Altcoin Investing For Beginners

- Why Altcoins Could Be Your Next Big Move

- Discussion: Understanding Altcoin Investing for Beginners

- Key Strategies for Altcoin Investing

- Important Aspects for Altcoin Investing for Beginners

- Six Essential Tips for Altcoin Investing for Beginners

- Short Article: Cracking the Crypto Code for Beginners

- The Beauty of Timing: Knowing When to Dive In

Welcome to the exciting universe of altcoin investing for beginners! In a world where digital currencies are making headlines, you might find yourself intrigued by the buzz around Bitcoin’s lesser-known siblings, the altcoins. The term “altcoin” is derived from “alternative coin” and represents any cryptocurrency other than Bitcoin. While Bitcoin steals the limelight, there are over 10,000 altcoins out there, each with unique features and potential for returns. As a beginner in this universe, you may feel overwhelmed by the plethora of options and the technical jargon, yet therein lies the opportunity. As Robert Frost might not have said but surely felt, the altcoin road less traveled could make all the difference in your investing journey.

Read More : Why Robo-advisors Are Great For Starters

Altcoin investing for beginners isn’t just about choosing a coin and waiting for it to rise like a soufflé in the oven. It’s about understanding the ecosystem of these digital marvels. Altcoins are not just digital money; they represent future technologies, solutions to global problems, and sometimes merely fun communities. For a beginner, the playing field is wide open, and while it’s a learning curve, mastering altcoin investing can lead to significant financial empowerment. But why should you care? Because the next big thing in the cryptocurrency space might just be an altcoin that hasn’t yet hit the mainstream. Now, are you excited yet?

You’ve got the attention, but how about interest? Analysts like to quote jaw-dropping statistics such as a thousand percent return on investment in specific altcoins. But can those eye-watering figures be your story too? Yes, with research, strategic planning, and a sprinkle of luck. Imagine a world where your coffee purchase history leads to targeted opportunities of epic financial proportion — if only you sift through the right data! As intriguing as it sounds, altcoin investing for beginners demands diligence, research, and, above all, an appetite for learning. Stay tuned as we deep dive into the world of altcoins, exploring how to identify the potential winners in the digital coin realm!

Why Altcoins Could Be Your Next Big Move

Altcoins are captivating because they bring more technological innovation than Bitcoin. For instance, Ethereum, the most famous altcoin, introduced smart contracts, opening avenues for decentralized applications. It wasn’t just a new coin but a revolution in how we perceive transaction processes. Similarly, altcoins like Cardano and Polkadot focus on solving prevalent blockchain problems such as scalability, energy efficiency, and security. This innovative nature is what makes altcoins compelling for new investors seeking growth beyond Bitcoin.

—

Discussion: Understanding Altcoin Investing for Beginners

Altcoin investing for beginners can be likened to walking into a vibrant carnival. The colors are bright, the opportunities (booths) are plenty, and the potential to win big (prizes) is undeniably attractive. Yet, like every carnival game, understanding the rules improves the chances of success. In the altcoin world, these “rules” are the research, vigilance, and strategic diversification needed to navigate the dynamic terrain of cryptocurrency investments. For beginners, initial steps might involve cracking the basics of blockchain technology and recognizing ICOs (Initial Coin Offerings) that promise substantial returns.

So, what should a beginner know before plunging into the wild waters of altcoin investing? First, it’s about recognizing your risk threshold. Cryptocurrency, renowned for its volatility, rewards those with patience and the stomach for risk. Imagine the adrenaline of a rollercoaster—altcoin investment can replicate this sensation. However, the emotional highs and lows can be tempered with a grounded approach based on diligent research and analysis. New investors are advised to begin trading with a “paper portfolio” or virtual money to understand market trends without enduring financial loss.

Enter the arena of “altcoin communities.” These fan bases are not just hype machines; they provide crucial insights, updates, and networking opportunities. A bit like joining a specialized club, engaging with these communities can provide invaluable perspective on emerging coins and trends. Moreover, reputable online platforms like Reddit’s r/CryptoCurrency and forums like Bitcointalk offer valuable information for altcoin investing for beginners. It’s not just about which “horse to back” but learning why certain altcoins are ahead in the race for innovation or adoption.

Key Strategies for Altcoin Investing

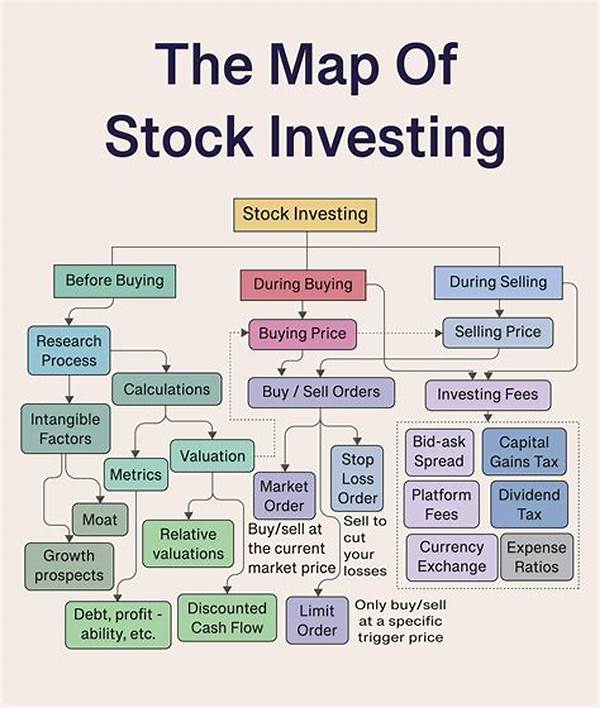

Understanding Market Trends: The Goldmine for Beginners

For beginners, recognizing market trends involves analyzing historical cycles of altcoin values. Understanding when prices typically surge or dip, coupled with societal factors that trigger such movements, can be instrumental in crafting an effective investment strategy. Such awareness converts raw data into actionable insights, empowering beginners to make informed decisions rather than impulsive buys driven by FOMO – Fear of Missing Out.

Suppose you see an altcoin related to a burgeoning field, like renewable energy or digital privacy. This intersection of tech and ethical consumerism could see exponential adoption due to socio-economic trends. Therefore, knowledge of tech advancement and consumer behavior trends could be your most potent tools in identifying valuable altcoins.

Altcoin Diversification: Explore the Exciting Ecosystem

Diversification doesn’t mean placing coins like darts on a board and hoping for a bullseye. Instead, it’s a strategic choice, balancing potential high-gainers with stable options. A beginner would be wise to include a mix of established altcoins like Ethereum or Litecoin and promising newcomers showing robust development plans. Remember the adage, “don’t put all your eggs in one basket”? It rings undeniably true in cryptocurrency investments, where digital portfolios provide the blueprint for diversified success.

—

Important Aspects for Altcoin Investing for Beginners

Here are five things beginners should consider when diving into altcoin investments:

Building a Robust Foundation in Altcoin Investment

In any domain, having a strong foundational knowledge acts as a safety net, guiding you through uncertain terrain. It’s no different with altcoin investing for beginners. Start with understanding the nature of cryptocurrency markets. Unlike traditional commodities, their value is derived not just from tangible goods or tangible money, but from shared belief and speculative futures. This might seem a slippery concept, but knowing what fuels market trends helps anchor your investment strategy.

Furthermore, networking within the cryptocurrency space can embolden your confidence. Engaging with forums, Twitter feeds, or Discord groups linked to altcoin projects embeds you within a real-time news environment where information moves quickly and often from the ground up. By cultivating your community presence, you stay at the forefront of influential shifts within the bitcoin and altcoin markets, ensuring more informed, timely decisions. Embarking on altcoin investing for beginners is like training wheels—awkward but essential for balance until you’re comfortable riding solo.

Six Essential Tips for Altcoin Investing for Beginners

Starting Your Altcoin Journey: An Insider Look

Stepping into the universe of altcoin investing for beginners is your gateway to boundless possibilities. Cryptocurrency represents the next frontier in financial systems, providing both risk and opportunity. For many, the attraction is akin to prospecting for gold—the chance to find the elusive nugget that sets one financially free. Yet, as any grizzled veteran will tell you, it’s a game of patience, wits, and educated gambles.

Ultimately, the best advice is to retain objectivity. The noise surrounding cryptocurrencies can prove deafening, yet it can be filtered through consistent research and community engagement. If you’re joining this digital gold rush, shall we say, “May the best coin win!” Remember, success in altcoin investing for beginners requires equal parts homework, cautiousness, audacity, and a keen eye for trends sometimes hidden in plain sight, the kind that redefine markets and fortunes alike.

—

Short Article: Cracking the Crypto Code for Beginners

Cryptocurrencies are making millionaires overnight and perhaps you’re wondering how altcoin investing for beginners plays into this paradigm shift. Can everyone make it big, or is it just another pipe dream? The answer is yes, everyone has a fair shot—providing they’re willing to invest the time and effort. Altcoins offer a dazzling array of choices, enough to make any beginner’s head spin. Which ones should you choose, and how do you separate the promising from the pretenders?

The good news is, this isn’t about blind luck. By spending time unraveling the tech behind these coins and understanding market signals, a beginner can make educated decisions in this seemingly labyrinthine market. One crucial element to grasp is the volatility synonymous with cryptocurrencies. Prices can rise or plummet on a whim, driven by anything from major corporate endorsements to regulatory news. Those prepared for this rollercoaster will find opportunities to buy low and sell high, all part of the strategic arsenal in altcoin investing for beginners.

The Beauty of Timing: Knowing When to Dive In

Timing is everything in altcoin investing. New altcoins emerge continually, each promising to disrupt existing technology or fill a market gap. Yet as exhilarating as it sounds, the mantra “if it’s too good to be true, it usually is” holds strong. Evaluating altcoins means exercising due diligence—reading white papers, analyzing trends, and sleuthing into developer backgrounds. But once armed with information, that moment of deciding when to invest becomes less daunting. In fact, it morphs into an informed choice backed by data, not just a leap of faith.

Joining the Crypto Community: More Than Just Cheerleading

Remember, investing isn’t lonely. With one tweet, you can connect with a global community sharing insights and advice. It’s like discovering a soccer fan club for teams you’ve never heard of—quickly, you become engrossed in stats, strategies, and community stories driving these digital currencies. Altcoin investing for beginners becomes not just about potential riches, but a shared experience with a like-minded crowd. Who knows? The advice from a fellow newbie or a seasoned expert might just lead you to your next golden opportunity.

Crafting a structured plan sets the stage for effective altcoin investing. Determine your risk comfort, decide your research levels, and adjust your strategy as you gain confidence. It’s that adaptability—with the ability to learn and unlearn as the market fluctuates—that transforms the altcoin investing journey from daunting to delightful. So, grab your metaphorical surfboard and prepare to catch the digital wave. Just remember: with great adventure comes great responsibility, and potentially, even greater rewards.