Why Diversification Is Key In Crypto Portfolios

Why Diversification is Key in Crypto Portfolios

Read More : Logo Crypto

In the fast-paced world of cryptocurrencies, volatility is the name of the game. Prices swing wildly from one day to the next, making it both a thrilling and terrifying arena for investors. While some have become overnight millionaires, others have lost their life savings in the blink of an eye. Amidst this digital gold rush, understanding why diversification is key in crypto portfolios can be your lifeline.

Diversification is a strategy that spreads investments across different assets to reduce risk. In layman’s terms, it’s akin to not putting all your eggs in one basket. By holding a mix of different cryptocurrencies and other assets, you can mitigate losses when a particular coin takes a nosedive. The crypto market is notorious for its unpredictability, with factors like regulatory news, technological advancements, and market sentiment causing wild swings. However, by diversifying, an investor can smooth out the ride over time. There’s an innate desire for anyone invested in this market to not only protect their capital but to grow it, and that’s where diversification plays its crucial role.

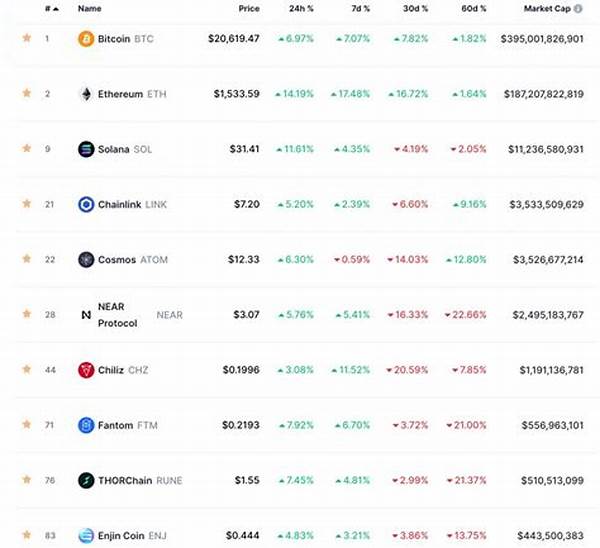

Let’s imagine you invested all your funds in Bitcoin. While Bitcoin has been a fruitful investment for many, relying solely on it exposes your portfolio to significant risk. A regulatory crackdown, technological issue, or a competing cryptocurrency’s rise can severely impact Bitcoin’s price, and subsequently, your financial footing. However, if you also held Ethereum, Solana, or Chainlink, the positive performance of these can offset any negative impacts on Bitcoin, showcasing why diversification is key in crypto portfolios.

Cryptocurrencies are often termed as digital gold, but unlike gold, the crypto market witnesses technological innovations regularly. New projects emerge, offering solutions and use cases that were previously unattainable. No single cryptocurrency can hold dominance forever, and portfolio diversification captures the growth potential across different projects. Historical data, research, expert testimonials, and user stories consistently highlight that diverse portfolios are more resilient.

Imagine you’re sailing a ship. What would you prefer – a ship with a single hull or one with a multi-hull that can navigate rough seas more efficiently? Investing in crypto without diversification is like sailing on a single-hulled ship in a stormy sea. With diversification, you shift to a multi-hull, ready to weather any financial storm.

—Understanding Portfolio Diversification in Crypto Investments

Managing investment risk requires a strategy, particularly when navigating volatile markets like cryptocurrencies. Crypto markets are known for their wild swings, and without a strategic approach, investors may face significant losses. Thus, grasping the importance of why diversification is key in crypto portfolios is critical.

Diversification spreads risk by investing in various digital assets. Even when one asset might underperform, others in the portfolio could yield enough returns to mitigate losses, providing a balance against market volatility and fostering more stable growth.

Examining the impact of diversification illustrates its benefits. Historical patterns demonstrate that singular investments can underperform against diversified portfolios. Diversification not only helps shield assets from potential losses but also capitalizes on multiple growth opportunities within the vast crypto landscape.

In the crypto world, where new tokens and technologies emerge quickly, a diversified portfolio allows investment across established assets and promising newcomers. This approach enhances the potential for long-term growth while reducing dependency on any single token’s performance.

Investors considering diversification should identify their risk tolerance and financial goals. Whether you’re involved in crypto for short-term gains or long-term stability, understanding your objectives will guide the crafting of a diversified portfolio tailored to your aspirations. Thus, why diversification is key in crypto portfolios cannot be overstated in maintaining a balanced and forward-looking investment strategy.

—Crypto Diversification: Quick Summaries

—Discussion: The Power of Diversification in Crypto Investing

The concept of diversification is not new to seasoned investors. However, in the realm of digital currencies, its importance is magnified. Many new investors find themselves enticed by the massive returns they hear about in the crypto world. Stories of individuals turning modest investments into substantial fortunes circulate widely, pushing more players into the field—many of whom may overlook the concept of calculated risk reduction.

As an intriguing combination of technology and finance, the allure of crypto can cloud judgment. Enthusiastic investors, driven by emotion rather than rational strategy, might flock to trending coins without considering the holistic health of their portfolios. This emotional investment can lead to concentrated portfolios, high in potential but equally high in risk. Investing blind based on trends is risky; no single cryptocurrency has ever shown consistent, rapid growth without accompanying slumps. This volatility makes the case for why diversification is key in crypto portfolios.

Building a diversified crypto portfolio requires research and patience. It involves analyzing coins with differing technological backends, missions, and potential markets. By combining established cryptocurrencies like Bitcoin and Ethereum with target-specific technologies like Polkadot or decentralized finance tokens, investors position themselves to capture niche market gains. This structured approach not only aligns with the market’s rapid evolution but also provides a safety net against market shifts, embodying the essence of diversification.

—Exploring Diversification in Crypto Portfolios

Diversification in investment is a traditional strategy tailored to mitigate risk by distributing capital across varied financial vehicles. Yet, in the chaotic crypto markets, its execution is pivotal. Understanding why diversification is key in crypto portfolios is vital to grasp as it allows investors to navigate uncertainty while maintaining growth potential.

Crypto spheres, unlike traditional markets, face issues like unprecedented volatility and regulatory shifts. Diversifying closes the gap between potential for gains and exposure to risks. It involves spreading investments across established tokens like Bitcoin, utility tokens like Ethereum, and newer players that offer innovative solutions.

Crypto infrastructures evolve rapidly, making predicting future leaders challenging. Hence, a diversified approach captures potential winners. Historical success stories of early investments in Bitcoin are enticing, yet singular investments ignore the emerging technology risk, where new blockchain solutions can quickly make older ones obsolete.

Emotion often governs crypto investing. Diversification aims to temper decisions with strategic allocation, lessening impacts of poor-performing holdings and balancing them with high-performing ones. Crypto investors who engage emotionally with singular infrastructure might face devastating losses if market forces shift unfavorably.

Diversification is not foolproof but serves as a credible approach to reduce single-point failures while exploiting varying growth lanes within crypto. Maintaining a clear vision and systematic approach is fundamental. Active monitoring and adaptive decisions ensure the portfolio remains relevant, capturing new market entrants while discarding underperforming assets, showcasing the constant dance adaptation required in successful diversification.

—Illustrations of Effective Crypto Diversification

—Descriptions of Diversification Tactics in Crypto

Navigating the energetic world of crypto investing, diversification is a strategy that minimizes risk and captures diverse growth avenues. Imagine having a basket full of different fruit varieties; if one spoils, the others remain intact, sustaining the basket’s value. Similarly, a crypto portfolio inclusive of a mix of tokens, ranging from the steadfast Bitcoin to innovative projects like DeFi applications, ensures stability and potential returns.

As various digital assets represent differing technologies, use cases, and market sentiments, holding a diverse portfolio becomes a hedge against isolated failures. The process involves diligent research and regularly updated strategies to reflect crypto’s rapid evolution. This effort not only minimizes potential losses but opens opportunities across the crypto landscape. Investing in just a few tokens limits participation in emerging developments, but diversification casts a wider net, capturing new market trends and expanding potential success.

—Key Reasons Why Diversification is Essential in Crypto Investing

In the unpredictable environment of crypto investing, a diversified portfolio remains crucial for success. Investors who grasp why diversification is key in crypto portfolios recognize this approach mitigates the high volatility inherent in digital assets. By distributing investments across an array of tokens, from stalwarts to nascent technology solutions, a diversified approach provides resilience against market swings.

When venturing into cryptocurrencies, one quickly realizes the potential for dramatic gains and losses. However, concentrating investments on just a few tokens amplifies risk, akin to balancing on a tightrope with no safety net. Diversification, in contrast, offers a cushioning effect, distributing risk to allow investors to walk the tightrope with more confidence.

Within the crypto sphere, technological advances and market dynamics shift rapidly. By diversifying, investors capture growth prospects across a range of innovations, increasing chances of favorable returns. They avoid being anchored to the fortunes of a single currency, instead benefiting from the collective upward trend of the market.

Notably, diversification in crypto investing also means flexibility to adapt to new opportunities. A diversified portfolio can accommodate shifts in market sentiment or emerging regulations. It positions investors to partake in breakthrough technologies that may redefine current paradigms, such as decentralized finance or blockchain interoperability.

Crypto veterans often laud diversified portfolios as more sustainable, citing historical performance data. They balance the allure of spectacular gains with realistic assessments of long-term investment health, effectively reducing risks posed by unexpected downturns. Understanding why diversification is key in crypto portfolios helps forge an investment approach primed for enduring the volatile tides of the digital currency ocean.