Crypto Bubble

The Crypto Bubble: Navigating the Financial Frenzy

It’s a late Tuesday night, and as I scroll through my social media feed, I see a whirlwind of familiar terms: Bitcoin, Ethereum, blockchain, and, most notably, the dreaded “crypto bubble.” You can’t help but wonder if this digital currency craze is the new gold rush or a ticking time bomb waiting to burst. Welcome to the world of cryptocurrency, where fortunes are made and lost overnight, and where everyone wants to tell their story of striking virtual gold or experiencing digital despair.

Read More : Crypto Halal Atau Haram

The crypto bubble is a term that stirs emotions and debates alike. With tales of lavish lifestyles funded by market gains circulating around the globe, one might think everyone should get in on the action. Who doesn’t want a piece of that action, or rather, a bite of that Bitcoin? Yet, looming in the background is the constant question: is this sustainable, or are we all tiptoeing around a bubble waiting to burst?

For those of us peering curiously into the world of digital currency, stories abound. A college student with a few hundred dollars’ worth of Ethereum now allegedly living the high life, or the neighbor next door who invested in Dogecoin to wake up to riches one fine morning. These narratives illustrate the allure and danger of the crypto bubble—a phenomenon marked by rapid growth, mass enthusiasm, and the slight tinge of uncertainty regarding its future.

Understanding the Crypto Bubble

The crypto bubble represents a significant phase in modern finance, characterized by both remarkable opportunity and considerable risk. Like the Internet boom of the late 1990s, this bubble has attracted myriad investors, some guided by comprehensive research, others merely following the hype. Yet, beneath the glossy exterior lie stories of dramatic rises and falls, of fortunes created and obliterated in click of a button, making it crucial for potential investors to navigate with insight and caution.

—

An In-Depth Examination of the Crypto Bubble

Origins and Growth of the Crypto Bubble

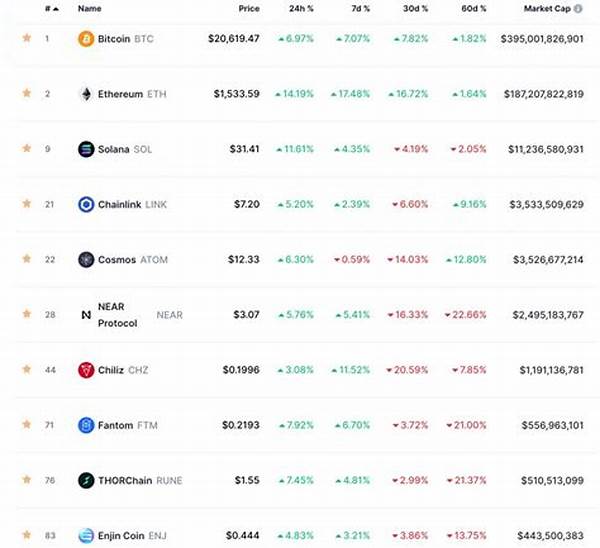

Cryptocurrency’s advent shifted the financial paradigm, promising decentralization and autonomy from traditional banks. Bitcoin, the grandfather of digital coins, paved the way in 2009, luring early adopters with dreams of a revolutionized currency. As the fervor intensified, the market exploded. The concept of blockchain, the ledger technology behind these digital coins, fueled the narrative of a transparent, secure financial future.

Bitcoin’s meteoric rise set a precedent, inviting throngs of investors eager to stake their claim in a financial phenomenon. Overnight, stories of crypto millionaires emerged, each tale more outrageous than the last. But behind the glitz, the volatility was unmistakable. Like a rollercoaster with no seatbelts, the crypto bubble’s dramatic swings rattled even the most seasoned of investors.

Challenges and Criticisms

As the crypto bubble continues to expand, critiques abound. Regulatory concerns hover ominously, with governments perplexed on how to manage a currency that defies control. Each announcement of potential regulation results in market turbulence, and the threat of governmental intervention looms like a storm cloud over the market’s sunny days.

Moreover, environmentalists express concern over the astronomical energy consumption associated with crypto mining. The blockchain’s promise of immersion in a digital age appears somewhat paradoxical, as critics argue that the climate cost may outweigh the benefits. Add to this an intense debate over the fundamental purpose of cryptocurrency—medium of exchange or speculative asset?—and you have an investment landscape rich with uncertainty.

Future Prospects: Boom or Bust?

The future of the crypto bubble remains uncertain. Proponents argue that cryptocurrency will be the bedrock of financial systems worldwide, citing its potential for inclusivity and innovation. Meanwhile, skeptics caution against investing money you can’t lose, warning that bubbles inevitably burst.

Is there room for optimism, or should one heed the cautionary tales? Time will tell, but no matter which side of the debate you fall on, there’s no denying the influence and intrigue of cryptocurrencies. As ever-shifting as the technologies they’re built on, they demand an investor’s discerning eye, and perhaps a touch of courage.

The Human Element: Stories from the Frontline

Amidst the statistical analyses and rampant discussions lies an essential component—the human element. What draws individuals to the world of cryptocurrencies, into a sphere filled with both potential and peril? Interviews with investors reveal diverse motivations; some driven by a distrust in conventional banks, others captivated by the thrill of high-stake investments.

An anonymous interviewee, dabbling in Ethereum, shared, “It’s not just about money. It’s about being part of something innovative, even if that innovation comes with its own risks.” Such testimonials shine a light on the crypto bubble’s dual nature—a chance to participate in revolutionary finance, but not without its share of challenges.

—

Key Takeaways on the Crypto Bubble

—

The Crypto Bubble: A Discussion

As cryptocurrency continues to captivate investors globally, the term “crypto bubble” has become a fixture in financial thought. But, what exactly characterizes a bubble, and how should investors respond? The discourse surrounding this topic is varied and often heated, as the potential for greatness clashes head-on with the risk of catastrophic loss.

Proponents maintain that the crypto bubble is a natural result of groundbreaking innovation. They argue that like the dot-com bubble, volatility is a byproduct of burgeoning technologies pushing boundaries. Drawing parallels to the advent of the internet, supporters believe cryptocurrency possesses the transformative power to reshape financial landscapes. Much like early internet skeptics, they regard detractors as cautious to a fault, unwilling to see past short-term turbulence to grasp long-term potential.

Conversely, critics point to classic hallmark signs of a bubble: feverish speculation overshadowing intrinsic value, rapid price increases, and investor overexuberance. They warn that prices inflated by exuberant speculation tend to culminate in sharp corrections. Influences from regulatory actions, market panic, or investor sentiment shifts could instigate a market pullback with profound ramifications for crypto enthusiasts.

Ultimately, the future trajectory of the crypto bubble hinges on where you stand in the debate. As the conversation continues to unfold between innovation advocates and skeptical analysts, it serves a reminder of the complexities and risks inherent in revolutionary markets. Individuals can only hope to stay informed, weigh risk versus reward, and approach the crypto arena with eyes wide open.

—

Understanding the Complexities of the Crypto Bubble

The Beginnings of the Crypto Bubble

The journey of cryptocurrency began with Bitcoin’s birth—designed to revolutionize monetary transactions through cryptographic security and decentralization. Early adopters, lured by promises of financial autonomy, set the stage for explosive market growth. Bitcoin’s unprecedented surge invited a multitude of digital currencies, each vying for distinction in an increasingly competitive landscape.

The Consequences of Hype and Overvaluation

The euphoria surrounding cryptocurrencies intensified, fueled largely by media hype and speculative trading. An unfortunate byproduct of this fervor was the emergence of overvaluation within the crypto market, as opportunistic investors jumped into the fray, often with little understanding of underlying technologies. Such behavior contributed to the inflation of the crypto bubble, marking a familiar pattern reminiscent of past market manias.

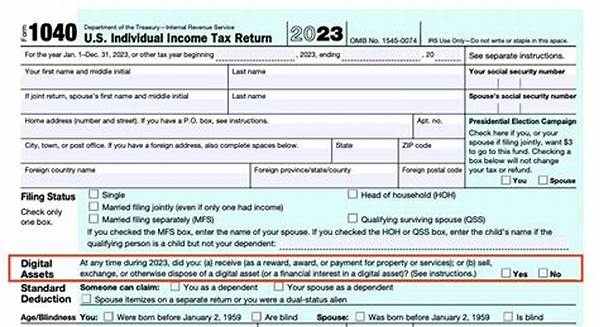

Regulatory Implications and the Crypto Bubble

As governments around the world grapple with cryptocurrency’s implications for regulation, the ramifications for the crypto bubble are manifold. Striking a balance between fostering innovation and safeguarding consumer interests proves complex, with potential regulations often sparking volatility within the market. These shifts further complicate the bubble’s trajectory, prompting investors to closely monitor policy developments.

Consumer Perceptions of Cryptocurrencies

Investors remain polarized on cryptocurrencies’ ultimate role—safe haven assets, speculative investments, or something entirely different. This discord underscores the challenges traditional investors face when integrating cryptocurrencies into established portfolios. As conventional institutions cautiously explore crypto integration, consumer perceptions are pivotal in shaping the market’s evolution and stability.

Global Effects of Cryptocurrency Adoption

Cryptocurrencies’ global proliferation has profound consequences beyond financial borders. From fostering economic inclusion to impacting geopolitical dynamics, digital currencies unveil fascinating prospects for global integration. Yet as adoption rates fluctuate, the sustained relevance of the crypto bubble remains a topic of ongoing investigation, leaving investors eagerly pondering potential pathways forward.

The Future Path of the Crypto Bubble

As cryptocurrency gains traction on the global stage, the fate of the crypto bubble continues to pique collective interest. The innovation-driven landscape holds vast potential for growth, but not without acknowledging inherent risks. Investors weighing crypto ventures would do well to adopt discerning approaches, recognizing that savvy engagement may minimize exposure to volatility’s whims.

—

Crypto Bubble: Insights and Reflections

—

The Crypto Bubble: A Brief Exploration

The swift ascension of cryptocurrency has induced a whirlwind of speculation, leading many to utter the term “crypto bubble.” As investors dive into digital currencies, prospects brim with both impressive gains and precipitous declines. Behind the financial jargon lies a kaleidoscope of human experiences—stories of vast wealth accumulation, but also tales of significant losses.

Cryptocurrencies’ allure cannot be denied, drawing in novice and experienced investors. The intrigue of decentralization and potential disruption captivates many, reinforcing cryptocurrency’s undeniable grip on the financial imagination. Yet, while crypto enthusiasts embrace innovation, critics caution against unsustainable surges driven by speculative behavior. Reports of regulatory clampdowns amplify investors’ fears, suggesting bubbles’ tendency toward tumultuous tension.

Contemplating cryptocurrency’s future ultimately involves examining both explosive growth prospects and unpredictable pitfalls. Prospective investors ought to remain vigilant, dissecting complex market forces and industry shifts with utmost care. The crypto bubble’s ever-evolving narrative reminds us to approach speculative adventures with realistic expectations and discerning insight. As the financial landscape continues to transform, the crypto realm invites those daring enough to navigate its intricate maze.