How To Rebuild Credit After Bankruptcy

Facing bankruptcy can bring a whirlwind of emotions: fear, confusion, and uncertainty about the future. But, as daunting as it may seem, it’s also a fresh start, an opportunity to rebuild credit and emerge stronger. Imagine for a moment the process of rebuilding an old car. It requires patience, careful planning, and steady effort. Your financial life post-bankruptcy is much like that car. You’re not just trying to get it to run; you’re aiming for it to purr like a well-oiled machine once again. The journey from bankruptcy to financial stability isn’t just about recovery; it’s about transformation and growth. Rebuilding your credit stands at the forefront of this journey, with specific steps that lay a new financial foundation. The key? Knowing “how to rebuild credit after bankruptcy” effectively and efficiently.

Read More : The Future Of Credit Scores And Digital Identity

Bankruptcy is not the end; it’s a new beginning. Just as a phoenix rises from its ashes, your financial persona can be resurrected and elevated. True, it won’t happen overnight, but like any great endeavor, it starts with a single, deliberate step. Start with a clean slate, understand your past financial decisions, and educate yourself on better choices. Consider this: even Thomas Edison experienced thousands of failures before lighting up our world with the electric bulb. Success is more about learning from failures than avoiding them altogether.

Steps to Rebuild Your Credit

The first step on “how to rebuild credit after bankruptcy” is establishing a new relationship with credit. Credit-builder loans or secured credit cards can be a springboard. These tools aren’t just financial products; they’re stepping stones on your path to financial reliability. Albeit limited, their credit lines allow you to demonstrate your new, more responsible approach to credit. Remember, Rome wasn’t built in a day, and your credit won’t be either. However, with consistent, on-time payments, your credit history will slowly but surely recover.

Have you ever found yourself in a situation where life’s unpredictability charted a different financial course than the one you planned? If so, you’re not alone. Many have wrestled with the intimidating reality of bankruptcy. But take solace in knowing that it’s not an insurmountable hurdle. It’s more a gateway to a new beginning, a chance to learn from past mistakes and switch up your financial narrative.

When you embark on the journey to understand “how to rebuild credit after bankruptcy,” think of it as setting the stage for a brighter financial future. Let’s take a little trip down memory lane; recall the first time you learned to ride a bike. You likely fell off numerous times, felt the sting of scraped knees, yet persisted until you found your balance. Rebuilding credit is similar. It requires persistence, resilience, and a touch of courage.

So what’s the secret sauce to rebuilding credit after bankruptcy? It’s basically the three Rs: Reflection, Reconstitution, and Resilience. Reflect on past financial habits, reconstitute a wiser financial routine, and approach the journey with resilience. According to recent statistics, individuals who develop a structured plan post-bankruptcy significantly enhance their chances of successfully restoring their credit scores.

Understanding Bankruptcy and Credit Recovery

Bankruptcy might sound like the ultimate financial failure, but it isn’t. It’s a solution, an opportunity to put financial missteps behind and start anew. How you tackle it can set a precedent for future financial dealings. Once you grasp the essence of “how to rebuild credit after bankruptcy,” it becomes a strategic game of patience and prudence. Our ingrained fear of failure often overshadows potential success. Embrace bankruptcy as a financial education seminar where the lessons learned hold lifelong value.

The Emotional Journey of Credit Rebuilding

Rebuilding credit after bankruptcy is as much an emotional task as it is a financial one. The feeling of empowerment resurfaces once you make that first timely payment on a secured card. Your credit score starts inching upwards, almost like an encouraging nod saying, “You’re on the right path.” It’s essential to surround yourself with positive encouragement, much like athletes listening to motivational speeches before their big game.

Seek stories and testimonials of individuals who’ve successfully walked this path. A simple online search will reveal folks who’ve gone from the brink of financial ruin to thriving economic well-being. One compelling narrative could be your guiding light, the spark that reignites hope and determination.

Essential Steps to Rebuild Credit After Bankruptcy

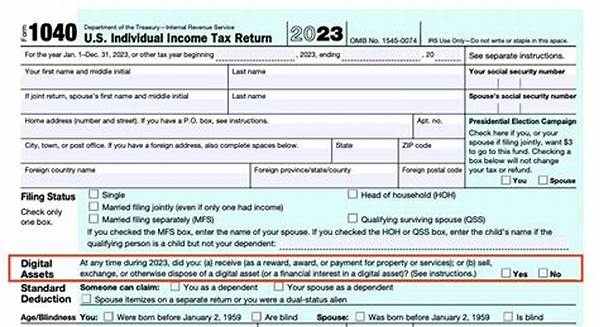

One pivotal piece of advice on “how to rebuild credit after bankruptcy” is to monitor your credit report vigilantly. Accuracy breeds trust. Any discrepancies in your credit report can hinder your progress, obstructing the road to recovery. Additionally, budgeting isn’t just a monthly task but a lifestyle choice. It’s your financial GPS, course-correcting and guiding you steadily towards financial independence.

Navigating the post-bankruptcy world requires both rational strategies and emotional fortitude. Rationally, you’ll want to address outstanding debts, negotiate better terms where possible, and avoid repeating financial pitfalls of the past. Emotionally, it’s about realizing that your financial identity isn’t defined solely by a credit score. It’s the relentless drive to improve, to forge a legacy not just for yourself but perhaps for future generations.

At the heart of every monumental change is a compelling purpose. The purpose of proudly tackling “how to rebuild credit after bankruptcy” is not just to boast a high credit score. It’s about reclaiming financial freedom, liberating oneself from the shackles of past mistakes, and setting a promising precedent for the future. Your financial renaissance isn’t just beneficial personally; it demonstrates resilience and perseverance to those around you.

Have you considered how liberating it will feel when financial institutions view you as a credible asset rather than a liability? Credit affects more than loan eligibility; it’s about opportunities, personal growth, and ultimately, peace of mind. Reintegrating oneself back into the financial world opens doors that seemed permanently sealed during the tumultuous bankruptcy period.

Setting measurable goals is instrumental. By charting your progress, celebrating small victories, and reflecting on occasional setbacks, you’ll maintain momentum towards credit recovery. Seek professional guidance—credit counseling services can offer personalized strategies and educational resources to fortify your journey.

Surround yourself with individuals who not only understand but support your quest to rebuild better. The journey of nurturing a healthy financial life is profoundly enriched by solidarity and guidance from those who’ve successfully transitioned through similar situations.

In essence, embracing the roadmap to effectively rebuild your credit after bankruptcy is about empowerment. Not just empowering your wallet, but empowering the life you wish to curate, full of intention and prosperity.

Remember, your financial narrative is a story penned by you, and the best chapters often come after the most challenging cliffs.