Crypto Market Cap

I’m here to help you craft a single article or a section of an article at a time. Let’s start with the first part of your request:

Read More : New Research Alert: This Popular Crypto Wallet Is Facing Major Security Vulnerabilities!

—

In the ever-evolving world of digital finance, one term that consistently pops up is “crypto market cap.” This fundamental metric, short for “cryptocurrency market capitalization,” serves as a vital tool for investors, enthusiasts, and analysts alike to gauge the scale, health, and influence of the cryptocurrency space. But what exactly does crypto market cap mean, and why should you care about it? Let’s dive in.

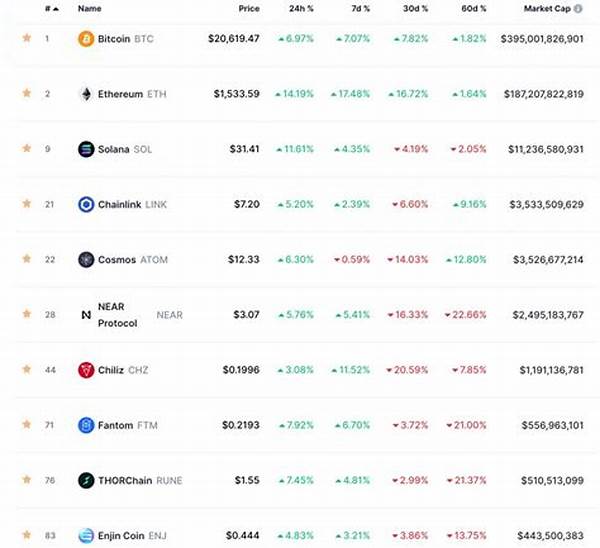

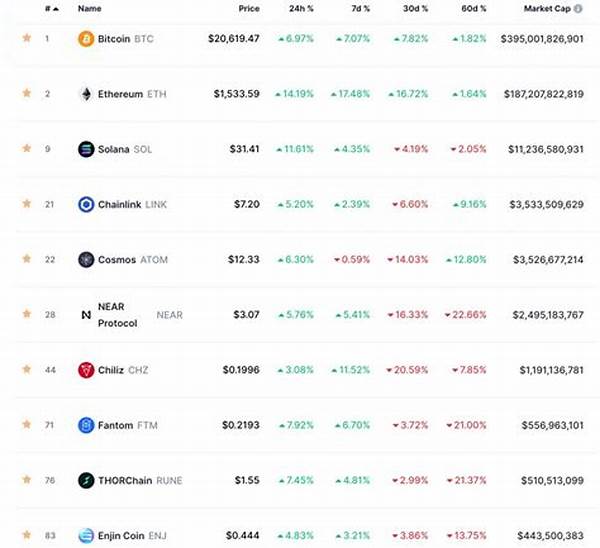

Essentially, crypto market cap is the total market value of a cryptocurrency, calculated by multiplying the current price by its circulating supply. Think of it as a snapshot of a crypto asset’s value at any given time. For those new to the crypto world, understanding this concept can feel like deciphering a complex puzzle, but fear not! By grasping its principles, you can navigate the exciting pathways of digital investments with confidence.

Crypto market cap is akin to a barometer of popularity and worth within the crypto universe. Like a spotlight, it shines a light on dominant players such as Bitcoin and Ethereum, highlighting their colossal influence. But it’s not just about the big names; the market cap also opens the floor to promising underdogs, offering insights into emerging projects that could one day redefine the digital landscape. Whether you’re a seasoned trader or a curious newcomer, keeping an eye on the market cap helps in making informed decisions, spotting trends, and crafting a strategic investment portfolio.

In comparing cryptocurrencies, market cap serves a role similar to stock market valuation. It helps in categorizing cryptos into large-cap, mid-cap, and small-cap, each with its unique risk-reward profile. Large-cap cryptocurrencies generally present less volatility, providing a sense of stability in an otherwise tumultuous market. Meanwhile, small-cap assets, while riskier, offer the tantalizing allure of significant growth. Thus, crypto market cap does not just quantify—it narrates the dynamic tales of digital currencies, painting a landscape full of opportunities and challenges.

Why Crypto Market Cap Matters

The relevance of the crypto market cap extends beyond mere numbers. It’s an analytical tool that provides insights into the market’s movements. By understanding fluctuations in market cap, you can predict potential growth spurts and downturns. Imagine it’s like weather forecasts for investors, offering clues to sunny skies or impending storms. Being well-versed in this metric enables investors to optimize their strategies—buying the dip, riding the wave, or holding onto assets during erratic phases.

Moreover, crypto market cap plays a pivotal role in the global financial narrative. It represents a movement, a digital revolution that challenges traditional finance structures. As cryptocurrencies gain mainstream acceptance, market cap emerges as a metric of legitimacy and validation. It’s a testament to the cryptocurrency market’s evolution from a rogue digital frontier to a recognized investment avenue, shaping the future of global commerce and economics.

—

This is your first section. Let me know which specific next part you’d like to work on, or feel free to provide more context or focus for the rest of your request!