Top 5 Credit-building Loans In 2025

Article Title: Top 5 Credit-Building Loans in 2025

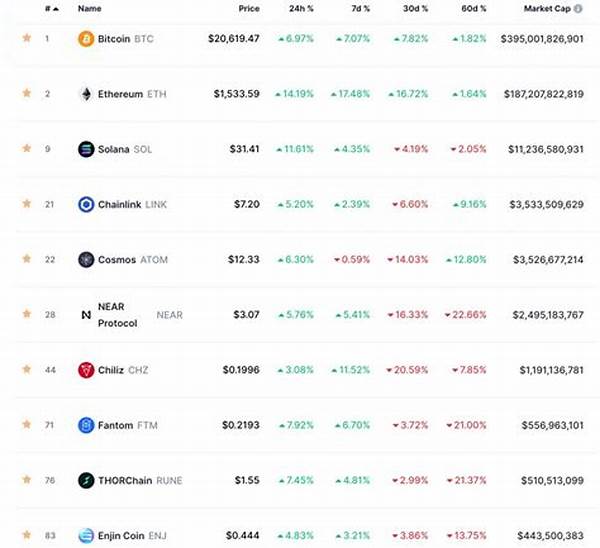

Read More : Belajar Crypto

In a world where financial stability plays a pivotal role in accessing opportunities, maintaining a good credit score has become more vital than ever. Enter 2025, where the landscape of credit-building loans continues to evolve, offering new and innovative solutions to help individuals boost their credit scores. Whether you’re a student looking to establish credit for the first time or someone seeking to rebound from past credit mishaps, choosing the right credit-building loan can set you on a course for financial success. Here, we delve into the top 5 credit-building loans in 2025, exploring what makes them unique, why they’re essential, and how they can be your financial ally.

One might wonder why credit-building loans have gained so much traction. The answer is simple: a good credit score isn’t just a number; it’s a gateway to better financial products, like lower interest rates on mortgages or car loans and even better terms on rental agreements. The stakes are high, but with the right information—like understanding the top 5 credit-building loans in 2025—you can make informed decisions. This article will entertain you with humor, engage you with stories of those who’ve walked this path before, and educate you on making the best choices for credit-building. The journey to financial empowerment begins now!

Imagine stepping into a bank, the aroma of freshly printed banknotes wafting through the air, only to find that you’re greeted with lukewarm enthusiasm due to a less-than-perfect credit score. Bummer, right? Here’s where credit-building loans make their grand entrance—cue the spotlight! These loans aren’t a magical fix, but they are a structured path to better credit health. For those ready to say goodbye to credit woes, putting these loans to work in your financial plan is an action-packed strategy. We’ll explore the nuances, potential traps, and ultimate benefits of embracing these loans in the upcoming sections.

One of the most fascinating aspects about the top 5 credit-building loans in 2025 is their adaptability to different financial situations. Whether you’re combating the aftermath of identity theft or just starting to understand your personal finance landscape, a well-designed credit-building loan can be tailored to suit your needs. These loans offer not only a chance to build credit but also the education and support needed to manage credit responsibly. So buckle up—let’s dive deeper into the transformative journey these loans promise.

Understanding the Innovations in Credit-Building Loans

As we navigate the dynamic world of 2025, the need for innovative financial products becomes clear. The top 5 credit-building loans have distinguished themselves by incorporating features that cater to modern needs, such as flexible payment plans, low interest rates, and user-friendly digital platforms. These features have been backed by extensive research and consumer feedback, making them both cutting-edge and practical. The testimonials from users around the globe further highlight the remarkable impact of these loans on personal credit scores, and we’re here to share those stories.

In conclusion, embarking on the journey with the top 5 credit-building loans in 2025 opens up unique opportunities for financial rehabilitation and growth. While the specifics of each loan will vary, they all provide a structured, reliable means to achieve a better credit score. For those willing to take action and commit to the process, the path to financial freedom is full of promising possibilities—and maybe a few laughs along the way.

—Purpose of Top 5 Credit-Building Loans in 2025

In an era where your credit score can have profound implications on your financial wellbeing, understanding the purpose and benefits of credit-building loans is crucial. The top 5 credit-building loans in 2025 aim to equip consumers with the tools necessary to enhance their credit scores systematically. This isn’t just about securing loans—it’s about opening doors to opportunities and creating a financial safety net for the future.

A significant advantage of these modern loans is their accessibility. With fintech advancements, borrowers can now apply online, track their progress, and receive educational resources all from the comfort of their own homes. Gone are the days of intimidating bank visits or lengthy paperwork. Instead, users are met with friendly interfaces and personalized advice, helping demystify the credit-building process.

It’s paramount to recognize that these loans offer more than just credit score improvements. They contribute to financial education and discipline by mandating regular, timely payments. Borrowers who engage with the top 5 credit-building loans in 2025 often speak to the valuable lessons learned in budgeting, saving, and credit management. This combination of practical application and educational support fosters long-term financial health.

Moreover, statistics have shown that individuals who utilize credit-building loans experience significant improvements in their credit scores. Financial experts and real-life users alike have lauded these products, highlighting their effectiveness and transformative capabilities. This is more than a trend—it’s a holistic approach to financial rejuvenation, targeting the root causes of poor credit.

As we delve deeper into the specifics, it’s essential to note the emotional and psychological reassurance that comes alongside improving one’s financial standing. The peace of mind that comes from knowing you’re actively enhancing your financial profile cannot be overstated. For many, rebuilding credit means restoring dignity and confidence.

Finally, the actionability of these loans lies at the heart of their success. For consumers ready to take control of their financial future, the top 5 credit-building loans in 2025 present a tangible, streamlined method of achieving better credit scores. Through educational resources, community support, and innovative technology, borrowers are not only changing their credit history but rewriting their financial story.

The Elements of Credit-Building Success

To fully grasp the importance of selecting the right credit-building loan, one must understand the core elements that contribute to successful credit improvement. From low-interest rates to personalized customer support, each component plays a vital role in molding one’s financial journey. In our deep dive, we’ll explore how these elements are integrated into the top 5 credit-building loans of 2025, ensuring that borrowers can approach their financial future with confidence and insight.

How to Choose the Right Loan

Adventuring into the world of credit-building loans requires careful consideration and insight. Choosing the right one involves evaluating your personal financial goals, understanding the loan terms, and comparing various products. Whether your focus is on minimizing costs or maximizing your credit score potential, being equipped with the knowledge of the top 5 credit-building loans in 2025 will guide your choice and set you up for success.

—Actions Related to Top 5 Credit-Building Loans in 2025

—Short Description of Top 5 Credit-Building Loans in 2025

The financial realm of 2025 introduces us to a new era of credit-building strategies designed for diverse personal situations. Among these, the top 5 credit-building loans stand out due to their innovative approach towards enhancing one’s credit score. By focusing on user-friendly interfaces and personalized financial planning, these loans cater to the dynamic needs of modern consumers.

Each loan product within the top 5 credit-building loans in 2025 offers distinct features such as low fees, flexible terms, and supportive educational resources. These factors come together to ease the credit-building journey, making it both achievable and insightful. Borrowers can experience a clear pathway towards financial growth, understanding the nuances of credit management along the way.

This transformational experience transcends the traditional loan purposes. Consumers not only witness improvements in their credit scores but also gain invaluable financial literacy, which is essential in today’s fast-paced economic environment. By engaging with these loans, users embark on a rewarding journey towards financial empowerment and stability.

Key Benefits and Considerations

Understanding the intrinsic benefits of credit-building loans ensures that borrowers make informed decisions aligning with their financial goals. We’ll delve into key considerations when engaging with the top 5 credit-building loans in 2025, supporting your quest for financial improvement while highlighting the successful integration of innovation and traditional lending practices.

Financial Growth Pathways

Pursuing a credit-building loan is more than a singular financial decision—it’s a pathway to broader economic opportunities. By focusing on comprehensive growth strategies, we aim to explore how top 5 credit-building loans in 2025 foster both immediate credit enhancement and long-term financial well-being, guiding borrowers through their unique financial endeavors.

—Content and Tips for Top 5 Credit-Building Loans in 2025

Navigating the world of credit-building loans in 2025 can be a rewarding venture if approached with the right knowledge and tools. The top 5 credit-building loans offer strategic pathways to enhance credit scores, but selecting the appropriate loan requires careful analysis of personal objectives and loan offerings. This guide provides a comprehensive look at effective credit-building strategies.

The importance of understanding the loan terms cannot be overstated. Each of the top 5 credit-building loans in 2025 comes with unique conditions that suit different needs, such as varying interest rates, repayment periods, and fee structures. Assessing these elements is crucial to align a loan with one’s financial goals, avoiding potential pitfalls like late payment fees or hidden charges.

Furthermore, potential borrowers should consider the educational resources that accompany these loans. High-quality credit-building loans often come with guidance on managing credit effectively, enabling users to maintain improved credit scores over time. This educational support is vital to long-term financial success, equipping users with the knowledge necessary to avoid common credit mistakes.

Tips for Maximizing Credit-Building Loans

—

By thoroughly understanding the top 5 credit-building loans in 2025 and their implications, individuals can transform their financial landscape with informed decisions and strategic actions, unlocking the door to myriad possibilities and a secure financial future.