E Investing For Beginners

I’m happy to help with creating content on “e investing for beginners.” Below, you’ll find an article, description, summaries, purpose narrative, tips, and a short article based on your requirements.

Read More : The Set It And Forget It Hack: Using Automatic Investments To Eliminate Decision Paralysis!

—Welcome to the dynamic world of electronic investing! As a beginner, you might feel a whirlpool of excitement mixed with a dash of apprehension. This guide is here to turn your apprehension into confidence. Imagine your first venture into e investing for beginners as a journey filled with discoveries, potential profits, and lessons learned. Let’s explore this digital financial landscape that has revolutionized the way we look at money.

The traditional days of stockbroker phone calls and paper ledgers have evolved into real-time digital transactions at your fingertips. E investing for beginners transforms this once daunting process into something manageable from the comfort of your home. Imagine sipping your morning coffee while watching your investment portfolio grow with just a few clicks. That’s the magic of e investing! You don’t need a PhD in finance; you just need the right guidance, starting here. With a plethora of apps and platforms flooded with resources, your learning curve has never been more supportive. Let’s dive in!

The world of e investing for beginners is vast, exciting, and at times, overwhelming. As we embark on this journey, let’s start by identifying your unique financial goals. Whether it’s saving for a new home, building a retirement nest egg, or simply making your money work harder for you, setting clear objectives is crucial. With stories of everyday investors turning their fortunes around, the appeal of participating in the global market has never been stronger. But remember, every investment involves risks. Start small, learn the ropes, and grow your confidence. You’ll be amazed at what you can achieve!

Once you’ve decided to embark on this financial adventure, the next step is choosing the right platform. With countless options available, it’s important to do a deep dive into reviews and feedback. Platforms such as Robinhood, ETRADE, or Webull provide various features catering to both rookies and seasoned investors. The key is finding one that matches your investing style and needs. Don’t just ride the hype – do your research, test out demo accounts, and ensure that security measures are in place. Your financial future deserves thoughtful planning and protection.

Choosing the Right Platform for E Investing

—Description

Exploring e investing for beginners is like stepping into a new, thrilling world where control over your financial destiny seems possible and profitable. With technology making financial tools more accessible than ever, the primary barrier to entry – knowledge – is increasingly being broken down. The democratization of investing allows even the greenest of novices to dabble in markets with a few taps on their smartphones.

The question often arises, how does one begin this journey and make informed choices? E investing for beginners usually starts with understanding different investment tools such as stocks, bonds, ETFs, or mutual funds. This requires research and education, but with the availability of online courses and webinars, turning oneself into an informed investor is becoming more achievable.

Understanding Investment Tools

Stocks, commonly referred to as equities, represent a fraction of ownership in a company and are an excellent starting point for beginners. Then there are bonds, essentially loans you give to an entity (usually a corporation or government) in exchange for periodic interest payments. Mutual funds and ETFs, on the other hand, allow beginners to invest in a collection of stocks or bonds, diversifying their portfolio and reducing risks. It’s critical for e investing beginners to understand these tools before putting their money on the line.

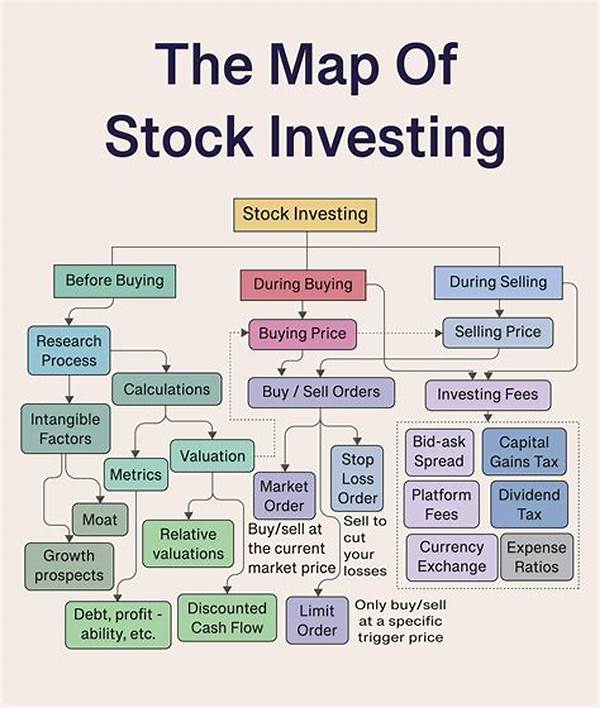

Developing a Strategy

When starting out with e investing, having a clear strategy is paramount. Are you a risk-taker looking for quick gains, or do you prefer a conservative approach focusing on slow, steady growth? Many platforms offer tutorials and virtual portfolios so beginners can get accustomed to investing without financial risk. Analyze market trends, scrutinize economic indicators, and develop a plan that aligns with your financial aspirations. Once your strategy is set, commit to it and be prepared to adjust as you learn and grow.

Remember, e investing for beginners is not just about earning money. It’s about expanding your financial literacy, growing your discipline, and yes, occasionally making mistakes but leveraging them as valuable learning experiences.

In a world where money rarely sleeps, e investing provides the flexibility to manage your investments around the clock. And with features like automated trading and AI-powered insights, even beginners can have a leg up in the fast-paced market environment. However, it’s essential to stay cautious and not to get carried away by the ease of access. Greed and haste can lead to costly mistakes, so always keep your goals and capacity for risk in check.

—Summaries

—PurposeIntroduce Financial Markets

E investing for beginners serves to open the door to financial markets with minimal barriers to entry. It allows novices, who might have felt sidelined by traditional investment avenues, to experience the benefits of wealth accumulation through smart choices and informed strategies. By demystifying investment concepts, it invites a diverse audience into the fold, fostering inclusivity.

Empower Novices

The ultimate goal is to empower beginners with the confidence and knowledge to manage their own portfolios. They gain the ability to control their financial destinies and adapt to market changes. This empowerment extends beyond personal gain, impacting larger economic models by increasing market participation.

Encourage Continuous Learning

Another critical purpose of e investing for beginners is to encourage a lifetime of financial learning. Because investment markets are in constant flux, the only way to maintain an edge is through continual education and adaptation. By setting this foundation early, beginners become seasoned investors over time, contributing to a more robust and informed economic landscape.

—

Essential Tips for E Investing Beginners

—Short Article DiscussionThe Dream of Financial Freedom

Ah, the dream! Who doesn’t want financial freedom? E investing for beginners is the modern-day treasure map for those seeking to escape the endless grind for wages. It’s the golden ticket to explore opportunities that could lead to unprecedented financial gains. But, remember not all treasure maps lead to riches; caution, knowledge, and strategy are key.

Why E Investing?

The question isn’t just why, but why not? With the digital revolution, investing has never been more accessible. Say goodbye to intimidating financial jargon and intimidating brokers. Now, anyone with a smartphone has the power to be an investor, to learn, grow, and profit from the comfort of their home. E investing for beginners is a game-changer!

E Investing Tools at Your Finger Tips

Tools? You mean trading platforms, analytical software, and educational resources that you can touch? Yes! E investing for beginners isn’t about jumping into the deep end without life vests. It’s about using the tools at hand to make safe, calculated steps towards financial growth. Ever heard of “learn before you earn”? That’s the mantra!

The Emotional Journey

Investing can be a rollercoaster of emotions. The highs of seeing your investments grow, and the lows of market dips can even test the strongest willpower. Emotional discipline is crucial in e investing for beginners. Yet, this journey also teaches resilience and the importance of thinking rationally, even under pressure.

In summary, e investing for beginners is the door to newfound potential. It’s a thrilling journey of knowledge, strategy, and yes—a bit of humor to laugh off those dips and soar further. Invest in learning before you invest in stocks, and remember to enjoy the process!

—

This should provide a comprehensive guide to e investing for beginners while keeping it engaging, informative, and consistent with the requested style and themes.