Dividend Stocks Explained For New Investors

H1: Dividend Stocks Explained for New Investors

Read More : Crypto Investing For Beginners

Welcome to the fascinating world of investing, a domain where numbers dance and opportunities abound. If you’re a new investor, the concept of “dividend stocks” might seem like an intimidating puzzle at first. But fear not! We’re here to help you piece it together with style, flair, and maybe even a few good laughs along the way.

Imagine this: you’re sipping your coffee while watching your favorite TV series, and your phone pings with a notification. It’s not a reminder about a bill due, but rather an alert about money coming into your account. That’s the magic of dividend stocks—where companies reward you for simply being a shareholder. “Dividend stocks explained for new investors” is our mission today, and trust us, you’ll want to dive deep with us into this rewarding adventure.

So what exactly are these mystical dividend stocks? Think of them as your loyal sidekick in the vast kingdom of financial markets. Companies, often well-established ones, distribute a portion of their earnings back to you, the shareholder, in the form of dividends. It’s a way for businesses to share their profits and keep you, the investor, happy and loyal. Who knew that revenue-sharing could be such a thrilling concept?

Yet, we know you have questions. You’re probably wondering how to identify the best dividend stocks or how they fit into your long-term investment strategy. Perhaps you’re pondering about the risks, because, let’s face it, no story is complete without a little drama. But worry not—you’re in capable hands on this journey called “dividend stocks explained for new investors,” and we’re here to ensure your experience is not just insightful but also entertaining.

Why Dividend Stocks Matter

In the exhilarating realm of stocks and investments, dividend stocks hold a special place. They offer not just growth potential, but a regular income stream that can be reinvested or enjoyed as cash in hand. As you embark on your financial journey, understanding dividend stocks can be a game-changer, and we’re excited to be your guide.

—

Introduction to Dividend Stocks: Explained for New Investors

If the stock market were a lavish party, dividend stocks would undoubtedly be the charming guests everyone wants to meet. For a beginner, entering this investment party might seem like stepping into uncharted territory filled with jargon and numbers. But picture dividend stocks as your friendly guide—ready to demystify the complexities while keeping things exciting and rewarding. “Dividend stocks explained for new investors” isn’t just a guide; it’s your gateway to smart investing.

To truly appreciate dividend stocks, you must first understand their core functionality. Companies earn profits, and rather than hoarding all the riches, the generous ones distribute a portion to their shareholders, calling this distribution a “dividend.” It’s as if the company is saying, “Thank you for your trust. Here’s part of the spoils to show our appreciation.” These regular payouts can be a reliable source of income, adding to the allure of such stocks.

Now, you might wonder, why do companies bother paying dividends at all? Isn’t it enough that their stocks (hopefully) appreciate in value over time? Consider this: dividends signify a company’s confidence and stability. By offering dividends, they communicate their profitability and a promise to shareholders that things are sailing smoothly. It’s the corporate way of saying, “Don’t worry; we’ve got this.”

Yet, like every enticing offer, dividend stocks come with nuances that new investors should grasp. Different sectors offer varying dividend yields, and not every high-yield stock is a wise choice. Factors such as the company’s financial health, dividend growth history, and market conditions all play a critical role in making informed decisions. Like piecing together a financial jigsaw, these components form the bigger picture of dividend reliability.

Furthermore, cashing in on dividends can fulfill different financial goals. Whether you’re aiming for income generation during retirement or seeking a passive income stream, dividends cater to diverse investor needs. To strategically align with these objectives, analyzing dividend yield and payout ratios becomes crucial. Yet again, when faced with these figures, don’t panic. We’re here on this knowledge journey together, making “dividend stocks explained for new investors” an insightful and enjoyable read.

Ready to embark on this investment adventure? The story continues as we delve deeper into the world of dividend stocks. Equip yourself with knowledge, a dash of humor, and a clear vision of your financial goals as you explore further.

H2: Beginner’s Guide to Dividend Investing

Understanding the nuances of dividend stocks is not just about knowing what they are but also about implementing effective strategies. After recognizing their potential, new investors must engage with practical methods to integrate dividend stocks into their portfolios successfully. So, what’s next on your learning path?

—

Engaging with Dividend Stocks – Explained and Explored

Venturing into the realm of dividend stocks can feel akin to joining the ranks of seasoned investors. Diving headfirst might seem daunting, but rest assured, it’s a journey worth undertaking. As we unravel the ins and outs of dividend investing, you’ll discover both subtle intricacies and solid strategies to pave your way to financial success. Let’s make “dividend stocks explained for new investors” a story of tangible growth.

Think of dividend investing as sowing seeds in a vast investment landscape. The credits you reap in the form of dividends can either be plowed back for compounding growth or enjoyed as a steady cash stream. The brilliance lies in their dual benefits: value appreciation and revenue generation. Over time, a well-crafted dividend portfolio can provide consistency and stability amid market tumult.

But let’s amp up the excitement a tad. Remember the thrill of treasure hunting as a kid? Finding the most promising dividend stocks often carries the same exhilarating suspense. What’s the secret? A sharp eye, robust research, and understanding critical metrics like dividend yield and payout ratios. By evaluating companies that consistently award their patrons, savvy investors unearth hidden gems amidst market waves.

The journey doesn’t stop here. As you gain confidence, diversifying your dividend stock portfolio becomes crucial. Explore various sectors—each offering its unique dividend dynamic. Tech stocks might promise growth, whereas utilities could provide steady yields. Balance is paramount, ensuring your investment garden flourishes through varying economic climates.

Navigating dividend stocks also means acknowledging potential pitfalls. High yields might seduce, but sustainability matters. Businesses that overextend might cut dividends during downturns, impacting expected income streams. Thus, understanding a company’s commitment and financial health is paramount. Do your homework, stay informed, and your investment saga might transform into a joyous tale.

Now that we’re immersed in the essence of dividend investing, it’s time for some action. Platforms like Seeking Alpha and services such as dividend-focused fund managers can catapult your knowledge to the next level. Remember—investing isn’t a solitary endeavor. Reach out, connect, and refine your strategies through community insights and evolving market analyses.

H3: Key Considerations for New Dividend Stock Investors

At this exhilarating point, you’ve gleaned ample knowledge about dividend stocks. Eager to embark on this financial journey? Here lie a few pivotal considerations to bear in mind as you begin navigating these waters.

—Discussion Topics Related to Dividend Stocks Explained for New Investors

Understanding the Value of Dividend Stocks

The phenomenon of dividend stocks has piqued the curiosity of investors worldwide. With potential as vast as an ocean, these stocks have captivated both seasoned financiers and rookies. Our mission to explain “dividend stocks explained for new investors” is to decipher what makes this category not just desirable but indispensable for modern investors in their bid for wealth maximization.

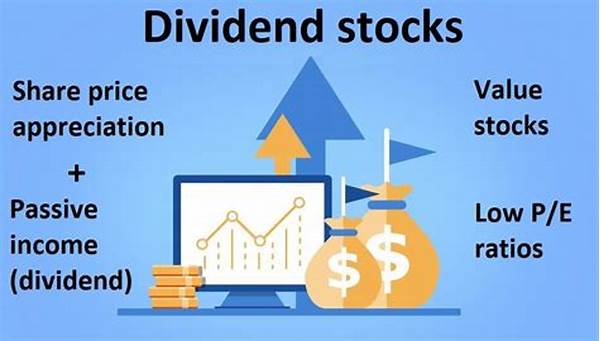

At its core, dividend stocks boast of two-fold offerings—capital appreciation through increased share value and immediate rewards via dividend yields. This multi-dimensional growth avenue distinguishes them within investment realms. Newbie investors often view dividends as a gateway to consistent cash flow. These stocks offer income amidst broader market uncertainties.

Furthermore, building a holistic financial portfolio demands attention to consistent revenue influx, especially significant in planning retirements or crafting passive income strategies. Dividend stocks fulfill this fundamental need, doubling as a safety net. Investing in companies with a robust financial footing assures dividends for years to come, even through turbulent market phases.

However, wisdom is vital in choosing these equities—a high yield today may not guarantee future payouts. That’s where research becomes the investor’s best friend. Bye-bye reckless choices! Hello, educated decisions powered by a sound comprehension of market dynamics and financial acumen.

The surge in information accessibility has democratized engaging with dividend stocks. New investors stand benefited from credible resources, tools, and financial advisories, ensuring this journey stays exciting and prosperous. And as you delve deeper into the realm of “dividend stocks explained for new investors,” remember—knowledge and strategy transform dreams into reality.

H2: Embarking on Your Dividend Journey

Embrace this opportunity to harness the potential of dividend stocks. Savor the wisdom of seasoned investors and dedication to careful selection as you explore an evolving market landscape.

—

Tips for New Investors on Dividend Stocks

H2: Essential Tips for Investing in Dividend Stocks

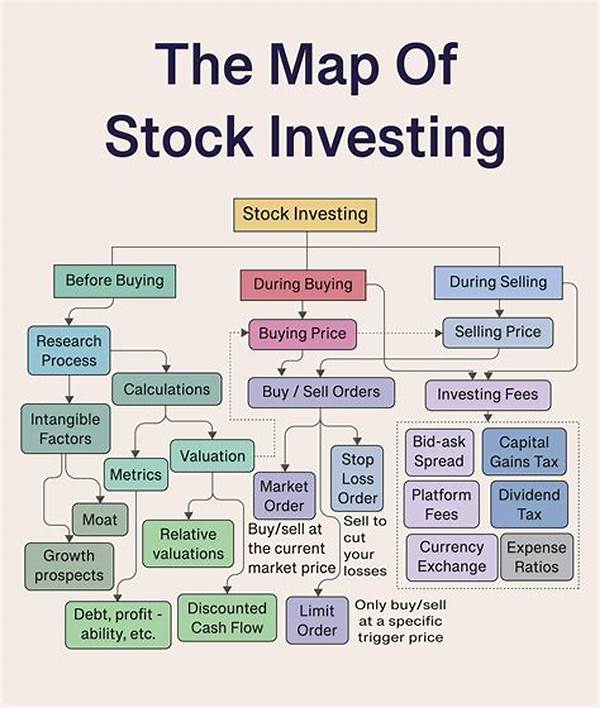

It’s vital to understand the core business and financial health before investing in dividend stocks. Look for a track record of consistent and stable dividend payouts.

Make sure to evaluate dividend yields along with payout ratios; these metrics will help gauge the sustainability and growth potential of the dividends.

Spread your investments across various industries to reduce risk, ensuring some level of income regardless of sector-specific downturns.

Allow dividends to compound by reinvesting them into buying more shares, thus increasing your holding and potential returns over time.

Regularly review your portfolio and keep an eye on market trends to make timely adjustments to your investments.

Understanding dividend stocks, their mechanics, and strategies for effective investing is crucial for new entrants into the stock market. The allure of steady income and potential for long-term growth draws many towards dividend investing. However, with this attraction comes the responsibility of informed decision-making. But fear not; the journey through “dividend stocks explained for new investors” provides both wisdom and motivation to make prosperous investment choices.

H3: Key Metrics for Evaluating Dividend Stocks

Understanding crucial metrics, such as dividend yield and payout ratio, helps investors make informed decisions.

—

Engaging Content on Dividend Stocks for New Investors

H2: The Dynamics of Dividend Stocks

Investing in dividend stocks isn’t just about financial acumen; it’s a blend of art and science. New investors eager to explore can find hope and opportunity within dividend terrain. With an abundance of resources available, you’re ready to navigate this path and reap satisfaction throughout the ride.

The allure of dividend stocks lies in both their complexity and simplicity. You, the investor, become the hero of this tale as you master the balance between dividends’ immediate reward and the promise of future appreciation. By understanding concepts like dividend yield and payout ratios, you’re not only safeguarding your investments but nurturing them toward fruition.

Charting your course demands more than gathering information. It involves interpreting data, identifying the core metrics, and focusing efforts where they matter most. A structured approach should be every investor’s compass, creating a portfolio that reflects both prudent judgment and calculated risks. The story of “dividend stocks explained for new investors” becomes a dynamic guide through strategic decision-making.

No one sails this monetary journey alone. The investors’ community welcomes you to connect, share ideas, and challenge assumptions. Whether it’s through personal networks, online platforms, or financial advisories, engagement sparks growth and transformation. Be bold, remain curious, and explore beyond traditional boundaries for rewarding experiences.

Ultimately, the dividends you strive for transcend numerical gains. They contribute to overarching life goals and dreams. Like a trusted ally, dividend stocks bolster you with income and confidence, empowering strides toward a promising financial future. Through informed choices, vigilant strategies, and determined focus, you’re poised to conquer this investment odyssey and shape your destiny.

H3: Strategies for Building a Dividend Portfolio

Craft a diverse, resilient portfolio that adapts to changing market dynamics, ensuring longevity and sustainability.

—

This content is crafted to engage new investors in understanding and exploring dividend stocks, utilizing varied writing styles and elements to maintain interest and inform effectively.