Why Stablecoins Are Trending In 2025

The financial landscape is continuously evolving, and each year presents new opportunities and challenges for investors, consumers, and regulators alike. In 2025, one of the most significant developments in this sphere is the widespread adoption of stablecoins. But what exactly are stablecoins, and why are they trending in 2025? To understand the significance, we need to dive deep into the reasons behind the appeal of these digital assets. In this article, you’ll find not only a unique perspective on why stablecoins are capturing attention worldwide, but also an insightful exploration into the market dynamics that fuel their popularity. Imagine a world where volatility in cryptocurrency is no longer a hurdle, where digital transactions are seamless, and where financial inclusivity is more than just a buzzword—it’s a reality. This is the promise of stablecoins, and in 2025, their influence is more profound than ever.

Read More : Apa Itu Crypto

The Financial Stability of Stablecoins

First and foremost, stablecoins offer a unique proposition—bringing stability to the notoriously volatile world of cryptocurrencies. By pegging their value to stable assets like fiat currencies or commodities, stablecoins reduce the price swings that have made traditional cryptos less attractive to average consumers. This stability is why stablecoins are trending in 2025, as they provide a secure environment for both everyday transactions and large-scale financial operations.

Moreover, stablecoins are revolutionizing cross-border transactions. In a globe where economies are more intertwined than ever, traditional banking channels can be slow and cumbersome for international payments. Stablecoins facilitate quick and cost-effective transfers without the typical banking fees and foreign exchange fluctuations. As a result, businesses, especially those operating globally, are embracing them for their efficiency and reliability.

Lastly, the increased interest in decentralized finance (DeFi) has bolstered the popularity of stablecoins. As the backbone of many DeFi projects, stablecoins provide the liquidity and security needed to empower a new era of financial products and services. They lend themselves perfectly to lending protocols, yield farming, and liquidity pools, offering consumers access to innovative financial ecosystems previously inaccessible through traditional banks.

A New Era in Financial Transactions

The year 2025 marks a pivotal point in the adoption of financial technologies, and stablecoins are at the forefront of this revolution. Why stablecoins are trending in 2025 is a testament to their ability to combine the best of both fiat currency stability and cryptocurrency innovation. If you’re looking to stay ahead of the curve, integrating stablecoins into your financial portfolio is no longer just an option—it’s a necessity.

—

Introduction to the Rise of Stablecoins

In recent years, the financial universe has been experiencing unprecedented transformation, driven by evolving technological advancements and shifting consumer needs. 2025 is no exception, as the impact of stablecoins continues to alter the economic landscape. Many describe this as the era where decentralized finance comes into full bloom, driven largely by stablecoins, challenging traditional mechanisms, and presenting new opportunities for economic growth and financial inclusion.

What Are Stablecoins?

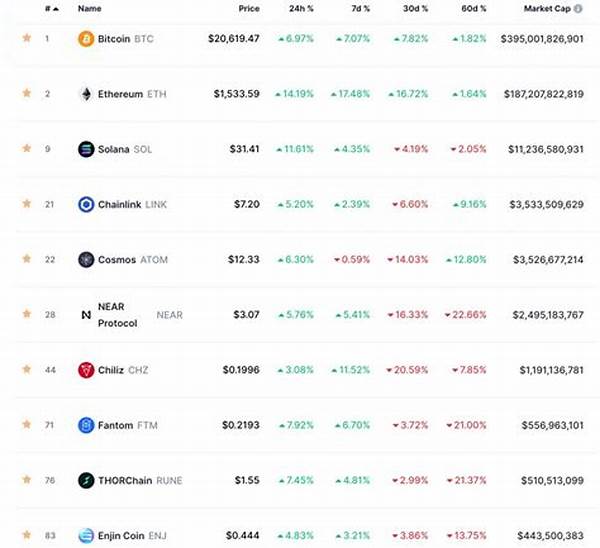

At their core, stablecoins are digital currencies pegged to a stable asset, like the US dollar or gold, designed to minimize the price volatility inherent in other cryptocurrencies like Bitcoin. These coins present a middle ground between the high volatility of cryptocurrencies and the slow, highly regulated nature of traditional fiat currencies.

The Advantages of Stablecoins

Stablecoins offer a multitude of benefits, including stability, which shields users from the wild swings seen in other digital assets. Moreover, they enable quick and cheap transactions, often circumventing the slower banking processes. It’s no wonder why stablecoins are trending in 2025. More and more individuals are waking up to these advantages and integrating stablecoins into their daily transactions.

Interestingly, the utility of stablecoins goes beyond mere financial transactions. They offer new pathways for financial products like loans and savings that are not tied to high risks, opening avenues for steady income in the world of decentralized finance.

Furthermore, businesses and investors alike are increasingly drawn to stablecoins for their potential in investment diversification and earnings generation. In 2025, the stable, quick, and efficient qualities of these coins are becoming indispensable in modern financial strategies.

Why the Surge in 2025?

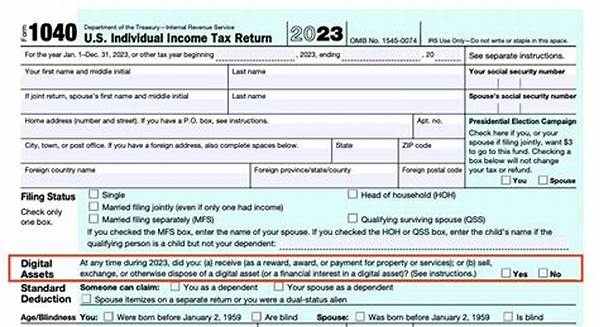

It’s crucial to understand why stablecoins are trending in 2025 to grasp the larger picture. The trend is driven not only by their operational benefits but also by the wider acceptance of blockchain technology. Regulators are also taking note, imposing favorable frameworks that integrate stablecoins seamlessly into the existing financial system.

Additionally, global economic unpredictability has pushed many to seek financial products that offer certainty and reliability. In this search, stablecoins have emerged as a solution that captures the stability of fiat while offering the revolutionary benefits of digital currencies.

Growing Use Cases of Stablecoins

The increase in stablecoin adaptability means they are rapidly gaining traction across numerous industries today. Why stablecoins are trending in 2025 is evidently linked to their ability to cater to a wide array of use cases, each promising significant economic impacts both locally and globally.

—

Reasons for the Sudden Popularity

Discussion on Market Impacts

The trend of stablecoins gaining ground continues to stir conversations across financial forums globally. The year 2025 isn’t just about technological intrigue; it’s a testament to the changing face of economics and finance. The spike in discussions, investments, and regulatory involvement around stablecoins cannot be ignored.

With their steady value, stablecoins offer a reliable option for a diverse group of stakeholders: from tech-savvy users exploring decentralized finance to conservative investors seeking predictability in digital currency. This dual appeal bridges the gap between traditional financial wisdom and the future of currencies.

While the shift towards stablecoins brings numerous opportunities, it also raises questions about regulatory challenges and their potential to disrupt established fiscal operations. Financial experts and economic strategists are constantly debating the long-term impacts, creating a fertile ground for future developments.

The dialogue around why stablecoins are trending in 2025 is filled with hope as well as caution. As much as stablecoins promise to change the financial landscape, experts advise keeping an eye on associated risks, including regulatory crackdowns, potential security threats, and concerns over data privacy.

Expert Insights on Future Trends

Our research includes insights from leading economists, finance professors, and crypto enthusiasts who highlight stablecoins as more than a temporary fad. This analysis reveals how stablecoins are not just reshaping financial transactions, but redefining how we understand value in a digital-first economy.

—

Exploring the Future of Stablecoins

In the thrilling narrative of financial technology evolution, the spotlight in 2025 shines brightly on stablecoins. Why stablecoins are trending in 2025 might seem straightforward at surface level—stability, accessibility, and innovation—but diving deeper reveals a rich tapestry of interconnected factors that lay down a blueprint for the future of economies around the globe.

At the heart of this shift is the growing trust garnered by stablecoins, as they blend the technological prowess of blockchain with the familiarity of regulated fiat currencies. The blend creates a versatile tool that not only appeals to individual users but also to governments, corporations, and innovative startups seeking streamlined, cost-effective financial solutions.

Economic Stability and Global Adoption

Now, the major storyline revolves around the economic viability that stablecoins offer across various sectors. Many emerging economies see stablecoins as a solution to hyperinflation and currency devaluation, offering stability and fostering economic resilience. Developed countries are also adopting policies that favor stablecoin inclusion in financial systems, ensuring economic stability.

The strength of stablecoins lies in their flexibility, meeting diverse needs while mitigating economic weaknesses. From enabling financial autonomy for unbanked populations to fostering innovation in digital currencies, the stablecoin ecosystem is teeming with possibilities.

Technological Advancements and Monetary Policy

The seamless integration of stablecoins into various platforms, including e-commerce and digital wallets, has given rise to new fintech applications, altering consumer behavior and expectations. Why stablecoins are trending in 2025 lies in their adaptability, driven by technological advancements that are pushing against the boundaries of traditional monetary policies, leading to a more dynamic, interconnected financial ecosystem.

Through blockchain technology, stablecoins unlock opportunities for smarter contracts, decentralized identities, and unparalleled data analytics, further influencing the trajectory of financial services.

Tips for Leveraging Stablecoins Now

In conclusion, as we look forward to the potential that comes with stablecoins, embracing their trajectory today sets a path for harnessing an exciting, financially inclusive tomorrow.

—

This intricate world where finance and technology intersect is exponentially transformative; it’s why stablecoins are trending in 2025. We stand at the helm of a fascinating fiscal evolution, and as stablecoins continue to shape the future of wealth, we invite you to join this conversation and ride the wave towards a stable financial future.