How To Read Stock Charts For Beginners

How to Read Stock Charts for Beginners

Have you ever looked at a stock chart and felt like you were gazing upon a cryptic piece of modern art? You’re not alone. For beginners, stock charts can appear intimidating, filled with lines, numbers, and candlestick patterns that seem like they’re speaking a language all their own. Yet, mastering these charts is like unlocking a frozen treasure chest where the ice melts away to reveal secrets of successful investing. Designed to provide insights at a glance, stock charts are the visual representation of stock market performance, showcasing patterns and trends that can guide your investment decisions. Whether you’re looking to dabble in day trading or just want to make your first informed stock purchase, understanding how to read stock charts for beginners is crucial.

Read More : Stock Market Basics Every New Investor Must Learn

Imagine sitting in your favorite coffee shop, laptop open, sipping on a grande latte while the barista scribbles your name on a cup with a friendly smile. In front of you, the once-daunting stock chart starts making sense. It’s like the Rosetta Stone of Wall Street; suddenly, those jagged peaks and troughs can tell you whether it’s time to hold, sell, or buy more. The stock market might sound like a battleground where only seasoned warriors tread, but armed with knowledge, even beginners can navigate it with confidence and make informed decisions.

And speaking of being in the know, we’ve designed this guide to demystify the complex appearance of stock charts with humor and clarity because learning should be as enjoyable as that warm cup of coffee in your hand. We’ll present real-world analogies, incorporate bits of humor, and give you actionable steps to empower your financial future. Buckle up; it’s time to transform into a stock-savvy superhero with our guide to how to read stock charts for beginners!

Why Stock Charts Matter

The key to how to read stock charts for beginners lies in grasping why these charts are quintessential. The reality is that numbers alone can’t tell you the whole story of market sentiment and stock momentum. This is where stock charts come in – bringing visual clarity and context to numerical data that might otherwise be misleading or vague.

Stock charts are like the weather forecast for your investments. Just like you wouldn’t head out in a storm without an umbrella, you shouldn’t venture into the stock market without knowing whether you’re entering during a bull run or a bear retreat. This makes the process of reading charts an essential skill, an educational necessity akin to reading and writing when it comes to managing your financial health.

Consider stock charts as the Twitter of the trading world – brief messages (data points) that, when compiled, tell a full story. Once you learn to decode these visual narratives, you’ll be equipped to make more strategic decisions that align with your financial goals and risk tolerance. How to read stock charts for beginners isn’t just a slogan, it’s the bridge between novice investor and knowledgeable trader.

—

Getting Started with Stock Charts: A Step-by-Step Introduction

If you’ve ever felt like deciphering stock charts is akin to translating ancient Latin texts, don’t worry; you’re about to become a fluent reader in the intricate language of stocks. Learning how to read stock charts for beginners is both an art and a science, interweaving analytical thinking with visual intuition. Let’s map this journey like explorers hitting the trail with excitement and a trusty compass.

To start, remember the first rule: don’t panic. Stock charts might look like waves crashing against rocks, but fear not, they are as logical and predictable as a well-rehearsed dance. Begin by focusing on essential chart elements: price history, time frame, moving averages, volume, and trend lines. Each of these components acts as coordinates on your treasure map, guiding you to hidden riches.

Through a mix of storytelling and real-world examples, we’ll simplify these essential components. Imagine them as a pizza, each slice representing a different variable of chart analysis. Understanding the “cheese” (price), “crust” (time), and “toppings” (trends and volumes) will give you a full-flavored appreciation of stock charts.

How to Interpret Chart Patterns

Patterns, my dear Watson, patterns! The art of reading stock charts lies in recognizing patterns and understanding their significance. Patterns such as the head and shoulders, double tops, or flags are like the emojis of charting – subtle indicators that convey powerful messages. In the stock universe, they help predict potential shifts in market trends. Just like figuring out the punchline to a joke, catching these patterns gives you an upper hand in the investing game.

In the treacherous world of stocks, where only the bold venture, these recognizable chart patterns are like the sword you wield against the unpredictability of the market. They offer a window into the market psyche, revealing when it might be time to laugh (buy) or cry (sell).

Identifying Trends and Making Decisions

Spoiler alert: stocks rarely move in straight lines. Trends are what rock the stock market boat, empowering us to predict where it might sail next. Upward trends suggest you set sail on a bullish journey, while downward trends advise caution. Even the seemingly stable sideways trends carry their tales, ready for the certified chart reader to interpret.

Once you’ve mastered the basics, take steps to apply your newfound knowledge. Observe the trends, analyze the patterns, and when you’ve done your homework, make your move. Remember, practice makes perfect. The more you indulge in the art of chart reading, the sharper your investment acumen will become.

—

Examples of Essential Stock Chart Elements

Unveiling the Mystery of Candlesticks

—

How to Read Stock Charts for Beginners: An In-Depth Look

Stock charts are like the orchestras of the financial world, with each beat symbolizing a crucial piece of data in the investment symphony. In essence, learning how to read stock charts for beginners gives you a backstage pass to the concert. Whether you envision yourself as a maestro or an enthusiastic newcomer, this guide aims to strike the perfect note.

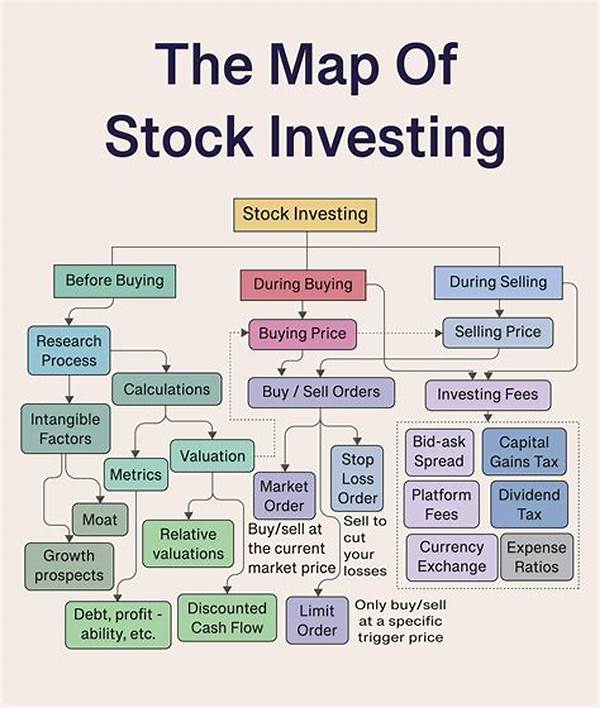

Understanding the Core Components of Stock Charts

Stock charts primarily consist of price data plotted over a time axis. If you’ve ever marveled at a graph, tracing its ups and downs, you’re already on your way to understanding chart fundamentals. Lines and bars reflect price movement with the precision of a metronome, revealing investor sentiment and market trends in real time.

Divining Trend Lines: Your Financial Clutch

Think of trend lines as the lead singer’s vocals, guiding you through the musical journey. Recognizing trends – whether uptrends, downtrends, or sideway trends – gives you insight into whether the market is bullish or bearish. They are foundational parts of any comprehensive analysis.

Practicing the Art of Chart Analysis

So how can beginners master the art of stock charts? Practice and patience are the keys. Start by analyzing historical data affecting well-known stocks. Utilize online tools that offer virtual trading environments to hone your analytical skills before diving into the real market.

Be a detective: look for clues within candlestick patterns and predict possible market reversals using analytical tools. Before you know it, reading charts will seem as natural as streaming an album on your favorite music app.

Blooper Reel: Mistakes to Avoid

Embarking on this new journey means you’ll likely hit a few wrong notes, and that’s okay. Even legends have their off days. Remember not to rely too heavily on one type of chart. Diversify your methods, include other forms of analysis like fundamental analysis (looking at a company’s health), and never invest more than you can afford to lose.

Above all, don’t be in a rush to catch every opportunity. The stock market is a marathon, not a sprint. Evaluate risks sensibly, and remember: a well-prepared investor is a successful investor.

—

9 Brief Explanations on “How to Read Stock Charts for Beginners”

Stock Chart Elements Demystified

—

Delving into how to read stock charts for beginners isn’t merely a skill but a strategic vantage point in your financial journey. Whether you’re a casual observer or an aspiring trader, stock charts are a crucial ally. They narrate the ebb and flow of market scenarios and investor behaviors. Their beauty lies in their ability to distill complex data into recognizable patterns and trends, arming you with foresight and precision.

Understanding the language of stock charts is akin to wielding a powerful instrument in a grand orchestra. Begin with the basics – price movements, candlestick patterns, moving averages. Then proceed to advanced analyses, incorporating technical indicators like the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD), which function as reality check-ins with market conditions.

For beginners, caution against common pitfalls such as reading charts in isolation or making rushed decisions. Invest time in mastering diverse analysis methods, incorporating fundamental data to complement technical insights. This strategic approach enables balanced decisions, minimizing risk while maximizing potential returns.

Embarking on this venture transforms mysteries into clear narratives, making the complex world of stocks accessible and navigable. Embark with confidence, and let your financial acumen flourish!