How To Check Your Credit Score For Free

- How to Check Your Credit Score for Free

- The Benefits of Knowing How to Check Your Credit Score for Free

- Description: The Best Steps for Monitoring Your Credit Score for Free

- Harnessing The Power of Your Free Credit Report

- Getting the Most Out of Your Free Credit Report

- How to Check Your Credit Score for Free: Tips

- Discussion: The Importance of Regularly Monitoring Your Credit Score

- Exploring Free Credit Score Monitoring Services

- How to Check Your Credit Score for Free: Free Services Insight

- How Free Credit Scores Benefit You

- Illustrations: Ways to Check Your Credit Score for Free

How to Check Your Credit Score for Free

In today’s modern world, your credit score has become an essential aspect of financial management. Whether you’re looking to buy a home, lease a car, or even apply for a new credit card, understanding what your credit score is and how it impacts your financial life is critical. But here’s the catch—keeping tabs on your credit score can often come with a hefty price tag. Fear not, for there are legitimate ways to check your credit score for free, and today we’ll explore just how to do that. Let’s face it, no one enjoys paying extra fees, especially when it comes to something as integral as your credit score. So, buckle up as we take a deep dive into how to check your credit score for free without any hidden costs. We’ll guide you through the resources, explain the importance, and ultimately, empower you to take control of your financial destiny. Are you ready to become a credit-savvy wizard? Let’s get started!

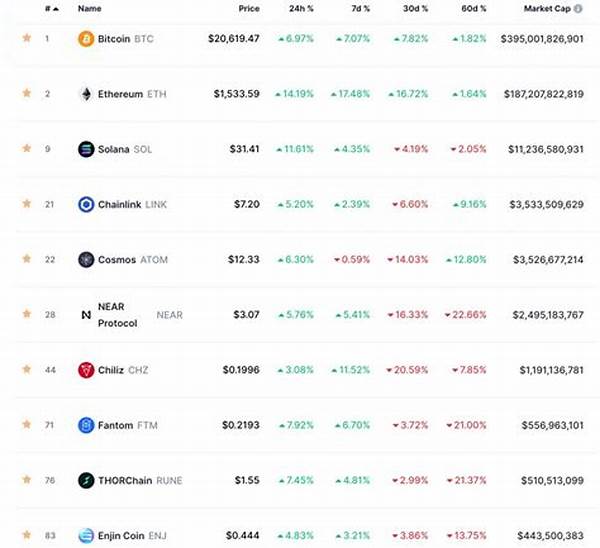

Read More : Crypto Halal Atau Haram

Checking your credit score shouldn’t feel like rocket science or a drain on your wallet. That’s where the beauty of free credit reports comes into play. Websites like AnnualCreditReport.com offer you not just one, but three free credit reports annually. These reports, sourced from the major credit bureaus—Experian, TransUnion, and Equifax—provide a comprehensive look into your financial health. By knowing how to check your credit score for free, you equip yourself with the power to spot any inaccuracies or fraudulent activities that might be lurking in your history.

Imagine diving into a world where you have a clear picture of your eligibility for loans, mortgages, and even rental homes, all without spending a dime. Not only does checking your credit score regularly improve your financial confidence, but it also keeps your records accurate, helping you avoid any unforeseen tribulations that can arise from credit mishaps.

The process of checking your credit score for free can feel liberating, as you discover the nuances of what makes up your score—payment history, credit utilization, length of credit history, and more. This awareness not only educates you but also forms a cornerstone in building a financially responsible future.

Taking charge of knowing how to check your credit score for free puts you in the driver’s seat of your financial journey. It’s time to drop the fear, embrace the unknown, and become the master of your credit universe. With resources available at no cost, there are no excuses left to remain in the dark about your financial standing.

The Benefits of Knowing How to Check Your Credit Score for Free

Understanding how to check your credit score for free isn’t just about curiosity—it’s about empowerment. When you’re aware of your credit score, you have the ability to make informed financial decisions that can save you money. Whether it’s finding lower interest rates or better financial products, knowledge is truly power.

—

Description: The Best Steps for Monitoring Your Credit Score for Free

How often do you find yourself avoiding tasks simply because you’re unsure how to approach them? Monitoring your credit score frequently falls into this category. The good news? There’s a tried-and-true solution: learning how to check your credit score for free. The first step in this journey is knowing why a credit score is so important. Financial experts regard your credit score as a defining factor that opens doors—or closes them. Without regularly checking it, you’re flying blind in a world where your credit worthiness can determine so much of your financial trajectory.

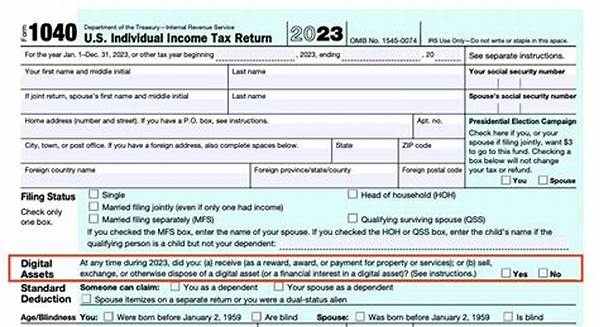

The second essential step is identifying credible sources where you can obtain your credit score at no cost. The Federal Trade Commission (FTC) mandates that every consumer is eligible for three free credit reports each year—one from each of the major credit bureaus. Additionally, many financial institutions offer credit score monitoring as a complementary service to their customers, empowering them to maintain healthy credit management habits.

Harnessing The Power of Your Free Credit Report

Subscribing to platforms that offer how to check your credit score for free can feel like you’ve got a secret financial superpower. These resources do more than just give you a number; they provide in-depth insights, personalized recommendations, and even strategies to enhance your financial standing over time.

An interesting aspect of this process is knowing how to interpret the data offered. Your free credit report unlocks a wealth of information, showing you precisely how various actions, like paying off debt or opening a new line of credit, affect your score. With this knowledge, taking proactive measures becomes a calculated strategy rather than a mere whim.

With all this information at your fingertips—literally at no cost—you can identify discrepancies or fraudulent activity sooner, potentially saving you from financial ruin. This proactive approach is not just smart but virtually indispensable in today’s digital age, making checking your credit an actionable item on your financial checklist.

Getting the Most Out of Your Free Credit Report

Once you’ve gotten over the initial thrill of obtaining your credit report, it’s crucial to use this as a launching point for meaningful action. Reach out to financial advisors or forums for advice tailored specifically to your circumstances. By knowing how to both interpret and act on your credit score, you amplify the benefits of checking it for free.

Taking these steps helps turn your newfound credit awareness into positive changes in your financial life overall, ensuring that your journey to credit excellence is both insightful and rewarding.

How to Check Your Credit Score for Free: Tips

—

Discussion: The Importance of Regularly Monitoring Your Credit Score

In today’s complex financial landscape, keeping a close watch on your credit score is imperative. Recent studies underscore that individuals who regularly monitor their credit scores tend to have higher scores. This correlation can be attributed to the fact that these individuals are more likely to spot and rectify errors or fraudulent activities promptly.

It’s not just about catching mistakes, however. It’s about becoming financially proactive. When a person knows how to check their credit score for free, it sets a precedent for responsible fiscal management. Knowing your financial strengths and weaknesses enables you to navigate the economic playing field more skillfully, providing a clearer strategy for achieving personal and professional financial goals.

Part of the challenge in maintaining an excellent credit score lies in understanding the nuances behind the number. It’s not just about debt, but how you manage that debt. By regularly checking your credit score, you gain deeper insights into how factors like card utilization, payment history, and credit inquiries affect it. This knowledge can help avoid potential pitfalls and encourage disciplined credit usage.

Lastly, regularly monitoring your credit score allows for strategic planning, especially when planning significant financial decisions like buying property or starting a business. Knowing your financial starting point helps tailor realistic, achievable plans to maximize the benefits of your credit score, ultimately leading you to financial prosperity with confidence and precision.

—

Exploring Free Credit Score Monitoring Services

How to Check Your Credit Score for Free: Free Services Insight

The advent of internet-based financial services has democratized access to credit scores, making it simpler than ever to check your credit score for free. Companies like Credit Karma, Credit Sesame, and WalletHub are front-runners in this space, providing not only access to your credit score but also offering personalized recommendations for credit-related products.

A recent study found that users of such free credit score monitoring services improved their credit scores by an average of 30 points over six months. Why does this work? Because constant monitoring translates into constant learning, leading to informed decisions and strategic financial planning. As such, leveraging these tools empowers consumers to demystify the credit system and allows them to approach financial management with renewed confidence.

How Free Credit Scores Benefit You

Armed with an understanding of how to check your credit score for free, you are better equipped to make decisions that positively impact your financial landscape. Whether it’s negotiating better terms with lenders or understanding your rights in financial transactions, your credit score becomes a powerful ally.

With access to free services, there’s little reason not to frequently monitor your credit health. It provides a window into your financial habits while helping you adapt as needed to align with your financial goals. Overall, checking your credit score for free is not just a financial task; it is a gateway to personal finance mastery.

Illustrations: Ways to Check Your Credit Score for Free

By integrating the resources and insights above, checking your credit score becomes an empowering and instrumental practice that leads you down the path to financial empowerment. Whether it’s strategizing for future goals or staying vigilant against fraud, maintaining an up-to-date understanding of your credit history is an invaluable tool in managing your financial well-being.