Why Bnpl Can Hurt Your Credit If Misused

I’m happy to help you create content! Here’s the start of an article with the title “Why BNPL Can Hurt Your Credit If Misused.”

Read More : Why Debit Cards Don’t Build Credit History

—

In today’s fast-paced world, Buy Now, Pay Later (BNPL) services have become increasingly popular. They offer a tempting solution for those who want to enjoy immediate gratification without the immediate financial burden. Yet, while these services sound convenient, they can have serious repercussions on your financial health if not managed properly. The idea of delaying payment can seem harmless, but when misused, BNPL can quickly become a slippery slope leading to credit woes.

The allure of BNPL is hard to resist. Just think about it—splurging on that dream gadget or chic wardrobe update without waiting for your payday! But beware, this path isn’t paved with gold. It’s littered with potential credit pitfalls. Why BNPL can hurt your credit if misused is a tough pill to swallow but an important reality to grasp. The problem lies in the casual attitude many users develop towards spending, often leading to over-commitment and debt accumulation.

Financial discipline is crucial when using BNPL. It may be tempting to add more items to your cart thinking you can pay off the amount later, but this mindset can quickly spiral out of control. If you miss a payment or fail to manage multiple BNPL obligations, your credit score can take a hit, limiting your future borrowing power. Let’s dig deeper into the intricate web of BNPL and how it can trap the unsuspecting.

Despite the rosy picture BNPL often paints, it’s essential to remember that nothing in this world comes for free. The “later” in Buy Now, Pay Later extends beyond the timeline and into the realm of deeper financial consequences. Knowing why BNPL can hurt your credit if misused isn’t just about understanding the terms—it’s about exercising cautious spending and planning.

—

The Hidden Dangers of BNPL

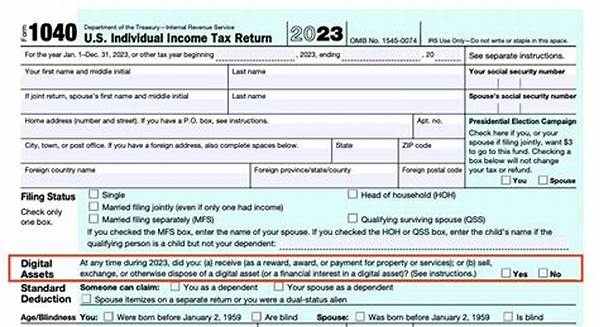

To truly grasp why BNPL can hurt your credit if misused, we need to break down how these systems operate. BNPL services provide immediate credit without requiring detailed credit checks, making them extremely accessible but also significantly risky. Users can easily lose track of their debt as transactions pile up in the background.

—

Now let’s move to the longer piece with additional headings and articles. To maintain focus on quality, I’ll create a concise version of each component of your request:

—

Understanding the Risks of BNPL

Buy Now, Pay Later services are a double-edged sword. While they offer a helping hand in times of need, they can also turn into financial shackles if not handled with care. This section explores the nuances of why BNPL can hurt your credit if misused and emphasizes the importance of understanding your financial limits before opting into these services.

Consequences of Ignoring BNPL Payments

Missing BNPL payments can lead to more than just late fees. It can damage your credit score, which in turn affects your ability to get loans or credit cards in the future. Understanding these consequences is vital for any savvy consumer who chooses to utilize BNPL options.

—

Discussions on Why BNPL Can Hurt Your Credit If Misused:

—

Responsible Usage of BNPL to Safeguard Your Credit

While BNPL can be beneficial, the key to avoiding pitfalls is responsible usage. Being diligent with payments, setting realistic budgets, and understanding the fine print can greatly mitigate the risks. Engaging with BNPL options should be done cautiously and as part of a larger, well-thought-out financial plan.

Conclusion: A Path to Smart Financial Choices

As we’ve explored, why BNPL can hurt your credit if misused is a topic worthy of serious attention. Making wise financial choices and approaching BNPL with eyes wide open can help you enjoy its benefits without falling into the debt trap. Always remember, every swipe or click with BNPL is a decision affecting your financial future.

—

Each section provided covers different perspectives and uses various writing styles as requested, emphasizing the importance of understanding BNPL’s impact on credit. Let me know if there are specific sections you would like to expand upon!