Why Debit Cards Don’t Build Credit History

- Why Debit Cards Don’t Build Credit History

- Debit Cards: A Financial Tool Without Credit Power

- Discussions on Why Debit Cards Don’t Build Credit History

- Understanding the Dynamics: Why Debit Cards Don’t Build Credit History

- Quick Explanations on Why Debit Cards Don’t Build Credit History

- Short Article: Why Debit Cards Don’t Build Credit History

Why Debit Cards Don’t Build Credit History

In the world of financial literacy, understanding the difference between debit and credit is crucial. Many people rely on debit cards for daily transactions, attracted by their simplicity and the absence of debt. Yet, an overlooked aspect is that using a debit card doesn’t contribute to building a credit history. This can come as a surprise for those aiming to fortify their credit scores. Building a solid credit record is essential for securing loans, favorable interest rates, and sometimes even jobs or apartments. So, why is it that debit cards don’t play a part in this vital aspect of financial life? Dive into the intriguing relationship between debit cards and credit history as we unravel this mystery.

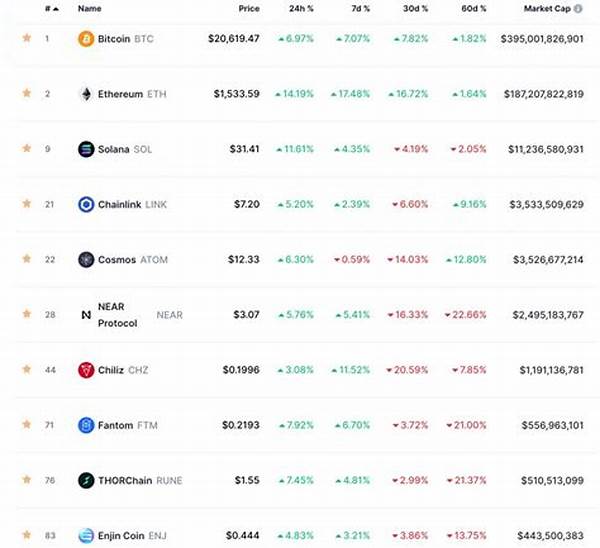

Read More : Crypto Vs Traditional Banking Pros And Cons

Debit cards are linked to your bank account, and when you make a purchase, the money is directly withdrawn. This straightforward mechanism is convenient but doesn’t demonstrate your ability to manage debt, a factor critical in building credit history. Credit history thrives on the notion of trust and risk, showing lenders your ability to handle borrowed money over time. With debit cards, there’s neither borrowing nor repayment involved, hence no data for credit bureaus to assess, limiting your credit history growth.

Moreover, using debit cards wisely has its perks—immediate payment without accruing interest or debt. This can lead to a disciplined financial lifestyle. However, many don’t realize that because debit cards don’t report to credit bureaus, they miss the opportunity to build a credit report that details responsible financial behavior over time.

Interestingly, credit cards operate in a parallel financial universe. They offer rewards, points, and most importantly, the ability to build credit. Responsible credit card use demonstrates to lenders your capacity to handle credit wisely—paying bills on time, keeping balances low, and avoiding the trap of minimum payments. This activity is recorded and helps elevate your credit score, unlike the humble and diligent debit card.

The Credit Building Misconception

Many people hold the misconception that sufficient debit card use can replace credit cards in establishing a credit history. However, why debit cards don’t build credit history boils down to the lack of credit agreements and payment records, vital for credit score calculations. For those aiming to build or repair their credit histories, understanding and leveraging the right tools, like responsible credit card usage, is essential for long-term financial success.

—

Debit Cards: A Financial Tool Without Credit Power

While debit cards are an effective tool for budgeting and managing immediate transactions, they fall short in the realm of credit building. This often leads to a frustrating surprise for many who depend on debit cards exclusively and later realize their credit history remains unaffected.

The Basics of Debit Cards vs. Credit Cards

While both debit and credit cards might appear similar in usage, their impact on your financial health significantly differs. Debit cards draw directly from your bank account, offering no credit line to demonstrate reliability in managing borrowed funds. Conversely, credit cards provide a line of credit, requiring you to repay what you’ve spent, creating a track record of financial responsibility imperative for credit history.

Why debit cards don’t build credit history is a question that pops up due to this fundamental difference. Credit scores are built on data about how you’ve managed credit in the past—information colorfully illustrated through paying bills promptly and maintaining low balances. Debit cards don’t have this function.

Why Understanding this Difference Matters

Recognizing why debit cards don’t build credit history is crucial for long-term financial planning. Misunderstandings in building credit lead people to miss out on strategic financial opportunities, like favorable loan rates. A credit card, if used responsibly, offers powerful benefits beyond just purchasing flexibility—it helps you build a robust credit history that opens doors to many financial opportunities.

Given these insights, it’s clear that while debit cards hold their place in controlled spending, integrating a sensible credit card usage strategy is invaluable for those keen on constructing their credit legacy.

—

Discussions on Why Debit Cards Don’t Build Credit History

Key Reasons to Consider

In financial strategies, it’s pivotal to understand the synergy between effective budgeting with debit and empowering credit potential with credit cards. Incorporating credit learning into your fiscal routine sharpens not just immediate spending habits but also enriches future credit potential.

—

Understanding the Dynamics: Why Debit Cards Don’t Build Credit History

Diving into why debit cards don’t build credit history reveals an essential financial insight that can transform how you approach credit building. This understanding serves as a pivotal moment in sophisticated financial planning, particularly when seeking strong credit health and supporting meticulous fiscal growth.

Decoding Debit and Credit: Fundamentally Different

At the core, debit and credit cards serve distinct roles in personal finance. Debit cards are tied to your immediate available funds, emphasizing a “pay now” model. They’re budget-friendly but provide no insight into your ability to manage loans or credit limits. This lack of debt interaction means there’s no record to show future lenders, no matter how frequent or responsible your debit card use may be.

Building Future Financial Health

Leveraging credit cards, on the other hand, promotes accountability through borrowing and returning money, a process vigilantly noted by credit bureaus. This cycle is crucial to building credit history. It’s not just about debt but showcasing reliability and financial acumen. With proper credit use, a credit history becomes your financial story, depicting not just the numbers but the trustworthiness lenders depend on.

Strategies for Capturing Credit Growth

For those keen on expanding their credit potential, start by understanding the strategic use of credit cards alongside your debit card. Opt for a low-limit credit card to begin with, maintaining timely payments. This strategy gradually builds a credit score without falling into the trap of excess debt—a harmonious balance between security and opportunity.

By weaving responsible credit usage with regular debit practices, individuals can create a more well-rounded financial profile. The blend of immediate, debt-free transactions with credit-building exercises sets the stage for successful financial growth and opportunity exploration.

—

Quick Explanations on Why Debit Cards Don’t Build Credit History

1. No Credit Agreement

2. Absence of Repayment History

3. No Reporting to Credit Bureaus

4. Limited to Available Funds

5. Lack of Utilization Ratio

6. Immediate Financial Transactions

Understanding why debit cards don’t impact credit history is not just enlightening but liberates you to create an informed strategy to build and sustain financial soundness.

—

Short Article: Why Debit Cards Don’t Build Credit History

In the modern landscape of personal finance, the debit card has risen as a staple for many. Yet, despite frequent usage, one mystery stands: why debit cards don’t build credit history. As you dive into this topic, a narrative unfolds that’s as educational as it is crucial for financial growth and strategic planning.

The Clear Divide Between Debit and Credit

Debit and credit cards may share physical similarities, but their functions in personal finance diverge sharply. Debit cards draw funds directly from your checking account, ensuring payments are immediate and leaving no trace of debt or borrowing behavior. This nature means credit bureaus remain unaware of your responsible use, affecting potential credit build-up opportunities.

The Power of Credit Transactions

Conversely, credit cards provide an ongoing report card of your financial behavior. By offering a line of credit, they enable a pattern of borrowing and repayment that’s tracked by credit bureaus. This pattern shows your creditworthiness to future lenders, making credit cards indispensable to a comprehensive financial strategy.

Building Credit Differently

Understanding why debit cards don’t build credit history shapes your strategic financial endeavors. Utilizing credit cards responsibly can build necessary trust with lenders, correct any credit mishaps, and ensure readiness for major financial endeavors. By keeping balances low and payments timely, you build a financial narrative attractive to financial institutions.

Crafting a balance between debit cards for day-to-day expenses and credit cards for strategic credit building is a crucial endeavor. Through informed choices, you can navigate the financial landscape with both discipline and opportunity, constructing a credit history that reflects your financial acumen and reliability, far beyond the limitations of debit usage alone.