Crypto Vs Stocks Which Is Better For Beginners

H1: Crypto vs Stocks: Which is Better for Beginners?

Read More : Stock Market Investing 101 For Beginners

In today’s fast-paced financial world, the decision to dive into investing can be as daunting as choosing between the red or blue pill in “The Matrix.” Crypto and stocks present two parallel investment universes, each with its own unique set of rules, challenges, and adventures. The critical question for beginner investors seems to persist: crypto vs stocks, which is better for beginners? Let’s embark on this enthralling journey to discover which path might be the most fitting adventure for rookie investors by examining both worlds through the lenses of risk, opportunity, and growth potential. So, hold onto your hats and glasses as we take a ride down the financial superhighway, equipped with tales, stats, opinions, and expert testimonials that will help you navigate these exciting waters and ultimately make an informed decision.

In recent years, cryptocurrencies, with their cryptic codes and decentralized allure, have captured the imagination of many, converting folks from finance novices to full-fledged “crypto geeks.” On the other hand, the stock market, an old-school player since the 17th century, continues to attract individuals looking for stable and long-term investment opportunities. But where should a beginner start? Is it within the vast ocean of crypto, filled with unexplored potential and high-volatility waves, or the historically dependable landscape of stocks, epitomized by the structured yet sensibly rewarding paths of blue-chip companies? As we compare crypto vs stocks, which is better for beginners, we’ll unravel an exciting narrative that’ll keep you engaged and informed.

The crypto world is a buzzing hive of technological innovation and cutting-edge finance. As of late, the stories of Bitcoin millionaires have flooded news headlines, creating a sense of hope and urgency among would-be investors. An adventure into crypto promises the Wild West of finance, where creativity and calculated risk can turn dreams into reality. However, it’s important to wield an understanding of blockchain technology and market behavior to truly thrive in this space. Could this be the right field for beginners seeking fast-paced excitement?

Contrasting the crypto craze, stocks represent the well-trodden path of financial growth. By owning tiny shares of some of the biggest names in the business world, investors can benefit from long-term gains. Warren Buffet didn’t make his fortune overnight, but through prudent investment and patience, much like a grandparent would save pennies in a jar, stocks have enabled slow and steady wins. The stock market offers substantial educational resources and structures, making it a ripe starting point for those more inclined towards stability and calculated growth.

H2: Understanding Risks and Rewards for Beginners

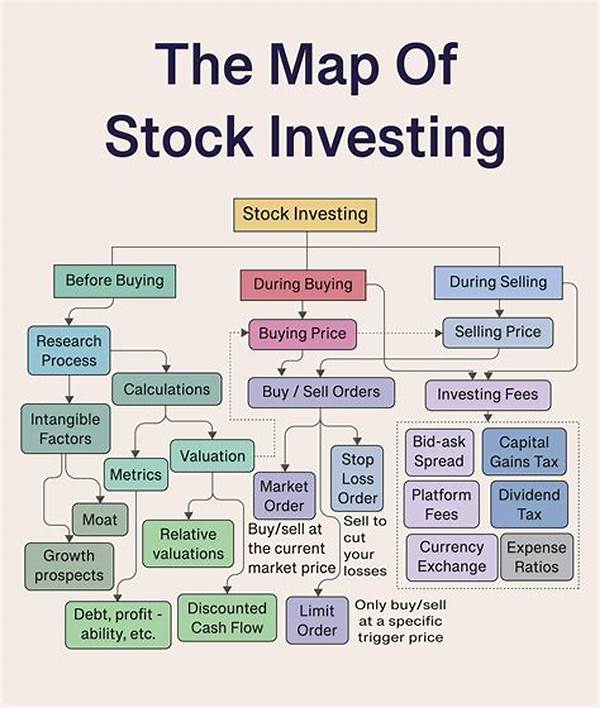

When it comes to understanding the intricacies and finer details of investments, knowledge is power. The first critical aspect of deciding between crypto vs stocks which is better for beginners is understanding each option’s risks and rewards. Stocks have traditionally been perceived as the more stable investment, rooted in actual company performance and economic indicators. Contrast this with cryptocurrencies, where prices can surge or plummet based on tweets, regulatory news, or sudden market speculation. For beginners, aligning investment goals with a keen awareness of these reward-to-risk ratios is key.

—Discussion on Crypto vs Stocks: Which is Better for Beginners?H2: Market Volatility and Investment Learning

Navigating the financial seas can be both thrilling and treacherous. Market volatility is a fundamental element when discussing crypto vs stocks which is better for beginners. Cryptocurrencies are known for their wild market swings, providing opportunities for profits but also high potential for losses. The stock market, with its relatively stable growth patterns, allows newbies to learn the ropes without experiencing the constant adrenaline rush typical in crypto trading.

With the amplified volatility in the cryptocurrency market, beginners could find themselves overwhelmed by the rapid price changes. For instance, Bitcoin and Ethereum have experienced dramatic highs and lows within short time frames, which can be both an opportunity and a downside. When weighing benefits for beginners, it’s crucial to be prepared for market fluctuations and consider whether the likely blow of volatility will be more educational or crushing.

H3: Strategy and Long-term Investment Goals

Another aspect is the strategy and temperament of the beginner investor. For crypto enthusiasts, a flexible, innovative approach might be more fitting. The crypto space thrives on disruption, which appeals to those with an adventurous spirit. Conversely, stock market investments often call for long-term commitment and strategic planning, making it ideal for those looking for steady growth and fiscal discipline.

When assessing crypto vs stocks which is better for beginners, consider your long-term goals and personality. Those seeking stability and predictability might gravitate towards stocks, with slower but surer ROI. However, those craving the potential for significant gains, albeit with a higher risk, might find solace in the crypto realm, where fortunes can change with the blink of an eye—or the stroke of a market influencer’s tweet.

In terms of emotional resilience, knowing one’s risk tolerance is essential. Crypto’s unpredictability demands a strong stomach for losses, whereas stock investments provide more serene waters. Yet, both markets teach invaluable lessons such as strategic thinking, patience, and the basics of investment.

Crypto has the allure of innovation—Web 3.0, decentralized finance (DeFi), and non-fungible tokens (NFTs) make it appealing for the tech-savvy. Stocks, however, hold a narrative grounded in tangible company performance and historical growth patterns. Whatever avenue chosen ultimately depends on your personal affinity towards technology or traditional business models.

H2: Real-world Learning Through Expert Testimony

For a more grounded view, let’s turn to the sage advice of seasoned investors. Diversification, say the experts, is a key strategy regardless of whether you choose crypto or stocks. By spreading investments, one can mitigate risks. Typical examples, real-world scenarios, and testimonies collected from beginner investors underline how a mixed portfolio often results in a better cushion against unpredictability.

Emily, a novice investor, shares, “Dabbling in both stocks and crypto has opened my eyes to different worldviews. The stock market taught me patience and informed decision-making through dividends, while crypto instructed me on agility and staying updated with the newest trends.” This holistic approach paints a vivid picture of how beginners can gain from the best of both worlds.

Crypto vs Stocks for Beginners: Gaining Insights and Perspectives

The takeaway for those deliberating crypto vs stocks, which is better for beginners, is to start small, educate yourself, and never invest more than you can afford to lose. What may start as an intimidating venture soon becomes a thrilling experience rich with learning curves, failures, and eventual triumphs.

—Top 5 Topics Related to “Crypto vs Stocks: Which is Better for Beginners?”

Discussion on Diversification and Risk Management

Venturing into investments can seem akin to walking through a financial jungle, with dangers and treasures at every corner. Diversification and risk management are imperative for beginner investors, especially when debating crypto vs stocks which is better for beginners. This strategy involves spreading investments across various financial instruments to reduce exposure.

In recent research, it’s noted that diversified portfolios tend to withstand market shocks better than those concentrated in one area. This is particularly relevant for beginners who might be more vulnerable to emotional decision-making or rash moves triggered by sudden market changes. Dispersion across diverse assets also enriches learning, offering insights into various market behaviors and performance metrics.

Understanding the dynamics of both worlds—stocks governed largely by tangible performance and traditional metrics, versus the speculative, zeitgeist-driven world of crypto—is invaluable. Diversification blends the best of both realms, opening educational avenues while buffering risks. Expert investors often advise understanding each asset class’s history, studying tendencies, and using tools such as ETFs or mixed portfolios to maintain balanced exposure.

In summation, students new to investing should balance their portfolios cautiously while engaging with both crypto and stocks to maximize both learning and growth potential. Effective risk management combined with education provides a stable foundation for long-term investing success.

—H2: Making Informed Decisions for a Balanced Portfolio

With the above discussions in mind, balancing your portfolio becomes crucial, especially for beginner investors weighing the crypto vs stocks which is better. In a world where unexpected economic shifts and technology disruption can make headlines, staying educated and prepared is the key to safeguarding investments while optimizing returns.