Trading Crypto Adalah

- Trading Crypto Adalah

- Structure for “Trading Crypto Adalah”

- Navigating the Crypto Terrain

- Key Aspects of Trading Crypto Adalah

- Goals of Trading Crypto Adalah

- Seven Illustrations Related to Trading Crypto Adalah

- Comprehensive Discussion on Trading Crypto Adalah

- Adopting Effective Trading Strategies

- The Future of Trading Crypto

Trading Crypto Adalah

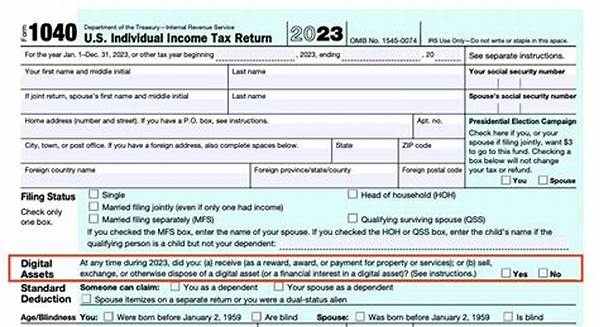

In the grand arena of digital finance, trading crypto is a captivating endeavor that has caught the attention of many. With the boom of cryptocurrencies like Bitcoin and Ethereum, trading has evolved from mere speculation to a sophisticated art form. Exciting, isn’t it? But before delving deeper, it’s essential to understand what trading crypto entails, and why it’s more than just numbers on a screen. Imagine yourself not just as a trader, but an adventurer in a digital landscape where fortunes can change at the blink of an eye. What keeps this thrilling world ticking, and why are so many captured by its allure? Trading crypto is the perfect blend of technology and finance, seasoned with a pinch of risk and reward that could be either prosperous or perilous, depending on how you navigate its intricate pathways.

Read More : Brilliant Crypto

For those seeking financial autonomy, trading crypto is akin to embarking on a treasure hunt armed with both a map and a mysterious key. The map guides you through analysis and strategy, while the key unlocks potential opportunities unique to the crypto universe. The volatile nature of cryptocurrencies can be a double-edged sword, but for the prepared trader, it presents opportunities to leverage price movements for profitable returns. Embrace the cryptocurrency trading arena with eyes wide open and strategies firmly in place.

The journey of trading crypto is likened to a rollercoaster ride—full of ups, downs, sudden turns, and thrilling speeds. It’s not just about buying low and selling high; it’s about understanding market sentiments, technological trends, and geopolitical factors that might influence crypto prices. A calculated risk taker finds the adventure exhilarating. So, if you’re ready to buckle up and dive into the fast-paced world of cryptocurrency, remember that trading crypto is an art, a science, and, for many, an unforgettable journey.

The Dynamics of Trading Crypto

Trading crypto demands not just a financial investment but an emotional one as well. The digital realm is fast-paced, where changes occur in mere seconds. It’s a space that tests patience, hones instincts, and rewards calculated risks. The market can be unpredictable, with prices fluctuating wildly based on news, technological advancements, and shifts in supply and demand. Learning to navigate these waters effectively can be financially rewarding but requires commitment and continuous learning.

—

Structure for “Trading Crypto Adalah”

In the ever-evolving financial landscape, trading crypto is a dynamic venture that captures the imaginations of many aspiring investors. It represents an innovative frontier where digital assets converge with traditional trading principles, offering a unique platform for profit generation.

For potential traders, the understanding of what trading crypto is starts with its fundamentals. At its core, it’s about capitalizing on price discrepancies in the cryptocurrency market. Unlike traditional assets, cryptocurrencies operate on the principle of decentralization, often independent of conventional financial institutions. This lends the market an added layer of complexity, yet simultaneously, the promise of higher returns.

Navigating the Crypto Terrain

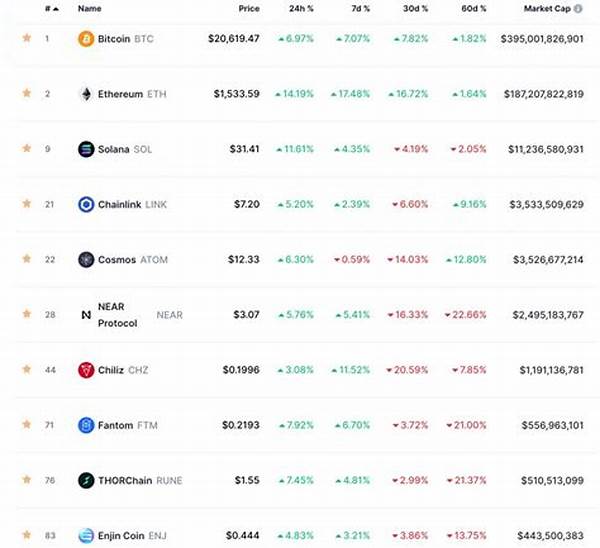

With the trading crypto landscape, there are multiple paths to consider. Whether through spot trading, futures, or options, each method carries its own set of strategies and risks. Spot trading involves buying and holding, awaiting the right moment for sale based on market trends. Futures trading, on the other hand, allows for speculation on currency prices at future dates, offering potential profit from both rising and falling markets.

Strategic Insights into Crypto Trading

Aspiring traders must equip themselves with knowledge and tools. Understanding market indicators, leveraging trading platforms with advanced analytics, and staying updated with news are crucial for informed decision-making. The volatility that marks crypto markets is both a risk and an opportunity. Mastery of this domain requires a balance of strategy, analysis, and intuition.

Successful crypto trading strategies often involve a mix of risk management techniques, diversified portfolios, and a continuous learning curve. The journey is not without setbacks, but the potential rewards are enticing. The essence of crypto trading lies in its unpredictability—what defines a successful trader is the ability to adapt and thrive in the face of uncertainty.

—

Key Aspects of Trading Crypto Adalah

—

Goals of Trading Crypto Adalah

Trading crypto is arguably one of the most discussed topics in modern finance. The allure of crypto trading is undeniable, with stories of striking it rich and tales of significant losses both contributing to its mythos. However, at the heart of crypto trading lies a set of fundamental goals that every trader, novice or seasoned, aspires to achieve.

Profit generation is the most apparent goal for any trader, crypto or otherwise. The crypto market, renowned for its volatility, can yield high returns, making it attractive for those looking to maximize their income. The dynamics of rapid price changes mean that fortunes can be made in a relatively short period, provided one has the astuteness to navigate the market wisely.

Another significant goal is diversification. For investors, incorporating crypto assets into a portfolio offers a diversification strategy, potentially reducing risk by spreading investments across various asset classes. Unlike traditional markets, the decentralized nature of cryptos can act as a buffer against certain economic pressures.

Additionally, gaining expertise and understanding of blockchain technology is an essential goal. As traders delve into the crypto world, they inherently learn about blockchain, which is revolutionizing many aspects of business and economy. A thorough understanding not only aids in effective trading but opens new professional avenues in a digital economy increasingly underpinned by blockchain technology.

Mastering the Crypto Trade

Honing one’s skills in cryptocurrency trading involves mastering both the art and science of it. Success is built on a foundation of research, continuous learning, and strategic thinking. Markets are influenced by a myriad of factors—from regulatory changes to technological developments—and being attuned to these can make a significant difference. Thus, pursuing mastery in crypto trading is a goal that ensures adaptability and potential prosperity.

—

Seven Illustrations Related to Trading Crypto Adalah

1. Volatility Chart: A graphical representation showing the high and lows of Bitcoin’s price over a year, illustrating market volatility.

2. Technology Infographic: An infographic depicting blockchain technology and how it supports various cryptocurrencies.

3. Decentralized Finance Diagram: Illustrates the components of DeFi and how they interact with traditional financial systems.

4. Market Access Schedule: A calendar showing 24/7 trading hours compared to traditional stock markets.

5. Trading Risk Management: An educational poster highlighting risk management strategies in crypto trading.

6. Portfolio Diversification Graphic: Demonstrates how crypto assets can be integrated into a mixed investment portfolio for risk diversification.

7. Blockchain Learning Pathway: A flowchart illustrating the steps to gaining blockchain proficiency as part of a trading strategy.

Describing the Universe of Crypto Trading

Crypto trading thrives within an ecosystem that combines financial acumen with technological prowess. The volatile nature of this market is both a challenge and a boon. Imagine riding a digital wave where each crest and trough represents financial opportunity or peril. The key to success lies in understanding these dynamics, where every decision is a calculated risk influenced by numerous factors in the crypto environment.

Traders must be technologically savvy, for the backbone of cryptocurrencies is the blockchain—a complex yet robust system that guarantees decentralized transactions. Keeping updated with the latest technological advances can offer a competitive edge, whether it’s through employing automated trading bots or enhancing cybersecurity measures to protect digital assets.

Moreover, the decentralized finance (DeFi) sphere opens new doors for financial operations beyond traditional banking. Through DeFi, traders can engage in lending, borrowing, and earning interest on cryptocurrencies. This new paradigm shift in financial interactions means that traders are not merely participants but also contributors to an evolving financial system that redefines how we perceive value and wealth distribution in a globally connected society.

—

Comprehensive Discussion on Trading Crypto Adalah

Trading crypto is clothed in both opportunity and misperception. The intrigue surrounding it often arises from its decentralized nature and the liberties it offers compared to traditional trading systems. This duality makes it essential to examine how it operates, why it captures imagination, and who stands to benefit most from this digital revolution.

In essence, trading crypto is not just about exploring new financial landscapes; it’s about crafting a narrative where the trader plays a pivotal role in a decentralized economy. The ever-shifting crypto terrain serves as a canvas for traders. Imagine yourself drawing not just profits, but experiences and intelligence that transcend conventional investment boundaries. Through strategic foresight, trading crypto becomes a journey—a reflection of one’s knowledge and risk appetite.

The Psychology of a Crypto Trader

Understanding the psychology of trading is paramount. Trading crypto demands emotional resilience due to its fluctuating markets and the rapid pace at which decisions must be made. Traders must cultivate patience, discipline, and an analytic mindset to navigate both bull and bear markets effectively. This psychological preparedness is often the differentiator between success and failure in the crypto world.

Adopting Effective Trading Strategies

Effective cryptocurrency trading strategies encompass a blend of technical analysis, market sentiment evaluation, and strategic risk management. A successful trader utilizes charts, historical price data, and current market conditions to inform trading decisions. The willingness to adapt strategies based on market feedback is a hallmark of a seasoned trader, allowing one to pivot swiftly and leverage emerging opportunities.

Moreover, embracing new opportunities involves being open to the innovative financial solutions presented within the crypto market, such as engaging with decentralized finance platforms. These platforms offer a new frontier for conducting financial transactions without traditional intermediaries, often with enhanced returns and lower fees.

Tactics and Tools for Trade Success

The tools employed in crypto trading range from simple mobile applications to sophisticated algorithm-driven trading platforms. Selecting the right tools involves understanding their functions and aligning them with trading goals. Automation through bots, for example, can assist in executing trades with precision and timing unachievable by human effort alone.

Embracing a culture of continual learning and adaptation allows traders to remain competitive. The crypto realm is in constant flux, introducing innovations and challenges that demand an agile mindset. By staying informed and adaptable, traders can better position themselves to capitalize on both immediate and long-term market trends.

The Future of Trading Crypto

The future of trading crypto lies in its potential to democratize wealth management and create equitable financial systems worldwide. With greater accessibility and fewer barriers to entry, anyone with internet access can engage with cryptocurrency markets. This inclusivity presents profound implications for personal finance, empowering individuals to take greater control over their economic futures.

However, the road ahead is not without its challenges. Regulatory frameworks, security concerns, and technological hurdles must be addressed to ensure a stable and secure environment for digital trading. Collaboration between industry stakeholders and regulators will be crucial in shaping a sustainable future where trading crypto remains a viable and lucrative option for all.

—

By immersing oneself in the world of crypto trading, individuals not only seek financial gain but also participate in shaping the evolution of a new financial order. Trading crypto is transformative, with each transaction contributing to a larger narrative of economic empowerment and digital innovation.