to manage digital assets effectively.

The Role of Blockchain in Crypto

While the concept of cryptocurrency garners much attention, the underlying blockchain technology drives the engine of digital currencies. Every transaction is recorded on a distributed digital ledger, ensuring transparency, accountability, and security in a trustless environment. Blockchain has the potential to disrupt industries beyond finance, such as healthcare, logistics, and governance, tracking assets and proving authenticity with unparalleled accuracy.

To fully grasp the potential impacts of crypto, one must consider blockchain’s versatile applications that extend beyond currency. This requires not only a conceptual understanding but also the active involvement of developers, regulators, and businesses to collaboratively create frameworks that accommodate innovation and safeguard against misuse. Harnessing blockchain’s power paves the way for a future where information and value are more accessible than ever.

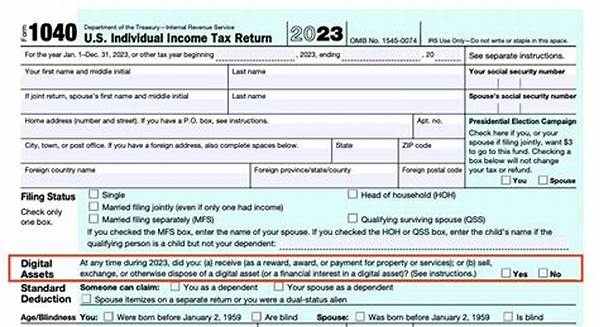

Regulation and the Future of Crypto

The path to mainstream crypto adoption necessitates addressing legal and regulatory challenges that arise from its decentralized nature. Globally, nations grapple with creating regulatory frameworks that ensure investors’ protection while fostering innovation. Effective regulation could unlock crypto’s full potential, ensuring fair use and protection against fraud while respecting individual privacy rights. The challenge lies in finding balance without imposing undue restrictions on human ingenuity or stifling economic potential.

—5 Illustrations Related to Crypto

Crypto and the Modern Economy

Cryptocurrencies and their underlying technologies have already begun reshaping sectors far beyond finance. Industries like supply chain management leverage blockchain’s transparency to track goods, ensuring quality and compliance. Similarly, healthcare sectors explore blockchain solutions to maintain medical records, protect patient privacy, and enhance interoperability between systems.

This integration speaks to the transformative potential of cryptocurrencies and blockchain technologies. Still, the vision of a crypto-centric future includes challenges that require nuanced approaches and collaborations across sectors. As regulatory frameworks evolve and technology matures, meaningful dialogue must occur between innovators, regulatory bodies, and consumers to fully realize this potential.

Cryptocurrency is not a passing fad but a revolutionary force fundamentally transforming how people conduct transactions, secure data, and access opportunities. It invites us to reconsider entrenched conventions about wealth distribution and control. In the coming years, crypto’s trajectory will be shaped by those willing to embrace change and foster an ecosystem that values innovation, transparency, and shared prosperity. As with any seismic shift, challenges and uncertainties abound, but so do unprecedented opportunities for growth and development.

—In-Depth Discussion on Crypto

Cryptocurrencies, often regarded as the digital gold of the modern world, have evolved into multifaceted instruments offering unprecedented opportunities for investment and innovation. Cryptocurrencies facilitate peer-to-peer transactions securely and transparently, impacting finance and extending their reach across various sectors. Although the promise of crypto is expansive, its complexity necessitates informed engagement and understanding of its nuances.

The crypto ecosystem offers an alternative viewpoint on wealth and financial interactions. Detractors argue that its volatility undermines cryptocurrencies’ viability, raising concerns about speculative bubbles and potential losses. Enthusiasts counter that volatility is a natural phase in any nascent market with transformative potential, akin to early internet days. By extending financial inclusion and reshaping monetary policy dynamics, crypto holds the promise of empowering individuals worldwide.

Crypto’s Impact on Society

As businesses and users leverage cryptocurrencies, the profound societal implications become increasingly evident. Crypto offers financial services to those traditionally underserved by banks, granting unprecedented access and freedom. However, the anonymity afforded by certain cryptocurrencies raises ethical concerns surrounding illegal activities including money laundering and fraud, necessitating vigilant regulatory oversight.

The Significance of Crypto Regulations

Regulatory frameworks are crucial in balancing opportunity and risk in the crypto realm. Responsible regulation may safeguard consumer interests, promote legitimate use of crypto, and foster an environment conducive to innovation. However, a misstep in regulatory approaches may hinder growth and push activity into unregulated areas with heightened risks. Insights into successful regulations can be gleaned by examining global precedents and adapting lessons learned to local contexts.

Technological Advancements and Crypto

The continuous technological advancement presents boundless opportunities for the crypto industry. Enhancements in blockchain infrastructure, scalability solutions, and smart contract capabilities fuel creativity and utility. As the sector matures, collaboration between stakeholders will be essential in designing agile architectures and developing novel applications that address real-world challenges.

The future of crypto resides not just in financial markets but across myriad spheres including supply chain management, healthcare, and energy. Addressing inherent challenges and leveraging blockchain’s potential could revolutionize industries, driving efficiency, transparency, and sustainability.

The Path Forward for Crypto

In conclusion, the transformative potential of crypto is accompanied by considerations that warrant attention. As individuals and businesses voluntarily integrate crypto into their operational frameworks, they must navigate challenges uniquely associated with this digital frontier. Ultimately, the success of crypto depends on fostering an ecosystem that values thoughtful adaptability and genuine collaboration across sectors.

—

These articles richly explore the multifaceted nature of crypto, challenging perceptions and provoking curiosity about its potential to redefine financial boundaries. They invite readers to engage with an evolving narrative that extends beyond merely chasing digital gold and towards understanding crypto’s nuanced role in the future.